Capital Gains Tax Property Limited Company

The rates are 18 or 28. It has led to widespread transfer of property portfolios to limited companies.

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments

You pay Corporation Tax which currently stands at 19 2019 - 2020 and is due to fall to 17 in April 2020.

Capital gains tax property limited company. Capital Gains Tax is not paid by limited companies or unincorporated associations like community groups or sports clubs. This is because any property you own is viewed as part of your business not a personal investment. When selling the property through a company any capital gains made on the sale are liable for the 19 corporation tax.

You dont pay Capital Gains Tax on property owned and sold by a limited company. A company within the scope of ATED will be subject to ATED-related Capital Gains Tax CGT at 28 on gains realised on disposal by reference to the April 2013 market value or acquisition cost if later. You will be required to refinance your buy to let mortgages.

This is called incorporation relief and utilises the provisions set out in the Partnership Act 1890. Capital gains for limited companies and unincorporated associations eg clubs and co-operatives are dealt with through corporation tax and are referred to as chargeable gains. From April 2016 the basic rate of capital gains tax has been reduced to 10 and the higher rate reduced to 20.

The CGT rate depends on the type of asset sold and the level of your personal income in the year in which the asset was sold. The individual pays Capital Gains Tax CGT on the sale Transferring an asset to a limited company will also usually give rise to a Capital Gains Tax CGT liability. Instead companies pay Corporation Tax which is another type of payment.

However it is possible to use the property partnership route to avoid both Stamp Duty Land tax and Capital Gains Tax when moving a rental property portfolio into a limited company. This is the difference between the market value and the price that you paid for the property. If the purpose of your business is to buy and sell property youre a property developer for example you do not pay Capital Gains Tax when you sell a property.

Any Stamp Duty Land Tax SDLT costs that will be incurred by transferring the properties into a limited company. A company can make a capital gain from selling or transferring an asset. When you sell a property to a limited company there are issues around.

You may have to pay up to 28 capital gains tax CGT on the difference between your original purchase price and your sale price. Incorporation of property business Capital Gains Tax CGT and funding implications The shock tax changes introduced by George Osbourne in the 2015 budget seriously affected many buy to let landlords. You pay Capital Gains Tax if youre a self-employed sole trader or in a business partnership.

2866treats a company and an individual who wholly or partly controls it as connected persons. Capital Gains Tax CGT that you will have to pay. Pensions and investments such as an ISA or PEP accounts are CGT-free although you will have to pay capital gains on shares and any assets you inherit and dispose of at a later date.

On the other hand when selling the property as an individual you receive an annual exempt amount of 12000. Current tax rates for long-term capital gains can be as low as 0 and top out at 20 depending on your income. However the new rates do not apply to disposals of residential property.

C Corporation There would be no long-term capital gains tax on the sale but there would be regular corporate income tax if a profit is realized on the house. When Do You Pay Capital Gains Tax. Do companies pay Capital Gains Tax.

Capital gains tax The transfer of the business into a company would prima facie be a transfer for tax purposes at market value with a resulting capital gain on the transferor in respect of any assets standing at a gain. Gains on the sale of collectibles are taxed at 28. The tax is assessed in the same accounting period that the gain is made.

C corporations do not have. Exclusion for Sale of Primary Residence Special rules apply to the capital gains when you sell your primary residence. Capital Gains on assets other than development land.

Capital gains below the 202021 level of 12300 12000 in 201920 per year are tax-free. The company could be liable to pay Stamp Duty. The relieving section is s162 TCGA 1992 generally known as Incorporation Relief.

This gain is usually included in the profits for Corporation Tax CT purposes on an online CT1 using Revenue Online Service ROS. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed. If you transfer the property from yourself to a company effectively the company buys the property.

Long-term capital gains taxes apply to profits from selling something youve held for a year or more. Other organisations like limited companies pay Corporation Tax on profits from selling their assets.

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

Concept Of Capital Gains In Case Of Joint Development Agreement

Concept Of Capital Gains In Case Of Joint Development Agreement

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

11 Ways To Reduce Your Capital Gains Tax Bill Face To Face Finance

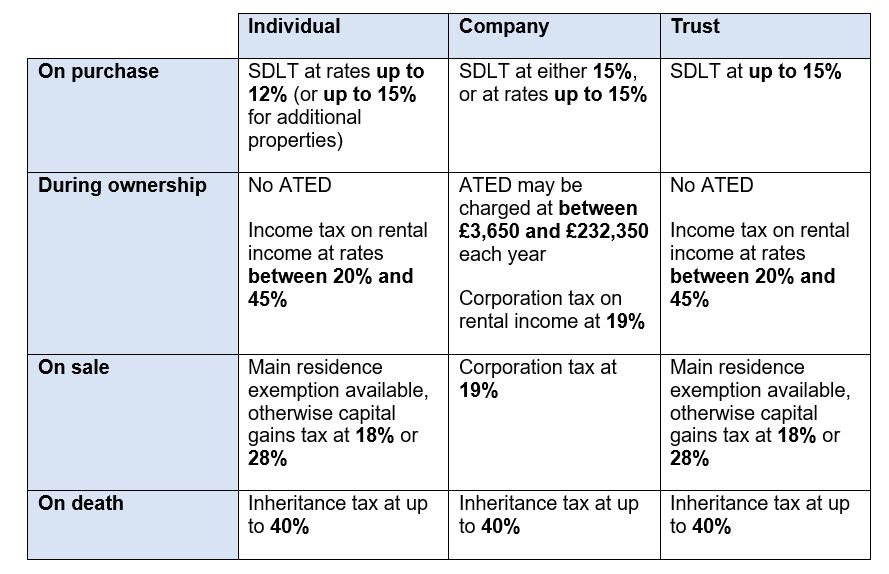

Uk Residential Property Structures What Are My Options

Uk Residential Property Structures What Are My Options

6 Important Ways About Saving Capital Gain Tax From Sale Of Property Capital Gains Tax Capital Gain Investment Tips

6 Important Ways About Saving Capital Gain Tax From Sale Of Property Capital Gains Tax Capital Gain Investment Tips

Incorporating Properties Into A Company Cgt And Sdlt Optimise

Incorporating Properties Into A Company Cgt And Sdlt Optimise

Income Tax Deductions List Fy 2020 21 Ay 2021 22 Tax Deductions Tax Deductions List Income Tax

Income Tax Deductions List Fy 2020 21 Ay 2021 22 Tax Deductions Tax Deductions List Income Tax

Capital Gain Definition Classification And Taxation Matters

Capital Gain Definition Classification And Taxation Matters

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

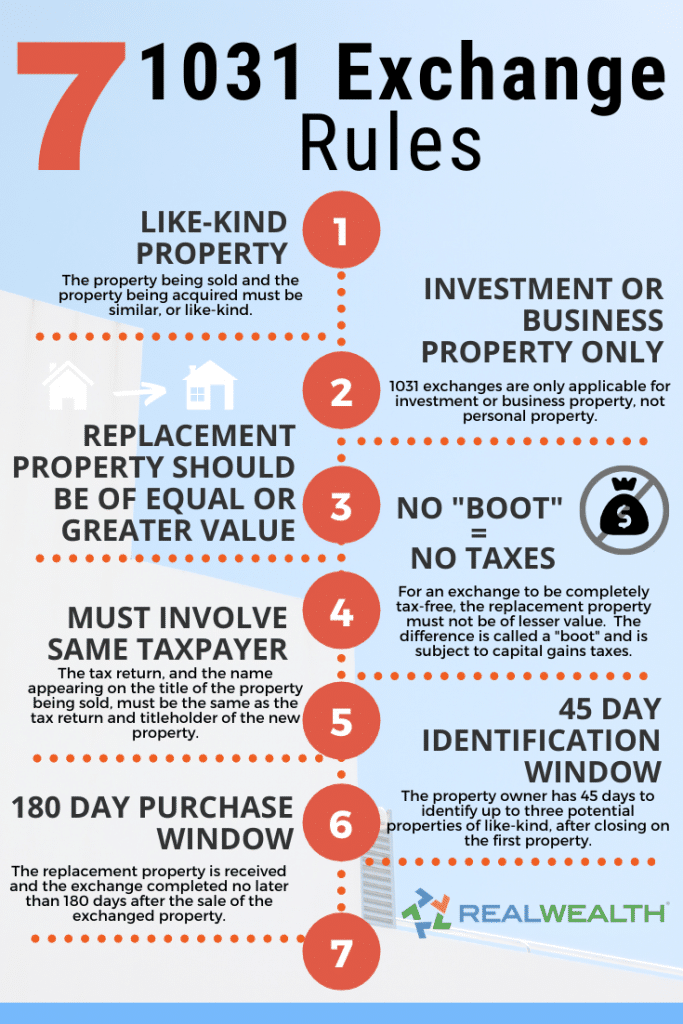

1031 Exchange Rules Success Stories For Real Estate Investors 2021

1031 Exchange Rules Success Stories For Real Estate Investors 2021

Long Term Capital Gain For Property Owner Critical Things To Know

Long Term Capital Gain For Property Owner Critical Things To Know

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Companies

Capital Gains Exemption On Sale Of Land How To Save Capital Gains Tax

Capital Gains Exemption On Sale Of Land How To Save Capital Gains Tax

Capital Gains Tax Implications On Properties Transferred Under Family Arrangements Settlements Housing News

Capital Gains Tax Implications On Properties Transferred Under Family Arrangements Settlements Housing News

What Is Short Term Capital Gains Tax Meaning Tax Rate Calculation The Financial Express

What Is Short Term Capital Gains Tax Meaning Tax Rate Calculation The Financial Express

How To Avoid Capital Gains Tax When Selling Property Finder Com

How To Avoid Capital Gains Tax When Selling Property Finder Com