Property Gains Tax Washington State

So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level. The tax rate is about 15 for people filing jointly and incomes totalling less than 480000.

State Taxation As It Applies To 1031 Exchanges

State Taxation As It Applies To 1031 Exchanges

It can jump to 20 if your combined income exceeds this amount.

Property gains tax washington state. Most states tax capital gains according to the same tax rates they use for regular income. About 11 billion annually in new revenue would come from a measure Inslee has proposed several times before. Some states also levy taxes on capital gains.

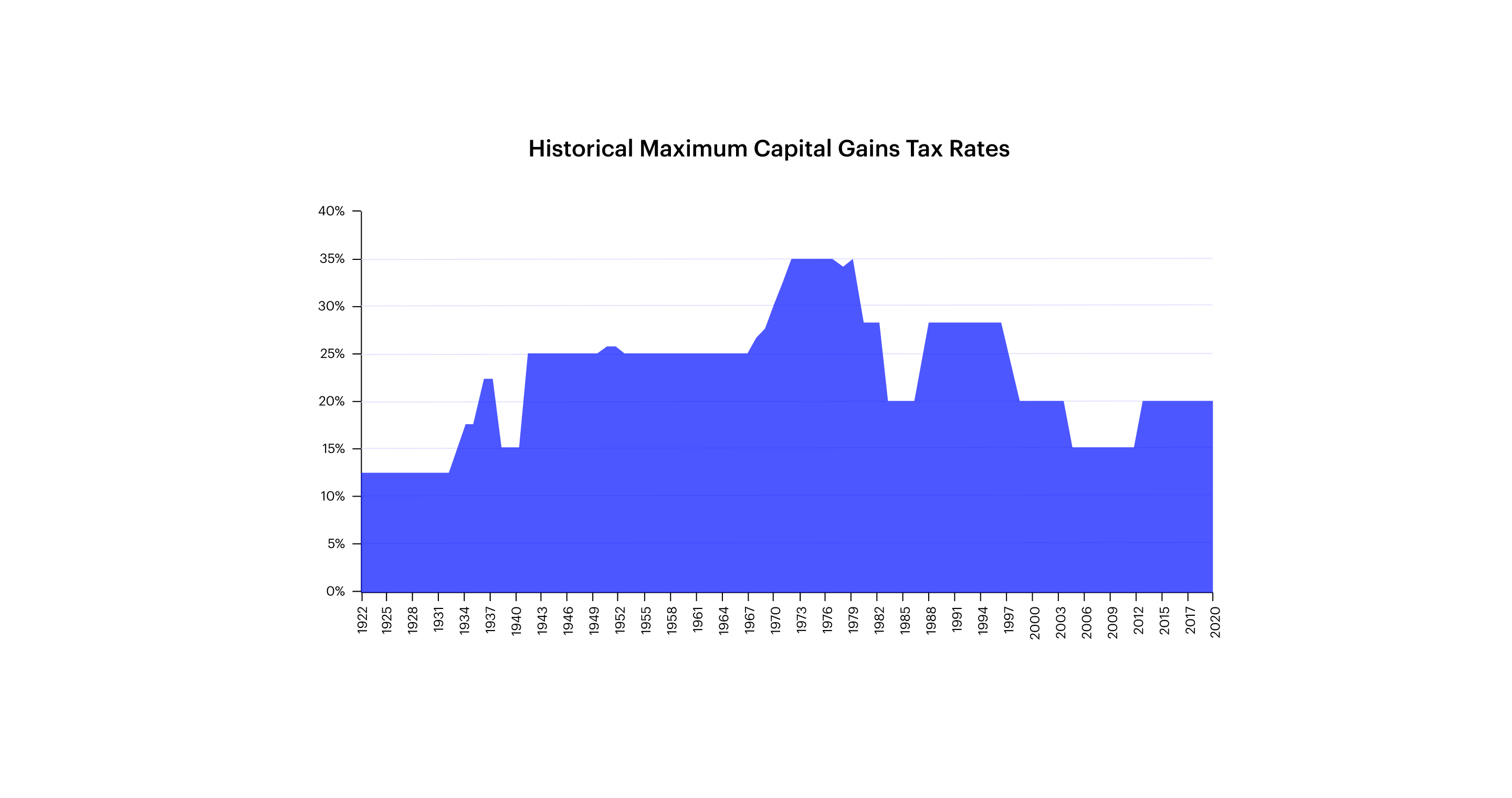

News WA Government New version of capital gains tax passes Washington Senate committee. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

Mail the payment and form to. In Seattle the real estate transfer tax on a median-valued home is 8749. Jay Inslees proposed budget.

By contrast the capital gains tax proposed by Gov. A tax on capital gains which include profits from selling assets such as stocks and. Long-term capital gains taxes apply to profits from selling something youve held for a year or more.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. Box 389 Port Townsend WA 98368 Ph. Jay Inslee in December is estimated to raise 875 million per year at a rate of 9 on stocks bonds and.

Make the check payable to. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Louis and Portland among other cities have no transfer taxes.

If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is taxed at your marginal. A capital gains tax is the revenue centerpiece in Gov. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

States without a capital gains levy. The first 350 million made from the capital gains tax each year would go towards the states education legacy trust account and set aside the remainder for a taxpayer relief account. In Washington DC the real estate transfer tax on a median-valued home is 5886.

Unlike your primary residence you will likely face a capital gains tax if you sell for a profit. The median transfer tax in the US. Capital gains is the income you make from buying something like a house stock or bond and then selling it later for a gain.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. To pay the estate tax send the payment with either a timely filed extension application or the Washington State Estate and Transfer Tax Return. Washington State Department of Revenue.

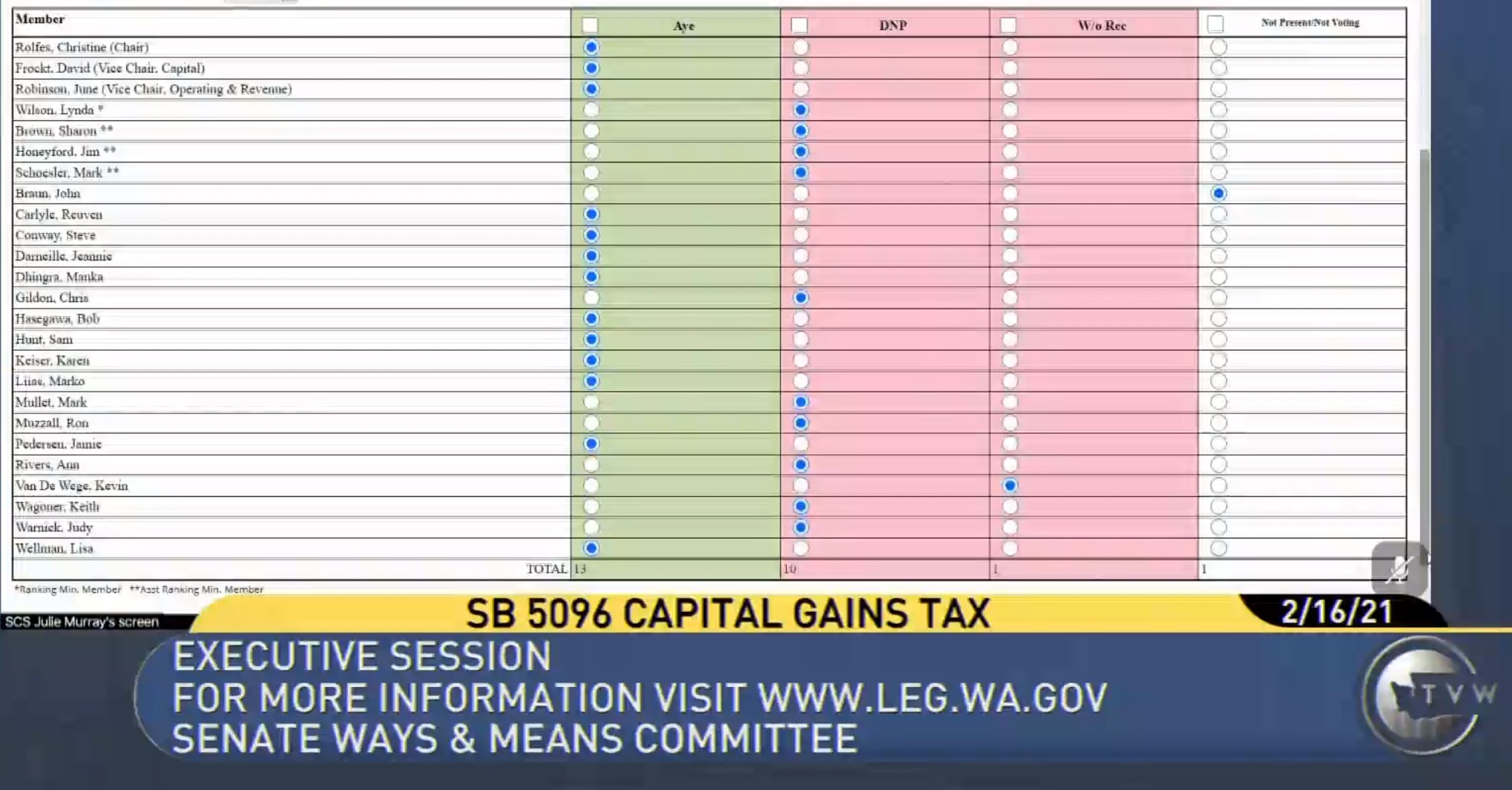

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. OLYMPIA A capital gains tax on the sale of high-profit stocks and bonds has been approved by a Senate fiscal committee. State Taxes on Capital Gains.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Revenue at a Glance provides more detail on property taxes and how they help fund these services. Jay Inslee has proposed a long-term capital gains tax of 9 percent on the sale of certain real estate stocks and bonds.

If Washington did adopt a capital gains tax moreover one wonders whether state officials would maintain their insistence that its an excise tax for purposes of the state and local tax deduction. Property taxes make up at least 94 percent of the states General Fund which supports public services for Washington residents. Tax reconditioning would remove Washington from the list of seven US.

If approved by the House and Senate this motion would rank the state as having the nations sixth highest. Property must be taxed uniformly in Washington state or it cannot be. Washington State Department of Revenue PO Box 47474 Olympia WA 98504-7474.

The Ways and Means Committee passed the measure Tuesday night over. It proposed a 9 tax on profits realized from selling investments such as stocks and bonds and other property. The Washington Capitol building is seen on the last day of the 60-day.

When determining federal tax liability taxpayers can deduct property taxes plus their choice of income or sales taxes up to a new cap of 10000.

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

Do You Pay Capital Gains Tax On Property Sold Out Of State Clever Real Estate

Do You Pay Capital Gains Tax On Property Sold Out Of State Clever Real Estate

Npi S Cascadia Advocate Welcome

Npi S Cascadia Advocate Welcome

Http Accf Org Wp Content Uploads 2017 01 Accf Specialreport State Cap Gains 2012 17 1 Pdf

How To Invest In Opportunity Zones And Avoid Capital Gains Stessa

How To Invest In Opportunity Zones And Avoid Capital Gains Stessa

What Is The Capital Gains Tax On Real Estate Thestreet

What Is The Capital Gains Tax On Real Estate Thestreet

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

Capital Gains Tax Brackets 2021 What They Are And Rates

Capital Gains Tax Brackets 2021 What They Are And Rates

10 Most Tax Friendly States For Retirees Retirement Locations Income Tax Retirement Planning

10 Most Tax Friendly States For Retirees Retirement Locations Income Tax Retirement Planning

Capital Gains Tax Calculator Estimate What You Ll Owe

Capital Gains Tax Calculator Estimate What You Ll Owe

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation