What Is The Difference Between The Yield To Maturity On A Coupon Bond And The Rate Of Return

Yield to Maturity. Hence the spot rate for the 6-month zero-coupon bond will be 3.

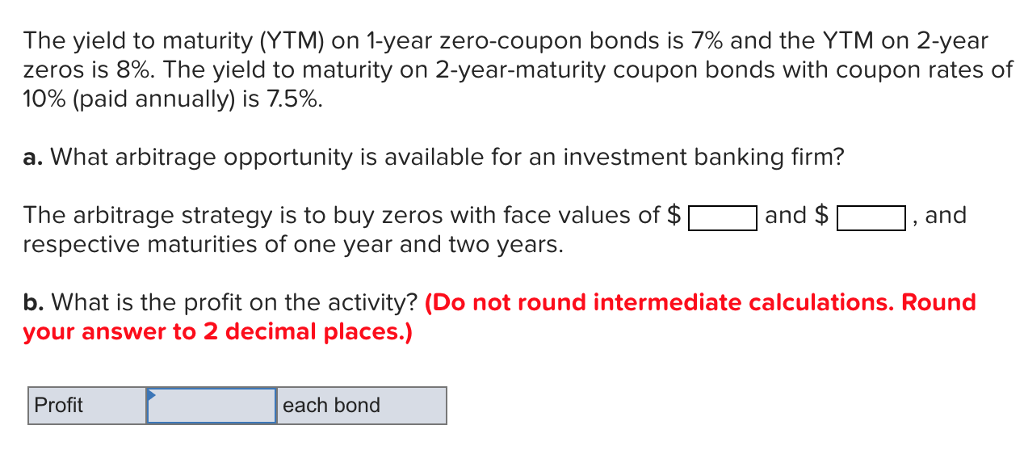

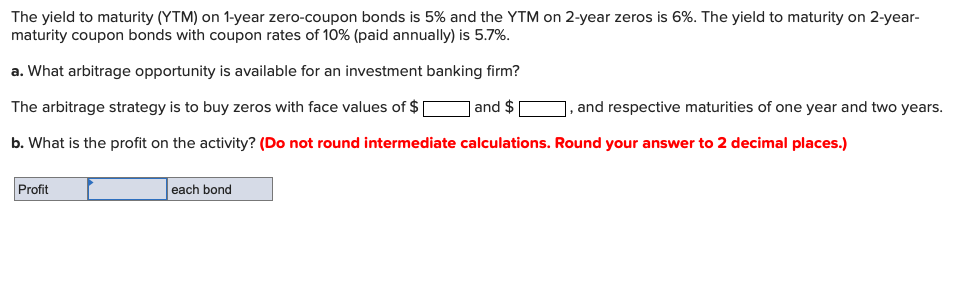

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the cash flows at the promised.

What is the difference between the yield to maturity on a coupon bond and the rate of return. The 5-year Government of Canada bond yield represents the return an investor gets by holding 5-year Canadian debt to maturity. The simple calculated yield which uses the current trading price and face value. Based on this information you are required to calculate the approximate yield to maturity on the bond.

Current yield is the bonds coupon yield divided by its market price. Bond YTC Calculator Outputs. It is the same number used in the bond.

Common examples of yield spreads are g-spread i-spread zero-volatility spread and option-adjusted spread. On this page is a bond yield to maturity calculator to automatically calculate the internal rate of return IRR earned on a certain bondThis calculator automatically assumes an investor holds to maturity reinvests coupons and all payments and coupons will be paid on time. Because government bonds have the full faith and backing of the Canadian government the 5-year Canadian bond is considered the safest Canadian investment with a 5-year term.

The price of the bond is 110179 and the face value of the bond is 1000. You dont have to make random guesses about what the interest rate might be. The yield spread of X over Y is generally the annualized percentage.

Coupon Payment Frequency - How often the bond makes coupon payments. An 8 bond with a par value of 1000 would receive 80 per year. This amount is figured as a percentage of the bonds par value and will not change during the lifespan of the bond.

The market price of a bond is the present value of all expected future interest and principal payments of the bond here discounted at the bonds yield to maturity ie. Treasury might issue a 30-year bond in 2019 thats due in 2049 with a coupon of 2. The coupon rate is 75 on the bond.

The yield to maturity is the yield that you would earn if you held the bond to maturity and were able to reinvest the coupon payments at that same rate. Since this bond is priced at a discount we know that the yield to maturity will be higher than the coupon rate. There are several definitions that are important to understand when talking about yield as it relates to bonds.

That relationship is the definition of the redemption yield on the bond which is likely to be close to the current market interest rate for other bonds with. Yield spread is the difference between the yield to maturity on different debt instruments. Lets compare a Sears Canada 11 bond due in 1999 Sears 1199 with a Government of Canada 925 bond due in 1999 Canada 1199.

The phrase is a compound of yield and spread. For example lets say that we buy a bond for 980 with five years until maturity. Enter the face value of a zero-coupon bond the stated annual percentage rate APR on the bond and its term in years or months and we will return both the upfront purchase price of the bond its nominal return over its duration its yield to maturity.

A bond is quoted with its coupon yield. Yield is a general term that relates to the return on the capital you invest in a bond. In finance the yield spread or credit spread is the difference between the quoted rates of return on two different investments usually of different credit qualities but similar maturitiesIt is often an indication of the risk premium for one investment product over another.

The converged upon solution for the yield to call of the current bond the internal rate of return assuming the bond is called. Use the below-given data for calculation of yield to maturity. Bond spreads can also be calculated between bonds of different maturity interest rate coupon or even different countries and currencies.

A bonds coupon rate is the rate of interest it pays annually while its yield is the rate of return it generates. Original face or par value 1000. To calculate the current yield for a bond with a coupon yield of 45 percent trading at 103 1030 divide 45 by 103 and multiply the total by 100.

A bond has a variety of features when its first issued including the size of the issue the maturity date and the initial couponFor example the US. For a 1-year bond there will be two cash flows at 6 months and at 1 year. Now for a zero-coupon with a maturity of 6 months it will receive a single coupon equivalent to the bond yield.

Estimate the interest rate by considering the relationship between the bond price and the yield. The second is the yield to maturity YTM. The bonds face value is 1000 and its coupon rate is 6 so we get a 60 annual interest payment.

Yield to Call. Bond Yield Rate vs. Bond yield is the internal rate of return of the bond cash flows.

The breakeven inflation rate is the difference between the nominal yield usually the market yield which includes an inflation premium on a fixed-income investment and the real yield with no inflation premium on an inflation-linked investment of similar maturity and credit quality. It is the sum of all of its remaining coupon payments. Coupon yield current yield yield-to-maturity yield-to-call and yield-to-worst.

The yield to maturity YTM is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. For longer duration bonds enter the number of years to maturity. A bonds coupon rate is expressed.

This refers to the annual interest payable as a percent of the original face or par value.

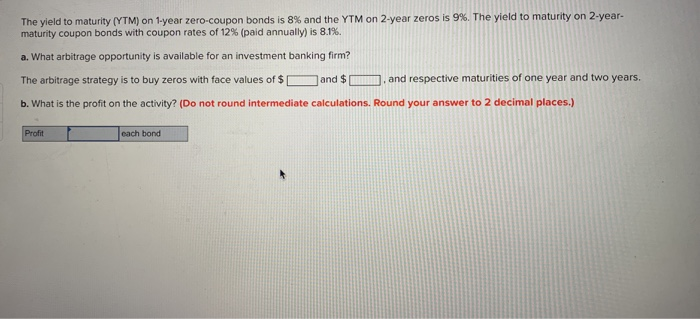

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

What Is Yield To Maturity How To Calculate It Scripbox

What Is Yield To Maturity How To Calculate It Scripbox

Bond Yield To Maturity Calculator For Comparing Bonds Mortgage Payment Calculator Budget Calculator Debt Calculator

Bond Yield To Maturity Calculator For Comparing Bonds Mortgage Payment Calculator Budget Calculator Debt Calculator

Current Yield Meaning Importance Formula And More Learn Accounting Accounting And Finance Investors Business Daily

Current Yield Meaning Importance Formula And More Learn Accounting Accounting And Finance Investors Business Daily

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Solved The Yield To Maturity On 1 Year Zero Coupon Bonds Chegg Com

Investing In Bonds Part2 Bond Returns Current Yield Yield To Maturity Realised Yield Investing Bond Issue Zero Coupon Bond

Investing In Bonds Part2 Bond Returns Current Yield Yield To Maturity Realised Yield Investing Bond Issue Zero Coupon Bond

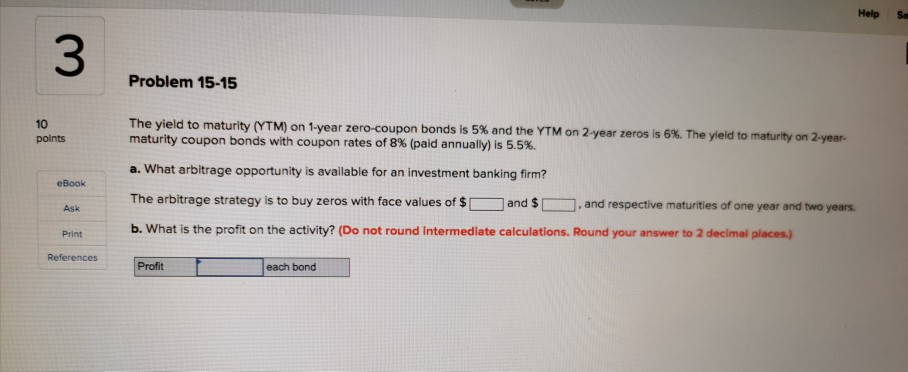

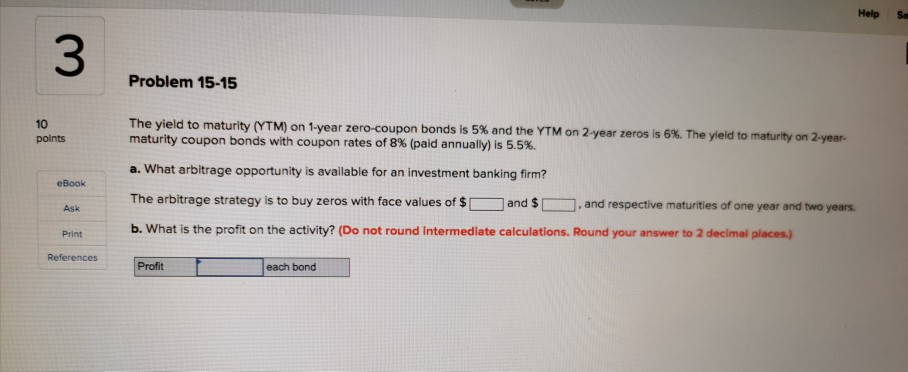

Solved Help Problem 15 15 10 Points The Yield To Maturity Chegg Com

Solved Help Problem 15 15 10 Points The Yield To Maturity Chegg Com

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg) Current Yield Vs Yield To Maturity

Current Yield Vs Yield To Maturity

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Calculate The Ytm Of A Coupon Bond Youtube

Calculate The Ytm Of A Coupon Bond Youtube

Calculating Yield To Maturity Of A Zero Coupon Bond

Calculating Yield To Maturity Of A Zero Coupon Bond

Coupon Rate And Yield To Maturity Youtube

Coupon Rate And Yield To Maturity Youtube

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

Solved The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

Coupon Vs Yield Top 8 Useful Differences With Infographics

Coupon Vs Yield Top 8 Useful Differences With Infographics

The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com

The Yield To Maturity Ytm On 1 Year Zero Coupon Chegg Com