Property Held Under Trust Meaning

Assets Held in the Trustees Name. This means that the cost of the home to you and to your brother is the value of the home at or around the time your mom died.

Obsidian Uses And Metaphysical Properties Crystals Healing Properties Meditation Crystals Crystal Healing Chart

Obsidian Uses And Metaphysical Properties Crystals Healing Properties Meditation Crystals Crystal Healing Chart

This can include money investments land or buildings.

Property held under trust meaning. It probably lists property that the settlor the person who set up the trust at least intended to transfer to the trust. The trustee is the person that owns or controls the asset while the beneficiaries of the trust are the person s for whom the asset eg. Premarital Property in a Trust Premarital property refers to assets owned by a spouse before the marriage.

Start with the trust document. A trust is an arrangement where property is held in trust by a trustee for the benefit of others the beneficiaries. Trust property refers to the assets placed into a trust which are controlled by the trustee on behalf of the trustors beneficiaries.

From a tax standpoint if this is a revocable trust the owner for tax purposes is the person who transferred assets into the trust. In your own name or in a trust which means the property is held in trust and you control the trust. The trustee will then hold that Trust property for the benefit of the beneficiaries.

People often assume that only advantages -- and no downsides -- come with placing their homes in a living trust. By inheriting the property even if it is held inside a trust it receives a stepped-up basis. From a pure legal standpoint trust property is owned by the trustee.

A trust allows a person or company to own assets on behalf of someone else or on behalf of a group of people. The beneficiary is usually the owner of the property or a person designated as the beneficiary by the owner of the property. A living trust is an alternative to a will and is set up in a similar fashion with legal documentation.

The trustee holds legal title to the property and the beneficiaries hold equitable title. If you sell the home shortly after her death you and your brother will pay no federal income taxes on the sale. A trustee may be either an individual or a corporation.

Trust property removes tax liability on the assets from the. Real Estate Placed in a Living Trust. If the asset is community property then technically each spouse owns half the property and each spouse owns half the asset for trust purposes.

It may sound complicated but this form of control has advantages. Advantages Disadvantages of Putting a House in a Trust. This arrangement is widely used as a tool to disguise owner names to help with estate planning or to allow a group of people to invest in a property without getting taxed differently.

With some exceptions premarital property is generally not subject to division in a divorce even if it is placed in a trust meaning a spouse would have no rights to it. Under these rules the individual who creates a grantor trust is recognized as the owner of the assets and property held within the trust for income and estate tax purposes. Some advantages include.

Generally a trust is a legal relationship that is set up whereby one person holds the legal title to the property the trustee and another has the benefit of the use enjoyment and income from. A trust is a legal document outlining how youd like putting property in a trust and other assets distributed after you die. A trust is an arrangement in which one person holds the property of another for the benefit of a third party called the beneficiary.

Only property that was legally transferred to the living trust before the deceased persons death can pass under the terms of the trust. Ie the title to trust property is split between the trustee and the beneficiaries. It is growing more common for property owners to place all property of real value in a living trust instead of writing a will mostly due to the simplicity of administering a living trust as well as its significant tax advantages.

If you are the sole owner of a piece of property you can include that property in your living trust. A trust is a legal vehicle used to pass assets in which trustees hold title to the property for the benefit of one or more beneficiaries. You will need to change the propertys title to reflect the ownership change.

A trust is created by a settlor who transfers some or all of their property to a trustee. First the creation of a trust involves the bifurcation of rights to the trust property. A property is owned.

There are two ways to hold property. A fiduciary relationship with respect to property subjecting the person by whom the title to the property is held to equitable duties to deal with the property for the benefit of another person which arises as a result of a manifestation of an intention to create it. If real property is transferred into a trust there are several additional issues to consider including the following.

3017701-4a defines a trust as.

Should You Hold Your Properties In A Trust Smart Property Investment

Should You Hold Your Properties In A Trust Smart Property Investment

Iolite Meaning And Properties Crystals Healing Properties Energy Crystals Spiritual Crystals

Iolite Meaning And Properties Crystals Healing Properties Energy Crystals Spiritual Crystals

Advantages And Disadvantages Of Family Trusts Ioof

Advantages And Disadvantages Of Family Trusts Ioof

Investment Trust Personal Assets Goes About Its Work Slightly Differently To Most Funds Its Main Objective Is To Preserve The Real Va Investing Trust Person

Investment Trust Personal Assets Goes About Its Work Slightly Differently To Most Funds Its Main Objective Is To Preserve The Real Va Investing Trust Person

What Is A Self Directed Ira Kingdom Trust Alternative Assets In 2020 Ira Investing For Retirement Safe Investments

What Is A Self Directed Ira Kingdom Trust Alternative Assets In 2020 Ira Investing For Retirement Safe Investments

What Is A Discretionary Trust Advantages And Disadvantages Infographic Http Www Assetprotectionpackage C Budgeting Money Estate Planning Financial Tips

What Is A Discretionary Trust Advantages And Disadvantages Infographic Http Www Assetprotectionpackage C Budgeting Money Estate Planning Financial Tips

Rose Quartz Meaning And Properties Rose Quartz Healing Rose Quartz Meaning Spiritual Crystals

Rose Quartz Meaning And Properties Rose Quartz Healing Rose Quartz Meaning Spiritual Crystals

Can A Spouse Take Ownership Of A Property In A Trust In A Divorce Legalzoom Com

Can A Spouse Take Ownership Of A Property In A Trust In A Divorce Legalzoom Com

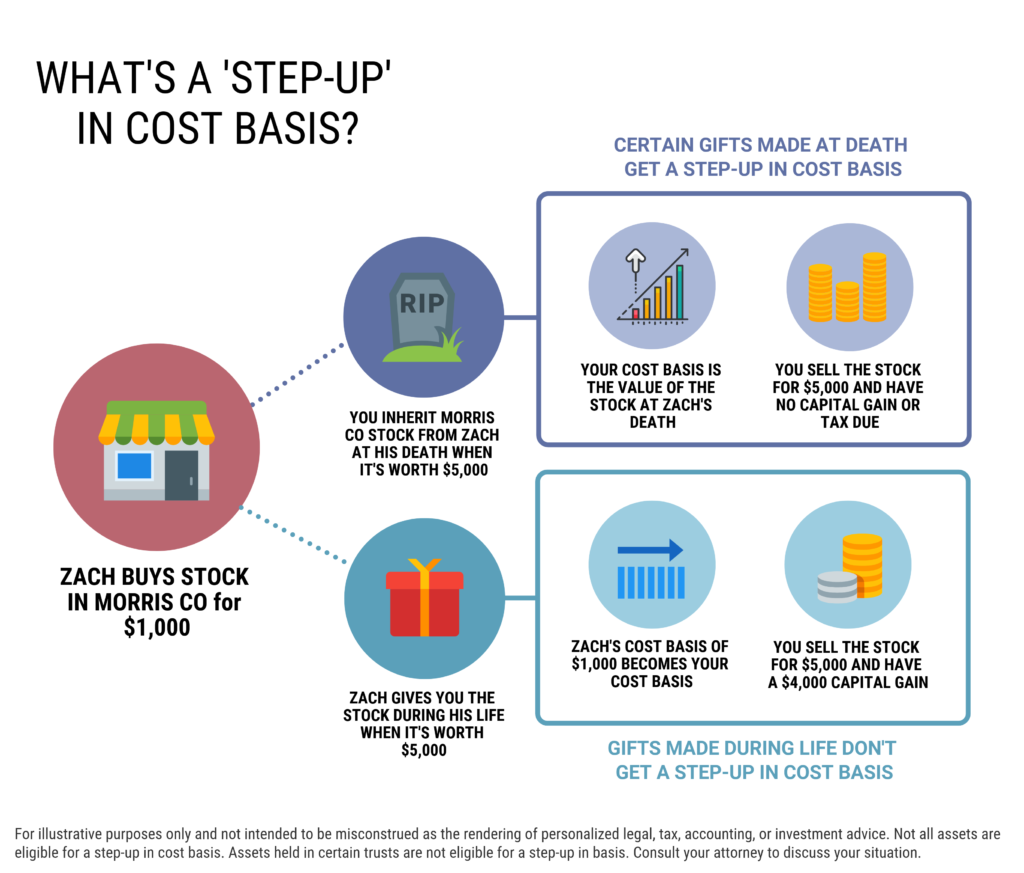

What Is A Step Up In Basis Cost Basis Of Inherited Assets

What Is A Step Up In Basis Cost Basis Of Inherited Assets

Here S Why You Would Put Your House In A Trust Clever Real Estate

Here S Why You Would Put Your House In A Trust Clever Real Estate

Larimar Meaning And Properties Gemstone Healing Crystal Healing Stones Energy Crystals

Larimar Meaning And Properties Gemstone Healing Crystal Healing Stones Energy Crystals

Should I Buy Property Using A Family Trust Your Mortgage Australia

Should I Buy Property Using A Family Trust Your Mortgage Australia

Deed Of Trust A Type Of Loan Available To Land Buyers Where The Title To A Property Is Held In Trust Until The Loan Types Of Loans The Borrowers

Deed Of Trust A Type Of Loan Available To Land Buyers Where The Title To A Property Is Held In Trust Until The Loan Types Of Loans The Borrowers

Printable Crystal Meaning Cards Gemstone Properties Gem Healing Spiritual Crystals

Printable Crystal Meaning Cards Gemstone Properties Gem Healing Spiritual Crystals

Pros And Cons Of Putting Property In A Trust Halt Org

Pros And Cons Of Putting Property In A Trust Halt Org

:max_bytes(150000):strip_icc()/GettyImages-709133131-efc8da9f5cd649c8a699c6102f163d4d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)