Nyc Property Tax Exemption Renewal Form

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. STAR School Tax Relief exemption forms Exemption applications must be filed with your local assessors office.

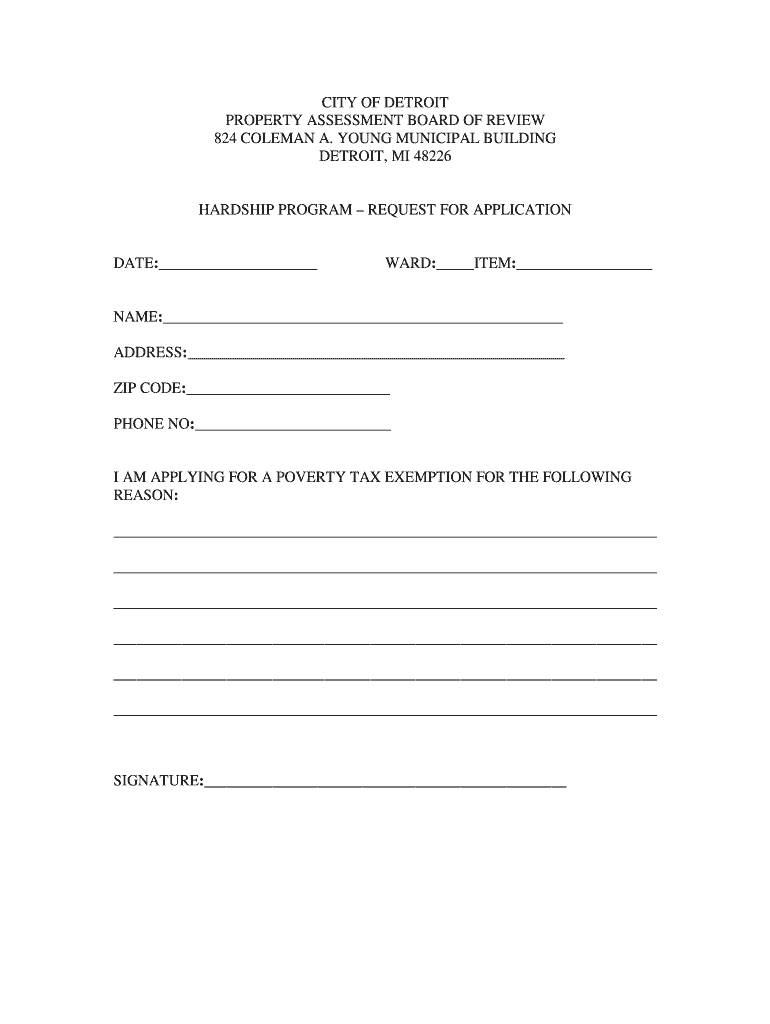

City Of Detroit Hardship Fill Out And Sign Printable Pdf Template Signnow

City Of Detroit Hardship Fill Out And Sign Printable Pdf Template Signnow

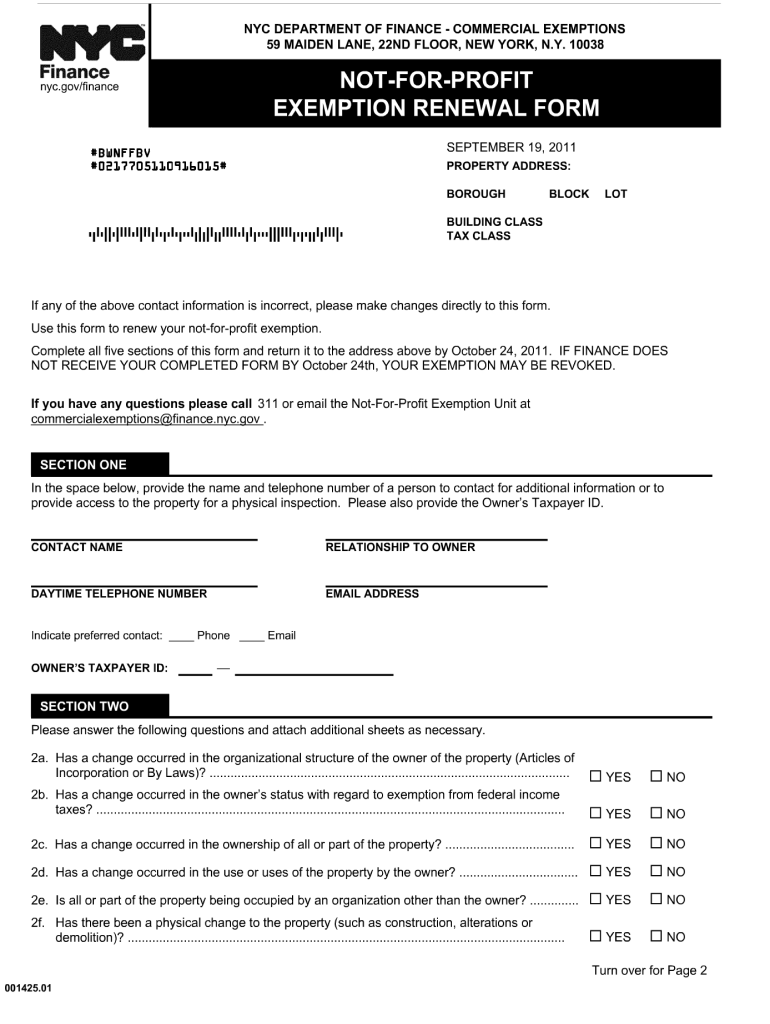

Yes if your organization currently owns the property you need to complete the renewal form.

Nyc property tax exemption renewal form. Thanks to changes in city and state law the DHE and SCHE Senior Citizen Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. See RP-467-I Instructions for Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens. GENERAL INFORMATION l Do I need to renew my Not-for-Profit Property Tax Exemption.

The 202021 renewal period has ended. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services. Chrome Safari Mozilla Firefox IE8 and higher.

Please see Form TP-64 Notice to Taxpayers Requesting Information or Assistance from the Tax Department for updated information if you are using any documents not revised since December 2010. We are accepting late renewal filings until April 1. The due date to renew your exemption is always January 5 for the tax year that begins the following July 1.

Eligibility requirements vary by location. Yes any Not-for-Profit organization that receives a full or partial property tax exemption is required to fill out a renewal form each year. Look up the status of a property tax exemption.

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief. The purpose of renewing the benefit is to provide the Department of Finance with the confirmation that the property continues to be used for exempt purposes. For purposes of exemptions granted pursuant to section 420-b of the Real Property Tax Law each year following the year in which exemption is granted on the basis of application forms RP-420-b-Org and RP-420-ab-Use a renewal.

Documents on this page are provided in pdf format. All not-for profit organizations receiving the not-for-profit property tax exemption are required to renew the benefit annually. Not-for-Profit NFP Renewal 2122.

To receive a tax exemption the propertys legal title must be in the name of a nonprofit organization the organization must be the owner of the property and the property must be used for an exempt purpose. If you own property outside of New York City and wish to apply for an exemption on that property you should contact your local county assessor to determine what documentation you need to submit. Most homeowners are eligible for this exemption if they meet the requirements for the Homeowner Exemption and were 65 years of age or older during calendar year 2020.

Federal 501c3 status alone does. See our Municipal Profiles for your local assessors mailing address. Form RP-467-Rnw Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens.

Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services. Once this exemption is applied the Assessors Office auto-renews it for you each year. If you sold the property before July 1 2015 in Section One answer NO type the name of the new owner and the date of the sale.

You can check the status of a property tax exemption application online or by phone. Find the forms you need - Choose Current year forms or Past year forms and select By form number or By tax type. Though all property is assessed not all of it is taxable.

A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments. However as long as you file your renewal application by the exemption filing deadline your benefit will be processed and if you are approved will appear on your July property tax bill. For a list of property types that may be eligible for the exemption visit the Eligibility page.

The City of New York offers tax exemptions and abatements for seniors veterans clergy members people with disabilities and other homeowners. See our Municipal Profiles for your local assessors mailing address. Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less.

New York City property tax exemptions are only available for your primary residence. Form RP-467 Application for Partial Tax Exemption for Real Property of Senior Citizens or. A property tax break for disabled New Yorkers who own one- two- or three-family homes condominiums or cooperative apartments.

We are going to sell this property. Form RP-467-Rnw Renewal Application for Partial Tax Exemption for Real Property of Senior Citizens. Property Tax ExemptionAbatement Renewals.

Sign the form and click Submit. To apply or reapply for the senior citizens exemption file the applicable form below with your assessor. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

Property tax forms - Exemptions Exemption applications must be filed with your local assessors office. This application has been optimized for use on browsers. These benefits can lower your property tax bill.

The purpose of renewing the benefit is to provide the Department of Finance with confirmation that the property continues to be used for exempt purposes. Property Tax Benefits for Homeowners. Do I still need to complete the renewal form.

Https Www1 Nyc Gov Assets Hpd Downloads Pdfs About Fce Application Filing Deadline Final Rule 6 19 17 Pdf

Mortgage Recording Tax Rates Up To 2 05 In Nyc Mortgage Mortgage Interest Mortgage Loan Officer

Mortgage Recording Tax Rates Up To 2 05 In Nyc Mortgage Mortgage Interest Mortgage Loan Officer

Https Www Tax Ny Gov Pit Property Star13 Rp425 Fs Nyc Pdf

Application For Approval Of Non Schedule Adjustment News How To Apply Schedule

Application For Approval Of Non Schedule Adjustment News How To Apply Schedule

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales Tax Exemption For Building Materials Used In State Construction Projects

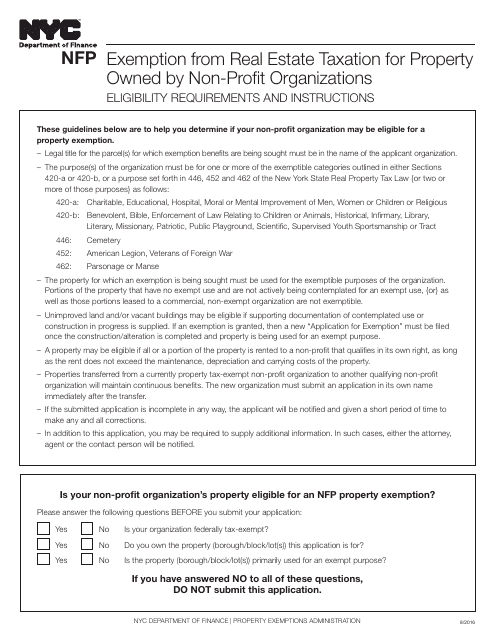

Form Nfp Download Fillable Pdf Or Fill Online Application For Exemption From Real Estate Taxation For Property Owned By Non Profit Organizations New York City Templateroller

Form Nfp Download Fillable Pdf Or Fill Online Application For Exemption From Real Estate Taxation For Property Owned By Non Profit Organizations New York City Templateroller

Https Www1 Nyc Gov Assets Finance Downloads Pdf Not For Profit Nfp Online Renewal Guide Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Payment Operations 2019 Sche Initial Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Icap Icap Renewal Guide Pdf

Nyc Gov Commercial Exemptions Fill Out And Sign Printable Pdf Template Signnow

Nyc Gov Commercial Exemptions Fill Out And Sign Printable Pdf Template Signnow

Https Www1 Nyc Gov Assets Finance Downloads Pdf Icap Icip Icip Renewal Guide Pdf

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

Https Www1 Nyc Gov Portal Apps 311 Literatures Dof Homeowners Exemption Application General 11 26 2013 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Faq Nfp Online Renewal Faq Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf Lien Sale 2016 Checklist Pdf

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

What Is The Nyc Senior Citizen Homeowners Exemption Sche Property Tax Senior Citizen Nyc

The Real Reasons Your Home Is Not Selling Buying A Condo Building Management Real Estate Marketing

The Real Reasons Your Home Is Not Selling Buying A Condo Building Management Real Estate Marketing

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

Http Manhattanbp Nyc Gov Downloads Pdf 2015 20421 A 20policy 20brief Pdf