Property Tax Number Lookup

Do you have questions about. Verify a sales tax exemption number E-number.

How To Obtain A Georgia State Tax Id Ehow Property Tax Last Will And Testament Tax

How To Obtain A Georgia State Tax Id Ehow Property Tax Last Will And Testament Tax

Review the tax balance chart to find the amount owed.

Property tax number lookup. Champaign County Property Tax Inquiry. Search Enter a name or address or account number etc. Enter the address or 9-digit OPA property number.

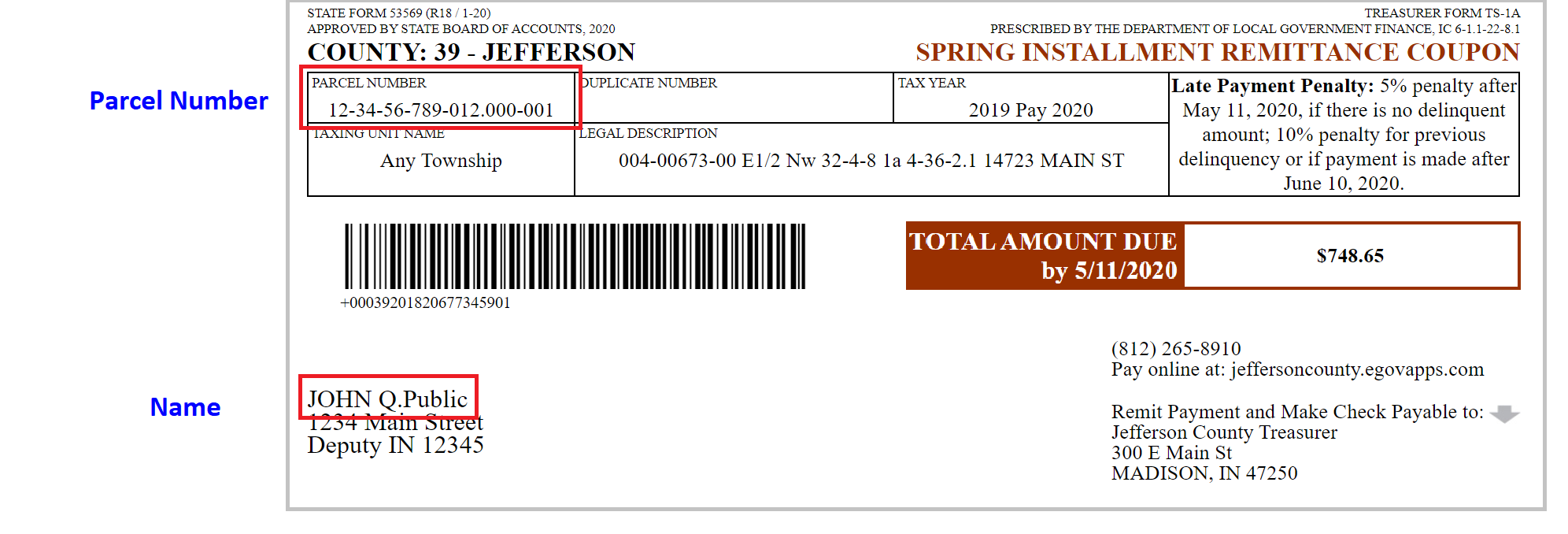

You may also get this number from your county assessors office. Enter Parcel Number with or without dashes Parcel Number. To find and pay property taxes.

By searching below you will be able to view current parcel information as well as historical information through 2003. This portal leads to the following information for a parcel. Information on this site was derived from data which was compiled by the Joliet Township Assessors office solely for the governmental purpose of property assessment.

118 North Clark Street Third Floor Room 320 Chicago IL 60602. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill. Tax bill information plus the ability to pay current year tax bill and print a duplicate tax bill.

This information should not be relied upon by anyone as a determination of ownership of property or market value. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill.

Enter PIN to see property details. Assessed value of your property. Click on the Township name below to find the townships assessor.

The best way to search is to enter your Parcel Number as it appears on your Tax Bill. Httpsassessorlacountygov 213 974-3211 Your actual tax rates. Please enter the information below for the current tax year to view and pay your bill.

Enter any of the following search criteria. Enter Parcel Number with or without dashes. Enter a name or address or account number etc.

Parcel Tax Details Inquiry Welcome to the Winnebago County Treasurers Parcel Tax Inquiry website. Enter 14 digit PIN. This portal has additional information about the four County departments involved in the property tax process providing answers for your property tax questions.

I agree to the terms conditions. Quick Links Production Related Tangible Personal Property Is Now Included within the Manufacturing Machinery and Equipment Exemption. Your Property Index Number PIN is printed on your tax bill your property closing documents and deed and notices from the Assessors office such as your assessment notice.

Once you have found the parcel that you are interested in use the drop down navigation in the Action field on the results screen to get started. Most functions on this website including paying your current taxes and filing an assessment complaint require you to first search for a parcel by parcel number owner name or property address. Pay for confidential accounts.

Billed Amounts Tax History Search to see a 5-year history of the original tax amounts billed for a PIN. If you are using the parcel number found on your tax bill or if you have a 16-digit parcel number in front of you match the number found in the 16-Digit Parcel Number column with the first two digits of your parcel number computer code. Choose options to pay find out about payment agreements or print a payment coupon.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. To begin they may enter their 14-digit Property Index Number PIN or property address. Or Owner Name as listed on tax bill Owner Name.

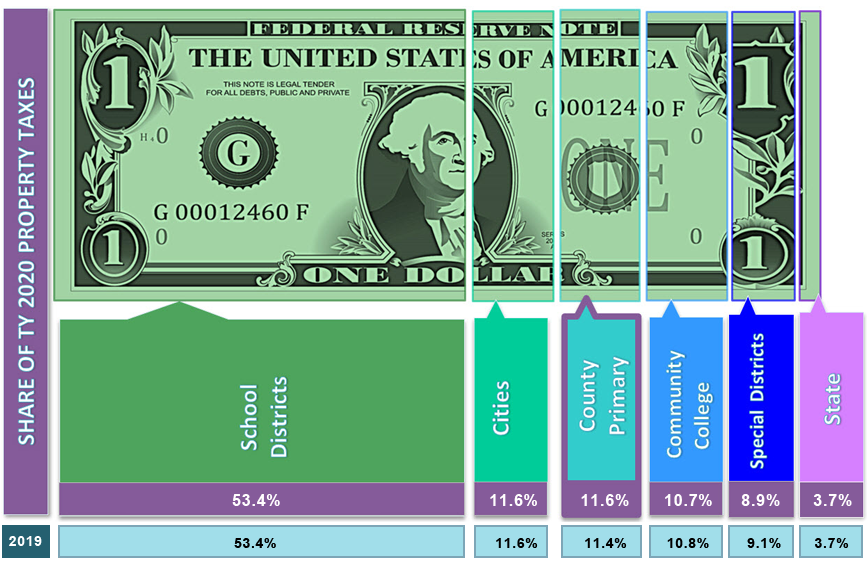

Tax distribution information - where do your tax dollars go. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return. Enter your search criteria into at least one of the following fields.

Certain property owners directly affected by COVID-19 may submit a Penalty Cancellation Request Form along with payment if they were unable to pay property taxes by the April 10 2020 December 10 2020 or April 12 2021 payment deadlines in accordance with the Governors Executive OrderTo qualify the property must be either. Includes links to the taxing bodies.

Search Unsecured Property Taxes

Search Unsecured Property Taxes

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Property Tax Credit Lookup Property Tax Tax Credits Tax

Property Tax Credit Lookup Property Tax Tax Credits Tax

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

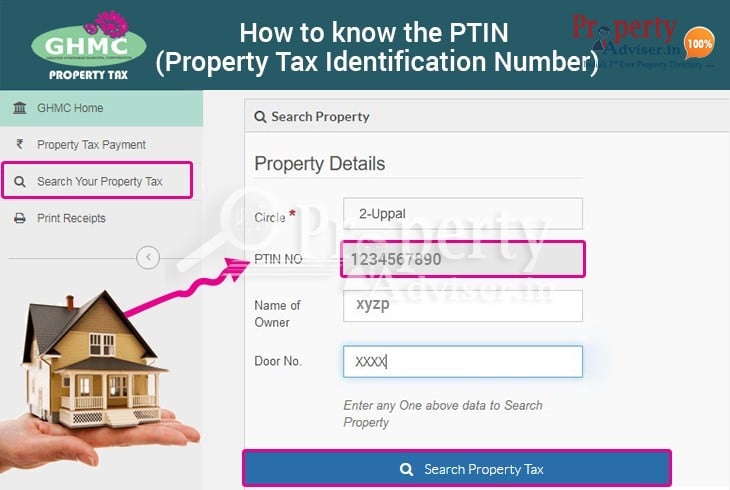

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Tax Tax Property

Easy Way To Know The Ptin Property Tax Identification Number In Hyderabad Property Tax Tax Property

Property Tax Information Lake County Il

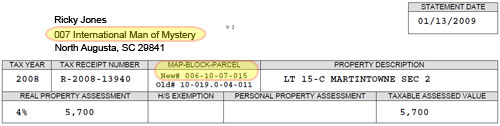

Property Tax Search North Augusta Sc

Property Tax Search North Augusta Sc

When Can Trust Money Be Paid Out Filing Taxes Tax Deductions Inheritance Tax

When Can Trust Money Be Paid Out Filing Taxes Tax Deductions Inheritance Tax

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Current Payment Status Lake County Il

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government