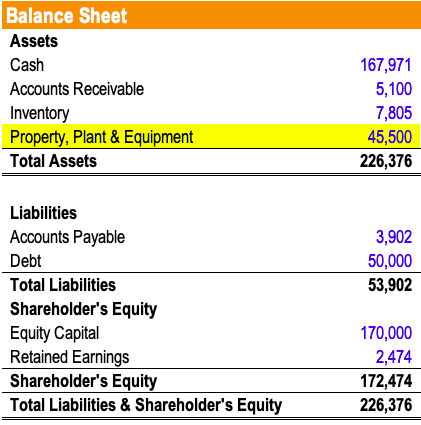

Under Us Gaap Property Plant And Equipment Is Reported On The Balance Sheet Based On

The warehouse is listed under the long-term assets account Property Plant and Equipment PPE at the historical cost of 100000. Property Plant and Equipment.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg) How Do Tangible And Intangible Assets Differ

How Do Tangible And Intangible Assets Differ

IAS 16 Property Plant and Equipment is one of oldest standard and its history goes back to 1980.

Under us gaap property plant and equipment is reported on the balance sheet based on. Mike can sell the warehouse for 150000 in 20X3. Step 3 of 3 Under US GAAP initial and subsequent measurement is not permitted. Examples of Balance Sheet.

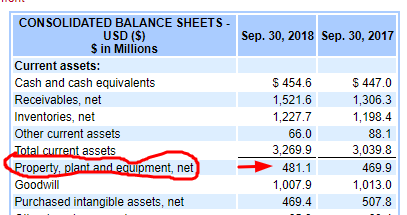

PPE is recognized as an asset in the Companys Balance sheet if and only if the cost of the item can be measured reliably and it is probable that the item will generate future economic benefits for the Company. The cost model is used as an accounting policy to report carrying an amount of property plant and equipment fixed assets in the balance sheet. In a post by Kim Ginste she focuses on the differences between the two methods.

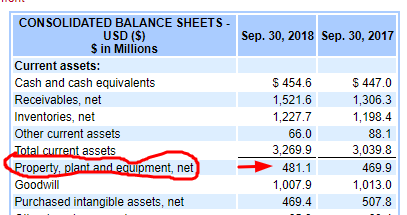

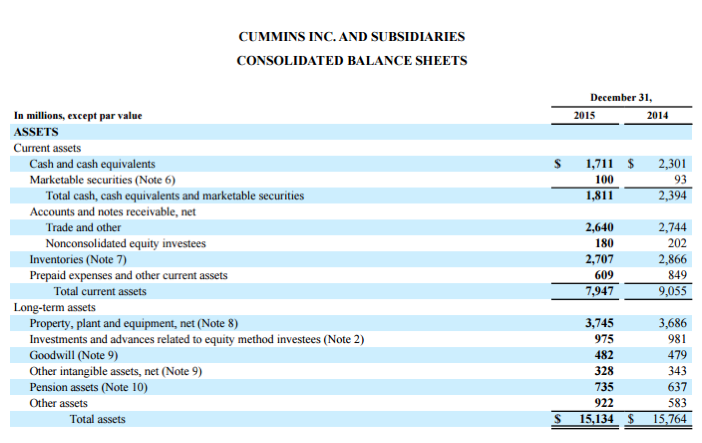

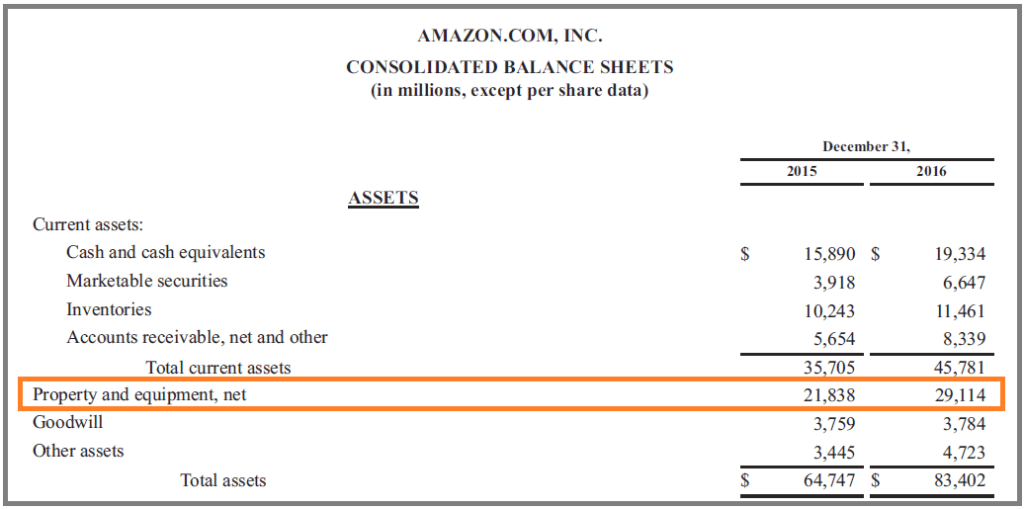

Purchases of PPE are a signal that management has faith in the long. It is impossible to provide a complete set that addresses every variation in every situation since there are thousands of such Balance Sheets. 32 Net property plant and equipment are reported on the balance sheet at.

The revaluation of assets is not allowed but some accounting standards allow recovery of impairment losses recognized in the past. The accounting standards that are relevant for PPE accounting are IAS 16 Property Plant and Equipment for IFRS ASC 360 Property Plant and Equipment for US GAAP. How Do the Main Provisions Differ from Current US.

The entire disclosure for long-lived physical asset used in normal conduct of business and not intended for resale. Intangible Assets lack physical existence and include items like purchased patents and copyrights goodwill the amount by which the fair value of an acquired business exceeds that entitys identifiable net assets rights under a franchise agreement and similar items. Property plant and equipment is measured initially at cost if cost can be measured with reliability and it ensures that it will generate economic benefits in future.

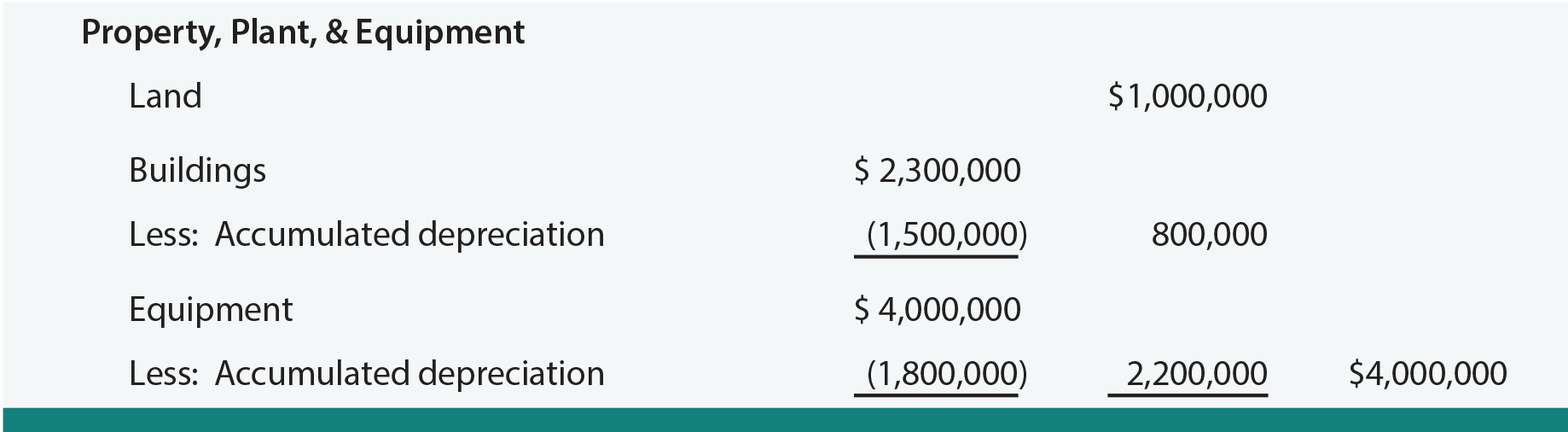

The following Balance Sheet example provides an outline of the most common Balance Sheets of US UK and Indian GAAP. Subsequent measurement of property plant and equipment is not permitted in US GAAP. The latest FASB ASU 2016-02 rule has now made operating leases more transparent and required its inclusion in the balance sheet.

C 33 Current liabilities are reported on the balance sheet at. Under both IFRS Standards and US GAAP with major new standards on revenue leases financial instruments and insurance. The difference in valuation of property plant and equipment is an important difference between US GAAP and IFRS that will have to be settled for a merger to ever be complete.

Property Plant and Equipment includes the land buildings and equipment productively in use by the company. I wont go into the issue of property plant and equipment disclosures under GAAP and IFRS but there are differences. Show examples of operating leases on the balance sheet Give.

On the balance sheet 100000 will be subtracted from PPE to write off the asset while a gain of 50000 will be reported on the income statement after taxes. For US GAAP however only the revenue standard is fully effective in annual periods. C historical cost minus accumulated depreciation.

For each class of property plant and equipment a company must disclose the measurement bases the depreciation method the useful lives or equivalently the depreciation rate used the gross carrying amount and the accumulated depreciation at the beginning and end of the period and a reconciliation of the carrying amount at the beginning and end of the period. Under the amendments in this Update the definition of discontinued operation differs from current US. D net realizable value.

Franco Co uses IFRS and owns property plant and equipment with a historical cost of 5000000. Net income is reported or statement of activities for a not-for-profit entity. Under the revaluation model property plant and equipment is reported on the balance sheet at a revalued amount measured as fair value at the date of remeasurement less accumulated depreciation and any accumulated impairment losses.

To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures. In IFRS the guidance related to accounting for property plant and equipment is included in International Accounting Standard IAS 16 Property Plant and Equipment and the guidance related to accounting for investment property is included in IAS 40. Generally Accepted Accounting Principles GAAP and Why Are They an Improvement.

Next subtract accumulated depreciation from the result. A current market value. Both IFRS and US GAAP require that property plant and equipment be reported at historical cost on the balance sheet.

For IFRS Standards implementation efforts are complete except for insurance. A current market value. Each example of the Balance Sheet states the topic the relevant reasons and additional comments as needed.

GAAP is included in the Financial Accounting Standards Boards Accounting Standards Codification ASC Topic 360 Property Plant and Equipment. Operating lease accounting in general can be confusing when you have to sift through multiple financial statements to quantify its impact. It requires an asset to be carried at its initial cost also referred to as historical cost less any accumulated depreciation and impairment losses.

IFRS includes a section on Decommissioning Liabilities while GAAP has a section on Fixed Asset Disposal Again assets held for sale are treated differently and should be recorded on the balance sheet separately. C discounted present value. Includes but is not limited to work of art historical treasure and similar asset classified as collections.

Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash. The guidance related to accounting for property plant and equipment in US.

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx) Lease Accounting A Guide For Tech Companies Bdo Insights

Lease Accounting A Guide For Tech Companies Bdo Insights

Ifrs Vs Gaap What S The Difference Floqast

Ifrs Vs Gaap What S The Difference Floqast

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Financial Reporting Of Investment Property Cfa Level 1 Analystprep

Financial Reporting Of Investment Property Cfa Level 1 Analystprep

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg) Cash Flow From Investing Activities

Cash Flow From Investing Activities

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Investing Activities Formula Calculations

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Impact Of Operating Leases Moving To Balance Sheet

Impact Of Operating Leases Moving To Balance Sheet

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Expenditure Capex Guide Examples Of Capital Investment

Solved In Preparation For Significant International Opera Chegg Com

Solved In Preparation For Significant International Opera Chegg Com

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)