Do I Have To Pay Hazard Insurance On My Mortgage

Insurance covers you if your home is damaged but it also protects our interest in your property as your mortgage lender. During a mortgage refinance its usually normal for your new lender to become the first mortgagee on your homeonwers insurance policy before finalizing the refinance.

The Language Of Mortgage What You Should Know Mortgage Mortgage Process Mortgage Tips

The Language Of Mortgage What You Should Know Mortgage Mortgage Process Mortgage Tips

Still this does not mean that you should get rid of your homeowners insurance.

Do i have to pay hazard insurance on my mortgage. The law generally provides two ways to remove PMI from your home loan. Many homeowners have an escrow account set up by their mortgage lender to cover homeowners insurance and taxes. But what theyre referencing is the coverage provided in a standard homeowners insurance policy.

Fact About Homeowners Insurance. In case you start defaulting on your home loan your lender would use this insurance to feed the losses. As a homeowner you probably had to initially get your homeowners insurance policy as a requirement when you got your mortgage.

Hazard insurance is the part of your homeowners insurance that reimburses you for repairs or replacements if your home or its contents are damaged. Hazard insurance vs homeowners insurance. After an earthquake you still have your mortgage even if you no longer have your home.

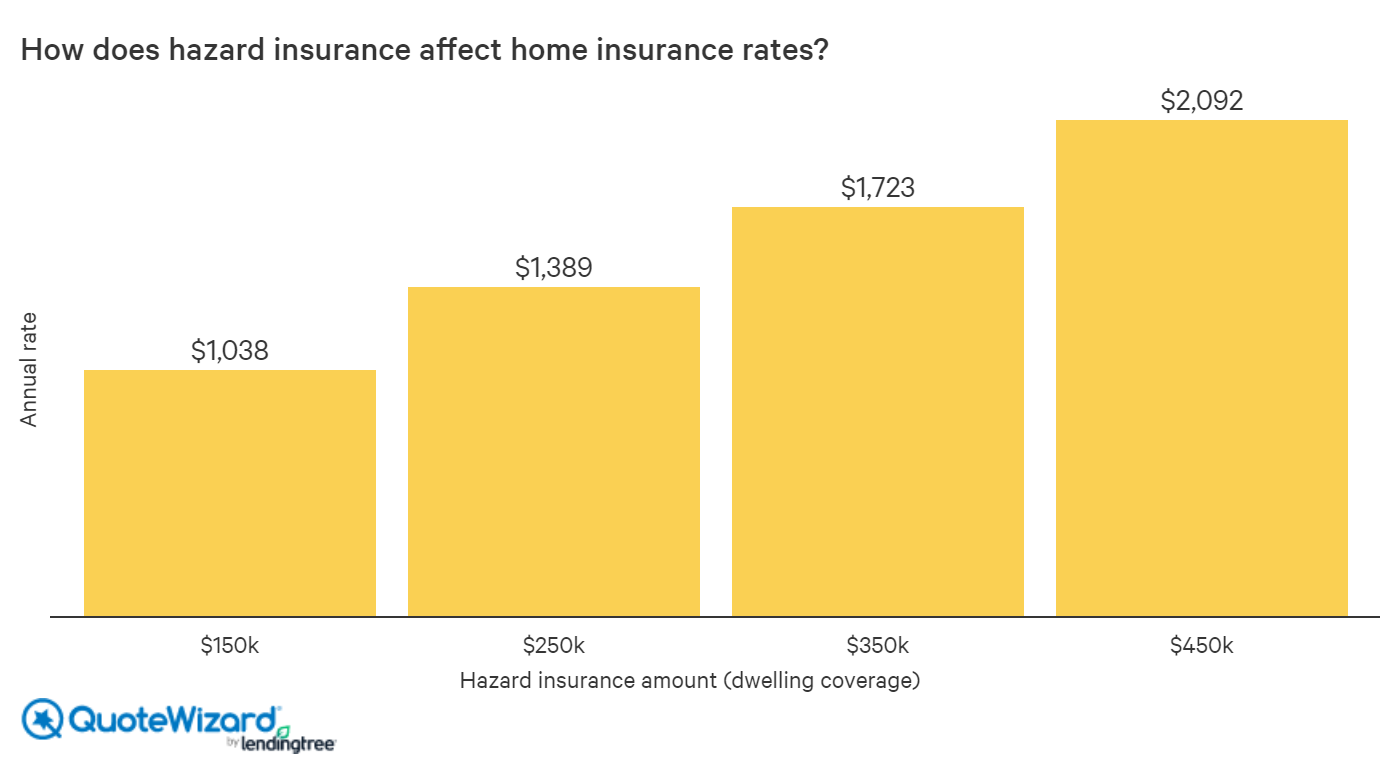

For example if like most people you take out a mortgage to buy a homeyour lender will require you to have a certain level of hazard insurance. Having homeowners insurance to cover you against hazards is not a legal requirement. If you are financing a home your lender will require you maintain hazard insurance and will usually escrow a portion of the annual policy premium from your total monthly payment.

However this doesnt mean you are completely free to decide whether you want to buy it or not. When filing a claim youll have to pay your policys deductible. If youve made a down payment of 20 percent or more you can usually choose whether or not you want to pay your insurance with your mortgage.

While you arent federally required to have it its important to keep your coverage since it protects you financially if your home incurs major damage or if someone is injured on your property. This is a convenient way to pay costs associated with your home but if youd rather. Hope that clarifies things a bit further for you Crossbreed.

This is because the lender had a lien on the home meaning that the lender could legally take ownership of the home through foreclosure if you failed to make your mortgage payments. Once your mortgage is paid off you no longer have a lender requiring you to have homeowners insurance. When you take out a mortgage the lender will require you to take out hazard insurance to protect their investment.

Plus youre required under the terms of your mortgage to have insurance until you pay off your loan. Prior to closing on a home loan your lender will require you to purchase hazard insurance to protect the property and your lenders investment from certain hazards. Remember you have an investment in your home.

Therefore you need to protect your own interest. Remember hazard insurance wont be an additional cost on top of homeowners insurance. Should a mortgage broker or a lender name themselves as the first mortgagee on a homeowners insurance policy without first completing the underwriting process appraisal and funding the loan.

Some mortgage lenders require homeowners to. Next to your insurance company your mortgage lender is your most important contact if your home is lost to fire. Those who decline to pay via escrow generally prefer to pay their insurance in one lump sum or have more control over when payments are made.

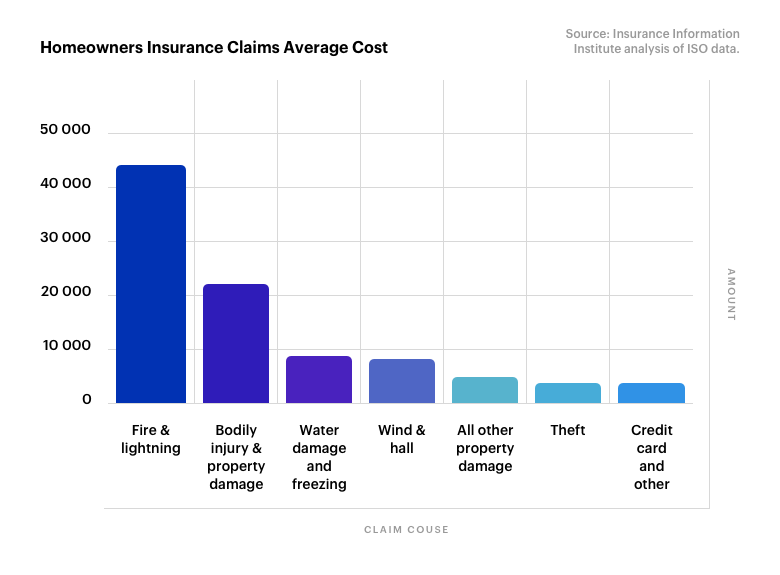

1 requesting PMI cancellation or 2 automatic or final PMI termination. And few homeowners carry earthquake insurance. When a covered hazard such as fire or theft prompts you to file a homeowners insurance claim you may have to pay a deductible which is the amount of money you have to pay out of pocket before your insurance company begins to help pay for a claimThe deductible for each coverage in your homeowners policy is stated in your policy declarations.

Your first year of coverage will be paid upfront at closing and then every year after that your lender will pay the insurance company. Thats because hazard insurance is one component of your standard homeowners policy. Your mortgage loan provider may require hazard insurance at minimum before they will issue you a loan because that is the only portion of the homeowners insurance policy directly related to the home structure itself.

Many lenders will incorporate the insurance payment into your monthly mortgage. The federal Homeowners Protection Act HPA provides rights to remove Private Mortgage Insurance PMI under certain circumstances. When you pay off your mortgage the requirement to have insurance likely goes away.

The deductible is the amount that you must. As you may pay for your home insurance upfront likewise you may have the choice to pay for it upfront or as a part of your monthly payments.

Homeowners Insurance The Truth About Mortgage

Homeowners Insurance The Truth About Mortgage

Home Business Insurance Coverage Endorsement Neither Home Occupation Vs B Business Insurance Homeowners Insurance Insurance Coverage

Home Business Insurance Coverage Endorsement Neither Home Occupation Vs B Business Insurance Homeowners Insurance Insurance Coverage

How Homeowner S Insurance Affects Your Mortgage Mortgage Tool Best Homeowners Insurance Home Insurance Home Insurance Quotes

How Homeowner S Insurance Affects Your Mortgage Mortgage Tool Best Homeowners Insurance Home Insurance Home Insurance Quotes

Mortgage Insurance Vs Hazard Insurance Video Hazard Insurance Mortgage Loans Mortgage

Mortgage Insurance Vs Hazard Insurance Video Hazard Insurance Mortgage Loans Mortgage

If You Re Working With A Lender To Buy A Home You Ve Probably Encountered The Term Hazard Insurance And Migh Hazard Insurance Homeowners Insurance Home Buying

If You Re Working With A Lender To Buy A Home You Ve Probably Encountered The Term Hazard Insurance And Migh Hazard Insurance Homeowners Insurance Home Buying

What Is Hazard Insurance In My Mortgage Payment

What Is Hazard Insurance In My Mortgage Payment

Hazard Insurance And How It S Related To Home Insurance Quotewizard

Hazard Insurance And How It S Related To Home Insurance Quotewizard

Understanding Your Home Insurance Declarations Page Policygenius

Understanding Your Home Insurance Declarations Page Policygenius

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

Eidl Loans Require Hazard Insurance Here S How To Get It Surfky Com

Mortgage Loan Real Estates Reverse Mortgage Mortgage Loans Mortgage

Mortgage Loan Real Estates Reverse Mortgage Mortgage Loans Mortgage

Hints On Filing Fire Insurance Claims Ehow Homeowners Insurance Hazard Insurance Mortgage Payment

Hints On Filing Fire Insurance Claims Ehow Homeowners Insurance Hazard Insurance Mortgage Payment

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

Pin By Best Sunday On Social Media Facebook In 2020 Hazard Insurance Flood Insurance Homeowners Insurance

Pin By Best Sunday On Social Media Facebook In 2020 Hazard Insurance Flood Insurance Homeowners Insurance

Pin By Security First Insurance On Homeowners Insurance Florida Homeowners Insurance Flood Flood Insurance

Pin By Security First Insurance On Homeowners Insurance Florida Homeowners Insurance Flood Flood Insurance

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

Is Hazard Insurance The Same As Homeowners Insurance Nationwide

Is Hazard Insurance The Same As Homeowners Insurance Nationwide

Learn More In The Video How To Absolutely Increase Every Opportunity You Have To Buy A Home Part 4 At Vimeo Co Homeowners Insurance College Budgeting Payback

Learn More In The Video How To Absolutely Increase Every Opportunity You Have To Buy A Home Part 4 At Vimeo Co Homeowners Insurance College Budgeting Payback

How Homeowner S Insurance Affects Your Mortgage Mortgage Tool Home Insurance Home Insurance Quotes Homeowners Insurance

How Homeowner S Insurance Affects Your Mortgage Mortgage Tool Home Insurance Home Insurance Quotes Homeowners Insurance

Hazard Insurance What Is It And Do You Need It Cover

Hazard Insurance What Is It And Do You Need It Cover