How To Find My Tax Jurisdiction Code

Alternatively conduct a site search for the term sales tax Locate a link or tab for finding tax jurisdictions. In addition to participating in the promulgation of Treasury Tax Regulations the IRS publishes a regular series of other forms of official tax guidance including revenue rulings revenue procedures notices and announcementsSee Understanding IRS Guidance - A Brief Primer for more information about official IRS guidance versus non-precedential rulings or advice.

Confluence Mobile Community Wiki

Confluence Mobile Community Wiki

672020 - Central Tax and Notification No.

How to find my tax jurisdiction code. JurisdictionRate Lookup by Address. These boundaries tend to overlap making them difficult to view all together. Use the tabs across the top to view each jurisdiction type individually.

Then contact the Tax CollectorOfficer to determine your local tax rates and PSD codes. Find juriscodes with Avalaras API. The following security code is necessary to prevent unauthorized use of this web site.

The tax jurisdiction code is a key which together with the tax code and other parameters determines the tax amount and the way in which payment of the entire tax amount is divided between different tax authorities. You will be redirected to a page where you need to input your PAN and the Captcha code. Use the Avalara API to look up jurisdiction information yourself and then filter your results.

Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. When working out your total income from all sources do not include any losses you. Corrigenda to Notification No.

This is typically on the primary page for a state department of revenue or taxation but if it is not click on a tab or link for businesses. Notifications issued amending notification no. Then the remainder of the condition records JRC1 - 5 uses this tax code as an input to determine the rate of tax based on the tax jurisdiction code in the customer master record.

Depending on where you live you may also have to comply with certain state tax obligations. What your tax code means Your tax code will normally start with a number and end with a letter. Missouri and some local tax statutes impose special tax rates for the sale of certain items such as food and qualifying sales tax holiday items.

CGST Act 2017 as amended up to 30092020 have been uploaded. The jurisdiction codes for every citycountydistrict combination will be listed on our websites rate chart at httpdormogovbusinesssalesrates. 412020-Central Tax and notification no.

Tax Jurisdiction and Infotype 0017. If you do not receive a return for your address on the Find Your Withholding Rates by Address webpage try an internet search on the City and State of the home and work address to determine the County for each. Once you submit the details your jurisdictional details will be displayed on the screen.

ListJurisdictionsByAddress - View all tax jurisdictions that apply to a specific address. Here you select the home tax jurisdiction code and this is used for per diems and flat rates etc. If you are using a screen reading program.

Alternatively you can use t-code OBCO. Enter the security code displayed below and then select Continue. Not every state has the same tax system.

For employees under Canadian company code tax jurisdiction is maintained in the employees infotype 0017 record via tcode PA30. The system can handle up to four jurisdiction levels for calculation procedure TAXUSJ and six jurisdiction levels for calculation. If you are interested in looking up a specific sales tax rate based on address please visit MO Department of Revenues website for Find Sales and Use Tax Rates.

The tax jurisdiction structure structure of the tax code is set up with following menu path. ListJurisdictions - View all jurisdictions and filter results by state or region. What Tax Jurisdiction Code should I choose when registering for procurePHX.

They let your small business pay state and federal taxes. Your tax code might be different for different types of income. 682020 - Central Tax issued.

On the left side of the home page there is a Services tab. When registering for procurePHX please select your local taxing jurisdiction to which your business reports and files taxes. Click on the link pertaining to sales and use taxes.

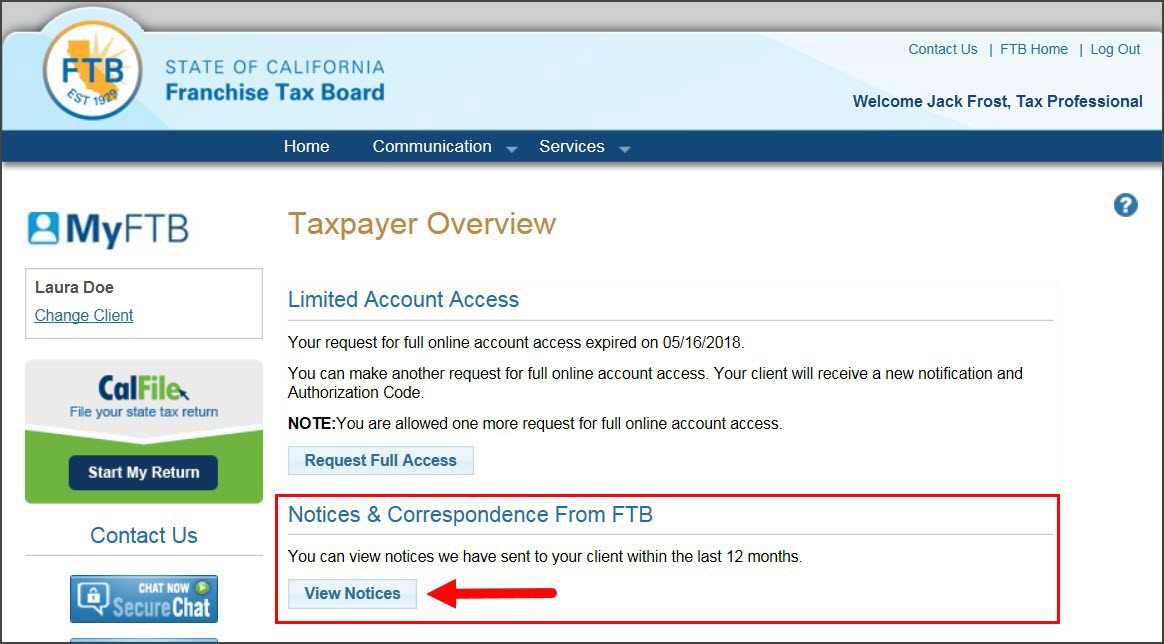

The tax year is from 1 April to 31 March. Under the Services tab you will find Know your jurisdictional AO Click on that. How the numbers are.

The tax jurisdiction is the only way for our financial system to maintain that accuracy. Special Item Tax Rates. IMG Financial accounting Fi Accounting basic settings tax on salespurchases basic settings specify structure for tax jurisdiction code.

Some states like Nevada and Texas have no income tax. You need a tax code if you receive salary wages income tested benefits interest dividends or other income which has tax taken out before you get paid. The CTXJ condition record is used to determine the tax codes which apply based on the relevant condition tables which includes things like country region customer tax code etc.

Other Official Tax Guidance. Filling out your federal taxes is just the first step in the tax process. 1250L is the tax code currently used for most people who have one job or pension.

Tax Jurisdiction Code Sap Simple Docs

Tax Jurisdiction Code Sap Simple Docs

Https Dor Georgia Gov Document Distributions Lgscountyandcitysalestaxidcodes2014pdf Download

Accounttax In Bapi Acc Document Post Sap Blogs

Accounttax In Bapi Acc Document Post Sap Blogs

Debugging Tips Error Message Ff793 Syst Tax Jurisdiction Code At Lowest Level Not Transferred Sap Blogs

Debugging Tips Error Message Ff793 Syst Tax Jurisdiction Code At Lowest Level Not Transferred Sap Blogs

Methods To Identify View And Table Name S From Img Node Sap Blogs

Methods To Identify View And Table Name S From Img Node Sap Blogs

Https Www Cdtfa Ca Gov Taxes And Fees Jurisdictioncodes Pdf

Account Id And Letter Id Locations Washington Department Of Revenue

Account Id And Letter Id Locations Washington Department Of Revenue

Calculate Tax Using Sabrix Sap Blogs

Calculate Tax Using Sabrix Sap Blogs

Confluence Mobile Community Wiki

Employer Frequently Asked Questions

Employer Frequently Asked Questions

Taxes Basic Settings Erp Financials Community Wiki

Taxes Basic Settings Erp Financials Community Wiki

Sales Tax By Zip Code You Re Doing It Wrong Avalara

Sales Tax By Zip Code You Re Doing It Wrong Avalara

Error Fs 861 In External Tax System Sap Blogs

Error Fs 861 In External Tax System Sap Blogs

Confluence Mobile Community Wiki

Tax Configuration For Sap Implementations Sap Training Hq

Data Services Information Steward And Master Data Governance Integrations Sap Blogs

Data Services Information Steward And Master Data Governance Integrations Sap Blogs

How To Locate Your It Ward No Circle Range Ao Code Online

How To Locate Your It Ward No Circle Range Ao Code Online