How To Calculate Proceeds From Sale Of Property Plant And Equipment

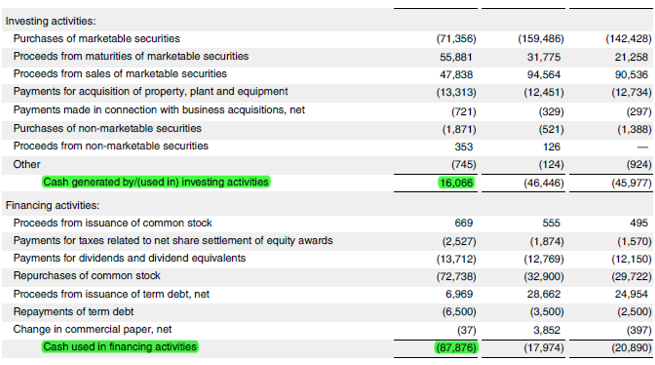

If the remainder is negative it is a loss. No proceeds fully depreciated.

Capital Expenditure Capex Guide Examples Of Capital Investment

Capital Expenditure Capex Guide Examples Of Capital Investment

Disposal of plant assets can occur through the retirement of discarded assets sales involuntary conversions or trade-insNo matter how the disposal is accomplished the accounting procedures are quite similar.

How to calculate proceeds from sale of property plant and equipment. Depreciation must be recorded up to the date of disposal and where appropriate a gain or loss must be recorded on the disposal. To illustrate accounting for the sale of a plant asset assume that a company sells equipment costing 45000 with accumulated depreciation of 14000 for 28000 cash. During 2015 equipment was sold for 3000 cash with an original cost of 20000 and 10000 of accumulated depreciation.

What is Property Plant and Equipment PPE. Subtract this carrying amount from the sale price of the asset. The gain or loss on the disposal of a long-lived asset is calculated as follows.

Property plant and equipment is considered a long-term. If a California resident later becomes a nonresident the income may remain California-source. These statements are key to both financial modeling and accounting of a business and is used to generate revenues and profits.

138000 22500 123500 10000 27500. This means the book value of the equipment is 1080 the original cost of 1100 less the 20 of accumulated depreciation. Cash outflow from purchase of property plant and equipment PPE 120000 170000 -50000.

They are also called as the fixed assets of the company as it cannot be easily liquidated. If the amount of the proceeds is greater than the book value or carrying value of the long-term asset at the time of the sale the difference is a gain on the sale or disposal. Computation of cash paid for purchase of equipment.

There were no other transactions in July. Purchase of property plant and equipment PP. What is the difference between gains and proceeds in terms of long-term assets.

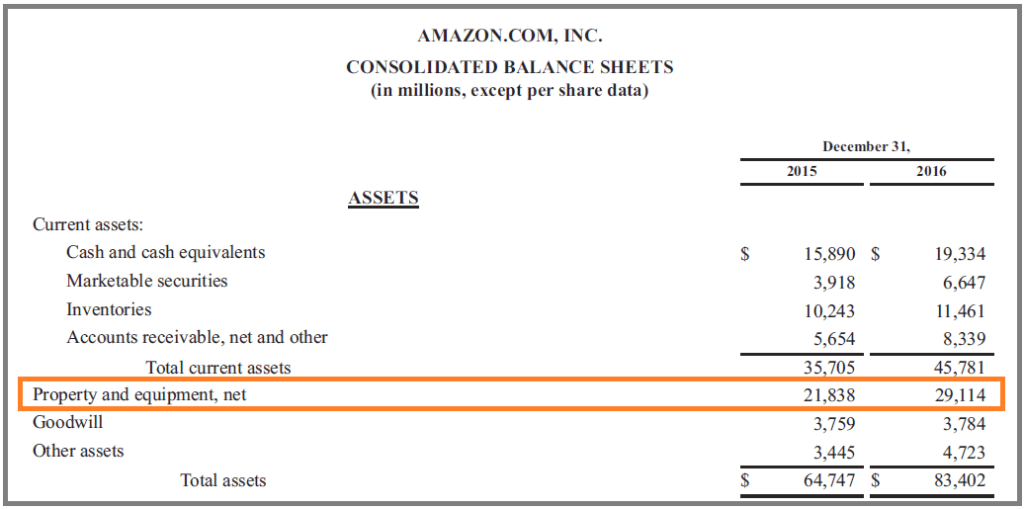

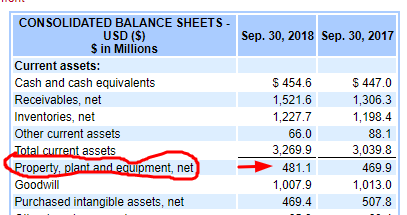

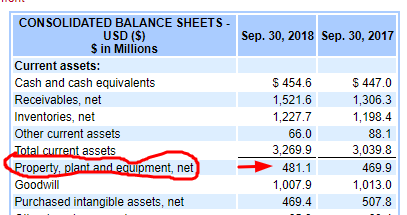

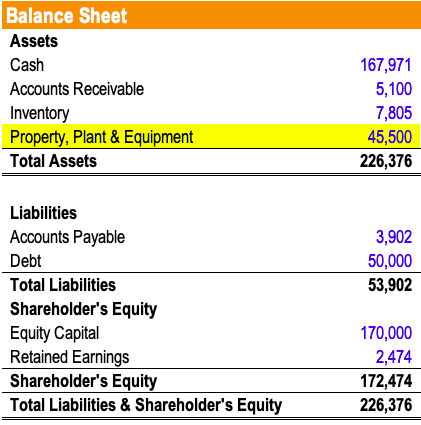

2 Please calculate the free cash flow for 2012 and explain the meaning of this ratio. There are two main items in non-current assets Land and Property Plant and Equipment. On the balance sheet the only long term asset we have comes from property plant and equipment and is the Equipment account.

Any remaining difference between the two is recognized as either a gain or a loss. Cash inflow from sale of Land Decrease in Land BS Gain from Sale of Land 80000 70000 20000 30000. Formula to Calculate Gains and Losses.

If the remainder is positive it is a gain. Cash flow from Investments formula Cash inflow from Sale of Land Cash outflow from PPE 30000 50000 -20000. Property plant and equipment PPE are long-term tangible assets that are physical in nature.

Next subtract accumulated depreciation from the result. The original purchase price of the asset minus all accumulated depreciation and any accumulated impairment charges is the carrying amount of the asset. Additional equipment was purchased for 220000 cash.

The gain or loss is calculated as the net disposal proceeds minus the assets carrying value. Here are the options for accounting for the disposal of assets. When long-term assets are sold the amounts received are referred to as the proceeds.

Proceeds from Sale of Property Plant and Equipment The cash inflow from the sale of long-lived physical assets that are used in the normal conduct of business to produce goods and services and not intended for resale. Depending on the asset sold the costs may account. To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures.

If the amount received is less than the book value. Net proceeds are the amount the seller receives following the sale of an asset after all costs and expenses are deducted from the gross proceeds. 1 Please calculate the percentage increase or decrease in cash for the operating investing and financing sections and explain the major reasons for the increase or decrease for each of these sections.

The company would realizes a loss of 3000 45000 cost 14000 accumulated depreciation is 31000 book value 28000 sales price. Debit cash for the amount received debit all accumulated depreciation debit the loss on sale of asset account and credit the fixed asset. The formula to calculate gains and losses is straightforward on the surface.

Cash paid for purchase of equipment has been computed as the balancing figure of the T-account. Debit all accumulated depreciation and credit the fixed asset. The cash paid for purchase of equipment may be computed by preparing a t-account.

Acquisitions of other businesses or companies. Since the cash proceeds from the sale should be reported under Investing first deduct the book gain from Operating Activity. Proceeds from the sale of PP.

Moreover if intangible personal property of a nonresident acquires a business situs in. These are non-current assets that are used in the companys operations for a longer part of the time. Sale income relating to the sale of intangible personal property is determined at the time of the sale.

Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Next determine the net book value of the asset sold. On July 1 Good Deal sells the equipment for 900 in cash and records a loss of 180 in the account Loss on Sale of Equipment on its income statement.

Invested Capital Formula Calculator Examples With Excel Template

Invested Capital Formula Calculator Examples With Excel Template

Cash Flow From Investing Activities Overview Example What S Included

Cash Flow From Investing Activities Overview Example What S Included

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

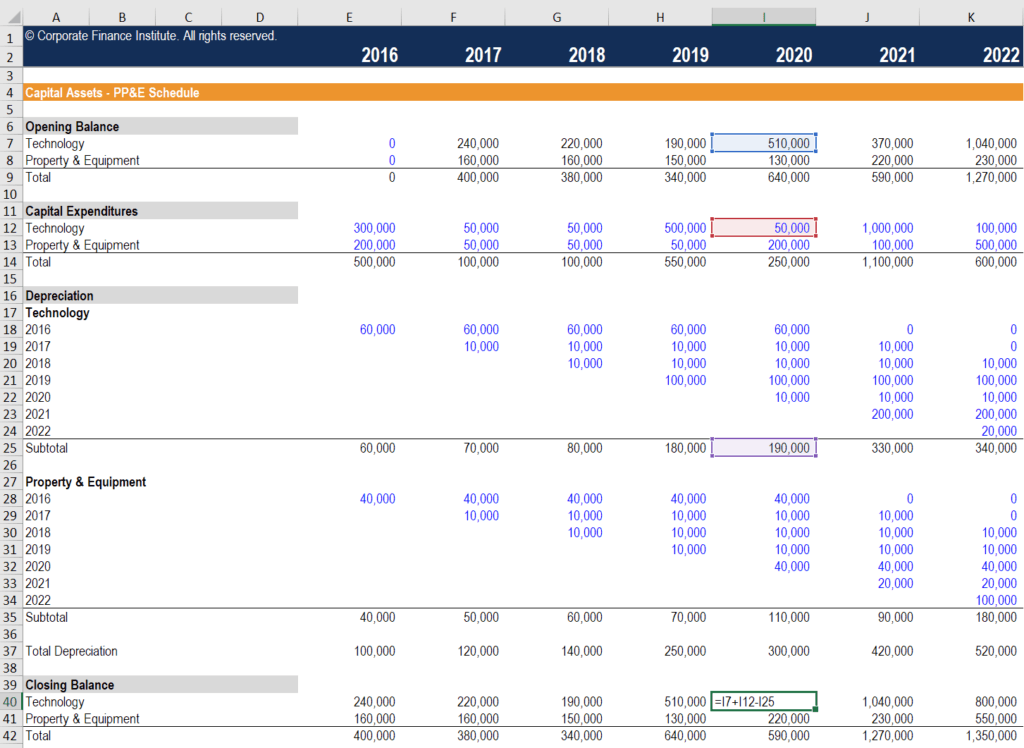

Property Plant And Equipment Schedule Template Eloquens

Property Plant And Equipment Schedule Template Eloquens

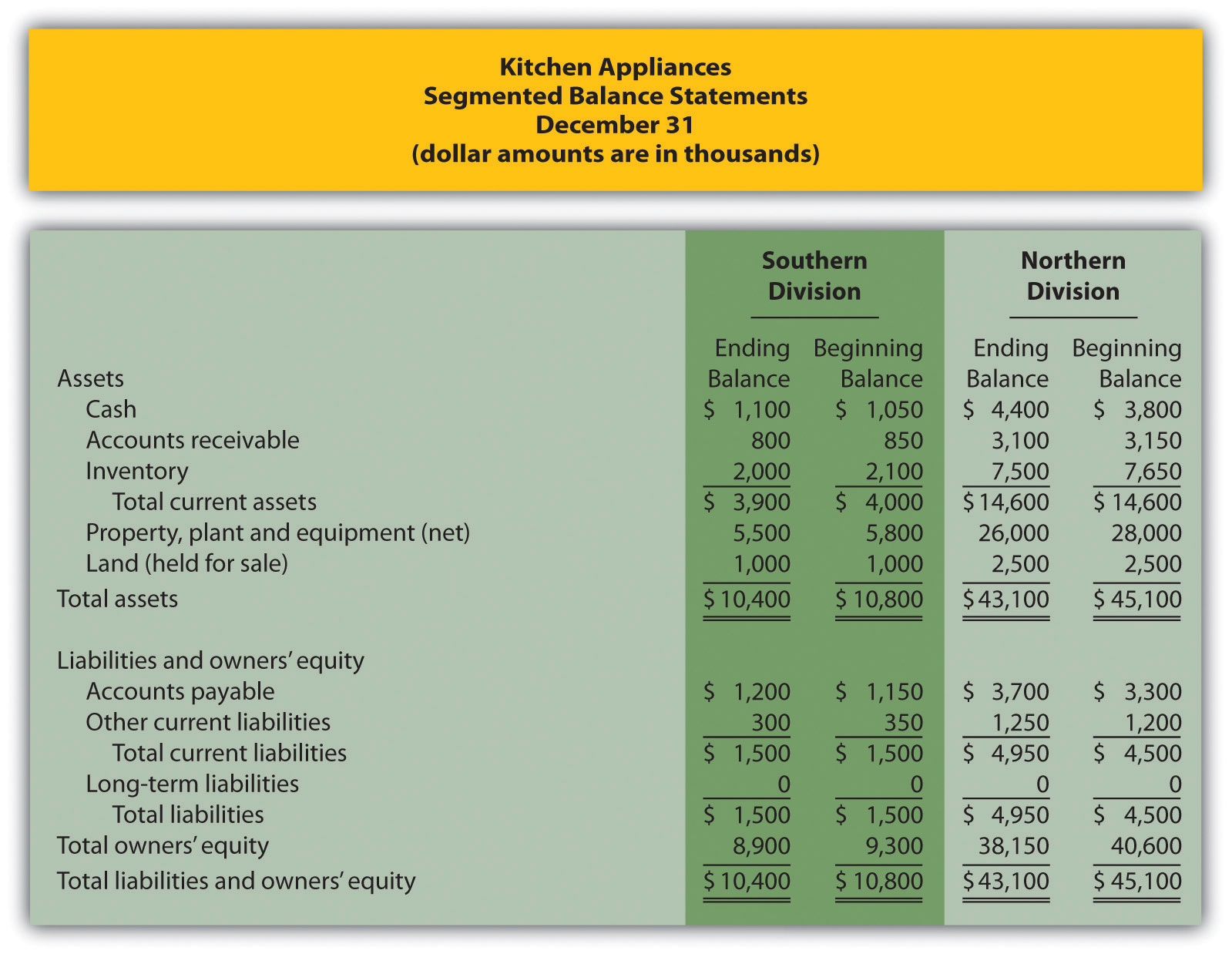

Using Return On Investment Roi To Evaluate Performance Accounting For Managers

Using Return On Investment Roi To Evaluate Performance Accounting For Managers

11 Property Plant And Equipment Notes To The Consolidated Financial Statements Consolidated Financial Statements Registration Document 2014

10 Acquisition And Disposition Of Property Plant And Equipment Ppt Download

10 Acquisition And Disposition Of Property Plant And Equipment Ppt Download

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg) Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Cash Flow From Investing Activities Formula Calculations

Cash Flow From Investing Activities Formula Calculations

How To Calculate Capex Formula Example And Screenshot

How To Calculate Capex Formula Example And Screenshot

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg) How To Calculate Return On Assets Roa With Examples

How To Calculate Return On Assets Roa With Examples

Using The Indirect Method To Prepare The Statement Of Cash Flows Accounting For Managers

Using The Indirect Method To Prepare The Statement Of Cash Flows Accounting For Managers

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg) Cash Flow From Investing Activities

Cash Flow From Investing Activities