Lorain County Ohio Property Tax Calculator

Yearly median tax in Lorain County The median property tax in Lorain County Ohio is 1991 per year for a home worth the median value of 147400. Lorain County 226 Middle Ave.

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

While the countys average effective property tax rate of 169 ranks as the 10th-highest in the state it is still well below the rate in neighboring Cuyahoga County 244.

Lorain county ohio property tax calculator. Estimate the net proceeds at closing. Calculate the Ohio title insurance rate estimate the OH transfer tax known as the Ohio conveyance fee. The sales and use tax rate for Portage County will be decreasing from 725 to 700 effective January 1 2021.

Located on Lake Erie in northern Ohio Lorain County is part of the greater Cleveland metropolitan area. 2020 Dog Licenses are available for purchase. 4th Street Lorain OH 44052 Phone.

Get to know the real possibility of AARP in Lorain. Find local Lorain OH AARP programs and information. Mission Statement To administrate and collect taxes on behalf of the City of Lorain as directed by the city ordinance efficiently and accurately.

Title insurance rates are REGULATED by the State of Ohio therefore. Estimate Property Tax Our Lorain County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. This calculator will estimate the Ohio title insurance premium Ohio conveyance fee transfer tax and seller assist cost if applicable.

Easily estimate the Ohio home seller closing costs and seller net with this home sale calculator. The Lorain County Sales Tax is collected by the merchant on all qualifying sales made within Lorain County. How 2021 Sales taxes are calculated in Lorain.

Groceries are exempt from the Lorain County and Ohio state sales taxes. Lorain County Real Estate Property Records Access. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

There are 5 Treasurer Tax Collector Offices in Lorain County Ohio serving a population of 305405 people in an area of 491 square milesThere is 1 Treasurer Tax Collector Office per 61081 people and 1 Treasurer Tax Collector Office per 98 square miles. Elyria Ohio 44035 Ph. Be sure to look up your county tax rate on the Ohio Department of Taxation website.

There is no city sale tax for Lorain. NOTICE TO TAXPAYERS OF FORTHCOMING PUBLICATION OF DELINQUENT TAX LIST. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States.

In Ohio Lorain County is ranked 58th of 88 counties in Treasurer Tax Collector Offices per capita and 2nd of 88 counties in. The Lorain County Ohio sales tax is 675 consisting of 575 Ohio state sales tax and 100 Lorain County local sales taxesThe local sales tax consists of a 100 county sales tax. Publication of Delinquent Tax List.

Property tax proration calculator Per diem interest calculator Tiered commission calculator Seller net calculator. The sales and use tax rate for Athens County will increase from 700 to 725 effective April 1 2021. City of Lorain Income Tax Department.

Ohio Title Insurance Rates Conveyance Fee Calculator. Lorain County Auditor Craig Snodgrass installed as Second Vice President of the County Auditors Associaton of Ohio. Click here to access the Lorain County Real Estate Records.

Simply multiply the sum of the figures from Steps 1 and 2 by your local tax rate. Youll have access to basic tax information property characteristics maps images and sketches. Lorain County Tax Abatement information is now available online.

The sales and use tax rate for Lorain County will decrease from 675 to 650 effective April 1 2021. The deadline to purchase without penalty is January 31 2021. NOTICE IS HEREBY GIVEN by the County Auditor of Lorain County Ohio as required by Section 572103 of the Revised Code of Ohio the Delinquent Land Tax List will be published in a newspaper of general circulation in Lorain County.

Monday - Friday 830 am to 400 pm. The exact property tax levied depends on the county in Ohio the property is located in. For example if you are purchasing a Ford Focus with a cash selling price of 18000 and a dealer documentation fee of 250 while living in Fulton county which has a 7 sales.

Delaware County collects the highest property tax in Ohio levying an average of 373200 148 of median home value yearly in property taxes while Monroe County has the lowest property tax in the state collecting an average tax of 69200 08 of. Ohio Seller Closing Costs Net Proceeds Calculator. 2021 1 st Quarter Rate Change.

The Lorain Ohio general sales tax rate is 575The sales tax rate is always 675 Every 2021 combined rates mentioned above are the results of Ohio state rate 575 the county rate 1. Lorain County collects on average 135 of a propertys assessed fair market value as property tax.

Lake County Ohio Treasurer Real Estate Taxes Due

Lake County Ohio Treasurer Real Estate Taxes Due

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

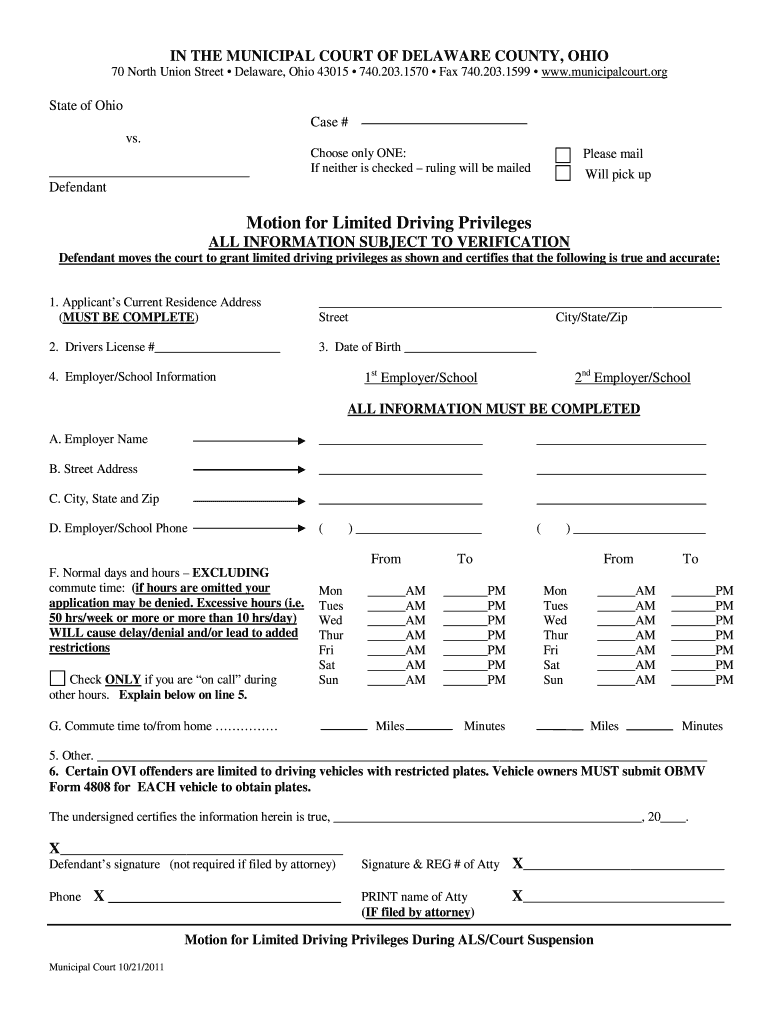

Driving Privileges Fill Out And Sign Printable Pdf Template Signnow

Driving Privileges Fill Out And Sign Printable Pdf Template Signnow

2020 Best Places To Buy A House In Lorain County Oh Niche

2020 Best Places To Buy A House In Lorain County Oh Niche

Medina County Auditor Announces Seal Design Contest Finalists Releases Weekly Financial Report Medina County Medina Contest Design

Medina County Auditor Announces Seal Design Contest Finalists Releases Weekly Financial Report Medina County Medina Contest Design

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Https Www Loraincounty Com Auditor Cms Files File 2020 2019 Cafr Pdf

Https Www Loraincounty Com Auditor Cms Files File 2018 Lorain County Cafr 2017 Pdf

Find Property Tax Rates For Greater Cleveland And Akron Communities Cleveland Com

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Medina County Habitat For Humanity Marks 25 Years The Medina County Gazette Medina County Habitat For Humanity Medina

Medina County Habitat For Humanity Marks 25 Years The Medina County Gazette Medina County Habitat For Humanity Medina

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Garfield Heights Now Has Top Rate In Northeast Ohio Cleveland Com

Resort History Silver Mountain Idaho Vacation Resort Resort Area

Resort History Silver Mountain Idaho Vacation Resort Resort Area

Elyria S Proposed Loan Program On Hold Lorain County Lorain County Proposal Loan

Elyria S Proposed Loan Program On Hold Lorain County Lorain County Proposal Loan

Tools Resources Revere Title Agency

Lorain County Property Values Up Some Taxes Too Auditor Says Lorain County Morningjournal Com

Lorain County Property Values Up Some Taxes Too Auditor Says Lorain County Morningjournal Com

Cuyahoga County Tax Maps Page 1 Line 17qq Com

Cuyahoga County Tax Maps Page 1 Line 17qq Com

.jpg)