Capital Gains Tax Japan Real Estate

But anyway same as lease income you need to file individual income tax return for capital gain on Japanese real estate. Capital Gains When Selling Property Under the Japanese tax law when a real estates value is increased and sold tax on the gains should be paid even if you are a foreign national living in Japan or a non-resident of Japan.

Us Expat Tax For Americans Living In Japan All You Need To Know

Us Expat Tax For Americans Living In Japan All You Need To Know

Usually the tax basis is the price the owner paid for the asset.

Capital gains tax japan real estate. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. If youre selling a property you need to be aware of what taxes youll owe. Below is a summary of the Capital Gains treatment as it relates to property disposition in Japan.

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. This is true even if theres no net capital gain subject to tax. Which rate your capital gains will be taxed depends on your taxable.

In Japan Capital Gains are taxed by the government. So lets look at how they can avoid paying capital gains tax. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital Assets.

If you sell real estate for a higher price than you paid for it you may have what is called a Capital Gain. Withholding tax at 1021 is generally assessed on the selling amount from the transfer of real estate by a non-resident individual or a foreign corporation. Overview of capital gains tax from the transfer of properties Capital gains from the transfer of real estate located in Japan are subject to income tax or corporation tax.

FREE - Guide to Real Estate Taxes. If I sell the stock in 2021 would I pay state capital gains in Michigan or Virginia. Capital gains taxes for real estate are more complex than for other asset types.

By contrast they set the top marginal. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. To understand capital gains tax you must understand the concept of tax basis.

This moved from Line 6 on the 2019 formmaking this the third straight year capital gains reporting has changed on Form 1040. The easiest way to avoid paying the tax is by using the 1031 exchange rule to swap whats known as like-kind real estate. Feb 04 2021 Aug 12 2019 by Matt Frankel CFP.

You can also add sales expenses like real estate agent fees to your basis. If you are a resident of Japan for tax purposes you may also be liable to pay capital gains tax on the sale of property overseas. For example if you bought a house for 100000 your tax basis.

You must first determine if you meet the holding period. Capital gain tax on Japanese real estate If Non-resident Individual sells Japanese real estate and earns capital gain capital gain tax is levied since this gain is Japanese sourced income. Governor Inslee is calling for the imposition of a 90.

Obviously Ill pay the federal capital gains tax rate regardless but is it possible to ensure I pay the lower Michigan rate. Learn about how you. The tax basis of an asset is the value thats used to calculate the taxable gainor losswhen the asset is sold.

You report all capital gains on the sale of real estate on Schedule D of IRS Form 1040 the annual tax return. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset. The IRS treats home sales a bit differently than most other assets generating capital.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Subtract that from the sale price and you get the capital gains. Real estate investors are those who most must worry about capital gains tax.

It applies to property shares leases goodwill licences foreign currency contractual rights and personal use assets purchased for more than 10000. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The capital gains tax rate is 425 in Michigan and Virginia is 575.

Lawmakers also agreed however on a new rate preference for capital gains establishing a flat 125 rate for capital assets held for at least two years. How is the capital gain tax for the state handled. Read on to learn about capital gains tax for primary residences second homes investment properties.

Many Washington State taxpayers will be facing a capital gains tax rate exceeding 50 if both the President and their governor get their way. The capital gains tax will be charged on the gains properties taxable portion.

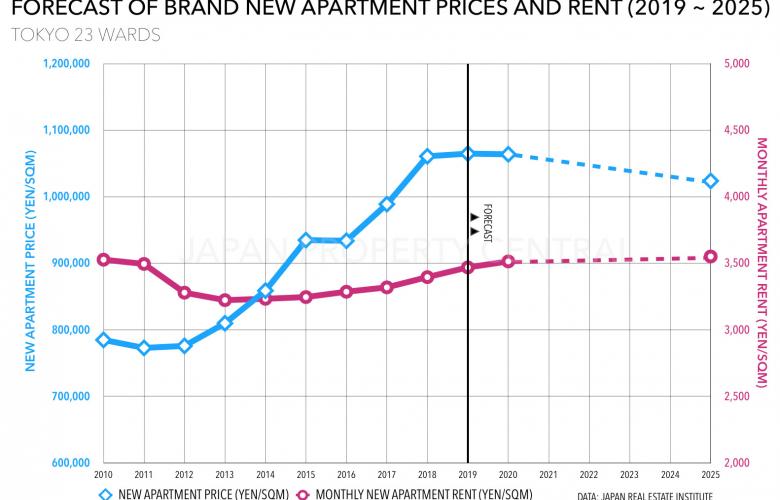

Will Japan See Another Property Bubble Like In The 80s Rethink Tokyo

Will Japan See Another Property Bubble Like In The 80s Rethink Tokyo

Https Www Pwc Com Jp En Taxnews International Assignment Assets Gms 20200114 En Pdf

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Steps To Take In Calculating Capital Gains For Selling Foreign Property

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

Real Estate Related Taxes And Fees In Japan

7 Asian Countries Without Capital Gains Tax

7 Asian Countries Without Capital Gains Tax

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

A Guide To Capital Gains Tax On Uk Property For Us Expats

A Guide To Capital Gains Tax On Uk Property For Us Expats

Capital Gains Definition 2021 Tax Rates And Examples

Us Tax On Foreign Property Greenback Expat Tax Services

Us Tax On Foreign Property Greenback Expat Tax Services

Withholding Tax On Real Estate Sales By Non Residents Plaza Homes

Withholding Tax On Real Estate Sales By Non Residents Plaza Homes

Https Home Treasury Gov System Files 131 Report Capial Gains Reduction 1978 Pdf

Red China Taxes Capital Relatively Lightly Tax Foundation Capital Gains Tax Tax Corporate Tax Rate

Red China Taxes Capital Relatively Lightly Tax Foundation Capital Gains Tax Tax Corporate Tax Rate

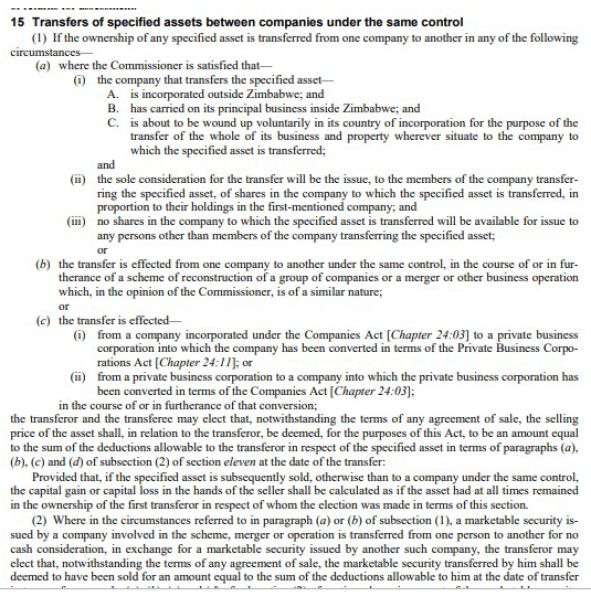

Capital Gains Tax Tax Zimbabwe

Capital Gains Tax Tax Zimbabwe

Minimizing Capital Gains When Selling Stock In Your Robinhood Account

Minimizing Capital Gains When Selling Stock In Your Robinhood Account

Buying Selling Real Estate Abroad For Us Expats

Buying Selling Real Estate Abroad For Us Expats

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax