How To Calculate Property Tax Mill Rate

A good rule of thumb for California homebuyers who are trying to estimate what their property taxes will be is to multiply their homes purchase price by 125. 29 mills therefore is equal to 29 for every 1000 of assessed value or 29.

Dont forget that to multiply a percentage you must either first change the percentage back to its decimal form or else divide your answer by 100.

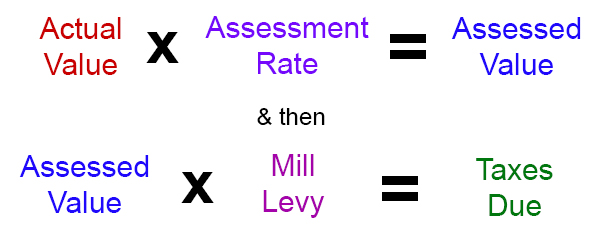

How to calculate property tax mill rate. Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4. So to convert millage rates to dollar rate amounts divide each mill rate by 1000. A mill is one one-thousandth of a dollar and in property tax terms is equal to 100 of tax for each 1000 of assessment.

The rate represents the amount a homeowner has to pay for every 1000 of a propertys assessed value. One mill equals one-tenth of one cent or 1 for every 1000 of a propertys value. The tax liability can also be calculated by multiplying the taxable value of the property by the mill rate and then dividing by 1000.

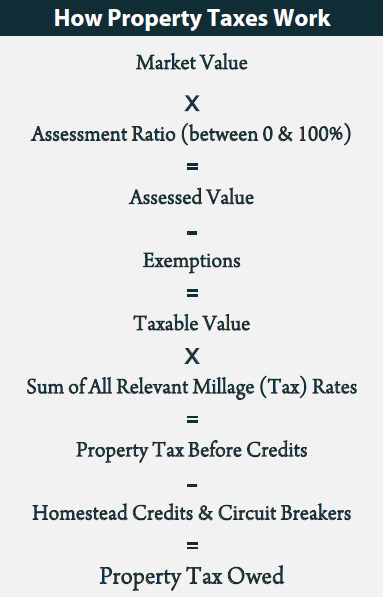

Assessing the value of your property is the first step in the process. To calculate the millage or mill rate a property owner divides the number of mills by 1000. Multiply by your property value.

Now heres where it gets confusing. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. Divide 5 mills by 1000 to get 0005.

For example say a local taxing authority has a mill rate of 15 on the assessed value of real property. Tax year Millage is found in the table below. The answer you get is the amount of money you owe in property tax.

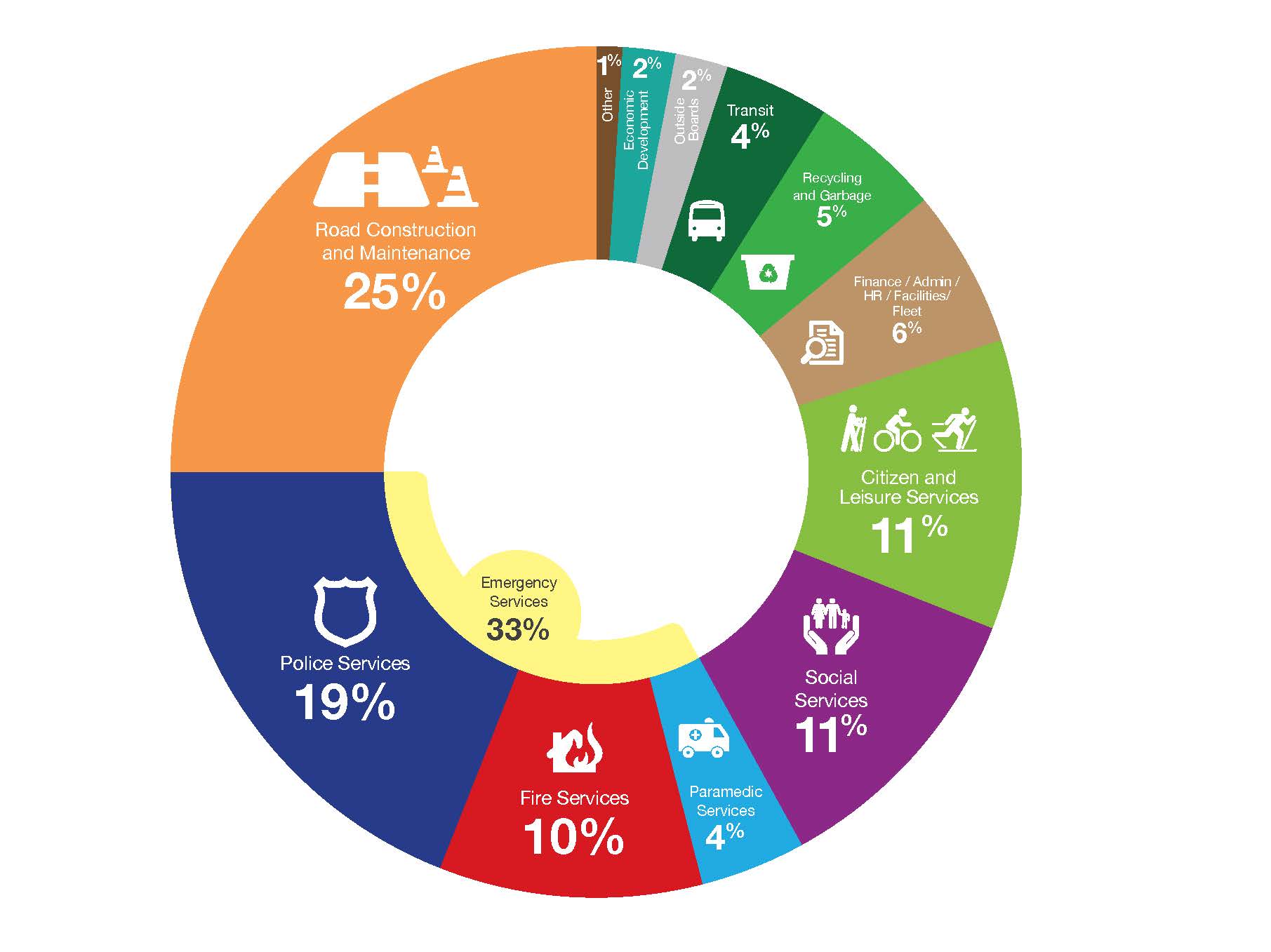

6 property 1Property Tax Value x 2Assessment Ratio Assessed Value x 3Millage Estimated Tax Amount. Linn Countys average effective property tax rate is 122. At that rate taxes on a home worth 150000 would be 1830 a year.

If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. To estimate your real estate taxes you merely. Millage- tax rate or tax levy as set by the schools county or city districts expressed in mils per 1000.

Continuing with the example divide 10 mills by 1000 to get 001. Multiply the assessed value by the mill levy which is listed under the tax unit the property is located and then divide by 1000 to estimate the property tax. To calculate tax estimate.

This rate is also sometimes called a millage rate or mill rate. So if the millage rate for a property is 7 mills this implies that. Based on population statistics Douglas County is ninth largest county in Oregon.

This incorporates the base rate of 1 and additional local taxes which are usually about 025. Millage rates are typically expressed in mills with each mil acting as 11000 of 1000 of property value or 1 total. Multiply the mill rate expressed as a decimal by the assessment ratio expressed as a decimal to figure the effective tax rate for your property.

Calculating Property Taxes Using the Mill Rate Property taxes are calculated by multiplying the assessed taxable property value by the mill rate and then dividing that sum by 1000. Millage Rate rate in dollars per 1000 of taxable value set by each taxing authority based upon tax revenue required in their annual budget. Take your total property tax rate and multiply it by the value of the property you are dealing with.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA. In this example multiply 002 by 075 to get an. The average effective property tax rate in Douglas County is 084.

The first number after the decimal point is tenths 1 the second number after the decimal point is hundredths 01 and going out three places is thousandths 001 or mills. Key Takeaways Millage rates are the tax rates used to calculate local property taxes. Ten mills is010 One hundred mills is100.

After that your propertys assessed value is then multiplied by the local tax rate. Millage Code A two-digit code related to your property location and jurisdiction which shows the taxing authorities and millage rates that make up your total rate. ______________ x _____________ 1000 ____________ assessed value mill levy tax bill.

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Home Valuation And Property Taxes Wellington Fl

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Tax Rates Gordon County Government

Tax Rates Gordon County Government

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Understanding Assessment Sama Saskatchewan Assessment Management Agency

Understanding Assessment Sama Saskatchewan Assessment Management Agency

Mill Levy Rate Overview How It Works Formulas

Mill Levy Rate Overview How It Works Formulas

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Montana Property Taxes Montana Property Tax Example Calculations

Montana Property Taxes Montana Property Tax Example Calculations

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

:max_bytes(150000):strip_icc()/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)

:max_bytes(150000):strip_icc()/options-lrg-5bfc2b1f4cedfd0026c10437.jpg)