Property Plant And Equipment Gross Vs Net

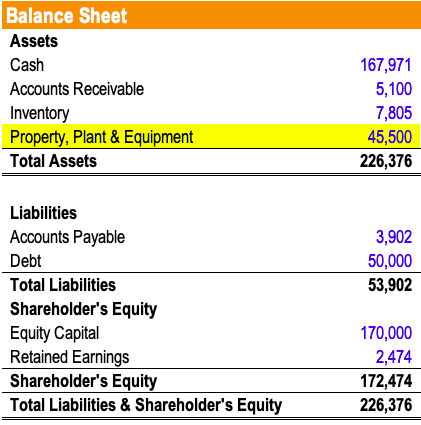

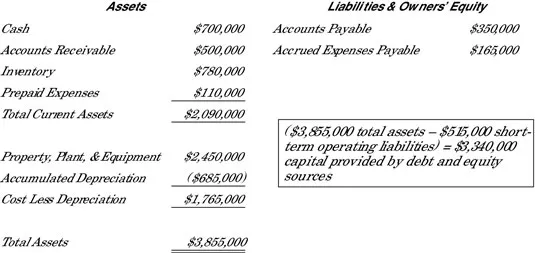

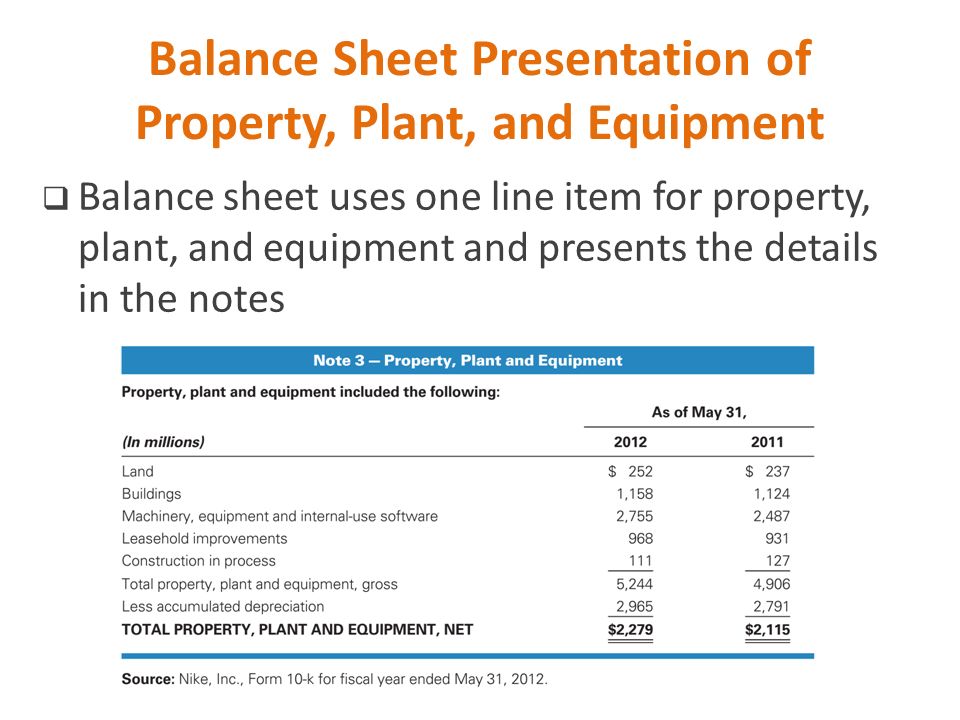

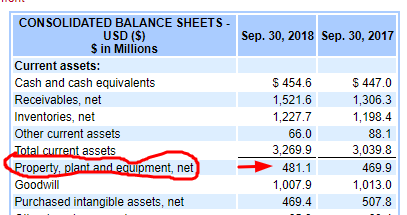

Property and equipment net Amount after accumulated depreciation depletion and amortization of physical assets used in the normal conduct of business to produce goods and services and not intended for resale. Net PPE 7 Million 10 Million 2 Million 5 Million Recognition of Property Plant and Equipment PPE The cost of PPE shall be recognized as an asset only if it is probable that future economic benefits will flow to the entity and the cost of it can be reliably measured.

How Do Intangible Assets Show On A Balance Sheet

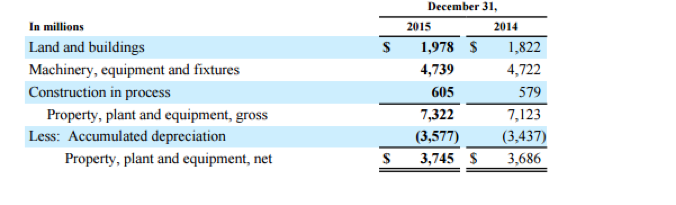

Target Corps property and equipment gross increased from 2018 to 2019 and from 2019 to 2020.

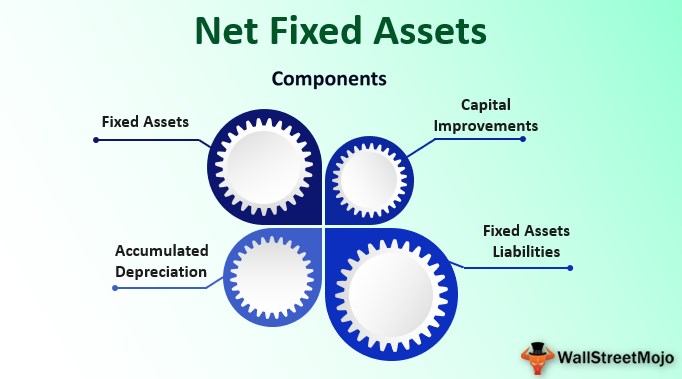

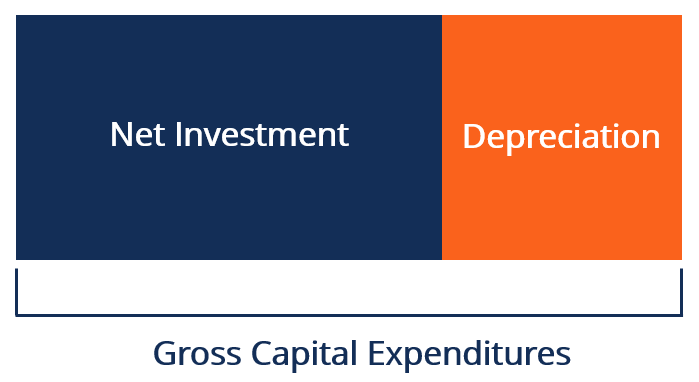

Property plant and equipment gross vs net. Property Plant and Equipment Gross Carrying amount at the balance sheet date for long-lived physical assets used in the normal conduct of business and not intended for resale. The net fixed assets include the amount of property plant and equipment PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. Net investment is the dollar amount spent by a business on capital assets or gross investment minus depreciation.

Kewaunee Scientifi Debt Non Current vs Property Plant and Equipment Net relationship and correlation analysis over time. This can include land physical structures machinery vehicles furniture computer equipment construction in progress and similar items. Property plant and equipment PPE are a companys physical or tangible long-term assets that typically have a life of more than one year.

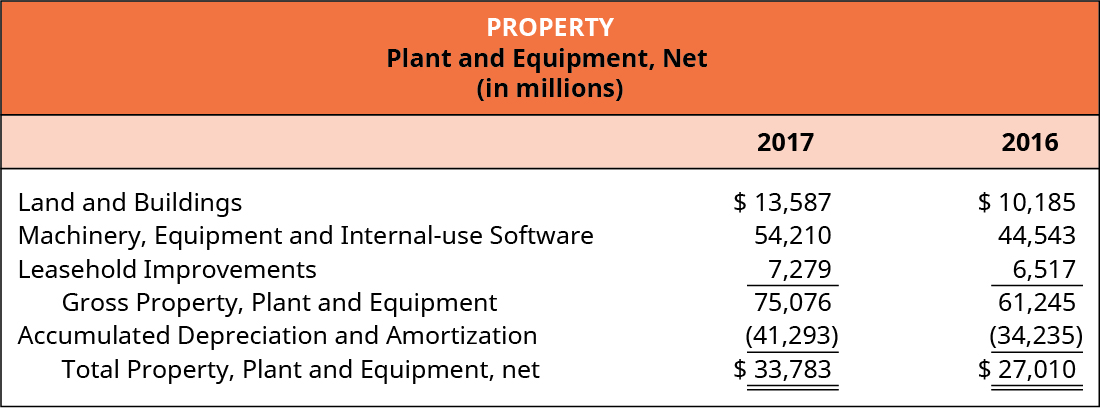

The term Net means that it is Net of accumulated depreciation expenses. The models Chapter 6 219 1. For example assume that a company buys a building worth 1000000 along with 50000 of furniture.

Property Plant and Equipment is the value of all buildings land furniture and other physical capital that a business has purchased to run its business. Fixed assets also known as long-lived assets tangible assets or property plant and equipment PPE is a term used in accounting for assets and property that cannot easily be converted into cash. Kewaunee Scientifi Total Debt vs Property Plant and Equipment Net relationship and correlation analysis over time.

These statements are key to both financial modeling and accounting of a business and is used to generate revenues and profits. Most of the time if you look at real balance sheets what you see is the net plant property and equipment which is the difference between original purchase cost gross minus accumulated depreciation. Net Sales Gross sales.

Since these accounts quite important what Im going to do is Im going to tell you now how does accounts change over a year. This ratio divides net sales by net fixed assets calculated over an annual period. Next subtract accumulated depreciation from the result.

The goal of the FY 2014 LTI Plan was for the average adjusted net operating loss for FY 2014 to FY 2016 divided by the average balances in the companys Gross Property Plant and Equipment account the primary account for capital investment over that same period to be no more than negative 19 percent. This chapter however deals with the two measurement models that IAS 16 allows you to apply. Purchases of PPE are a signal that management has faith in the long.

Gripping IFRS Property plant and equipment. Introduction This chapter is really a continuation of the last chapter in that both chapters relate to property plant and equipment and both are therefore governed by IAS 16. Examples of PPE include buildings machinery land.

Their Net PP. Citation needed This can be compared with current assets such as cash or bank accounts described as liquid assetsIn most cases only tangible assets are referred to as fixed. The average adjusted net operating loss for FY 2014 through FY 2016 was 2394 million and the average Gross Property Plant and Equipment balance was 192785 millionnegative 124 percent.

To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures. Namely property plant and equipment. Most of the time if you look at real balance sheets what you see is the net plant property and equipment which is the difference between original purchase cost gross minus accumulated depreciation.

The fixed asset turnover ratio measures how efficiently a company is generating net sales from its fixed-asset investments. Property Plant and Equipment PPE is a non-current tangible capital asset shown on the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash.

Kewaunee Scientifi Property Plant and Equipment Net vs Total Debt relationship and correlation analysis over time.

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg) Does Gross Profit Include Labor And Overhead

Does Gross Profit Include Labor And Overhead

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Property Plant And Equipment Net Financial Edge Training

Property Plant And Equipment Net Financial Edge Training

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Financial Statement Disclosures Cfa Level 1 Analystprep

Financial Statement Disclosures Cfa Level 1 Analystprep

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg) Cash Flow From Investing Activities

Cash Flow From Investing Activities

Operating Assets Property Plant And Equipment And Intangibles Ppt Video Online Download

Operating Assets Property Plant And Equipment And Intangibles Ppt Video Online Download

Net Fixed Assets Formula Examples How To Calculate

Net Fixed Assets Formula Examples How To Calculate

Net Investment Overview How To Calculate Analysis

Net Investment Overview How To Calculate Analysis

Solved Prepare A Cash Budget For The Month Of April Dete Chegg Com

Solved Prepare A Cash Budget For The Month Of April Dete Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

Distinguish Between Tangible And Intangible Assets Principles Of Accounting Volume 1 Financial Accounting

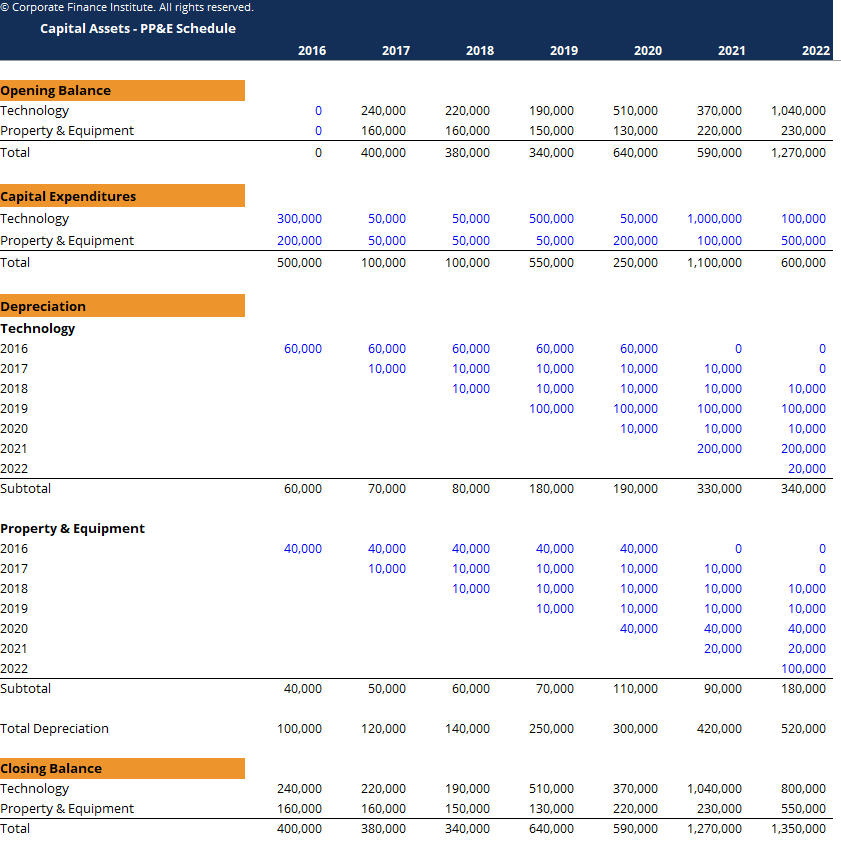

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)