Nyc Property Tax Relief Covid-19

Bills are generally mailed and posted on our website about a month before your taxes are due. The exemption would apply only to taxpayers whose property is assessed below 250000 and can demonstrate a financial hardship directly connected to COVID-19.

Monthly Property Tax Payments Dof

Monthly Property Tax Payments Dof

The program would grant property tax abatements to building owners who enter into recovery leases that last at least ten years and limit annual rent increases.

Nyc property tax relief covid-19. Tax relief for quarterly and part-quarterly monthly sales tax vendors affected by COVID-19. However by law the program expired after 2019. For general and filing information visit the New York State Department of Taxation and Finance.

As part of the US. NYC is a trademark and service mark of the City of New York. NYC is a trademark and service mark of the City of New York.

The bill would allow the city of New York to create a program to provide relief to both small business owners and building owners impacted by the COVID-19 pandemic. Eviction Fears Rise As New York City Tries To Fend Off Second Wave Of COVID-19 Small property owners and landlords in New York City are begging for relief saying they like many. If you are principally engaged in business as a restaurant or other food service establishment in New York City that had to suspend indoor dining due to Executive Order 20281 or as a restaurant or other food service establishment that had to suspend.

The Following New York City Taxes are collected by New York State instead of New York City. Property Tax Bills. NYC is a trademark and service mark of the City of New York.

Eligible homeowners received property tax relief checks in 2017 2018 and 2019. Coronavirus COVID-19 Alert While the coronavirus is affecting New York City it is strongly recommended that you pay your property taxes online with CityPay. If you expect to receive a STAR credit check and have not yet received it follow the steps below.

Property Records ACRIS Deed Fraud Alert. The New York State Tax Department along with the Governors office and other agencies throughout the state is responding to the spread of coronavirus COVID-19 with information for those affected. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older.

You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. Every week Mansion Global poses a tax question to real estate tax attorneys. Coronavirus COVID-19 Alert All assistance centers will be closed for in-person assistance until further notice.

Data and Lot Information. -- With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are. We do not mail you a Property Tax Bill if your property taxes are paid through a bank or mortgage servicing company or if you have a zero balance.

The federal Coronavirus Aid Relief and Economic Security Act CARES ACT and the Consolidated Appropriations Act 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers and businesses affected by COVID-19. For property taxes due July 1 2020 The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

What COVID-19 means for your property taxes We understand that this is a very stressful time especially for those suffering direct effects from this public health crisis and the Treasure and Tax Collectors Office is committed to helping in any way they can. Friday February 5 2021 NEW YORK WABC -- New York Governor Cuomo and New Jersey Governor Murphy are urging the federal government to allocate COVID-19 relief funds based on need and to repeal. Here is this weeks question.

The Property tax relief credit has expired. New York City Taxes Collected by New York State NYS Tax Department issues sales tax guidance related to COVID-19 tax relief. We know your first priority is to keep your family safe and well.

We will update this page as new information becomes available. So far only 16 states have either extended the filing. Telephone appointments are available.

Aid package in response to COVID-19 I understand there are. Property Bills Payments. This pandemic has reaffirmed how.

The economic impact of Covid-19 has had such far reaching implications that even real estate taxes have started to have some relief provided. Property Tax Bills Bills are generally mailed and posted on our website about a month before your taxes are due.

Senior Citizen Homeowners Exemption Sche

Senior Citizen Homeowners Exemption Sche

Aptc American Property Tax Counsel Property Tax Reduction

Aptc American Property Tax Counsel Property Tax Reduction

Covid 19 Property Tax Relief Opportunities Salt Shaker

Covid 19 Property Tax Relief Opportunities Salt Shaker

New York State And City Lawmakers Propose Covid 19 Recovery Leases For Small Businesses Brad Lander

New York State And City Lawmakers Propose Covid 19 Recovery Leases For Small Businesses Brad Lander

De Blasio Delay Plus Pandemic Means Property Tax Reform Appears Off The Table This Year

De Blasio Delay Plus Pandemic Means Property Tax Reform Appears Off The Table This Year

Calculating Your Property Taxes

Calculating Your Property Taxes

Cuomo Murphy Demand Repeal Of Federal Cap On State And Local Tax Deduction Cbs New York

Cuomo Murphy Demand Repeal Of Federal Cap On State And Local Tax Deduction Cbs New York

Https Www Paulweiss Com Media 3979787 Covid 19 Relief Programs For Businesses And Employers Pdf

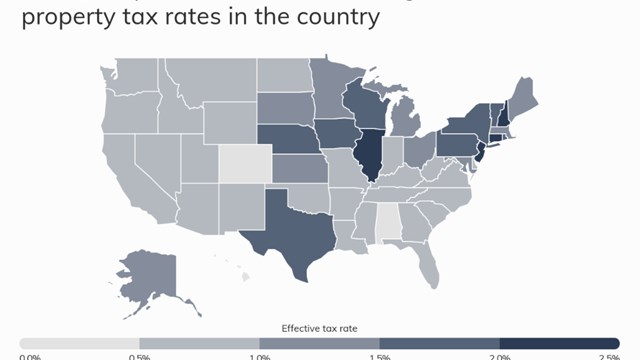

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Ny State City Lawmakers Propose Covid 19 Recovery Leases For Small Businesses Ny State Senate

Ny State City Lawmakers Propose Covid 19 Recovery Leases For Small Businesses Ny State Senate

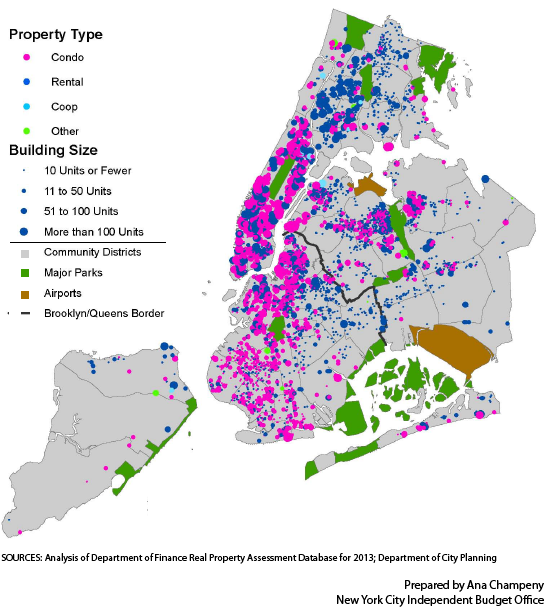

This Time With Clearer Rules For Co Ops Pied A Terre Tax Resurfaces The New York Cooperator The Co Op Condo Monthly

This Time With Clearer Rules For Co Ops Pied A Terre Tax Resurfaces The New York Cooperator The Co Op Condo Monthly

The School Tax Relief Star Program Faq Ny State Senate

The School Tax Relief Star Program Faq Ny State Senate

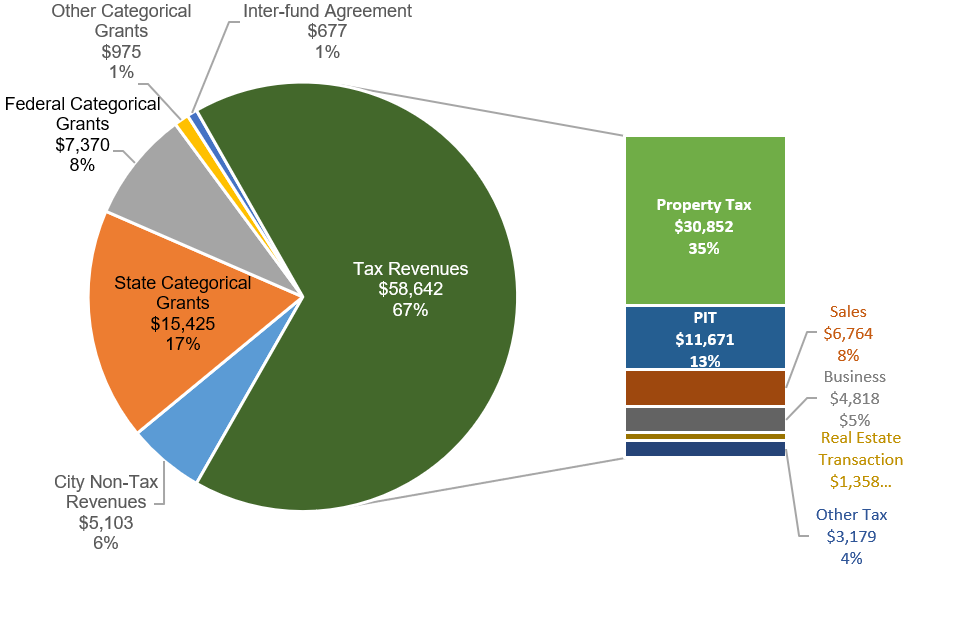

Comments On New York City S Fiscal Year 2021 Adopted Budget Office Of The New York City Comptroller Scott M Stringer

Comments On New York City S Fiscal Year 2021 Adopted Budget Office Of The New York City Comptroller Scott M Stringer

Taxes New York City By The Numbers

Taxes New York City By The Numbers

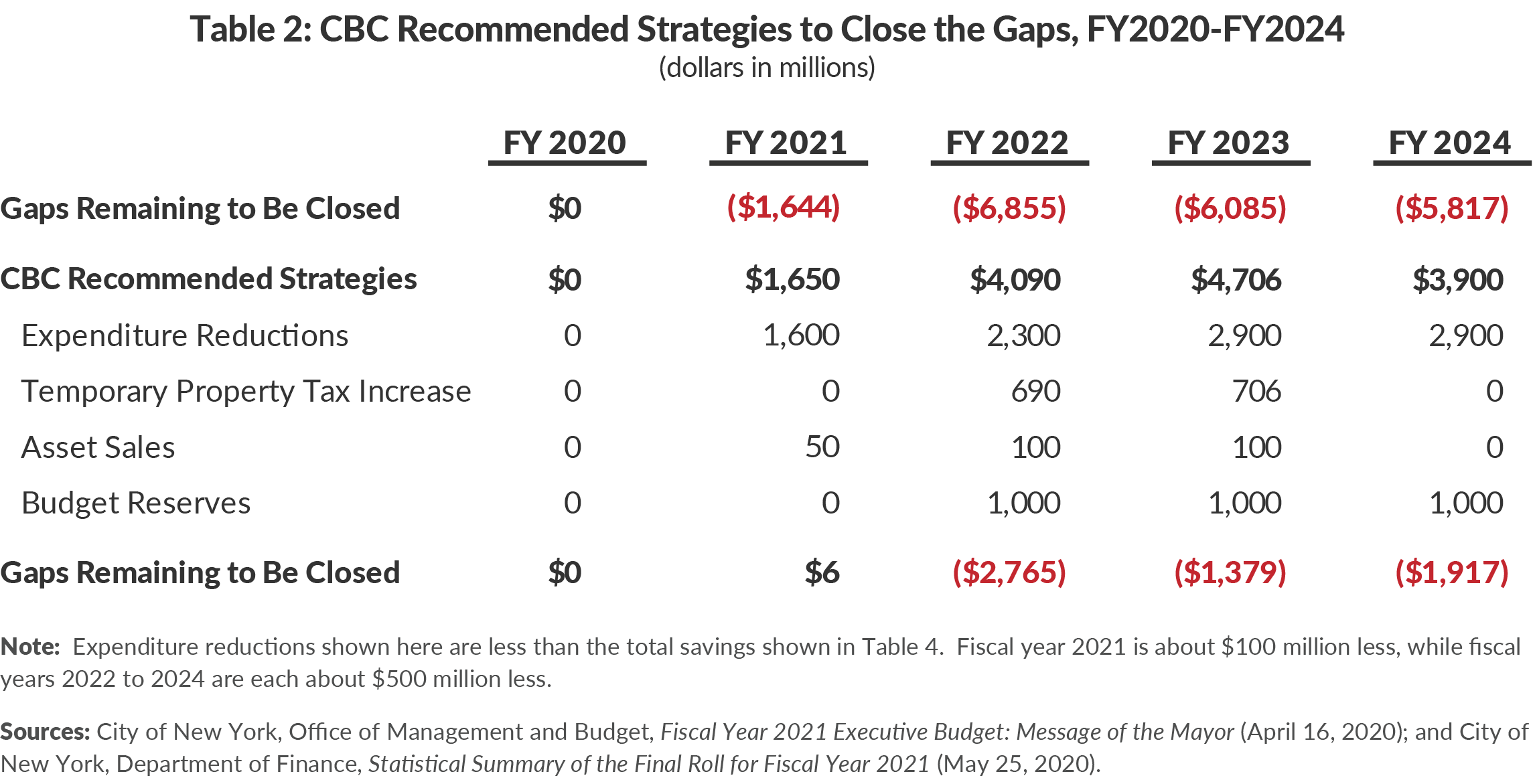

Hard Choices That Can Balance New York City S Budget Cbcny

Hard Choices That Can Balance New York City S Budget Cbcny