Capital Gains Tax Qld House

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. The best way to reduce how much tax you pay on your capital gains is to keep hold of all relevant receipts.

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

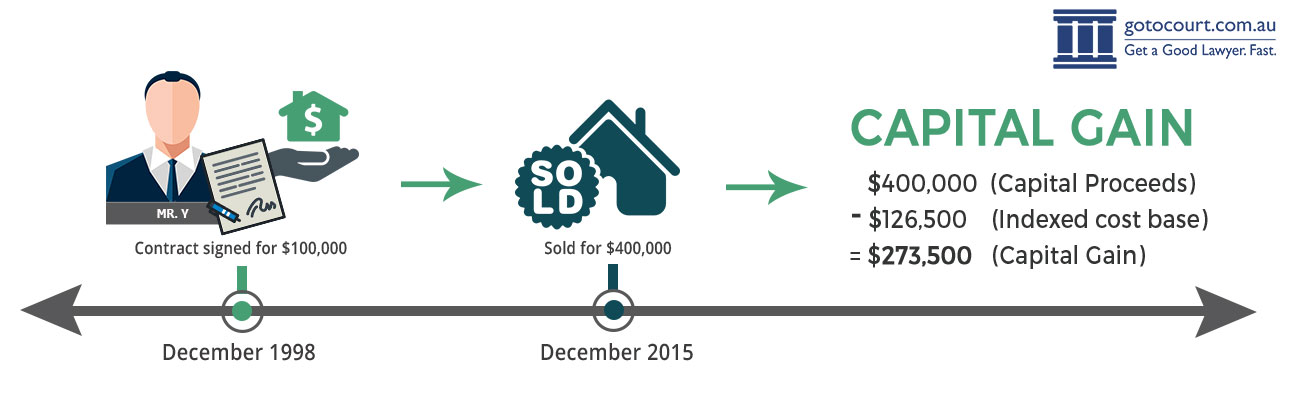

So if you sell a property for more than you paid for it thats a capital gain.

Capital gains tax qld house. That lowers the taxable gain to AUD37500. This is the difference between what it cost you to acquire the asset and what you receive when you dispose of it. You have to live in the residence for two of five years before selling it.

This amount is the difference between what it cost you to acquire and maintain the property and the amount you sell the property for. Which rate your capital gains will be taxed depends on your taxable. When you make a profit from selling your investment property you will be required to pay capital gains tax CGT.

You need to report capital gains and losses in your income tax return and pay tax on your capital gains. Selling a rental property. This rule exists because you usually dont generate an income from living in your own home.

Investing in real estate. It is actually part of your income tax. Read tips from the ATO for investing in rental properties.

If youre in the third tax bracket your tax rate will be 37 of the AUD37500 taxable gain. What is capital gains tax. Work out your gain and pay your tax on buy-to-let business agricultural and inherited properties.

The property has to be your principal residence you live in it. You also cant claim income tax deductions for costs associated with buying or selling your home. Theyre taxed at lower rates than short-term capital gains.

If an asset is held for at least one year then any gain is first discounted by 50 per cent for individual taxpayers or by 333 per cent for superannuation funds. Tax and finance advice. This tax does not apply to your own home known as your principal place of residence.

You pay tax on your capital gains which forms part of your income tax and is not considered a separate tax though its referred to as CGT. As a general rule you can avoid capital gains tax when selling your investment property if that property is your primary place of residence PPOR. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the property.

So you wont need to declare any profit on the sale of your home on your annual income tax return. About the Capital Gains Tax Estimator. Take note that this is not a separate tax by itself.

Capital gains tax is a part of your income tax. Capital Gains Tax when you sell a property thats not your home. How to avoid capital gains tax.

Sourced from the Australian Tax Office. If it is an investment property you will have to follow the normal capital gains rules. Long-term capital gains are gains on assets you hold for more than one year.

Check what tax and financial advice the Australian Taxation Office ATO provides for landlords. And if you sell it for less that is considered a capital loss. 12 Months Property Ownership If you are an Australian resident and have owned the property for more than 12 months you are able to claim a 50 discount on the capital gains tax payable.

Capital gains tax or CGT is a hefty tax you pay when selling a property for a profit. Capital gains tax If you sell a capital asset such as real estate or shares you usually make a capital gain or a capital loss. Buying and selling your home Generally you dont pay capital gains tax CGT if you sell the home you live in under the main residence exemption.

There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. Capital Gains Tax is calculated at either 100 of the capital gains amount or 50 of the capital gains amount depending on the length of time you have owned the asset. You can further reduce the capital gains tax from investment property by 50 because youve owned the property for more than 12 months.

A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchase. When youre selling real estate you usually stand make a profit a capital gain. Capital Gains Tax Calculator Values.

If you are thinking of selling a rental property you own find out how Capital Gains Tax may affect you. Under the new Capital Gains Tax legislation which came into effect on the 30th of September 1999 it is possible for an individual to calculate the CGT they will have to pay in one of two ways. If you hold the shares for less than 12 months You will pay tax on the full amount of profit.

The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Capital gains tax on a second home A second home is generally defined as a property that you live in for part of the year and that isnt primarily a rental property. Fortunately you dont have to pay CGT on your own home if you meet certain criteria which applies to most people.

The Capital Gains Tax Estimator provides an indication of the amount of capital gains tax you may be required to pay on an investment property. And so your net capital gain forms part of your assessable income in whatever tax year you sold your property. This is the amount you have made on top of your initial investment earnings.

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Cgt Exemption For Granny Flats Quill Tax Accountants Gold Coast

Cgt Exemption For Granny Flats Quill Tax Accountants Gold Coast

Capital Gains Tax On Property Experts For Expats

Capital Gains Tax On Property Experts For Expats

How To Calculate Capital Gains Tax Cgt Echoice Guides

How To Calculate Capital Gains Tax Cgt Echoice Guides

How Do I Avoid Capital Gains Tax In Australia

How Do I Avoid Capital Gains Tax In Australia

In Depth The Race To Beat Australia S Capital Gains Tax Deadline

In Depth The Race To Beat Australia S Capital Gains Tax Deadline

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How To Avoid Paying Capital Gains Tax Cgt When Selling A Property

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Live In Landlord Tax Deductions What To Claim To Improve Your Refund

Live In Landlord Tax Deductions What To Claim To Improve Your Refund

Calculating Capital Gains Tax Cgt In Australia

Calculating Capital Gains Tax Cgt In Australia

The Way Australia Taxes Housing Is Manifestly Unfair

The Way Australia Taxes Housing Is Manifestly Unfair

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Https Www Pwc Com Gx En Services People Organisation Publications Assets Pwc Australia Cgt Exemption For Homes Of Foreign Residents Removed Pdf

Australian Expats Face Hefty Taxes After Capital Gains Tax Exemption Is Scrapped

Australian Expats Face Hefty Taxes After Capital Gains Tax Exemption Is Scrapped

What S Tax Deductible When I Sell A House Upside Realty

What S Tax Deductible When I Sell A House Upside Realty

11 Strategies To Minimise Your Capital Gains Tax

11 Strategies To Minimise Your Capital Gains Tax

Can You Avoid Capital Gains Tax When Selling A House Canstar

Can You Avoid Capital Gains Tax When Selling A House Canstar