Property Tax Calculator Oklahoma

Furthermore that comes in as just over half the 2578 national median. If you are unsure call any local car dealership and ask for the tax rate.

Oklahoma State Tax Calculator.

Property tax calculator oklahoma. Not ALL STATES offer a tax and tags calculator. Our Garfield County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Oklahoma and across the entire United States. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

Our Oklahoma Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Oklahoma and across the entire United States. The Oklahomas tax rate may change depending of the type of purchase. This tax calculator performs as a standalone State Tax calculator for Oklahoma it does not take into account federal taxes medicare decustions et al.

Using our Oklahoma Salary Tax Calculator. Oklahoma has one of the lowest median property tax rates in the United States with only six states collecting a lower median property tax than Oklahoma. One reason for these low taxes is that state laws do not allow assessed home values to increase by more than 3 from the previous years value.

Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to. The results of this property tax calculator are for information purposes only. The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US.

As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country. The Oklahoma tax calculator is updated for the 202122 tax year. Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications Exemption Letters Motor Vehicle OkCARS - Online Renewal Find a Tag Agent Forms Publications General Motor Vehicle Forms.

With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Some of the Oklahoma tax type are.

Single filers will pay the top rate after earning 7200 in taxable income per year. This breakdown will include how much income tax you are paying state taxes. This will be a close approximation of the actual tax bill from the information entered.

However this top tax rate applies to taxable income over just 7200 for individual filers or 12200 for couples filing jointly and heads of household. Our Bryan County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Oklahoma and across the entire United States. Vehicle tax or sales tax is based on the vehicles net purchase price.

Oklahoma has a six-bracket progressive income tax system. Delinquent Tax Paid. Its fairly simple to calculate provided you know your regions sales tax.

Oklahoma state rates for 2021. Oklahoma State Payroll Taxes. For the 2020 tax year Oklahomas top income tax rate is 5.

In this example the final tax bill is 450. Please refer to the Oklahoma website for more sales taxes information. That puts Oklahomas top income tax rate in the bottom half of all states.

Dealership employees are more in tune to tax rates than most government officials. Estimate your tax using our tax calculator. Oklahoma County Assessor Estimated Tax Calculator.

You will need the following data. Oklahoma City Oklahoma 73102 Electronic CheckE-check If you want to pay through the E-Check option a 250 service fee will be charged by Official Payments for the following payment types. This could vary if the district in which the property is located had higher or lower school city or other bond issues.

Consumers use rental tax sales tax sellers use lodgings tax and more. The median property tax in Oklahoma is 79600 per year for a home worth the median value of 10770000. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Rates generally vary from 86 to 134 per thousand within the county. 45 is the smallest possible tax rate Elmore City Oklahoma. The median annual property tax payment in Oklahoma is 1278 which is the 10th-lowest amount of any state.

Tax rates range from 05 to 50. Counties in Oklahoma collect an average of 074 of a propertys assesed fair market value as property tax per year. To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. The states top income tax rate of 500 is in the bottom half of all states.

Oklahoma Tax Commission Tag Tax Title Fees

Oklahoma Tax Commission Tag Tax Title Fees

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

Total Sales Tax Per Dollar By City Oklahoma Watch

Smartasset S Free And Interactive Tools Help You Make Smarter Decisions On Home Buying Refinance Retirement Li Retirement Calculator Property Tax Retirement

Smartasset S Free And Interactive Tools Help You Make Smarter Decisions On Home Buying Refinance Retirement Li Retirement Calculator Property Tax Retirement

Mortgage Calculator Oklahoma New American Funding

Mortgage Calculator Oklahoma New American Funding

Tax Estimates Oklahoma County Assessor Ok

Http Www Qpublic Net Ok Garfield Docs Tes 14 Pdf

Oklahoma Paycheck Calculator Smartasset

Oklahoma Paycheck Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Oklahoma Property Taxes H R Block

Oklahoma Property Taxes H R Block

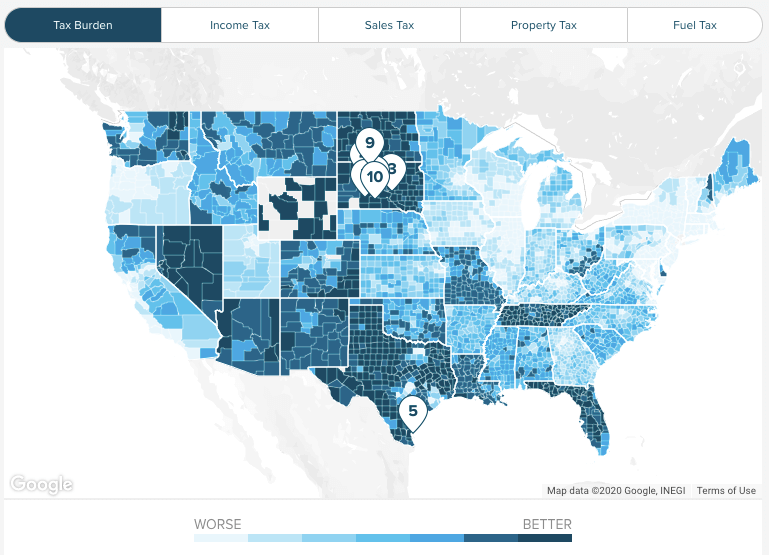

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Hawaii Property Tax Calculator Smartasset

Hawaii Property Tax Calculator Smartasset

Figuring Taxes Oklahoma County Assessor Ok

Indiana Income Tax Calculator Smartasset

Indiana Income Tax Calculator Smartasset

Arkansas Property Tax Calculator Smartasset

Arkansas Property Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Oklahoma Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Oklahoma Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income