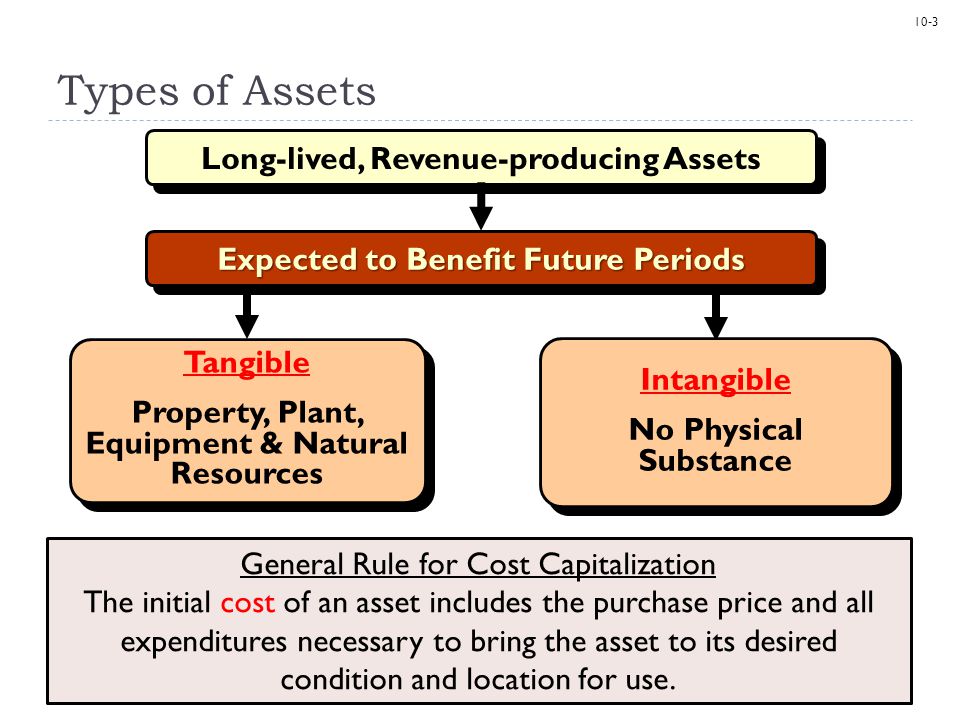

Property Plant And Equipment Are Types Of Tangible Assets

Tangible assets are assets with a physical form and that hold value. Key Characteristics of a Fixed Asset.

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

What are Tangible Assets.

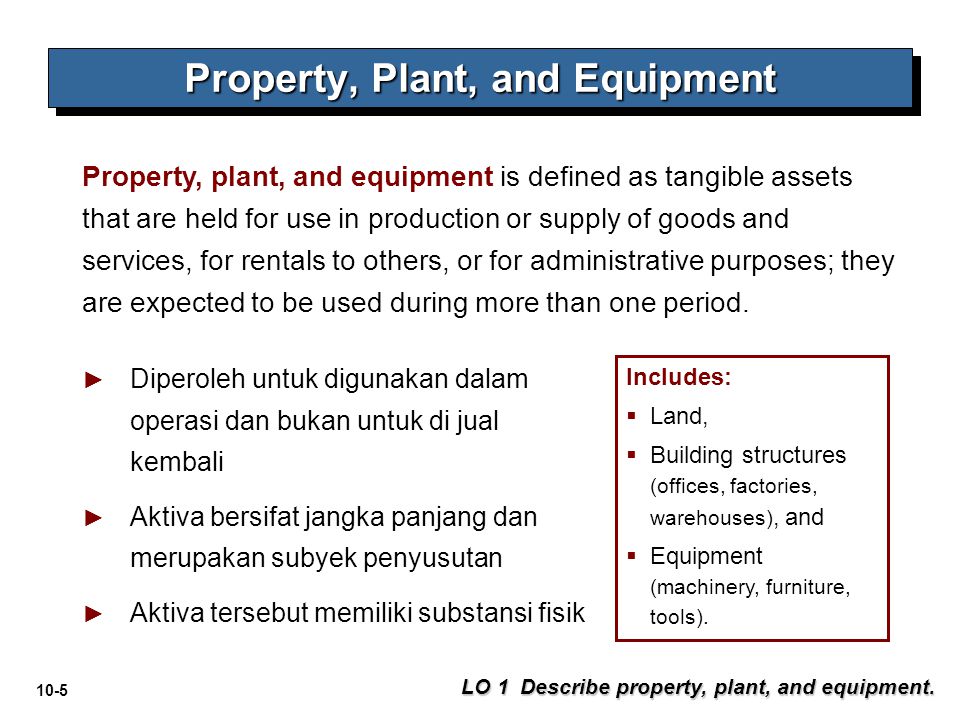

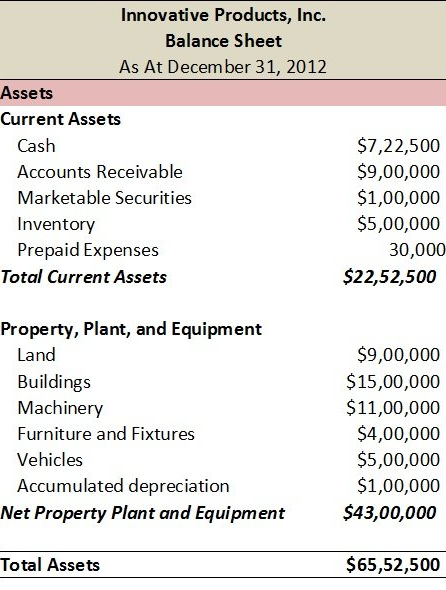

Property plant and equipment are types of tangible assets. A are held for use in the production or supply of goods or services for rental to others or for administrative purposes. The total value of PPE can range from very low to extremely high compared to total assets. International Accounting Standard 16 IAS 16 defines property plant and equipment as the tangible items that.

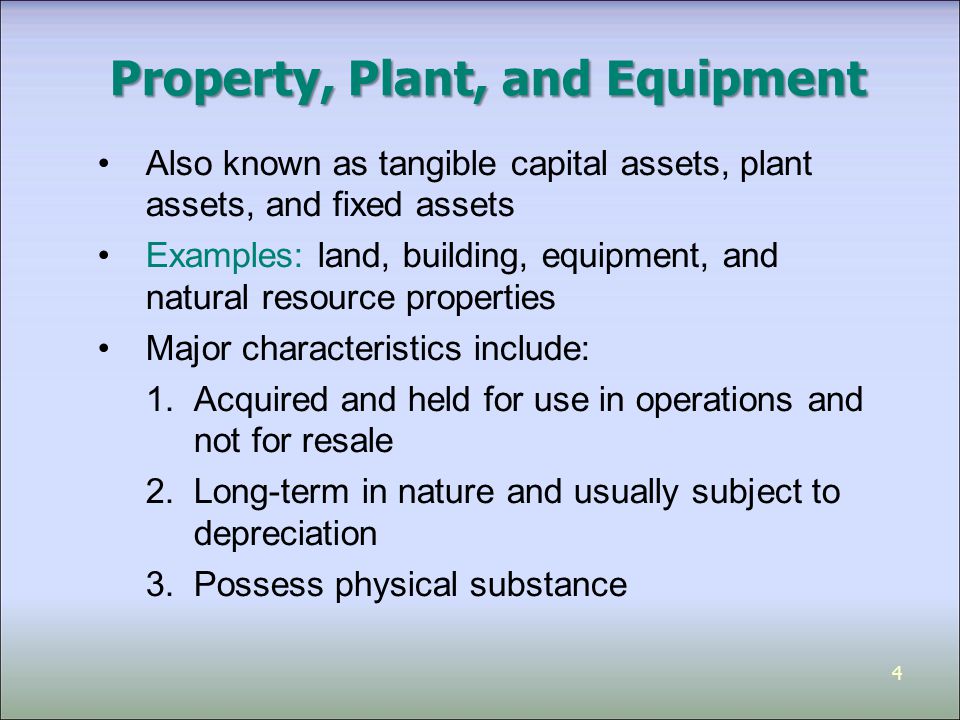

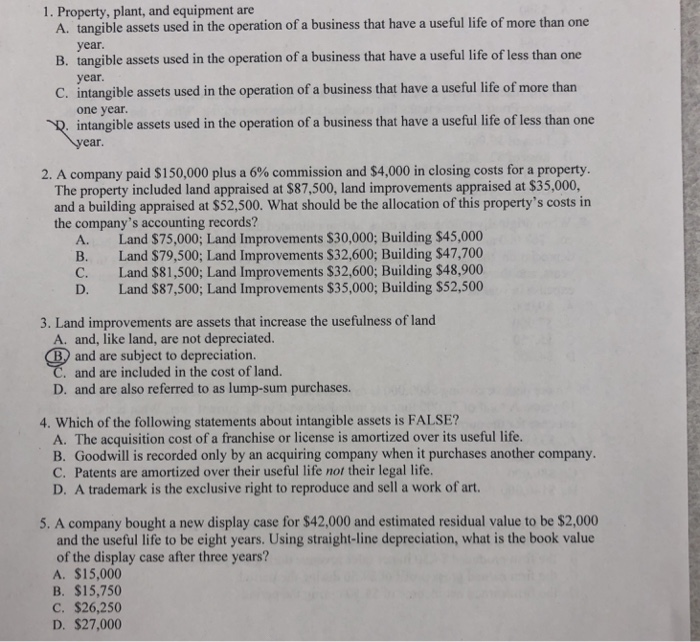

Property plant and equipment are tangible assets that are held for use in production or supply of goods or services for rental to others or for administrative purposes and are expected to be used during more than one period. Intangible assets used in the operation of a business that have a useful life of more than Q intangible assets used in the operation of a business that have a. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment.

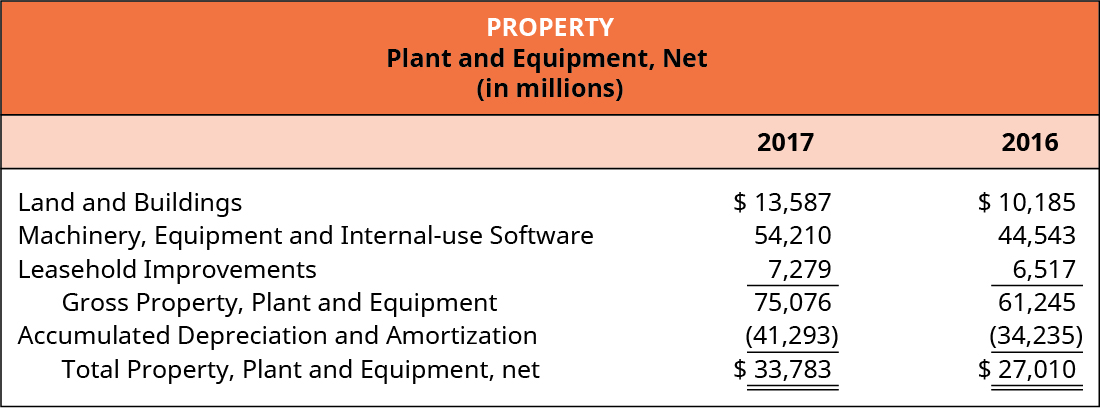

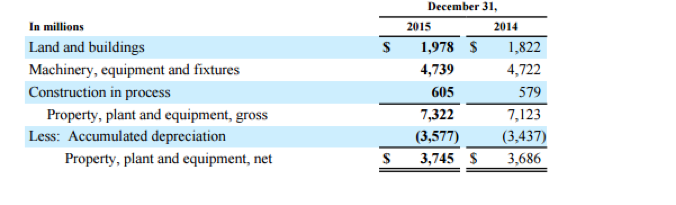

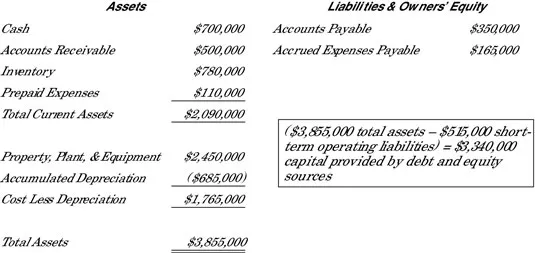

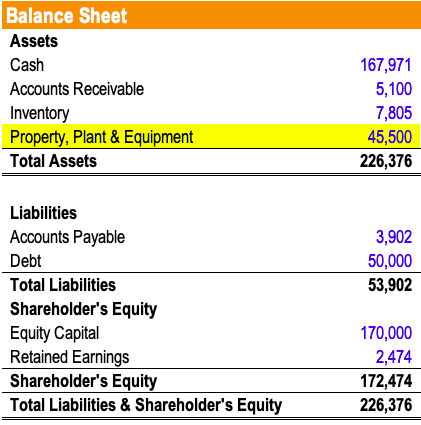

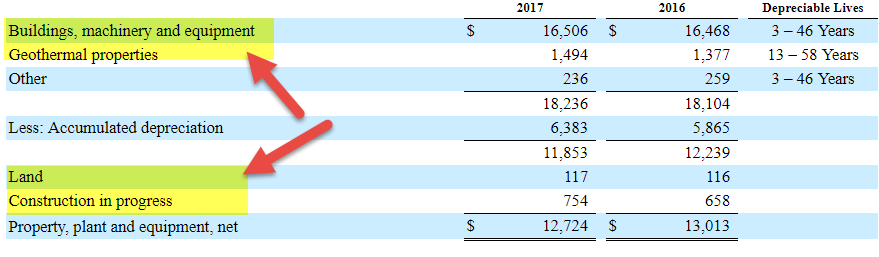

Property Plant and Equipment and Intangible Assets Analysts can use disclosures to better understand a companys investments in tangible and intangible assets how those investments changed during a reporting period how those changes affected current financial performance and what those changes might indicate about future performance. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Citation needed This can be compared with current assets such as cash or bank accounts described as liquid assets.

Fixed assets refer to long-term tangible assets that are used in the operations of a business. Property plant and equipment. A Tangible assets used in the operation of a business having a useful life of more than one accounting period.

1 Property plant and equipment are. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. Fixed assets also known as long-lived assets tangible assets or property plant and equipment PPE is a term used in accounting for assets and property that cannot easily be converted into cash.

Property plant and equipment are A. B are expected to be used during more than one period. Property plant and equipment include both tangible and intangible fixed assets.

Start studying Chapter 10 Property Plant and Equipment and Intangible Assets. Tangible assets used in the operation of a business that have a useful life of less than one C. This type of asset provides long-term financial gain has a useful life of more than one year and is classified as property plant and equipment PPE on the balance sheet.

Learn vocabulary terms and more with flashcards games and other study tools. PPE is impacted by Capex. Property plant and equipment.

Prospective application of a change in accounting policy. Tangible assets with physical substance used in normal operations long-term in nature. A are held for use in the production or supply of goods or services for rental to others for investment or for administrative purposes and b are expected to be used during more than one period.

Tangible assets sometimes referred to as tangible fixed assets or long-lived tangible assets are divided into three main types. Plant assets are long-lived assets because they are expected to last for more than one year. Examples include property plant and equipment.

Property includes the building and. Also referred to as PPE property plant and equipment or simply plant assets this consists of a companys assets that are continuously used in day-to-day operations. In most cases only tangible assets are referred to as fixed.

The objective of Ind AS 16 is to prescribe the accounting treatment for property plant and equipment so that users of the financial statements can discern information about an entitys investment in its property plant and equipment and the changes in such investment. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment. Long-lived assets consist of tangible assets and intangible assets.

Tangible assets used in the operation of a business that have a useful life of more than one B. Property plant and equipment are tangible assets meaning they are physical in nature or can be touched. PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet.

Applying the new accounting policy to transactions other events and conditions. Property plant and equipment are often called plant and equipment or simply plant assets. PROPERTY PLANT AND EQUIPMENT 1.

Non Current Assets Overview Types And Examples

Non Current Assets Overview Types And Examples

Acquisition And Disposition Of Property Plant And Equipment Ppt Download

Acquisition And Disposition Of Property Plant And Equipment Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg) How Do Tangible And Intangible Assets Differ

How Do Tangible And Intangible Assets Differ

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Chapter 10 Acquisition Of Property Plant And Equipment Ppt Video Online Download

Chapter 10 Acquisition Of Property Plant And Equipment Ppt Video Online Download

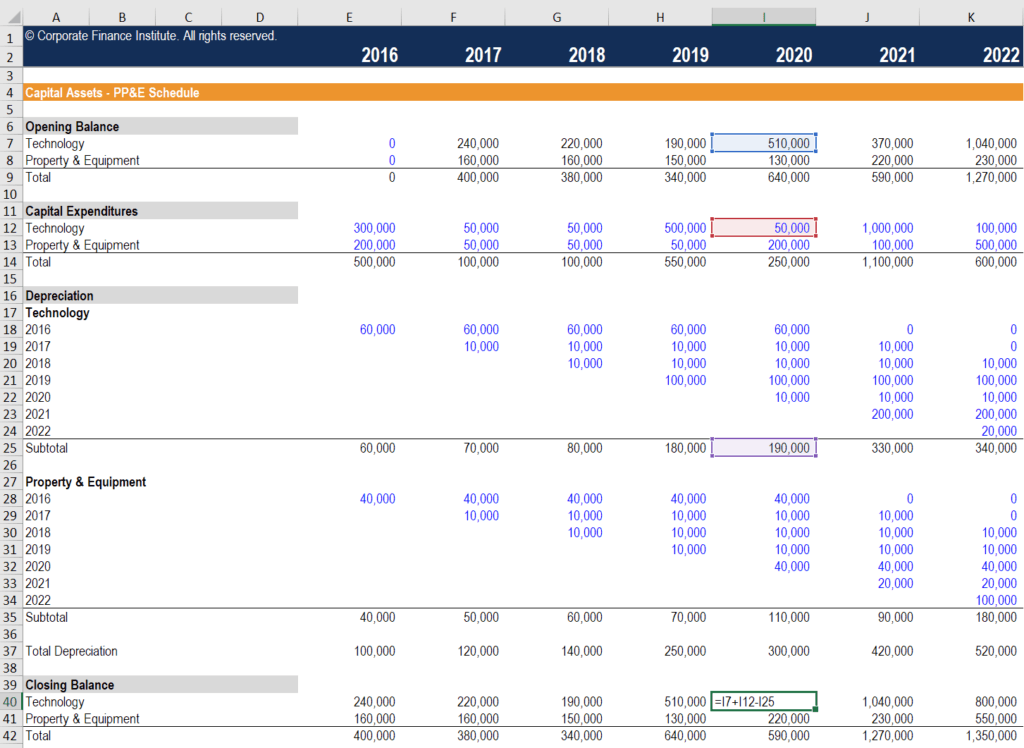

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Chapter 10 Property Plant And Equipment And Intangible Assets Acquisition And Disposition Ppt Download

Chapter 10 Property Plant And Equipment And Intangible Assets Acquisition And Disposition Ppt Download

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Solved 1 Property Plant And Equipment Are A Tangible Chegg Com

Solved 1 Property Plant And Equipment Are A Tangible Chegg Com

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

Types Of Assets In Accounting Top 3 Types With Examples

Types Of Assets In Accounting Top 3 Types With Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Types Of Assets List Of Asset Classification On The Balance Sheet

Types Of Assets List Of Asset Classification On The Balance Sheet

:max_bytes(150000):strip_icc()/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Are The Different Types Of Tangible Assets

What Are The Different Types Of Tangible Assets

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)