What Does Tax Assessment On Zillow Mean

Since it is determined by the taxing authority of the city county or state where you live. A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

How To Make An Offer On A House In 7 Steps Zillow

How To Make An Offer On A House In 7 Steps Zillow

Local governments rely on your assessment as the source for determining your annual property tax bill.

What does tax assessment on zillow mean. Factors such as your propertys size construction type age. Unlike ad valorem property taxes bonds and direct assessments are flat fees imposed on each parcel of real estate in an area after a city- or district-wide vote in order to fund various services for that area not covered or insufficiently funded by property tax revenue. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated.

You need to go to the citytowncountystate website and look for the property tax records. Property taxes are oftentimes the most important source of revenue for a local government. Even though Zillow held a hard line in 2014 when then-Chief Revenue Officer Greg Schwartz said that Zillow is a media company that helps people find homes theres no doubt that the company is.

ZGMI a fee to receive consumer contact information like yours. Properties can be assessed by different methods depending on whether theyre residential or commercial. Zillow makes the data previously inaccessible andor prohibitively expensive available in the interest of greater transparency in the real estate market.

Your assessment can increase and your taxes can decrease or vice versa. If you believe your assessment is fair but your taxes are too high you may wish to bring your concerns to your local elected officials. Sometimes it is the same as the market assessed value and other times counties will multiply the market value by an assessment ratio to get the tax assessed value which is often lower than the.

This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question. The assessed value of the structure and property some jurisdictions split this out. The Zillow Transaction and Assessment Dataset ZTRAX is the countrys largest real estate database made available free of charge to US.

Participating lenders may pay Zillow Group Marketplace Inc. A property tax assessment is a professional appraisal of the market value of a residential or commercial real estate. The assessed value of your property is only one factor in determining your property taxes.

Tax assessed value This figure varies throughout the US. Academic nonprofit and government researchers. The time that it takes to receive sale data varies widely among municipalities and largely depends on their systems to upload and share data.

There is a distinction between your assessed value and the state. Simply so what is a tax assessment on Zillow. Zillow gets their information from public databases.

Appraised Tax Value vs. The scenarios below illustrate how taxes and assessments can move in opposite directions. The assessment rate is a percentage of up to 100 that takes into account factors that could raise or lower the value of homes in a given area.

Annual property taxes are determined by multiplying the assessed fair market value against the local property tax rate. If my assessment increases does that mean that my tax bill will increase. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate.

An assessed value is the dollar value assigned to a property to measure applicable taxes. A property tax assessment estimates the fair market value of your property. ZGMI does not recommend or endorse any lender.

Normally there are two values. We display lenders based on their location customer reviews and other data supplied by users. Assessed valuationdetermines the value of a residence for tax purposes and takes comparable home sales and.

Assessment is made by recording the taxpayers name address and tax liability. Tax assessors property values can be inaccurate. Many real property sellers and buyers have gotten confused in trying to sort out a propertys true value.

The Zestimate also takes into account actual property taxes paid exceptions to tax assessments and other publicly available property tax data. Your total tax levy set by local taxing bodies like schools is an important factor in setting your tax rate. Assessment Assessment is the statutorily required recording of the tax liability.

Normally real property is valued according to its. Tax assessment information is provided from public county records collected and aggregated by a third party data provider and then sent to us. The assessors market assessed value is based on actual historical sales of similar properties for a specified study period.

This number is called your tax assessment.

Real Estate Comps How To Find Comparables For Real Estate Zillow

Real Estate Comps How To Find Comparables For Real Estate Zillow

817 W Portland St Springfield Mo 65807 Zillow

817 W Portland St Springfield Mo 65807 Zillow

What Is Tax Assessed Value Tax Appraised Value And Market Assessed Value Spokane Real Estate Curb Appeal Long Distance Moving Companies

What Is Tax Assessed Value Tax Appraised Value And Market Assessed Value Spokane Real Estate Curb Appeal Long Distance Moving Companies

1423 Rex Ave Joplin Mo 64801 Zillow

1423 Rex Ave Joplin Mo 64801 Zillow

Are Zillow Home Values Accurate Zillow S Estimates Explained Zillow Homes Real Estate Real Estate Education

Are Zillow Home Values Accurate Zillow S Estimates Explained Zillow Homes Real Estate Real Estate Education

504 S Albany Ave Bolivar Mo 65613 Mls 60179978 Zillow

504 S Albany Ave Bolivar Mo 65613 Mls 60179978 Zillow

690 W Danielle St Republic Mo 65738 Zillow

690 W Danielle St Republic Mo 65738 Zillow

9090 Oak Way Dr Mountain Grove Mo 65711 Zillow

9090 Oak Way Dr Mountain Grove Mo 65711 Zillow

17134 Turning Oaks Bnd Lutz Fl 33549 Zillow

17134 Turning Oaks Bnd Lutz Fl 33549 Zillow

7634 E Cinnabar Ln Strafford Mo 65757 Zillow

7634 E Cinnabar Ln Strafford Mo 65757 Zillow

Zillow Or Redfin Which Value Estimate Is Correct Realtor Nick French

Zillow Or Redfin Which Value Estimate Is Correct Realtor Nick French

An Estimated 123 000 Dreamers Own Homes And Pay 380m In Property Taxes Zillow Research

An Estimated 123 000 Dreamers Own Homes And Pay 380m In Property Taxes Zillow Research

226 N Cordie St Seymour Mo 65746 Zillow

226 N Cordie St Seymour Mo 65746 Zillow

How To Increase Your Home S Zillow Zestimate Toughnickel Money

How To Increase Your Home S Zillow Zestimate Toughnickel Money

1826 Smith Rd Northbrook Il 60062 Zillow Zillow Northbrook Patio

1826 Smith Rd Northbrook Il 60062 Zillow Zillow Northbrook Patio

10 Most Important Steps To Buying A House Zillow

10 Most Important Steps To Buying A House Zillow

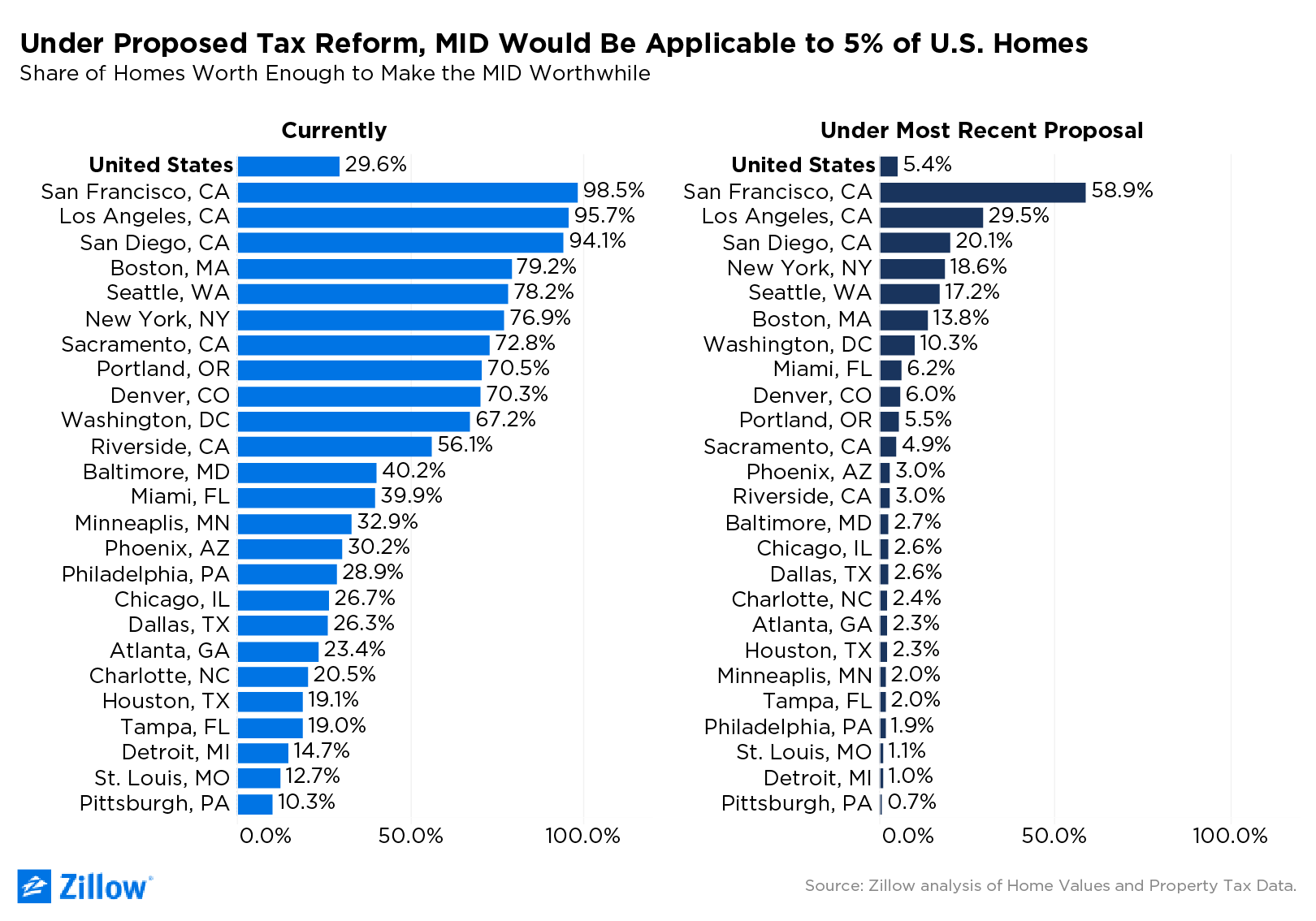

Under Proposed Tax Changes Taking Mid Would Be Worthwhile On Only 5 Of U S Homes Zillow Research

Under Proposed Tax Changes Taking Mid Would Be Worthwhile On Only 5 Of U S Homes Zillow Research

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg) Zillow Estimates Not As Accurate As You Think

Zillow Estimates Not As Accurate As You Think