Property Tax Calculator New Hampshire

The median property tax on a 24970000 house is 464442 in New Hampshire. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Merrimack County.

Understanding New Hampshire Taxes Free State Project

Understanding New Hampshire Taxes Free State Project

See how your monthly payment changes by making.

Property tax calculator new hampshire. Use this free New Hampshire Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. To use our New Hampshire Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Please refer to the New Hampshire website for more sales taxes information.

New Hampshire Unemployment Insurance. The median property tax on a 24970000 house is 262185 in the United States. Property tax bills are issued by the municipality where the property is located on either an annual semi-annual or quarterly basis.

2020 Taxes. New Hampshire Property Tax. After a few seconds you will be provided with a full breakdown of the tax you are paying.

The New Hampshire state sales tax of 0 is applicable statewide. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. For 2021 New Hampshire unemployment insurance rates range from 01 to 70 with a taxable wage base of up to 14000 per employee per.

The median property tax on a 24360000 house is 470148 in Merrimack County. The New Hampshires tax rate may change depending of the type of purchase. 0 is the smallest possible tax rate.

For a more specific estimate find the calculator for your county. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which your property is located and entering the approximate Fair Market Value of your property into the calculator. JavaScript must be enabled for some features to display properly.

This estimator is based on median property tax values in all of New Hampshires counties which can vary widely. New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset. New Hampshire does not have a mortgage excise or recordation tax.

Property tax rates vary widely across New Hampshire which can be confusing to house hunters. Enter your Assessed Property Value. The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NH property tax calculator. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. New Hampshires income tax is pretty simple with a flat rate of 5 and no local income taxes.

You can view the sales tax rates for various cities in New Hampshire here. Enter your Assessed Property Value in dollars - Example. Overview of New Hampshire Taxes.

Property tax is calculated based on your home value and the property tax rate. Calculates Federal FICA Medicare and withholding taxes for all 50 states. New Hampshire state rates for 2021.

When is the tax due. On average homeowners in New. Figuring Taxes New Hampshires tax year runs from April 1 through March 31.

Who do I contact with questions. Supports hourly salary income and multiple pay frequencies. These calculators should not be relied upon for accuracy such as to calculate exact taxes payroll or other.

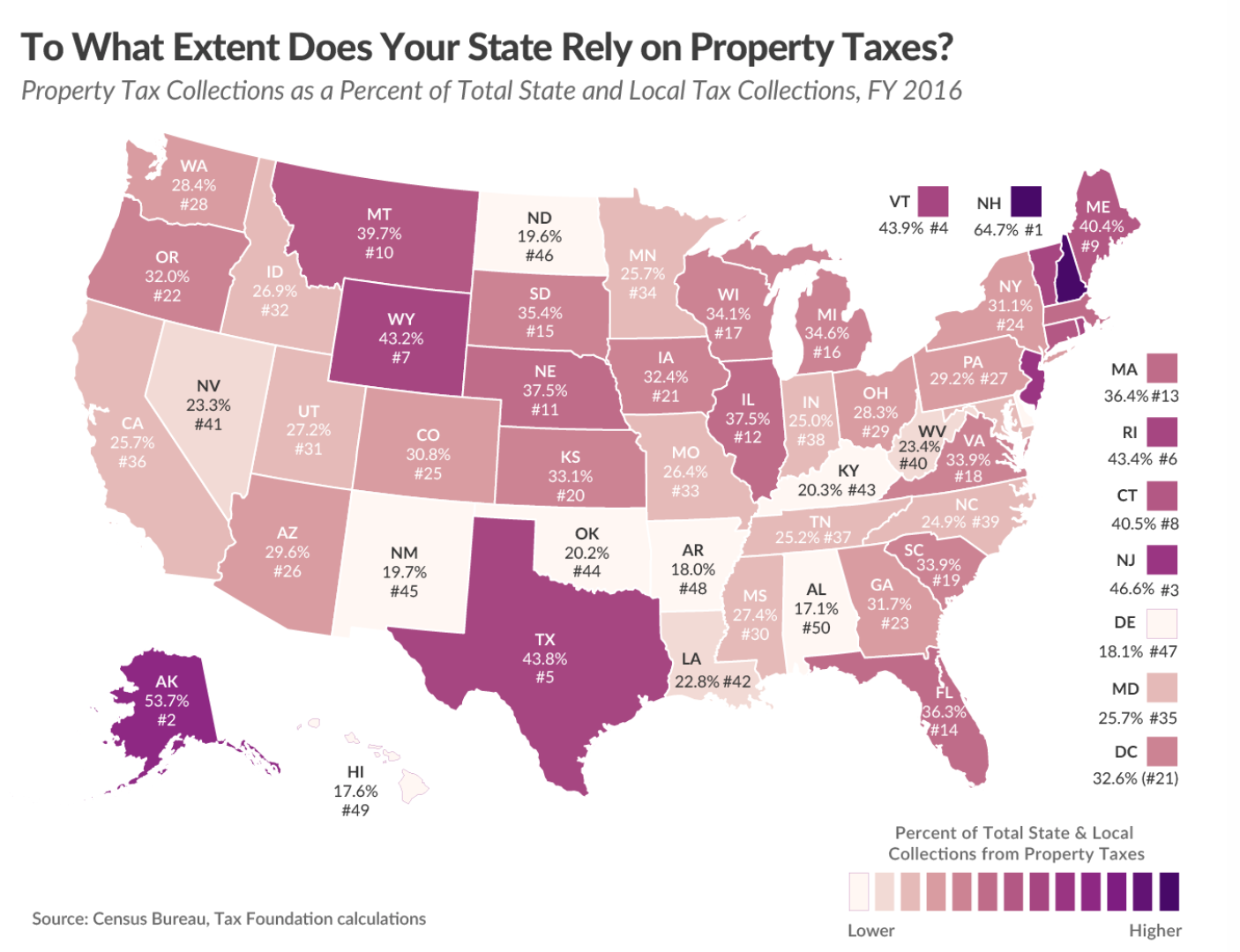

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The median property tax on a 24360000 house is 255780 in the United States. But while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US.

New Hampshire Local Sales Taxes New Hampshire does not allow local jurisdictions like cities or counties to collect a local sales tax. Does New Hampshire have a mortgage excise or recordation tax. Enter as a whole number without spaces dollar sign or comma.

Consequently the median annual property tax payment here is 5768. The result is the tax bill for the year. In Claremont for example the property tax rate is 41 per 1000 of assessed value while in Auburn its only around 21 per 1000 of assessed value.

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country.

Consumers use rental tax sales tax sellers use lodgings tax and more. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. Due dates vary based upon the issue date of the bill.

New Hampshire is known as a low-tax state. Some of the New Hampshire tax type are. The median property tax on a 24360000 house is 453096 in New Hampshire.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. As an employer youre responsible for paying unemployment insurance. Owners of New Hampshire property.

State with an average effective rate of 205. This free easy to use payroll calculator will calculate your take home pay. Withholding formsMore payroll resources.

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

New Hampshire Paycheck Calculator Smartasset

New Hampshire Paycheck Calculator Smartasset

States With The Highest And Lowest Property Taxes Property Tax States State Tax

States With The Highest And Lowest Property Taxes Property Tax States State Tax

What New Hampshire Has Business Taxes Appletree Business

What New Hampshire Has Business Taxes Appletree Business

Assessing Department Town Of Stratham Nh

Assessing Department Town Of Stratham Nh

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

To What Extent Does Your State Rely On Property Taxes Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

To What Extent Does Your State Rely On Property Taxes Gar Associates Ny Real Estate Appraisal And Market Analysis Firm

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Unh Extension

South Dakota Property Tax Calculator Smartasset

South Dakota Property Tax Calculator Smartasset

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Calculator Smartasset

Online Property Tax Calculator City Of Portsmouth

Online Property Tax Calculator City Of Portsmouth

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

What You Should Know About Moving To Nh From Ma

What You Should Know About Moving To Nh From Ma

Connecticut Property Tax Calculator Smartasset

Connecticut Property Tax Calculator Smartasset

Property Tax Information Town Of Exeter New Hampshire Official Website

Property Tax Information Town Of Exeter New Hampshire Official Website