Kentucky Property Tax Exemption For Disabled

This tax break is a property tax exemption of up to 37600 at the time of this writing for primary residences. Disabled veterans are eligible for the same homestead tax break that Kentucky residents aged 65 and older or who are declared as totally disabled as determined by a government agency in-state get.

Disabled Veterans Property Tax Exemptions By State Military Benefits

Disabled Veterans Property Tax Exemptions By State Military Benefits

Disabled veterans are also eligible for this exemption.

Kentucky property tax exemption for disabled. Kentucky does not tax active duty military pay. Colorado exempts 50 of the first 200000 of the actual value of your home for seniors and disabled veterans. Totally disabled veterans are eligible for up to a 37600 deduction on the assessed value of their home for property tax purposes.

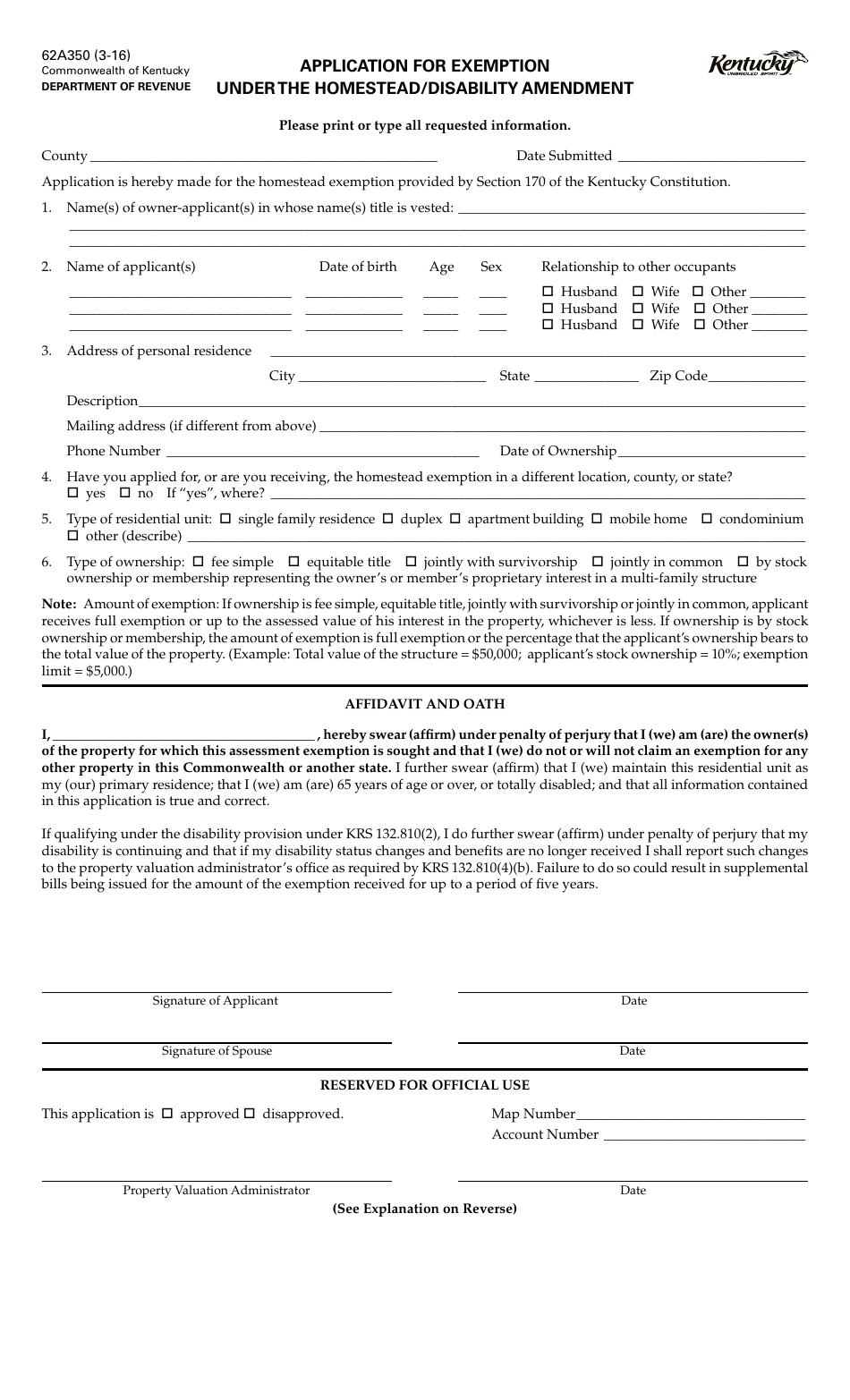

Kentucky Property Tax Exemption for Senior Citizens and the Disabled. This exemption is applied against the assessed value of their home and their property tax liability is computed on the assessment remaining after deducting the exemption amount. Kentucky Property Tax Exemption for 100 Disabled Veterans.

Kentucky Property Tax Exemptions. The exemption amount typically saves you between 400-500 dollars unless your tax bill is for less than that amount. Institute on Taxation and Economic Policy.

Provides information about military tax issues including military pay income tax exemption military spouses residency relief act military retirement and military filing extensions in Kentucky. According to Section 170 of the Kentucky Constitution real property owned and occupied by and personal property owned by institutions of religion are exempt from taxation. An application for the homestead exemption is available here.

Kentucky offers a homestead tax exemption for veterans with 100 service-connected disabilities as rated by the Department of Veterans Affairs. Be 65 years or older. How Property Taxes Work Accessed Aug.

Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined to be totally disabled and are receiving payments pursuant to their disability. To qualify for the Homestead Exemption a property owner must. There are age income and residency restrictions so its smart to read the fine print.

Application Procedure- It is easy to apply. Many states offer property tax exemptions to older homeowners and the disabled. And maintain the subject property as a taxable interest as of January 1 during the tax year for which the exemption is sought in accordance with KRS 1322201.

Property Tax Exemptions for Seniors and People With Disabilities Accessed Aug. The homestead exemption provides for a reduction in the net taxable value of the owners personal residence. Once approved for the Homestead Exemption you are not required to reapply annually.

During the 2020 tax year the exemption provided state and local property tax savings of approximately 248 million for more than 460000 elderly or disabled Kentuckians. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system. Kentucky residents are eligible for a 20 tax credit if the taxpayer is a National Guard member at the end of the calendar year.

In Kentucky homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption. Homeowners 65 and older or totally disabled as determined by a government agency in Kentucky may. Property Tax ExemptionSenior CitizensDisabled Persons Accessed Aug.

Own and Occupy the property as your primary residence prior to January 1st. And The exemption for 2017 is 37600. Kentucky law requires that every person who receives the disability exemption must reapply each year with the Property Valuation Administrator.

Various sections will be devoted to major topics such as. NONPROFIT RELIGIOUS EXEMPTIONS APPLICATIONS. Any property assessed for more than 37600 would require the property owner pay tax on the difference.

Kentucky State Tax Credit for National Guard Members. Only one exemption Homestead or Disability is allowed per household. Kentucky Veterans Preference for State Jobs Veterans with an.

The assessment of property setting property tax rates and the billing and. Find out more about the homestead exemption. In Kentucky all real property is assessed by a locally elected official known as a property valuation administrator PVA.

What does homestead exemption mean. Clark County Washington Assessor. The taxpayer must be receiving disability payments pursuant to that disability classification.

Kentucky offers homestead exemptions for homeowners who are totally disabled as determined by a government agency or retirement system.

Ky Dept Of Revenue Form 62a350 Fill Online Printable Fillable Blank Pdffiller

Ky Dept Of Revenue Form 62a350 Fill Online Printable Fillable Blank Pdffiller

Pin On Mortgage Tips Closing Costs Link

Pin On Mortgage Tips Closing Costs Link

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Https Www Peweevalleyky Org Uploads 1 5 8 9 15892188 Pva Exemptions Pdf

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Disabled Veterans Property Tax Exemptions By State Hadit Com For Veterans Who Ve Had It With The Va

Removing Pmi On Conventional Loans Nc Mortgage Experts Conventional Loan Mortgage Lenders Mortgage Loans

Removing Pmi On Conventional Loans Nc Mortgage Experts Conventional Loan Mortgage Lenders Mortgage Loans

Http Revenue Ky Gov Pvanetwork Documents Homesteadexemptionmanual2015 Pdf

Social Security And Va Veterans Disability Benefits What You Need To Know Disability Benefit Veterans Benefits Va Disability Benefits

Social Security And Va Veterans Disability Benefits What You Need To Know Disability Benefit Veterans Benefits Va Disability Benefits

Http Www Qpublic Net Ky Bullitt Docs 62a350homesteadapplication Pdf

Form 62a350 Download Fillable Pdf Or Fill Online Application For Exemption Under The Homestead Disability Amendment Kentucky Templateroller

Form 62a350 Download Fillable Pdf Or Fill Online Application For Exemption Under The Homestead Disability Amendment Kentucky Templateroller

Https Www Titleadvantage Com Mdocs Homeowners 20prop 20tax 20exemption 20all Pdf

Veteran Tax Exemptions By State

Veteran Tax Exemptions By State

Veteran Disability Exemptions By State Va Hlc

Veteran Disability Exemptions By State Va Hlc

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

How To Make Sense Of The Va Certificate Of Eligibility Coe Certificate Of Eligibility Same Day Loans Military Wife Life

How To Make Sense Of The Va Certificate Of Eligibility Coe Certificate Of Eligibility Same Day Loans Military Wife Life

Space A Locations What You Need To Know Before You Fly Poppin Smoke Military Discounts Family Adventure Travel Military Hops

Space A Locations What You Need To Know Before You Fly Poppin Smoke Military Discounts Family Adventure Travel Military Hops