Property Plant And Equipment Tax Treatment

We would like to show you a description here but the site wont allow us. Fixed assets also known as long-lived assets tangible assets or property plant and equipment PPE is a term used in accounting for assets and property that cannot easily be converted into cash.

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

The underlying purpose of this standard is to lay down or specify accounting treatment for Property Plant and Equipment.

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg)

Property plant and equipment tax treatment. IRM 1144 Personal Property Management. The IRS really frowns upon the improper acceleration of deductions. If qualified second generation biofuel plant property is originally placed in service by a lessor after October 3 2008 the property is sold within 3 months of the date it was placed in service and the user of the property does not change then the property is treated as originally placed in service by the taxpayer no earlier than the date of the last sale.

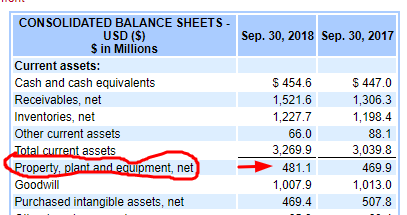

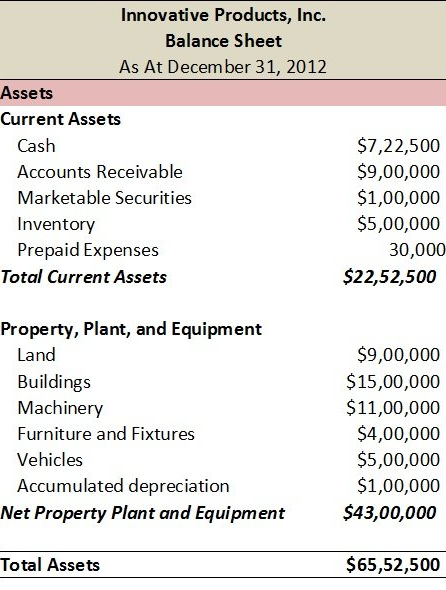

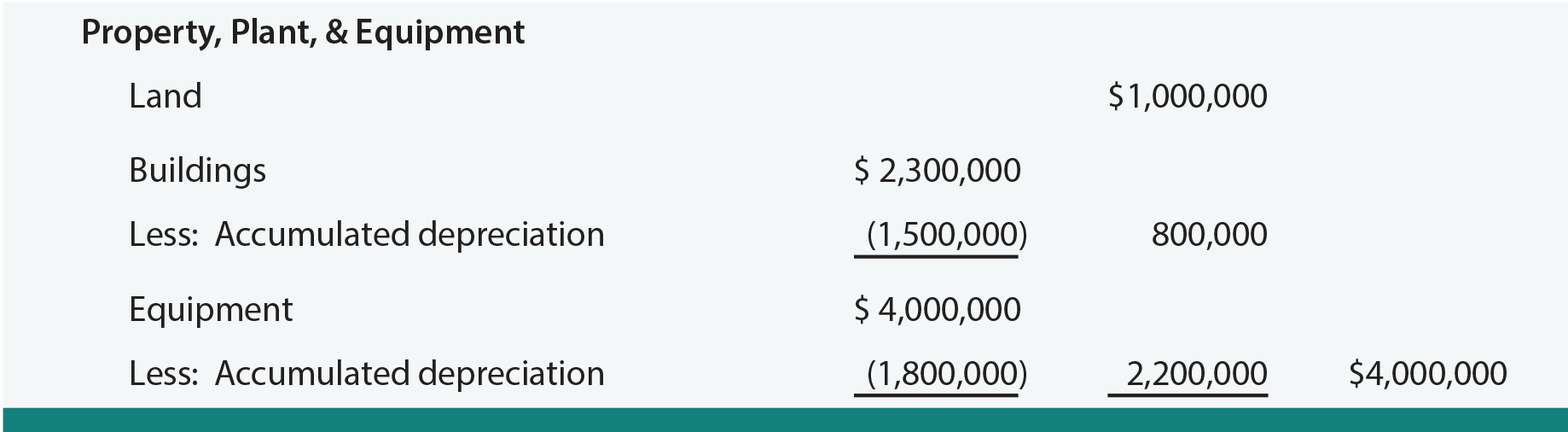

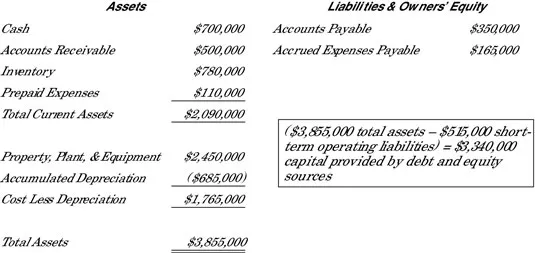

On the balance sheet these assets appear under the heading Property plant and equipment. Disposal of an asset of property plant and equipment is the process of removing the cost of the asset and its accumulated depreciation from general ledger by selling or writing off the asset during or at the end of its useful life so that it is no longer shown on the balance sheet. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment.

Illinois has expanded the states manufacturing sales and use tax exemption to include production related tangible personal property effective July 1 2019. Its purchase price including import duties and non-refundable purchase taxes after deducting trade discounts and rebates. IFRS and ASPE are similar in the treatment of property plant and equipment.

The cost of an item of property plant and equipment includes. The Accelerated Cost Recovery System ACRS is a method of depreciating property for tax purposes. Our Tax account has ignored the 167K figure and has deducted only 500 from the 24k using the 500 figure as the adjusted basis for the timber.

However there are some major differences in the requirements such as. Property plant and equipment also called fixed assets is tangible or intangible assets to be used in the production or supply of goods and services or for administrative purposes and it can. 10 Accounting for Internal Use Software PDF.

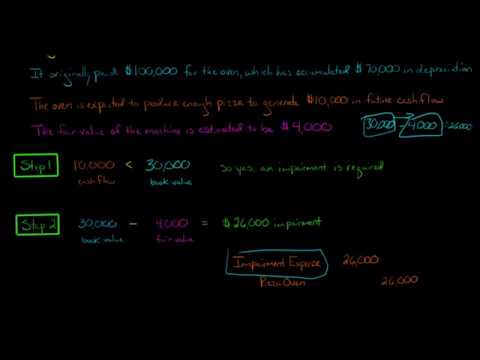

44 Accounting for Impairment of General Property Plant and Equipment Remaining in Use PDF. 42 Deferred Maintenance and Repairs PDF. One last question we paid 2k in California Yield Tax is this deductible.

This page describes the taxability of manufacturing and machinery in Missouri including machinery raw materials and utilities fuel. Could this be correct hard to believe. Citation needed This can be compared with current assets such as cash or bank accounts described as liquid assetsIn most cases only tangible assets are referred to as fixed.

The depreciation expense is used to reduce the value of the net balance and it flows to the income statement as an expense. Common plant assets are buildings machines tools and office equipment. From Pennys perspective leasing the equipment allows it to effectively recover the equipments cost over three years via its deductions of the rental payments.

The salvage logging yielded us only about 24k. For the purposes of calculating the depreciation deduction that is allowable for the new asset the cost of the asset is reduced by the offset amount. To learn more see a full list of taxable and tax-exempt items in Missouri.

This is to enable the users of the financial statements to understand the investment made by the business entity in property plant and equipment and the changes made therein. It allows individuals and businesses to write off capitalized assets in an accelerated manner. IRM 21491 Asset.

Under ASPE properties held by an entity for rental or capital appreciations are treated the same as property plant and equipment. 6 Accounting for Property Plant and Equipment PDF. Accounting Standard 10 deals with Property Plant and Equipment PPE.

We inherited the property in 1965. Production related tangible personal property is considered all tangible personal property that is used or consumed by a purchaser in a manufacturing facility. When a company acquires a plant asset accountants record the asset at the cost of acquisition historical cost.

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Depreciation reduces the value of property plant and equipment on the balance sheet as the value of assets is lowered over time due to wear and tear and the reduction of their useful life. This is known as the derecognition of PPE.

The total value of PPE can range from very low to extremely high compared to total assets. For example if it costs Bluebird 11 million to purchase a new plant and equipment 800000 will form the basis of the cost of the new machine when calculating depreciation. While Missouris sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Initial recording of plant assets. If it had purchased the equipment it likely would have recovered the cost over five years via depreciation deductions. Property plant and equipment are tangible assets meaning they are physical in nature or can be touched.

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx) Lease Accounting A Guide For Tech Companies Bdo Insights

Lease Accounting A Guide For Tech Companies Bdo Insights

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Accounting Policies Are The Specific Principles Bases Conventions Rules And Practices Applied By An Entity In Prepa How To Apply Accounting Accounting Notes

Accounting Policies Are The Specific Principles Bases Conventions Rules And Practices Applied By An Entity In Prepa How To Apply Accounting Accounting Notes

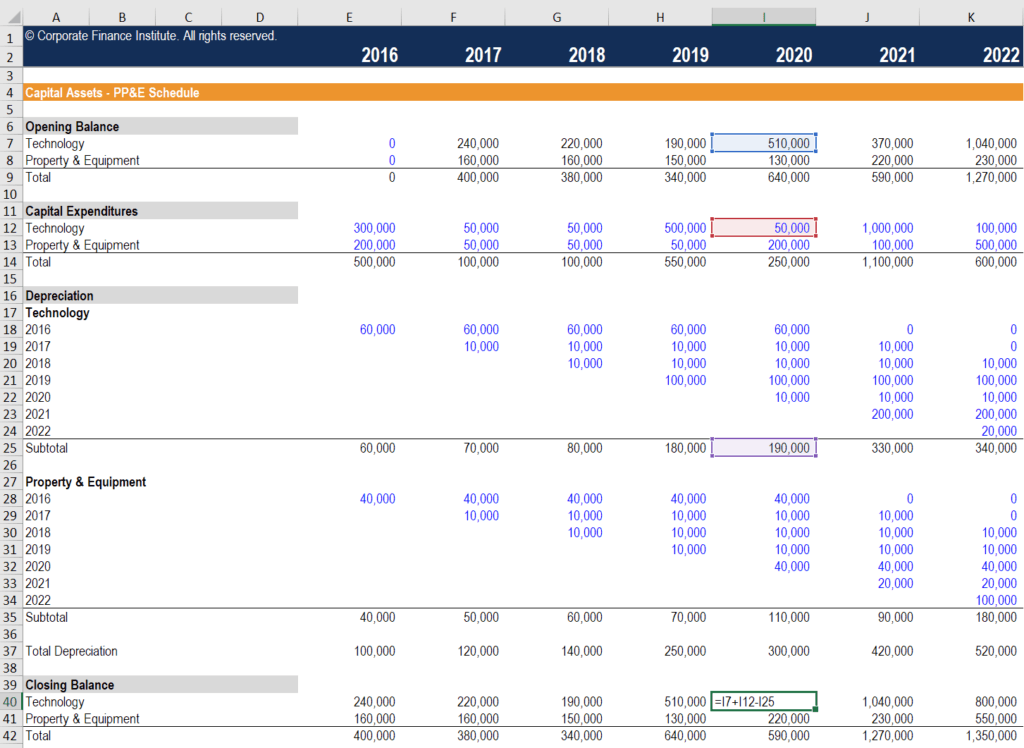

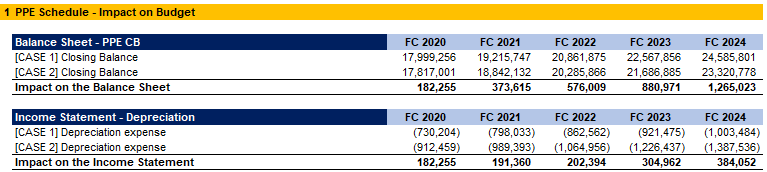

Capex Depreciation And Amortization In Financial Modeling By Dobromir Dikov Fcca Magnimetrics Medium

Capex Depreciation And Amortization In Financial Modeling By Dobromir Dikov Fcca Magnimetrics Medium

Https Policy Ucop Edu Doc 3410279

Impairment Of Property Plant And Equipment Youtube

Impairment Of Property Plant And Equipment Youtube

Ias 37 Provisions Contingent Liabilities And Contingent Assets Time Value Of Money Financial Instrument Financial Statement

Ias 37 Provisions Contingent Liabilities And Contingent Assets Time Value Of Money Financial Instrument Financial Statement

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Accounting Convention Of Consistency Meaning Accounting Bookkeeping Tax Services

Accounting Convention Of Consistency Meaning Accounting Bookkeeping Tax Services

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Deferred Tax Meaning Accounting Class Deferred Tax Accounting Classes Accounting

Deferred Tax Meaning Accounting Class Deferred Tax Accounting Classes Accounting

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg) Cash Flow From Investing Activities

Cash Flow From Investing Activities

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)