What Is Gain Tax On Property In Pakistan

Capital Gains Tax CGT It is best to file CGT in time to avoid being a defaulter. In the Finance Act 2019 many new taxation measures have been introduced and most importantly the capital gain tax has also been revamped.

Customer Review Filing Taxes Tax Services Tax

Customer Review Filing Taxes Tax Services Tax

There is a gain of Rs 1100000.

What is gain tax on property in pakistan. It is generally levied at a flat rate of 10 but the tax rates vary depending on the province. Zameens Laws and Taxes section helps all readers get a better understanding of how different laws work around taxes and other important matters of real estate. Also the tax brackets change every year.

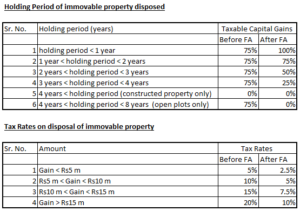

The tax applies to the property of the sellers. The tax chart changes every year. The Federal Board of Revenue FBR has made significant changes in the Income Tax Ordinance 2001 through the Finance Act 2020 for taxation of the capital gain on the disposal of immovable property.

Legal documents can be difficult to understand due to complex terminology. Suppose you bought a house for Rs 1400000 and sold it for Rs 2500000. Income from capital gain shall be declared in the return of income for tax year 2017.

Some of the things you need to understand about this tax are. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Is present in Pakistan for a period of or periods amounting in aggregate to one hundred and twenty days or more in the tax year and in the four years preceding the tax year has been in Pakistan for a period of or.

Days or more in the tax year. Capital Gain Tax is levied when the property is sold within the three years of its purchase. Capital Gains Tax CGT is a federal tax to be paid by the seller.

Federal Board of Revenue FBR has issued formula for computation of capital gain tax on disposal of immovable property as amended through Finance Act 2020. This is not payable on the complete price of the commodity you have sold but only on the profits you have made. Capital gain tax on property is the tax payable to the Federal Government Of Pakistan on the profits you make.

During the first year the tax is 10 in the second year it is 75 and in the third year the tax rate falls to 5. It is their only source of capital gains in the country. With the new government the tax has also become the most important initiative.

Prior to the Finance Act 2019 capital gain on immovable property was separately taxed on the basis of holding period of property. Income from Other Sources. Whereas the first-year tax is 10 the second year it comes down to 75 and in the third year its 5 only.

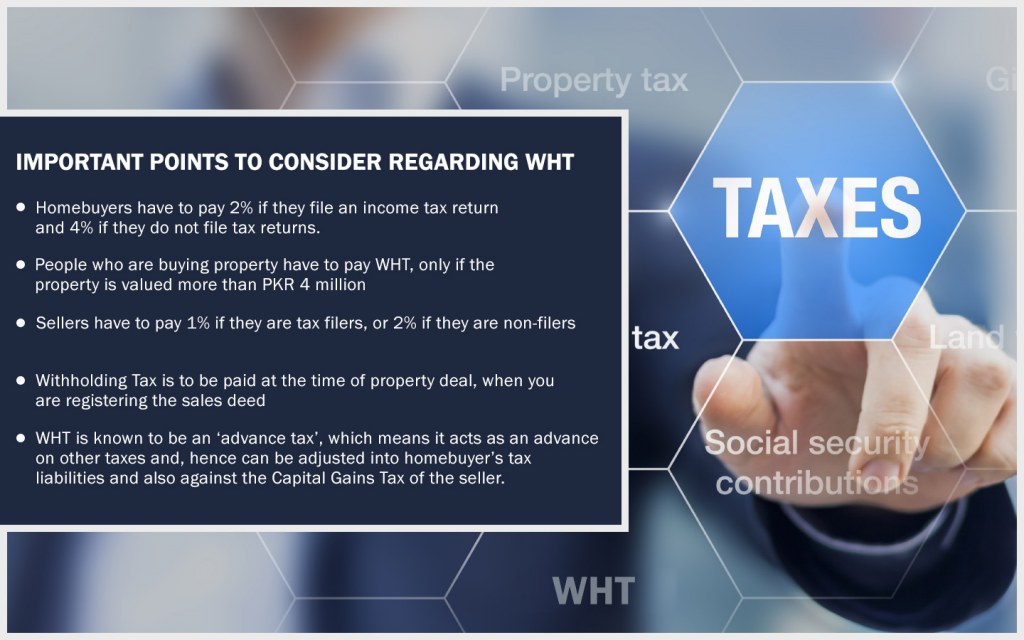

Capital gains taxes. Property tax is a provincial tax levied on the value of property. Advance tax under section 236C being a seller of property and capital gain tax under section 371A shall also be applicable on the valuation determined by FBR.

The property is directly and jointly owned by husband and wife. For a comprehensive breakdown of property taxes you can check out our blog on understanding property tax rates in Pakistan. After three years the seller is obliged to pay the Capital gain tax.

Property tax is levied at progressive rates in the Punjab province. The tax is levied at a rate of 25 of the annual rental value of the property. The National Assembly recently approved the Finance Act 2020.

The Act amended sub-section 3A of Section 37 of the Income Tax Ordinance 2001. 92 3 111 777 555 92 3 111 777 555 Favourite. Property Tax In Pakistan 2019-2020.

One of the most important concerns of people involved in the real estate sector in Pakistan is Capital Gain Tax. For the first year 10 tax. Rental income is taxed progressively so the rate you pay depends on the total amount youve received.

Comprehensive Pakistan property tax calculator to calculate advance withholding tax Capitals Gains Tax CVT Stamp duty. Kinds of tax on sale of property in Pakistan. Types of Taxes and collecting bodies.

In Pakistan you have to pay tax on any money you gain from the property so if you rent it out therell be tax to pay on the rent unless the gross amount from the rent doesnt exceed Rs 200000. According to the Pakistan finance act 2017 capital gain tax can only be levied when the property is sold within the first three years after the purchase. In very simple sense a capital gain arises when you acquire an immovable property at a lower price and sell it at a higher price the gain being the difference in the prices.

Stamp Duty SD Paid as per DC Rate for registry of property Withholding Tax WHT Paid as per FBR Rate Capital Gain Tax CGT Paid as per FBR Rate Wealth Tax WT Paid on the difference of FBR Rate DC Rate Tax. As the total capital gain is more than Rs10 million but less than Rs 15 million it will be taxed at 15 and tax payable will be Rs1800000. Here is the detail of Property Tax Rates in Pakistan as per Finance Bill 2017.

When it comes to taxes on sale of property in Pakistan there is Capital Gains Tax which needs to be paid on the gain of profits. They have owned it for 10 years. The PTI is trying to streamline the overall process by collecting taxes from the people of the country.

Extension Income Tax Return Filing 2019 20 Latest News For Pakistanis Income Tax Return Tax Return Income Tax Return Filing

Extension Income Tax Return Filing 2019 20 Latest News For Pakistanis Income Tax Return Tax Return Income Tax Return Filing

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

Income Tax Form Ay 3 3 3 Brilliant Ways To Advertise Income Tax Form Ay 3 3 Income Tax Income Tax Return Tax Forms

Top Tax Consultants In Lahore Pakistan Global Tax Consultants Tax Return Tax Software Tax Preparation

Top Tax Consultants In Lahore Pakistan Global Tax Consultants Tax Return Tax Software Tax Preparation

Fbr Significantly Changes The Taxation Of Capital Gains On Disposal Of Immovable Property Profit By Pakistan Today

Fbr Significantly Changes The Taxation Of Capital Gains On Disposal Of Immovable Property Profit By Pakistan Today

Tax Preparation Services Of Glg Accounting Feels That Wealth Planning For A Normal Man Could Be A Highly Complex Situation Business Tax Tax Services Income Tax

Tax Preparation Services Of Glg Accounting Feels That Wealth Planning For A Normal Man Could Be A Highly Complex Situation Business Tax Tax Services Income Tax

All You Need To Know About Real Estate Taxes In Budget 2019 20 Graana Com Blog

All You Need To Know About Real Estate Taxes In Budget 2019 20 Graana Com Blog

September 30 2020 Deadline For Return Filing Filing Taxes Tax Services Tax Return

September 30 2020 Deadline For Return Filing Filing Taxes Tax Services Tax Return

Tax Adjustment On Banking Transactions Filing Taxes Digital Tax Tax Services

Tax Adjustment On Banking Transactions Filing Taxes Digital Tax Tax Services

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Income Tax Return Form 8 Pakistan Why Is Income Tax Return Form 8 Pakistan So Famous Income Tax Income Tax Return Tax Forms

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Everything You Need To Know About Property Taxes In Pakistan Zameen Blog

Everything You Need To Know About Property Taxes In Pakistan Zameen Blog

Tax Rebate Digital Tax Filing Taxes Tax Services

Tax Rebate Digital Tax Filing Taxes Tax Services

Understanding Proprety Tax Rates In Pakistan Zameen Blog

Understanding Proprety Tax Rates In Pakistan Zameen Blog

Pm Imran Khan Announced A Historic Package For The Construction Sector Construction Sector Income Investing Resume Work

Pm Imran Khan Announced A Historic Package For The Construction Sector Construction Sector Income Investing Resume Work

Reduced Tax On Property Purchase And Transfer Filing Taxes Digital Tax Tax Services

Reduced Tax On Property Purchase And Transfer Filing Taxes Digital Tax Tax Services

How To Submit Income Tax Return Fbr Pakistan 2019 File Tax Return Step Filing Taxes Income Tax Tax Return

How To Submit Income Tax Return Fbr Pakistan 2019 File Tax Return Step Filing Taxes Income Tax Tax Return

Property Tax In Pakistan 2019 2021 Graana Com Blog

Property Tax In Pakistan 2019 2021 Graana Com Blog

Use The Limited Time To File Your Returns Filing Taxes Tax Services Income Tax

Use The Limited Time To File Your Returns Filing Taxes Tax Services Income Tax