Does An Llc Pay Capital Gains Tax

The long-term capital gains rate is below the tax rate youll pay on most other income. Capital Gains Tax on Your Investment Property.

There is a 250000 exemption 500000 for a couple and only gains above this amount are taxable.

Does an llc pay capital gains tax. There are some exceptional circumstances which may result in higher percentages and the net investment income tax of 38 is added if a taxpayer meets certain requirements at a high-income level. For example if the house is owned by an LLC. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Does LLC ownership count as time used as a primary residence. For a single-member LLC the answer is typically yes. How to Calculate a Capital Gain The.

TheStreet explains capital gains taxes and the current rate. If you receive the capital gain distribution evenly throughout the year you need to make four payments. Estimated tax payments should be made in the quarter in which you receive the capital gains.

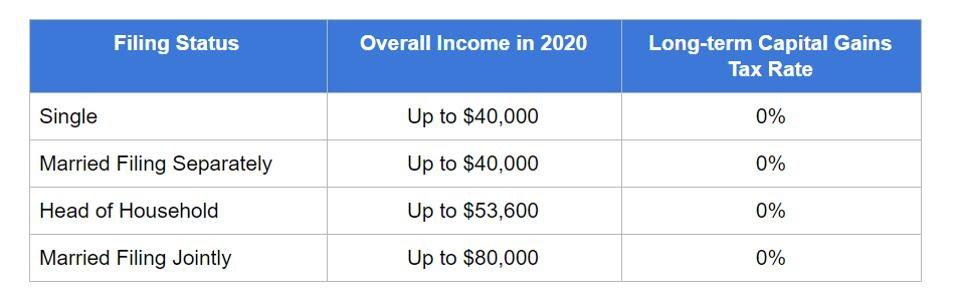

If you bought the property with the intent to resell it at a profit then the gain is taxed as ordinary income like real estate dealers do. A single-member LLC is a disregard entity to the IRS and treated like a sole-proprietorship. Currently the federal rates for tax on long-term capital gains are 0 15 or 20 depending on your income.

For example if you receive all the capital gains on May 31 make your estimated tax payment on June 15. If you are the only member you have 100 of the ownership. If you hold for more than a year its capital gains.

There would be no long-term capital gains tax on the sale but there would be regular corporate income tax if a profit is realized on the house. C corporations do not have any. If an LLC owns a real property for 2 years and then sells it are the profits deemed business income or capital gains.

Your contribution to the LLC as a member is called your capital contribution your contribution to the ownership. If you have more than 3000 in excess capital losses the amount over 3000 can be carried forward to future years to offset capital gains or income in those years. The capital gains tax provision in the budget will start to make these tax rates more even.

An individual must pay taxes at the short-term capital gains rate which is the same as the ordinary income tax rate if an asset is held for one year or less. The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax. Long-term capital gains on so-called collectible assets.

Capital gains tax is an income tax on gains made from various investments including LLCs. The capital gains tax rates in the tables above apply to most assets but there are some noteworthy exceptions. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

Some investors that have 2 LLC s. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity. Profits are paid out in dividends and the LLC members will pay taxes on the dividends at their individual tax rates.

If capital losses exceed capital gains you may be able to use the loss to offset up to 3000 of other income. Instead in most cases you only pay tax on half of your gains. One for their buy holds and another for their flips to keep the two separate.

The LLC pays taxes on capital gains at the corporate rate. Paying Tax on Capital Gains You usually dont have to pay tax on all of your capital gains. Capital gains on the sale of a primary residence are protected.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. For instance if you have a total of 100000 in capital gains you only have to include 50000 as taxable income on your tax return. Capital gains tax can affect what you pay for investments real estate and more come tax season.

In fact long-term capital gains are taxed at either 0 15 or 20 depending on your income and the. This is not an election. 50000 - 20000 30000 long-term capital gains.

If LLC owners choose to be taxed as a partnership they will have to pay taxes for the profits they make from the company. This capital contribution gives you a share in the LLC and the right to a percentage of the profits and losses.

This Guide To Capital Gains Taxes Will Help You Do A Quick Back Of The Envelope Calculation Of What You M Real Estate Values Probability First Time Home Buyers

This Guide To Capital Gains Taxes Will Help You Do A Quick Back Of The Envelope Calculation Of What You M Real Estate Values Probability First Time Home Buyers

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

Capital Gains Tax Brackets For Home Sellers What S Your Rate Tax Brackets Capital Gains Tax Capital Gain

The Act Allows Flow Through Businesses In New Jersey Such As Sub S Corporations Partnerships Llcs Or Sole Proprietorsh In 2020 Tax Services Tax Rules Tax Deductions

The Act Allows Flow Through Businesses In New Jersey Such As Sub S Corporations Partnerships Llcs Or Sole Proprietorsh In 2020 Tax Services Tax Rules Tax Deductions

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Gain

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Gain

How To Avoid Capital Gains Taxes When Selling Your House 2020

How To Avoid Capital Gains Taxes When Selling Your House 2020

Equity Long Term Capital Gain Tax Grandfathering Google Search Capital Gains Tax Capital Gain Budgeting

Equity Long Term Capital Gain Tax Grandfathering Google Search Capital Gains Tax Capital Gain Budgeting

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

Long Term Integrated Capital Gain Taxes Across Oecd Countries Png 881 485 Capital Gains Tax Capital Gain Term

What Is Capital Gains Tax And When Are You Exempt Thestreet

What Is Capital Gains Tax And When Are You Exempt Thestreet

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Investing

Do You Need To Pay Capital Gains Tax On Inherited Property If Sold Finance Zacks Capital Gains Tax Capital Gain Tax

Do You Need To Pay Capital Gains Tax On Inherited Property If Sold Finance Zacks Capital Gains Tax Capital Gain Tax

6 Ways To Eliminate Reduce Your Crypto Tax Rate

6 Ways To Eliminate Reduce Your Crypto Tax Rate

Capital Gains Tax On Stocks How Can They Benefit Your Portfolio

Capital Gains Tax On Stocks How Can They Benefit Your Portfolio

![]() How To Avoid Capital Gains Tax On Stocks Brandon Renfro Ph D

How To Avoid Capital Gains Tax On Stocks Brandon Renfro Ph D

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Real Estate Investing Rental Property Capital Gain

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

How To Calculate Capital Gains Tax On Real Estate Investment Property

How To Calculate Capital Gains Tax On Real Estate Investment Property