Riverside County Supplemental Property Tax Calculator

To address the concerns of not being able to record intergenerational transfers before 2162021. The supplemental property taxes would therefore be subject to a proration factor of 75 and your supplemental tax would be 750.

Mynhd Pricing California Real Estate Commercial Property Environmental Report

Mynhd Pricing California Real Estate Commercial Property Environmental Report

The countys average effective tax rate is 095.

Riverside county supplemental property tax calculator. The supplemental tax bill is sent directly to you by the Treasurer Tax Collector rather than to your mortgage company as may be the case with the regular property tax bill. To calculate your supplemental tax bill subtract your homes old value from the new market value based on the reassessment. The County Auditor finds that the supplemental property taxes on your new home would be 1000 for a full yearThe change of ownership took place on September 15 with the effective date being October 1.

However there is a supplemental assessment to the new main roll the annual tax roll created on the January 1 Lien Date that covers the full 12 months of the coming fiscal year. Property Assessment Property Tax Supplemental Assessments Supplemental Assessments Since July of 1983 whenever there is a change in ownership or completion of a new construction the Assessor shall reappraise the property at its full cash value unless there is a qualifying exclusion or exemption from reassessment. Riverside County taxpayers face some of the highest property tax rates in California.

The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. Finally the 1 tax rate is applied to that amount to get your supplemental tax total. You are taxed on that difference.

A supplemental event that occurs in June rolls over to July 1 the first day of the new fiscal year. To visit this site click here. The Placer County Supplemental Tax Estimator provides an ESTIMATE of the amount of supplemental taxes you can expect to pay if you have recently purchased a property.

Riverside County Property Tax Calculator While the exact property tax rate you will pay is set by the tax assessor on a property-by-property basis you can use our Riverside County property tax estimator tool to estimate your yearly property tax. Estimate Property Tax Our Riverside County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

The county offices of the Assessor Auditor-Controller and Treasurer-Tax Collector created a website to assist the public with general information concerning property taxes. The Supplemental Tax Estimator provides an estimate of supplemental taxes along with an estimate of property tax liability for the following tax year. This Supplemental Tax Estimator is intended for changes in ownership only and not for situations where assessed value is added due to new construction.

As a result there is no supplemental assessment to the current roll. Next we prorate what you owe based on the number of months left in the fiscal year. Currently you may research and print assessment information for individual parcels free of charge.

This calculator is designed to help you estimate property taxes after purchasing your home. The Office of the Los Angeles County Assessor will consider the execution and notarization date notarial execution on the document to determine eligibility for Prop. Please note that the estimator is a tool to assist property owners as they are waiting for their actual supplemental notice.

Riverside CA 92501 Telephone. In addition to the homeowners exemption you can apply through the Assessors Office for a number of other assessment exemptions eg veterans church and welfare that result in savings. Supplemental taxes are eligible for the same property tax exemptions and assistance programs as your annual taxes.

King County Washington Property Tax Calculator Show 2015 Show 2016 Show 2017 Show 2018 Show 2019 Show 2020 Places Receiving the Most Value for Their Property Taxes. After a property transfers State law Proposition 13 passed in 1978 requires the Assessors Office to set a new assessed value for your property. Overview of Riverside County CA Taxes.

951 955-3802 Is there a centralized location to obtain property tax information. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments. However rates can vary wildly depending on where you live within the county.

The State of California passed the supplemental assessment law in 1983 to provide additional funding primarily for schools. Before we start watch the video below to understand what are supplemental taxes.

Http Www Riversideca Gov Pworks Pdf Teq Ceqa 04 2009 Pdf

Nationwide Renters Insurance Review The Simple Dollar Renters Insurance Renters Insurance Quotes Homeowners Insurance

Nationwide Renters Insurance Review The Simple Dollar Renters Insurance Renters Insurance Quotes Homeowners Insurance

Fha Loan Limits Riverside County Fha Loans Riverside County Riverside

Fha Loan Limits Riverside County Fha Loans Riverside County Riverside

Mynhd Faq California Real Estate California Hazard

Mynhd Faq California Real Estate California Hazard

What Is This Extra Tax Bill I Got Supplemental Tax Bills Explained Youtube

What Is This Extra Tax Bill I Got Supplemental Tax Bills Explained Youtube

Https Www Rctc Org Wp Content Uploads 2019 06 June Budget And Implementation Committee Agenda Pdf

Https Www Rccdistrict Net Eb Pdf 20conversions 05162017 Complete Pdf

Riverside County Assessor County Clerk Recorder Supplemental Assessments

Riverside County Assessor County Clerk Recorder Supplemental Assessments

Riverside County Gift Deed Form California Deeds Com

Riverside County Gift Deed Form California Deeds Com

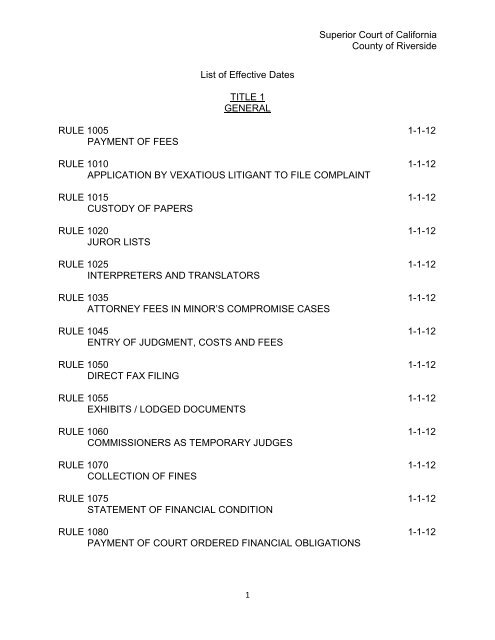

Complete Set Of Local Rules Superior Court Riverside State Of

Complete Set Of Local Rules Superior Court Riverside State Of

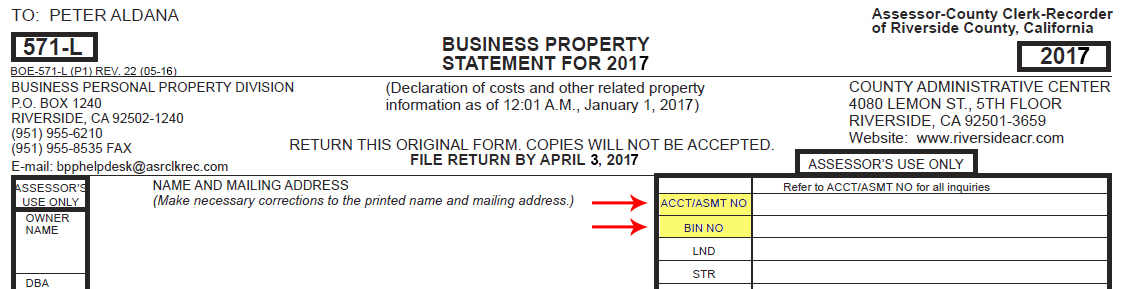

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Riverside County Assessor County Clerk Recorder File Your Business Property Statement Online

Mynhd Sample Supplemental Tax Calculator Estate Tax California Real Estate Tax

Mynhd Sample Supplemental Tax Calculator Estate Tax California Real Estate Tax

Http Countytreasurer Org Linkclick Aspx Fileticket Ib1xaaysnei 3d Tabid 171 Portalid 0

When Every Homeowner Should Know About Property Insurance Robyn Porter Realtor Your Real Estate Agent Home Insurance Home Buying Process Real Estate Tips

When Every Homeowner Should Know About Property Insurance Robyn Porter Realtor Your Real Estate Agent Home Insurance Home Buying Process Real Estate Tips

Riverside County Assessor County Clerk Recorder Decline In Value Proposition 8

Https Www Waterboards Ca Gov Santaana Water Issues Programs Stormwater Docs Rcpermit Damp Damp 07 29 11 Pdf

![]() Mynhd Sample Supplemental Tax Calculator Estate Tax California Real Estate Tax

Mynhd Sample Supplemental Tax Calculator Estate Tax California Real Estate Tax