How To Get An Extension On Property Taxes

Property taxes vary greatly by state and even county but of course theyre relative to how much a person is earning and their financial resources. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension.

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

10 Ways To Lower Your Property Taxes Property Tax Tax Tax App

Pay your real estate taxes and your business personal property taxes in one full payment or in first- and second-half installments except for parcels where the total taxes owed is 25 or less in which case only the full payment option is available.

How to get an extension on property taxes. The waiver for personal residential property taxes will extend through next May. Fill out a request for an extension using Form 4868 Application for Automatic Extension of Time to File US. But since COVID-19 has been.

If you qualify and have not received this application call 1-800-882-6597. When you need more time to complete your taxes whether because of something as serious as a global health scare or as simple as sheer procrastination all you need to do is fill out Form 4868 and. If you need additional time to complete your Annual Report and Personal Property Tax Return s you may get a 2 month filing extension provided you request the extension on this website by April 15th.

The Department does not have an extension form to obtain additional time to file. 15 to file a return. If at least 90 of your total tax liability is paid by April 30 2019 you will automatically have an additional six months to file your return.

King County Washington one of the counties that has postponed its April 30 property tax deadline says the extension until June 1 is only valid for property owners who pay their taxes. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. How to file for a tax extension.

Initially the extension had been limited to returns and related payments for the 2019 tax year and estimated tax payments for the 2020 tax year. In an effort to encourage timely payments a county news release issued last week regarding property tax deadlines did not mention Holcombs extension Hackman said. Form 4868 is available on IRSgovforms.

You can also print and mail the form. You have until October 31 2019 to file your return timely. Form PTR-2 is a personalized application that is not available online.

COVID-19-related Property Tax Information extensions deadlines. A federal extension does not apply for Iowa purposes. Please use our Tax Estimator to approximate your new property taxes.

You can file the form electronically through your regular tax preparer or tax filing service. Individual Income Tax Return. With the updated guidance released April 9 2020 any income gift or estate tax falling due within the period April 1 2020 to July 15 2020 now has a deadline of July 15 2020.

For people hit financially by the pandemic a. The Property Appraiser does not send tax bills and does not set or collect taxes. Property taxes are an unavoidable expense when you own a home and many people struggle to pay theirs even when theres not a major health and economic crisis at play.

The deadline for mailing the form to the IRS is April 18. Denver County COVID-19 Information. Common reasons for requesting an extension include a lack of organization unanticipated events or tax planning purposes.

Division 1 of the Revenue and Taxation Code including sections 7552 26105 2618 2922 2705 and 4103is suspended until May 6 2021 to the extent that it requires a tax collector to impose penalties costs or interest for the failure to pay taxes on property on the secured or unsecured roll or to pay a supplemental bill. The Homestead Exemption saves property owners thousands of dollars each year. Filing this form gives you until Oct.

Alternate documents to send as proof can be found in the Senior Freeze FAQ. Even if you obtain an extension to file you must still pay your income tax in full by the tax deadline. However the IRS does grant you an automatic extension to file your taxes every year as long as you complete Form 4868.

In order to get an extension you will need to file Form 4868 by the April tax filing deadline. Please visit the Tax Collectors website directly for additional information. Get an extension when you make a payment.

Businesses required to file an annual property taxes statement will have until the end of the month to file an. To get the extension you must estimate your tax liability on this form and should also pay any amount due. Nassau homeowners will get an extra month to pay school property tax bills this year after the state gave the county more time to resolve challenges to new home values before it finalizes the.

The verification form is your proof of property taxes due and paid.

6 Things New Homeowners Waste Money On New Homeowner Homeowner Home Ownership

6 Things New Homeowners Waste Money On New Homeowner Homeowner Home Ownership

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Filing Taxes Property

Thinking About Moving These States Have The Lowest Property Taxes Property Tax Filing Taxes Property

Sample One Page Contract For Wholesaling Houses Real Estate Investin Real Estate Investing Quotes Real Estate Investing Real Estate Investing Rental Property

Sample One Page Contract For Wholesaling Houses Real Estate Investin Real Estate Investing Quotes Real Estate Investing Real Estate Investing Rental Property

Real Property Tax Homestead Means Testing Department Of Taxation

Real Property Tax Homestead Means Testing Department Of Taxation

Due Date Extended For Availing A 5 Rebate On Property Tax In Bangalore Property Tax Rebates Tax

Due Date Extended For Availing A 5 Rebate On Property Tax In Bangalore Property Tax Rebates Tax

Rental Property Tax Deductions Are Numerous You Can Deduct Property Tax Mortgage Interest Repairs Accountant Fees Mortgage Interest Property Tax Tax Guide

Rental Property Tax Deductions Are Numerous You Can Deduct Property Tax Mortgage Interest Repairs Accountant Fees Mortgage Interest Property Tax Tax Guide

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

Your Property Taxes Just Jumped By More Than 50 Percent Now What Cnbc Property Tax Now What Tax

Your Property Taxes Just Jumped By More Than 50 Percent Now What Cnbc Property Tax Now What Tax

Challenging Property Taxes Property Tax Real Estate Advice Real Estate Business

Challenging Property Taxes Property Tax Real Estate Advice Real Estate Business

How To Pay Property Taxes Through An Escrow Account Escrow Property Tax Tax Help

How To Pay Property Taxes Through An Escrow Account Escrow Property Tax Tax Help

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) Taking Advantage Of Property Tax Abatement Programs

Taking Advantage Of Property Tax Abatement Programs

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Can I File A Tax Extension Get Answers To All Your Questions About Taxes Personal Finance Insurance And Filing Taxes Tax Extension This Or That Questions

Can I File A Tax Extension Get Answers To All Your Questions About Taxes Personal Finance Insurance And Filing Taxes Tax Extension This Or That Questions

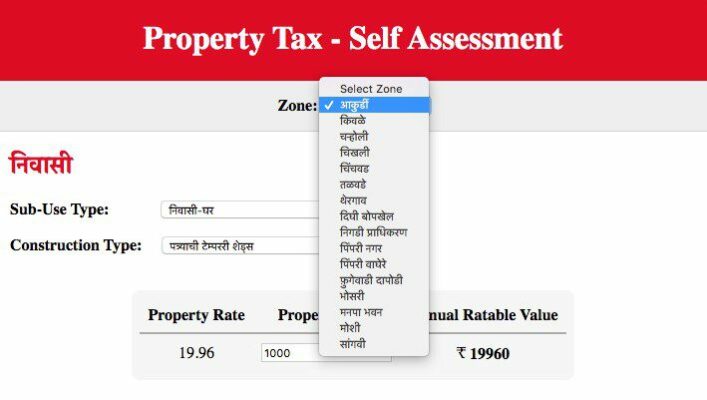

Pay Pcmc Property Tax Online A Step By Step Guide

Pay Pcmc Property Tax Online A Step By Step Guide

Treasurer Releases Estimate Of Average Property Tax Bill By Township Kane County Connects Property Tax Tax Extension Township

Treasurer Releases Estimate Of Average Property Tax Bill By Township Kane County Connects Property Tax Tax Extension Township

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/gettyimages-1197184592-2048x2048-22e8a8e779514a43a8347a0b583c1813.jpg) Property Tax Exemptions For Seniors

Property Tax Exemptions For Seniors

Application Society Noc Format For Property Tax Name Change Google Search Certificate Templates Templates Free Download Certificate

Application Society Noc Format For Property Tax Name Change Google Search Certificate Templates Templates Free Download Certificate