Property Plant And Equipment Are Measured At Cost Less

Assets which have life less than a year cannot be classified in this class. Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash.

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Compensation from the third party for PPE impairment shall be included in PL when compensation is receivable.

:max_bytes(150000):strip_icc()/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg)

Property plant and equipment are measured at cost less. Note that idle facilities and land held for speculation are more. Measured at cost 2. Purchases of PPE are a signal that management has faith in the long.

All plant and equipment is measured at historical cost less depreciation and impairment. By using our services you agree to our use of cookies. Property plant and equipment Freehold land is measured at cost.

The assets in property plant and equipment are initially recognized at cost. Property Plant and Equipment Initial measurement of property plant and equipment 1. Revaluation Model Fair value at the date of revaluation less any subsequent accumulated depreciation and any subsequent accumulated impairment losses.

Property plant and equipment are measured at cost less depreciation and impairment over their useful lives Cookies help us deliver our services. An item of property plant or equipment shall not be carried at more than recoverable amount. Aus151 Notwithstanding paragraph 15 not-for-profit entities shall initially measure the cost of an item of property plant and equipment at fair value in accordance with AASB 13 Fair Value Measurement where the consideration for the asset is significantly less than fair value principally to enable the entity to further its objectives.

Recoverable amount is higher of an assets fair value reduced by its selling cost and its utility. The cost may include purchase price import duties and nonrefundable purchase taxes. The cost of the asset is measured at the cash prize equivalent at the date of acquisition.

Under the IFRS revaluation method an item of property plant and equipment should be carried at fair value at the date of revaluation less any. Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash. Property plant and equipment should not be valued higher than its the recoverable amount.

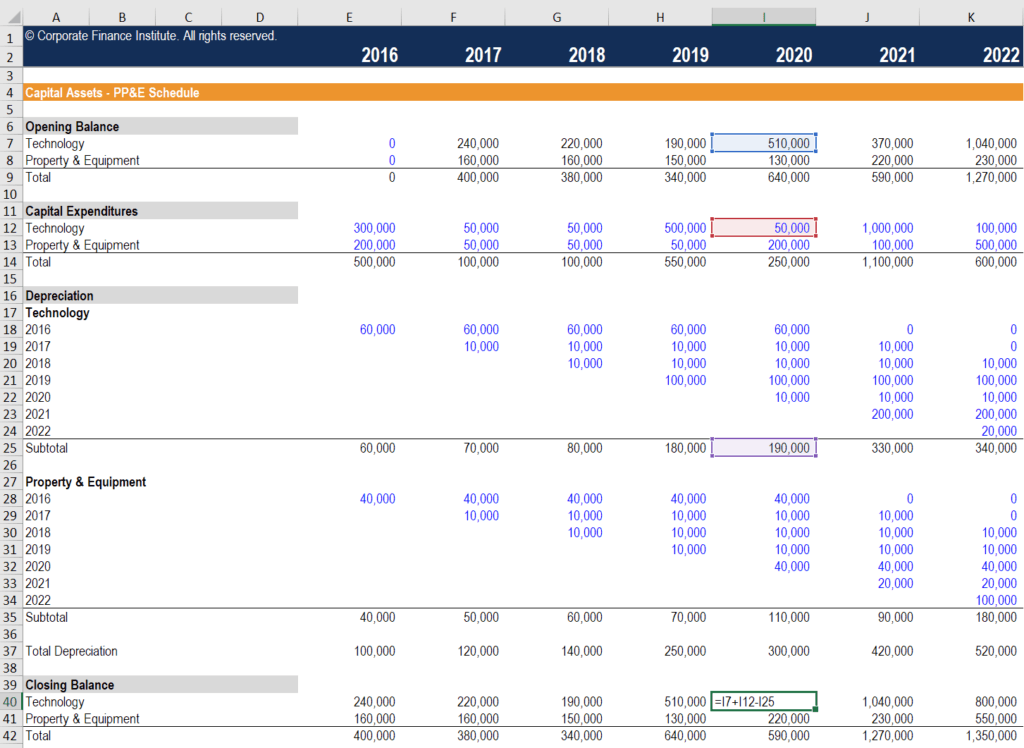

Cost includes A A all costs necessary to make the asset ready for intended use 3. Of property plant and equipment. Depreciation applies to three classes of plant assets.

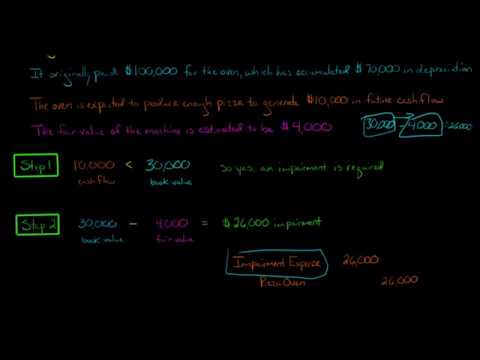

The depreciable amount of an item of property plant and equipment for the purposes of depreciation is defined as its cost or other amount substituted for cost less its residual value. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. Purchases of PPE are a signal that management has faith in the long.

Recoverable amount is the higher of an assets fair value less costs to sell and its value in use. Under both ASPE requirements and the IFRS cost method an item of property plant and equipment should be carried at its cost less any accumulated depreciation and any accumulated impairment losses. Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life.

The cost of such an item of property plant and equipment is measured at fair value unless a the exchange transaction lacks commercial substance or b the fair value of neither the asset received nor the asset given up is reliably measurable. During the construction period-- certain interest costs are also capitalized Subsequent measurement of property plant and equipment 1. Thus when property plant or equipment is purchased through the issuance of a note the interest related to that note is expensed when incurred.

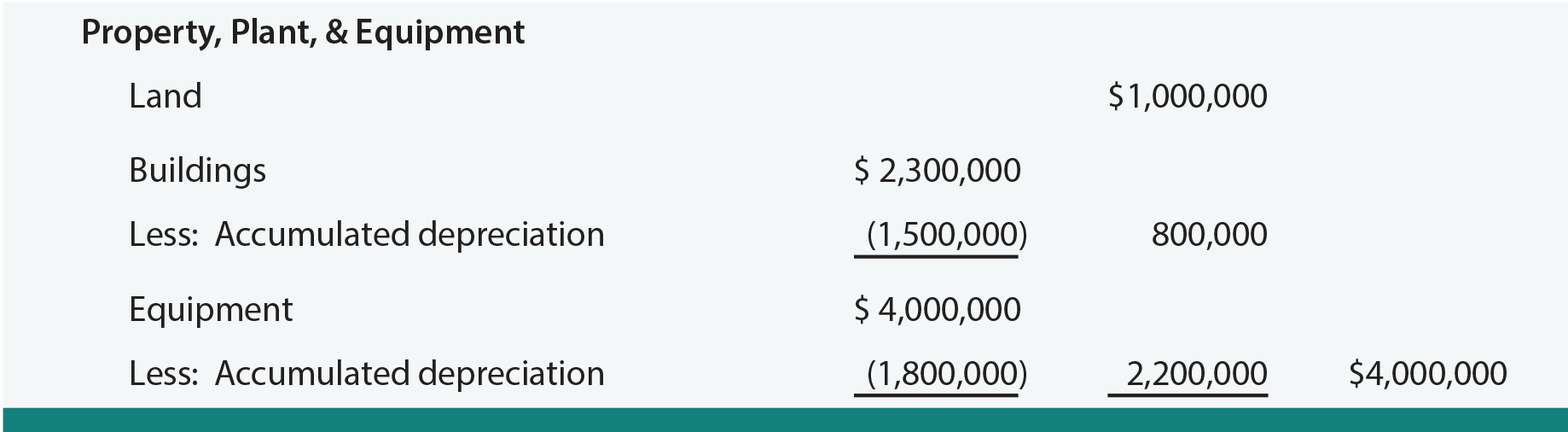

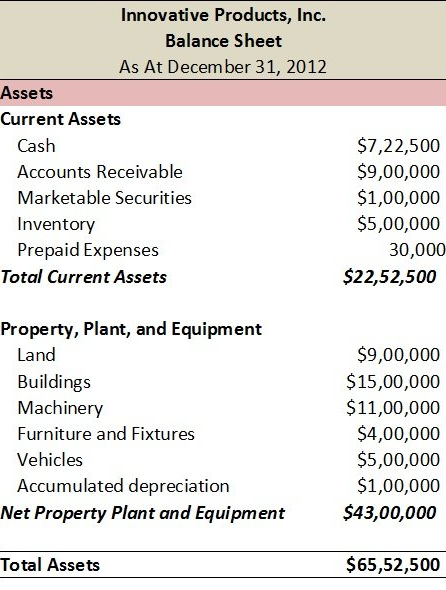

It typically follows Long-term Investments and is oftentimes referred to as PPE Items appropriately included in this section are the physical assets deployed in the productive operation of the business like land buildings and equipment. The basic principle of IAS 16 is that items of property plant and equipment that qualify for recognition should initially be measured at cost. Hotel resort properties are measured at historical cost less depreciation and impairment and all other property is measured at cost except investment properties which are measured at valuation.

Revaluations are to be made with sufficient regularity that the carrying amount. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment. In fact if an asset is fully depreciated it can have zero book value but still have a significant market value.

It is important to note that this type of investment property will only be measured in terms of s17 however the disclosure will made be made in accordance with s16 investment property. One of the easiest ways to remember this is that you should capitalise all costs to bring an asset to its present location and condition for its intended use. Cost Model Cost less any accumulated depreciation and any accumulated impairment losses.

However in 1979 the FASB issued Statement 34 which requires that in limited circumstances interest be capitalized and thus be included in the acquisition cost of certain noncurrent nonmonetary assets. Land improvements buildings and equipment. Initial cost Cost model Cost less accumulated depreciation and any accumulated impairment losses.

Thus the book valuecost less accumulated depreciationof a plant asset may differ significantly from its market value. Property Plant Equipment is a separate category on a classified balance sheet. Property plant and equipment.

Thus when an asset has been revalued the revalued amount instead of its cost will form the basis for calculating the depreciable amount.

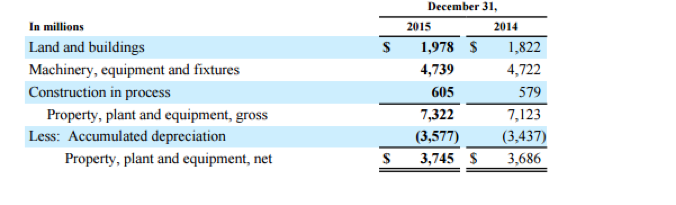

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

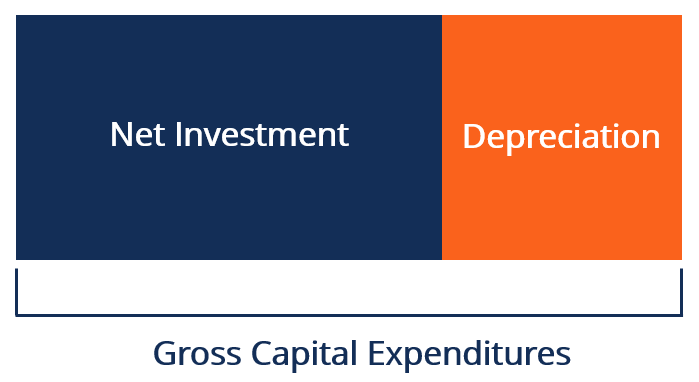

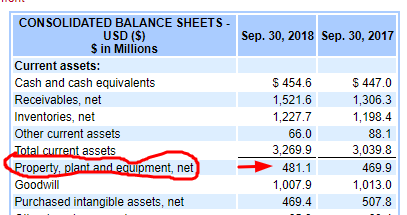

Net Investment Overview How To Calculate Analysis

Net Investment Overview How To Calculate Analysis

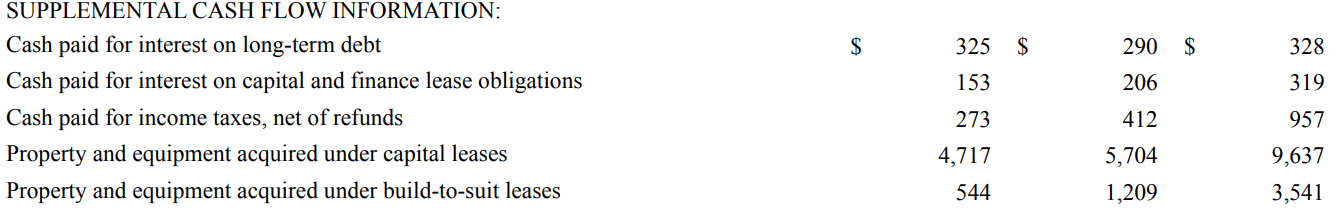

Financial Statements Examples Amazon Case Study

Financial Statements Examples Amazon Case Study

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

20 Property Plant And Equipment Theory Page 1 Of 7 Property Plant And Equipment Theory Related Standards 23 36 1 An Item Of Property Plant And Course Hero

20 Property Plant And Equipment Theory Page 1 Of 7 Property Plant And Equipment Theory Related Standards 23 36 1 An Item Of Property Plant And Course Hero

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

How Do You Calculate A Company S Equity

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

Components Of Asset Cost Boundless Accounting

Components Of Asset Cost Boundless Accounting

/GettyImages-1091470486-5b4ac16f07264b1a8b3738289324bfe5.jpg) Understanding Carrying Value Vs Fair Value

Understanding Carrying Value Vs Fair Value

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

The Quality Of Fair Value Measures For Property Plant And Equipment Sciencedirect

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg) Asset Turnover Ratio Definition

Asset Turnover Ratio Definition

As 10 Accounting Standard On Property Plant Equipment Quickbooks

As 10 Accounting Standard On Property Plant Equipment Quickbooks

Impairment Of Property Plant And Equipment Youtube

Impairment Of Property Plant And Equipment Youtube

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)