Property Damage Insurance Proceeds Taxable

However there are also exceptions to this rule. Reimbursement pending when return is due.

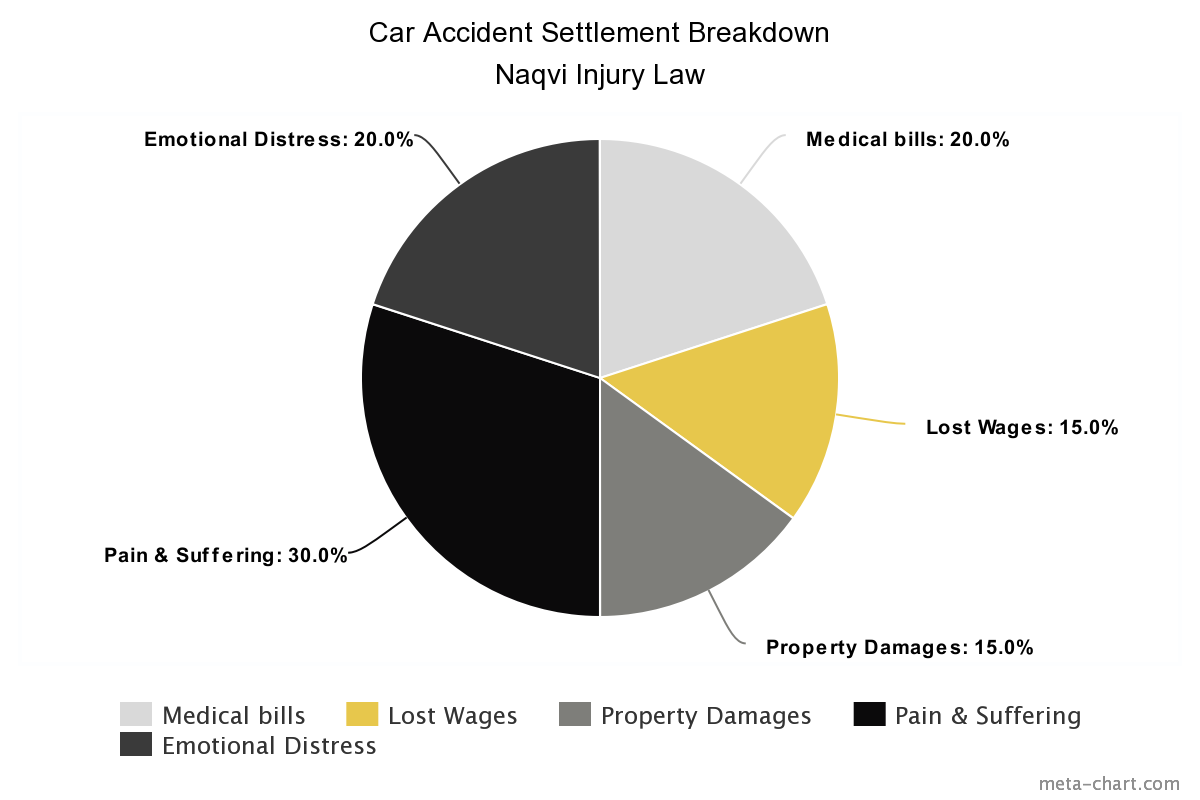

Are Auto Accident Settlements Taxable Naqvi Injury Law

Are Auto Accident Settlements Taxable Naqvi Injury Law

In order to defer taxation of the conversion gain these funds must be used to purchase property that is similar or related in service or use to either the damaged or.

Property damage insurance proceeds taxable. If part was DESIGNATED as attorneys fees those are taxable. And Estimated Tax and in Form 1040-ES Estimated Tax for Individuals. If you your spouse or your dependent enrolled in health.

A casualty gain is taxable income. This is not as unusual as it sounds since. Insurance is the most common way to be reimbursed for a casualty loss.

All other insurance proceeds received for such residence or its contents are treated as a common pool of funds received for the damage or destruction of a single item of property. Generally compensation for property damage is not taxable but any amount not used for repair or replacement of the damaged property must be subtracted from the cost basis. Theres really only one situation where insurance compensation is taxable and thats if the settlement exceeds the original cost of the damaged property.

One exception is disability insurance which is taxable to the insured as. Instead you have received an adjustment to the cost basis you have in. Publication 525 Taxable and Nontaxable Income visit our website at wwwirsgov or call toll-free at 1-800-829-1040.

However the property owner need not pay tax on the gain the year it is received if the owner replaces the destroyed property and the cost exceeds the insurance recovery. Cut Taxes by Reporting Property Damage. An insurance payment for property damage is considered compensation to restore your.

547 for more information. In general there is taxable income if the amount received from the insurance policy is more than the cost of what was lost. Insurance proceeds from property losses are gains to the extent the proceeds exceed the adjusted basis in the property.

If the basis is used up then anything left over is taxed as a capital gain. For tax years 2018 through 2025 if you are an individual losses of personal-use property from fire storm shipwreck or other casualty or theft are deductible only if the loss is attributable to a federally declared disaster federal casualty loss. If you receive insurance reimbursement that is more than your adjusted basis in the destroyed or damaged property you may actually have a gain as a result of the casualty or theft.

Most business owners are shocked to learn that the receipt of an insurance claim payment for a fire or other loss may result in taxable income. It is not considered any type of income to you. The insurance proceeds do not need to be reported as they were less than your repairs.

That is an important difference because of how it applies to taxation. For the most part insurance settlements for property damage and physical injuries are not taxable income. You will need to reduce your repair expenses by the insurance so that the total repair expenses deducted for the damage is 288190.

Taxpayers can however defer any gain by complying with the rules in IRC Section 1033. Important Note about Health Insurance Coverage. Not taxable with exceptions If a taxpayer receives compensation for property damage the taxpayer must reduce his or her tax basis in the property by the amount of the settlement or compensation.

Instead the gain is postponed until the replacement property is ultimately sold or otherwise disposed of. Property Damage Claims If you receive insurance money for damage to your car the IRS does not consider that taxable income. A claim is considered a type of benefit.

The taxable amounts received will depend on how the lawsuit proceeds were labeled. If the proceeds were given solely to compensate you for property damage that is not taxable income and you will enter the amount on line 21 of your return and then take it out as a negative to show the IRS. Insurance Proceeds and Taxes Insurance proceeds are tax-free in most cases regardless of the type of insurance or policy.

You can deduct the loss on your federal income tax return for the year before the event. Half of the self-employment tax contributions to. Say Thanks by clicking the thumb icon in a post.

This can happen where the amount of the insurance money received exceeds the businesss depreciated tax basis in the damage or loss on the property. For additional information see. As described in the above situation a home insurance claim occurs when a person files a request to their home insurance company for payment of damages that the policy covers.

When taxpayers receive insurance proceeds or other payments that exceed their adjusted tax basis in damaged andor destroyed property they are generally treated as having realized a gain for tax purposes known as gain from an involuntary conversion. The tax basis is usually the original cost of the property plus any improvements less any depreciation for business use. For instance the gain is not taxable to the extent the insurance proceeds are used to replace the property with similar property within two years.

You may be able to avoid immediate taxation on the gain by purchasing replacement property.

Non Life Insurance Icon Google Search Insurance Marketing Household Insurance Insurance

Non Life Insurance Icon Google Search Insurance Marketing Household Insurance Insurance

How Do I Report Property Insurance Reimbursement On My Tax Return

How Do I Report Property Insurance Reimbursement On My Tax Return

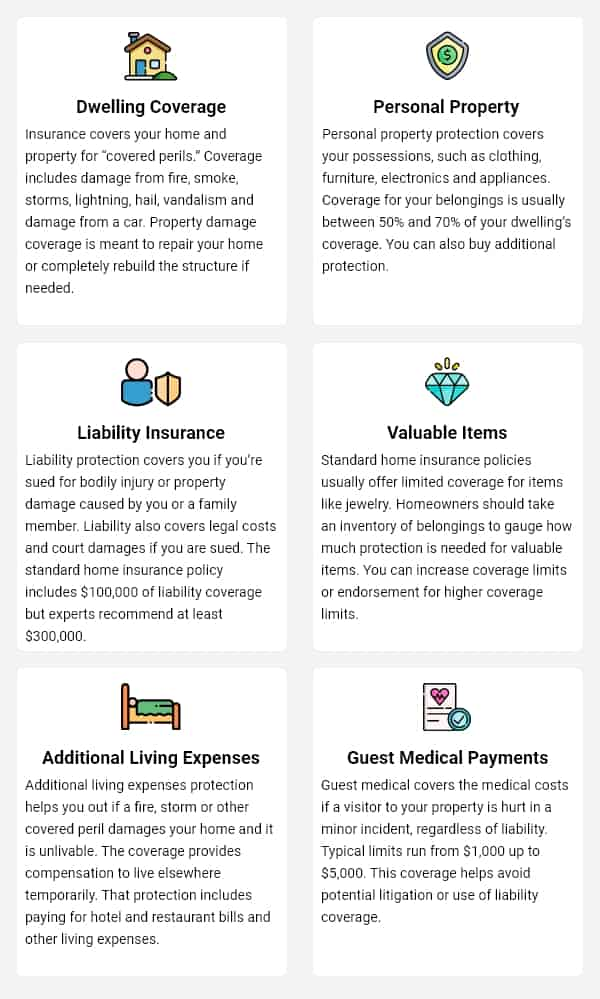

Homeowners Insurance California Insurance Com

Homeowners Insurance California Insurance Com

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template

9 Types Of Insurance That Might Be A Waste Of Money Home And Auto Insurance Homeowners Insurance Property And Casualty

9 Types Of Insurance That Might Be A Waste Of Money Home And Auto Insurance Homeowners Insurance Property And Casualty

Insurance Killeen Contact At 800 212 2641 Pet Health Insurance Car Insurance Insurance Policy

Insurance Killeen Contact At 800 212 2641 Pet Health Insurance Car Insurance Insurance Policy

Negotiating Contractor Expenses On Home Insurance Claims

Negotiating Contractor Expenses On Home Insurance Claims

Sample Contract For Wholesaling Flipping Houses Real Estate Investing Real Est Real Estate Investing Quotes Getting Into Real Estate Real Estate Contract

Sample Contract For Wholesaling Flipping Houses Real Estate Investing Real Est Real Estate Investing Quotes Getting Into Real Estate Real Estate Contract

![]() Everything You Need To Know About Overhead Profit O P In A Property Insurance Claim Claimsmate

Everything You Need To Know About Overhead Profit O P In A Property Insurance Claim Claimsmate

Insurance Is A Means Of Protection From Financial Loss It Is A Form Of Risk Management Personal Financial Planner Life And Health Insurance Financial Advisory

Insurance Is A Means Of Protection From Financial Loss It Is A Form Of Risk Management Personal Financial Planner Life And Health Insurance Financial Advisory

/house-model-and-key-in-home-insurance-broker-agent--hand-or-in-salesman-person--real-estate-agent-offer-house--property-insurance-and-security--affordable-housing-concepts-1076671916-586f4e8f2f994a5ca7518c675e7ae0e7.jpg) Is Homeowners Insurance Tax Deductible

Is Homeowners Insurance Tax Deductible

Do I Have To Pay Taxes On My Insurance Settlement Valuepenguin

Insurance Icons Flat Set Flat Design Icons Icon Design Inspiration Icon

Insurance Icons Flat Set Flat Design Icons Icon Design Inspiration Icon

Understanding Homeowners Insurance Policies And Coverage Autoversicherung Wohngebaudeversicherung Versicherung

Understanding Homeowners Insurance Policies And Coverage Autoversicherung Wohngebaudeversicherung Versicherung

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

Insuring Residences Owned By A Trust Llc Or Other Entity Expert Commentary Irmi Com

The 8 Steps Needed For Putting Universal Life Insurance Into Action Universal Life Insurance Universal Life Insurance Life Insurance Policy Car Insurance

The 8 Steps Needed For Putting Universal Life Insurance Into Action Universal Life Insurance Universal Life Insurance Life Insurance Policy Car Insurance

Are Homeowner S Insurance Loss Payouts Taxable

Are Homeowner S Insurance Loss Payouts Taxable