Net Property Yield Formula

Gross Yield Theres obviously a significant distinction between these two terms. Your net rental yield is equal to 30000 - 10000 500000 X 100 4 ie Annual rent - costs of owning your property The value of the property X 100.

Growth Retirement Portfolios Investing Finance Investing Finance Jobs

Growth Retirement Portfolios Investing Finance Investing Finance Jobs

N e t o p e r a t i n g i n c o m e R R O E w h e r e.

Net property yield formula. Divide your annual rental income by the property value and then multiply it by 100 to get your yield percentage. In this example the costs include 5500 of ongoing costs and 6500 for one month unrented. The formula for calculating the net initial yield is the following.

Annual rental income 5000. The table above is taken from Capitaland Commercial Trusts 2018 annual report. Net rental yield like gross rental yield is expressed as a percentage of the value of the property.

Similarly your property earns 24000 a year in net property income. Now lets say that it cost you 300000 to purchase the property. Its the annual rental income divided by the purchase price.

To get that percentage take the decimal you got when you divided the annual rental income less costs by the current value of the property and multiply it by 100. Use our handy graphic below as a reminder. In the above formula NOI t is the net operating income of the property during the quarter under consideration while CE t represents the capital expenditures related to leasing commissions and tenant improvements during that quarter.

Your net yield would be annual rent of 19500 375 x 52 annual expenses of 2875 property value of 450000 x 100 369. Property Cash Yield or FCFY NOI t CE t MV t-1. Purchase price 100000.

Dont forget to exclude anything from your annual rental income that you regularly spend on the properties or their maintenance or your yield percentage wont be accurate. Net yield weekly rental x 52 costs property value x 100 For example if you buy a property for 750000 with an annual rental income of 78000 1500 a week and yearly costs of 12000 you would get a net yield of 88. Calculating the gross yield of a property is pretty simple.

For instance if you buy ABC stock for 1000 and sell it two years later for 1600 the net profit is 600 1600 1000. You then multiply this by 100 to give you the percentage. The investment cost includes the purchase price plus any other costs spent by the investor for acquiring the property.

22518 divided by the property value of 300000 equals a rental yield of 75 percent. An income of 27360 minus the cost of 4842 works out to 22518 in rental income after expenses. 5000 100000 005 x 100 5.

ROI on the stock is 60 600 net profit 1000 cost 060. Gross yield annual rental income weekly rental x 52 property value x 100. As an equation this is expressed as Property Yield Net Property IncomeProperty Value X 100 Property Yield will give you an indication of the earning power of the portfolio of properties a REIT holds.

Net property income is gross revenue minus property maintenance fees property taxes and other operating expenses that are related directly to the property. Net Rental Yield Annual Rent Annual Costs Total Costs x 100 Using the same example above if you had encountered annual expenses of 1200 your net rental yield would equal 752 How We Can Help You. Begin aligned text Net operating income RR.

It is used as a barometer of how well a REITs portfolio of properties is performing including how much its costs to maintain. Net Initial Yield Net operating income NOI in the first year of the holding period Investment cost. Net yield is determined by first subtracting the propertys annual operational costs from its annual rent and then dividing this by the property value.

So if you buy a retail property for 750000 and rent it out for 1500 a week 78000 annually the annual return on your investment or your yield will be 104. Calculate the rental yield of a property using this rental yield calculator from Ian Ritchie Real Estate. Multiply by 100 to find your net rental yield.

Thus the value of our property is 240000055 436363. The prevailing market CAP rate for this property is 55. You pay 10000 each year in property-related expenses and the property is worth 500000.

You rent out the property for 375 a week and have annual expenses totalling 2875 1075 on lost rent and advertising 600 on repairs and 1200 on insurance. A good Property Yield percentage is a good indicator of the REITs ability to generate income in relation the value of property that it holds. R R r e a l e s t a t e r e v e n u e O E o p e r a t i n g e x p e n s e s.

Calculating your gross yield. Net Yield Annual Rent Operational Costs Property Value. Lets say you receive 30000 each year in rent.

Dividend Yield Calculator Www Investingcalculator Org Dividend Yield Calculator Html Investing Investment C Dividend Financial Calculators Investing Money

Dividend Yield Calculator Www Investingcalculator Org Dividend Yield Calculator Html Investing Investment C Dividend Financial Calculators Investing Money

Expected Return Meaning Calculation Importance Limitations In 2020 Financial Analysis Financial Management Portfolio Management

Expected Return Meaning Calculation Importance Limitations In 2020 Financial Analysis Financial Management Portfolio Management

Bond Ratings Explained Interpreting The Bond Rating System Credit Rating Agency Investing Investment Services

Bond Ratings Explained Interpreting The Bond Rating System Credit Rating Agency Investing Investment Services

Free Rental Yield Calculator By Landlord Vision

Free Rental Yield Calculator By Landlord Vision

How To Create Your Personal Net Worth Statement And Why You Need It Personal Finance Personal Financial Statement Budgeting Finances

How To Create Your Personal Net Worth Statement And Why You Need It Personal Finance Personal Financial Statement Budgeting Finances

Landlord Rental Income And Expenses Tracking Spreadsheet 5 80 Properties Being A Landlord Rental Property Management Property Management

Landlord Rental Income And Expenses Tracking Spreadsheet 5 80 Properties Being A Landlord Rental Property Management Property Management

3 Statement Modeling And Valuation Model Efinancialmodels Excel Financial Financial Modeling

3 Statement Modeling And Valuation Model Efinancialmodels Excel Financial Financial Modeling

3 Ways To Work Out A Rental Yield Wikihow

3 Ways To Work Out A Rental Yield Wikihow

How To Calculate Debt Yield In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

How To Calculate Debt Yield In Commercial Real Estate Argus Software Solutions For Commercial Real Estate

Stock Target Entry Price In 2020 Return On Equity Financial Position Stock Analysis

Stock Target Entry Price In 2020 Return On Equity Financial Position Stock Analysis

How Do I Calculate Yield On An Investment Property

How Do I Calculate Yield On An Investment Property

Pin By Robert Shoss On Investing Enterprise Value Debt Equity Investing

Pin By Robert Shoss On Investing Enterprise Value Debt Equity Investing

Valuation Ratio For Investors Stock Market Investing Ideas Of Stock Market Ideas Investing Investors Market In 2020 Financial Ratio Stock Market Investing

Valuation Ratio For Investors Stock Market Investing Ideas Of Stock Market Ideas Investing Investors Market In 2020 Financial Ratio Stock Market Investing

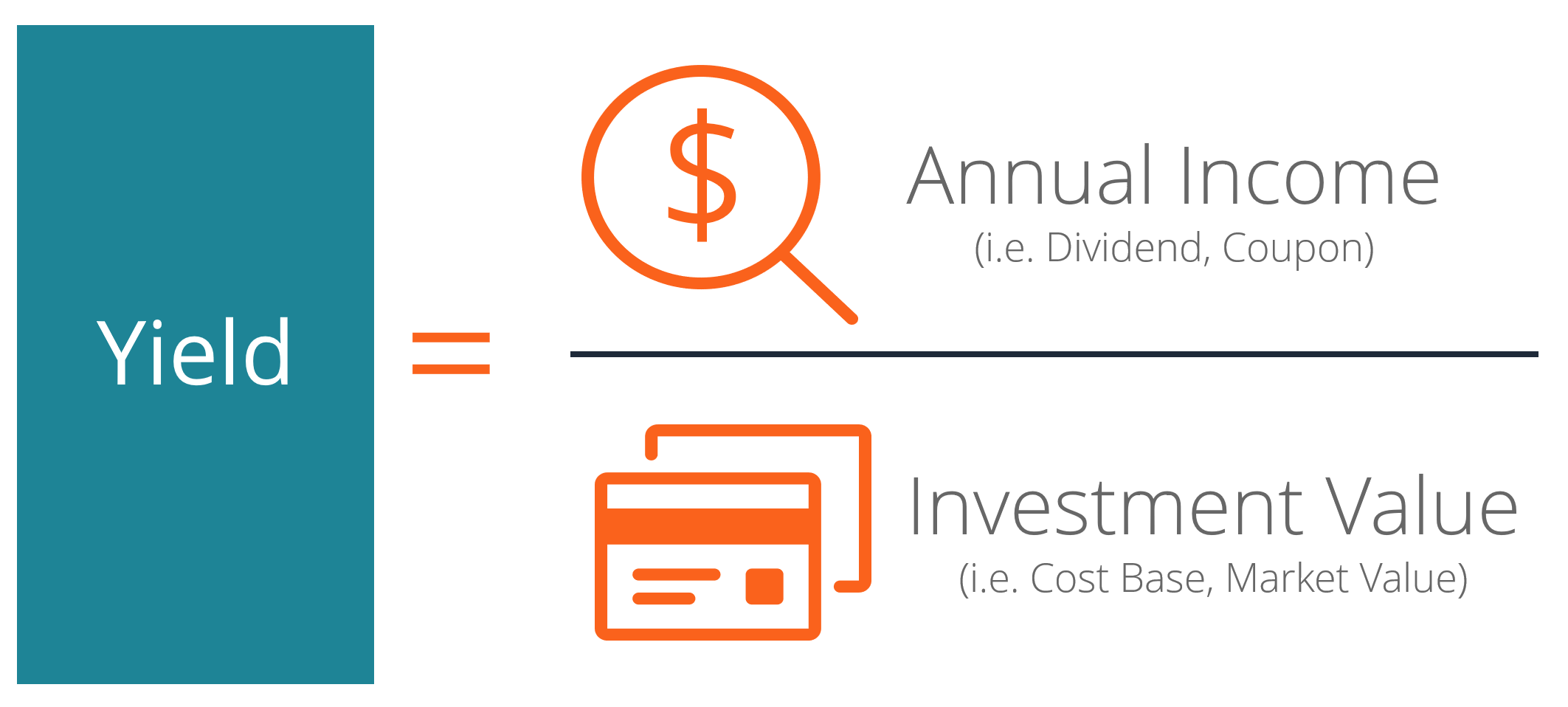

Yield Definition Overview Examples And Percentage Yield Formula

Yield Definition Overview Examples And Percentage Yield Formula

The Best Place To Invest Your Money At Every Stage Of Your Life Automatic Millionaire Investing Where To Invest

The Best Place To Invest Your Money At Every Stage Of Your Life Automatic Millionaire Investing Where To Invest

Wacc Formula Cost Of Capital Finance Financial Management

Wacc Formula Cost Of Capital Finance Financial Management