How To Get A Judgement Lien Removed From Your Property

How does a creditor go about getting a judgment lien in Tennessee. How to understand City of Philadelphia judgment and lien numbers in order to submit a payoff request.

What Did The Legislature Intend By Prescribing A 10 Year Period With An Option To Renew Concerning Judgment Liens On Real Propert Estate Lawyer Banker Judgment

What Did The Legislature Intend By Prescribing A 10 Year Period With An Option To Renew Concerning Judgment Liens On Real Propert Estate Lawyer Banker Judgment

Paying off the debt.

How to get a judgement lien removed from your property. Whether or not a court will agree to remove the lien will depend on the circumstances surrounding the judgment and the amount of time that has elapsed since the date of the judgment. In Tennessee a judgment lien can be attached to real estate only a house land etc. What does it mean when.

You will need to pay or resolve any lien related to a divorce settlement child support payments or any other creditors. Paying Off the Amount Owed. This acts as evidence that the debt has been paid and will effectively remove the lien from your property.

Asking the court to remove the judgment lien. You can pay off a property lien by paying the remaining loan balance. Judgment Liens and Bankruptcy Repaying a creditor holding a.

This is the most straightforward option. You should contact an attorney if you are thinking about pursuing this option. Remove judgment liens with these tips.

It is ex wife property title after I divorced 3 years ago. Removing a lien from your property can be a complex and drawn out process. Prevent sequestration Details on the Real Estate Tax Sequestration Program in which the City has a third party take over management of a tax-delinquent property.

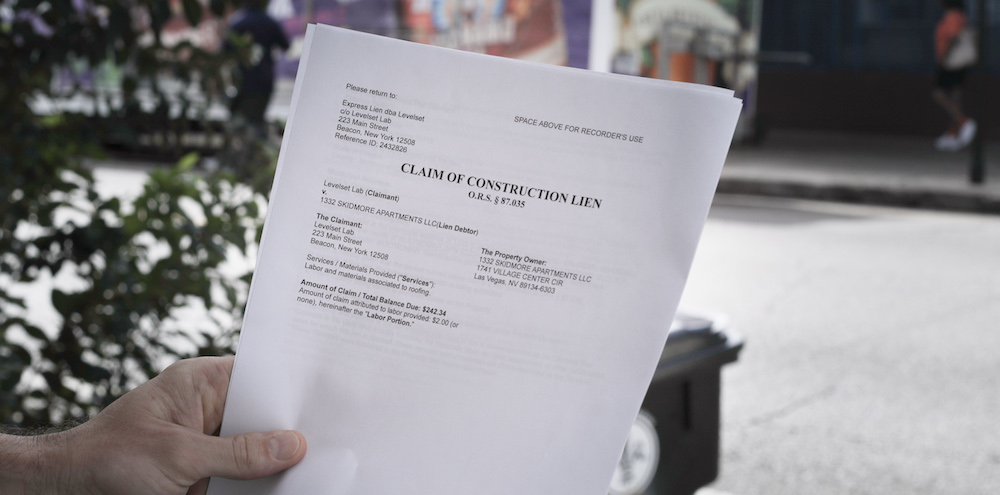

Generally a judgment lien is removed when the creditor holding it files a satisfaction of judgment with the court that issued the lien. Asking the Court to Remove the Judgment Lien. 1 immediately dispute the lien whether through statutorily provided preliminary means a demand toagainst the claimant or a full-blown lawsuit.

Mortgage is on the both names. However you do have a few options. It is best to make efforts to get rid of the judgment lien.

We focus on bankruptcy which is usually the quickest and cheapest way to remove a judgment. If you negotiated a different repayment amount you can remove the lien by paying that amount in full. But today we received notice of involuntary lien on the property.

Ways to Get a Lien Released or Extinguished. Once the creditor releases the lien you may sell trade or otherwise transfer the property as you please. Force the Issue If someone slaps on lien on your home file a Notice of Contest with the country real estate office.

However these circumstances apply to a large percentage of people filing bankruptcy who have a judgment lien on their home. Once you have paid off the balance of your debt in full you can file a Release of Lien form. Ask the court to vacate the judgment and remove the lien.

Once you do that they must either file a suit against you or the contractor or the lien will expire in 60 days. Make sure the debt the lien represents is valid. If you live in Minnesota and have been issued a judgment lien due to an unpaid debt we at Walker Walker Law Offices PLLC can help you with getting it removed from your property.

Request a release-of-lien form from your lender. The IRS releases your lien within 30 days after you have paid your tax debt. The creditor then files this release with the same authority with which it recorded the original lien.

If the debt is valid pay the creditor in full. Since the bankruptcy act that contains lien avoidance Chapter 7 supersedes the state courts judgment your request for judgment lien removal gets fast-tracked. To attach the lien the creditor files a certified copy of the judgment with the register of deeds in any Tennessee county where the debtor owns property now or may own property in the.

There are several ways to remove a lien from your property including. When conditions are in the best interest of both the government and the taxpayer other options for reducing the impact of a lien exist. Judgment liens are awarded through court order and must be repaid in full or otherwise satisfied for the creditor to release you from the obligation and remove the judgment lien from your homes.

Here are the steps to take to remove the claim of the lien holder against your property. Pay off the debt. If you pay off the underlying debt the creditor will agree to release the judgment lien.

In order to get rid ofavoida judgment lien that liens must impair your homestead exemption See Section 522f of the Bankruptcy Code. Judgment liens can be removed from an affected property in a few ways including. Credit card has 3700 debt and they put it in judgement lien and will have a hearing in 5 months this year.

If you dont believe you owe the debt to which the lien is attached you may want to consult with an attorney. How to Get Rid of a Lien Paying your tax debt - in full - is the best way to get rid of a federal tax lien. It can only be done under certain circumstances.

There are multiple options when a lien is filed against your property. Then mail it to the person making the claim. While paying off the existing amount owed may seem like the obvious solution it really depends on the situation.

Three of the most common are.

5 12 3 Lien Release And Related Topics Internal Revenue Service

5 12 3 Lien Release And Related Topics Internal Revenue Service

Can A Credit Card Put A Lien On My Home Judgment Liens

Can A Credit Card Put A Lien On My Home Judgment Liens

There S A Lot At Stake With Those Three Digits Your Credit Score Can Influence Whether A Landlord Approves Yo Dispute Credit Report Letter Templates Lettering

There S A Lot At Stake With Those Three Digits Your Credit Score Can Influence Whether A Landlord Approves Yo Dispute Credit Report Letter Templates Lettering

Resolutions For Common Transaction Issues Title Insurance Underwriting New Names

Resolutions For Common Transaction Issues Title Insurance Underwriting New Names

How To Remove Tax Liens From Your Credit Report 3 Easy Steps

How To Remove Tax Liens From Your Credit Report 3 Easy Steps

What Is A Lien Types Of Property Liens Explained

What Is A Lien Types Of Property Liens Explained

Richlyconnected Repair Quote Credit Repair Credit Repair Business

Richlyconnected Repair Quote Credit Repair Credit Repair Business

How Does A Judgment Lien Work Our Succinct Guide To Judicial Liens On Real Estate Deeds Com

How Does A Judgment Lien Work Our Succinct Guide To Judicial Liens On Real Estate Deeds Com

Tax Lien Help County Tax Liens Irs Liens Irs Tax Liens Property Liens Property Tax Liens Tax Li Payday Loans Fha Loans Debt Relief Programs

Tax Lien Help County Tax Liens Irs Liens Irs Tax Liens Property Liens Property Tax Liens Tax Li Payday Loans Fha Loans Debt Relief Programs

Https Saclaw Org Wp Content Uploads Sbs Petition For Release Of Mechanics Lien Pdf

3 Major Credit Bureaus Will Remove Most Tax Liens And Civil Judgments Credit Repair Credit Bureaus How To Remove

3 Major Credit Bureaus Will Remove Most Tax Liens And Civil Judgments Credit Repair Credit Bureaus How To Remove

The Big Change With The Removal Of Tax Liens And Judgments Continental Credit Credit Score Credit Repair Business Credit Repair

The Big Change With The Removal Of Tax Liens And Judgments Continental Credit Credit Score Credit Repair Business Credit Repair

Another Tax Lien Redemption Tax Lien Investing Tips Investing Tax Real Estate Investing

Another Tax Lien Redemption Tax Lien Investing Tips Investing Tax Real Estate Investing

Keeping Up With Your Tax Lien Certificates Certificate Intense How To Get

Keeping Up With Your Tax Lien Certificates Certificate Intense How To Get

Pin By Carla Bobbitt On Fixing Credit Score Credit Repair Business Credit Repair Letters Credit Repair Services

Pin By Carla Bobbitt On Fixing Credit Score Credit Repair Business Credit Repair Letters Credit Repair Services

What Is A Judgment Lien Millionacres

What Is A Judgment Lien Millionacres

Avoiding A Judgment Lien Removing A Judicial Lien

Avoiding A Judgment Lien Removing A Judicial Lien