Property Tax Deduction 2019 Nyc

Property Tax Bills. Property tax deductions offer homeowners the opportunity to lower tax bills significantly by reducing taxable income.

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

Property tax deduction 2019 nyc. As the owner of a condo you receive a tax bill separately but if you own a co-op the tax is included in your maintenance and you will get a statement from the board or management company saying what portion of the payment is mortgage and what portion is property taxes. New York City is one of just a few cities in the US. Property Bills Payments.

Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief STAR program.

For 2020 the exemption will rise to 585 million. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. Filing status Standard deduction amount 1 Single and can be claimed as a dependent on another taxpayers federal return 3100 1 Single and cannot be claimed as a dependent on another taxpayers federal return 8000 2 Married filing joint return.

Data and Lot Information. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separateIn addition you can no longer deduct foreign taxes you paid on real estate. Imagine you paid 7000 in state income taxes in 2019 and another 8000 in property taxes which for the record isnt unheard of in states like New York and New Jersey.

Take the standard IRS property tax deduction. The New York City tax is calculated and paid on the New York State income tax return. New York Gasoline Tax The Motor Fuel Excise Taxes on gasoline and diesel in New York are 805 cents per gallon and 800 cents per gallon respectively.

Fortunately the IRS allows you to take a property tax deduction for the cost of taxes that you must pay to local taxing authorities. New York Citys tax code doesnt include any deductions but the city does offer some credits of its own separate from those the state offers. But the IRS is picky about which tax deductions you may claim so you have a choice to either.

That has a personal income tax. If you are not required to file a New York State income tax return but you qualify for this credit just complete and file Form IT-214 to claim a refund of the credit. A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments.

Heres what that means. Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point. NYC is a trademark and service mark of the City of New York.

The state and city income taxes are very high in NYC. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes.

The rules changed somewhat with the passage of the Tax Cuts and Jobs Act TCJA in 2018 but the property tax deduction is still available. NYC is a trademark and service mark of the City of New York. Under the old rules youd be eligible for a 16000 deduction but under the.

Their problem sits with the new deduction cap on state and local taxes which the law caps at 10000. Property Records ACRIS Deed Fraud Alert. If you file a New York State personal income tax return complete Form IT-214 Claim for Real Property Tax Credit and submit it with your return.

16050 3 Married filing separate return. Lets say you pay 8000 in state income taxes and another 8000 in property taxes in 2019. April 9 2019 1205 PM.

This deduction was unlimited until the Tax Cuts and Jobs Act TCJA imposed an annual cap of 10000 effective tax year 2018. But families in high-tax states like New York. Bills are generally mailed and posted on our website about a month before your taxes are due.

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

The exemption for the 2019 tax year is 574 million which means that any bequeathed estate valued below that amount is not taxable. For New York purposes Form IT-196 lines 5 6 and 7 your state and local taxes paid in 2020 are not subject to the federal limit and. Thanks to the new tax.

NYC is a trademark and service mark of the City of New York. The Department of Finance DOF administers business income and excise taxes. DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales.

What Is Co Op Apartment Nyc Hauseit Nyc Co Op Nyc Apartment

What Is Co Op Apartment Nyc Hauseit Nyc Co Op Nyc Apartment

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

Co Op Gift Letter Sample And Instructions For Nyc Letter Gifts Nyc Lettering

Co Op Gift Letter Sample And Instructions For Nyc Letter Gifts Nyc Lettering

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Condo Future Lifestyle

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Condo Future Lifestyle

Miami Top In Us For Luxury Property Price Appreciation In Q1 Prime Global Cities Index Mrfisherisland Fisher Fisher Island Miami Real Estate Global City

Miami Top In Us For Luxury Property Price Appreciation In Q1 Prime Global Cities Index Mrfisherisland Fisher Fisher Island Miami Real Estate Global City

How Pied A Terres Work In Nyc Real Estate Nyc Real Estate Nyc Buying A Condo

How Pied A Terres Work In Nyc Real Estate Nyc Real Estate Nyc Buying A Condo

This Star Tax Relief Shines Brightly Elika Real Estate Nyc Real Estate Estate Tax Real Estate

This Star Tax Relief Shines Brightly Elika Real Estate Nyc Real Estate Estate Tax Real Estate

Advice For Co Buying A House Https Www Hauseit Com Co Buying A House Nyc Real Estate Nyc Buying A Condo

Advice For Co Buying A House Https Www Hauseit Com Co Buying A House Nyc Real Estate Nyc Buying A Condo

Figuring Out Square Footage For Co Ops In Nyc Square Footage Nyc Co Op

Figuring Out Square Footage For Co Ops In Nyc Square Footage Nyc Co Op

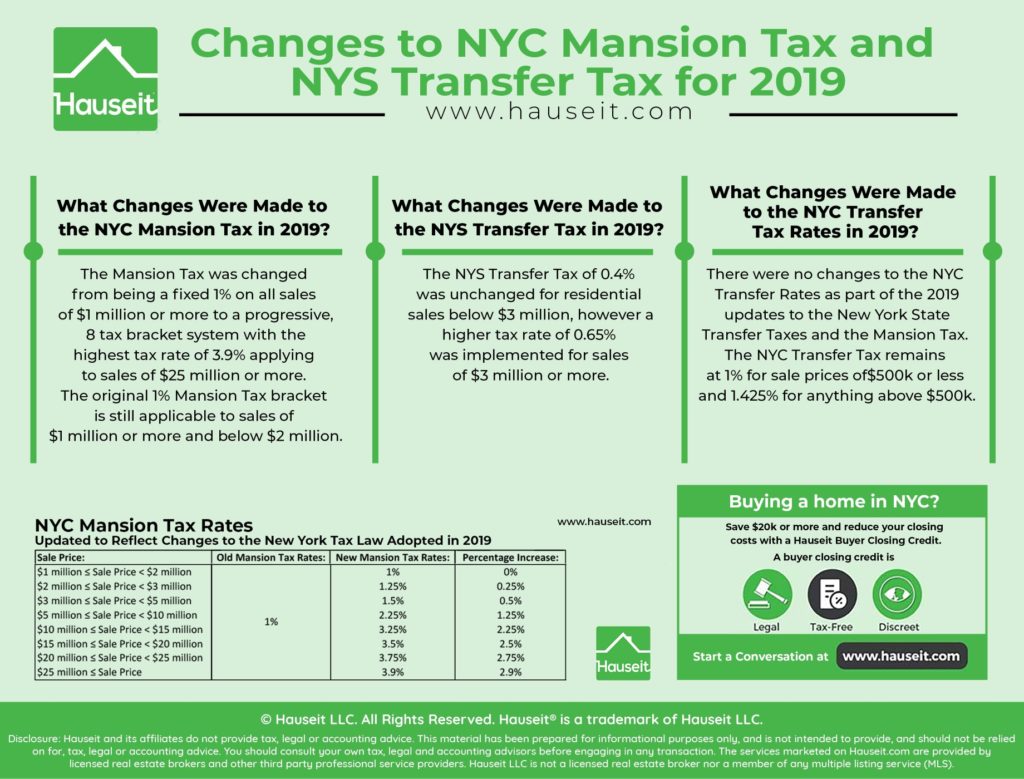

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Nyc Coop House Rules Hauseit House Rules Nyc Rules

Nyc Coop House Rules Hauseit House Rules Nyc Rules

Nyc Buying A House Without An Agent Hauseit Nyc Advice Agents

Nyc Buying A House Without An Agent Hauseit Nyc Advice Agents

1031 Exchange Tips Hauseit Capital Gains Tax Capital Gain Exchange

1031 Exchange Tips Hauseit Capital Gains Tax Capital Gain Exchange

Condo Co Op Managing Agent Responsibilities In Nyc Hauseit Nyc Building Management Paying Bills

Condo Co Op Managing Agent Responsibilities In Nyc Hauseit Nyc Building Management Paying Bills

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

Regrets Buying An Apartment Nyc Hauseit Nyc Buying A Condo Apartment

Regrets Buying An Apartment Nyc Hauseit Nyc Buying A Condo Apartment

Is It Really Worth It To Buy A House House Worth Mortgage Payoff Closing Costs

Is It Really Worth It To Buy A House House Worth Mortgage Payoff Closing Costs

Is Co Op Monthly Maintenance Tax Deductible In Nyc Hauseit Tax Deductions Deduction Income Tax Return

Is Co Op Monthly Maintenance Tax Deductible In Nyc Hauseit Tax Deductions Deduction Income Tax Return

Difference Between A Condo Vs Apartment In Nyc Hauseit Nyc Condo Apartment

Difference Between A Condo Vs Apartment In Nyc Hauseit Nyc Condo Apartment