Kansas Property Tax Calculator Johnson County

The assessment rate for commercial and industrial properties is 25. Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By.

Indiana Property Tax Calculator Smartasset

Indiana Property Tax Calculator Smartasset

Our Johnson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kansas and across the entire United States.

Kansas property tax calculator johnson county. Before that Kansas boat owners paid property taxes based on an assessed value that was 30 percent of the boats market worth. However the county actually has a relatively low average property tax rate of 124. One mill is equivalent to 1 for every 1000 of assessed property value.

The median real estate tax payment in Johnson County is 3018 one of the highest in the state. The assessment rate on residential properties is 115. The Johnson County Appraisers Office maintains property valuations and tax bills.

Kansas State Law KSA 19-547 requires delinquent personal property to be advertised in October and a publication fee of 15 will be assessed. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Average Age of Homes - The median age of Johnson County real estate is 32 years old The Rental Market in Johnson County.

Property tax in johnson county. Enter your Over 65 freeze year. Kansas City - and specifically the desirable suburbs within Johnson County - are leading the charge for Kansas.

He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. One mill is equivalent to 1 for every 1000 of assessed property value. Assessed property value is 115 of appraised market value for residential properties and 25 for commercial properties.

All warrants must be paid at the Johnson County Treasurers Office. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year. This is a rebate of up to 700 per year.

The states average effective property tax rate annual taxes as a percentage of home value is 137. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts. Home Appreciation in Johnson County is up 72.

Our Kansas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kansas and across the entire United States. So if you owned a 30000 boat the assessed value was 9000 and depending on the mill levee in the county you lived in you could have paid more than 1000 in annual property taxes. There is no city sale tax for Johnson.

Use this calculator to estimate the property tax due on a new vehicle purchase. The median home cost in Johnson County is 281800. The Johnson Kansas general sales tax rate is 65The sales tax rate is always 75 Every 2021 combined rates mentioned above are the results of Kansas state rate 65 the county rate 1.

Delinquent personal property tax notices are mailed in June. How 2021 Sales taxes are calculated in Johnson. Home appreciation the last 10 years has been 328.

Average property tax in Kansas counties. This means that depending on your location within Kansas the total tax you pay can be significantly higher than the 65 state sales tax. Calculating Property Tax Property tax rates are based on mills and are assessed through a mill levy.

Kansas has a 65 statewide sales tax rate but also has 375 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1552 on top of the state tax. If they are not paid tax warrants are issued by the 15th of July. To calculate your local property taxes visit the Overland Park Property Tax Calculator Property taxes are assessed through a mill levy.

Homeowners with a total household income of 35700 or less may be eligible for the Homestead Refund. Taxes on property in Kansas are higher than the average for all US. With a population of more than 585000 Johnson County is the largest county in Kansas.

Property Tax Calculation Your property taxes are determined by multiplying the actual value times the assessment rate times the mill levy. Enter your Over 65 freeze amount.

Wisconsin Property Tax Calculator Smartasset

Wisconsin Property Tax Calculator Smartasset

States Without Property Tax In 2021 No But Here Are The Best Worst

States Without Property Tax In 2021 No But Here Are The Best Worst

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Vermont Property Tax Calculator Smartasset

Georgia Property Tax Calculator Smartasset

Georgia Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Property Tax Calculator Smartasset

Missouri Income Tax Calculator Smartasset

Missouri Income Tax Calculator Smartasset

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Arkansas Property Tax Calculator Smartasset

Arkansas Property Tax Calculator Smartasset

Faq S On Personal Property Crawford County Ks

Faq S On Personal Property Crawford County Ks

Nebraska Property Tax Calculator Smartasset

Nebraska Property Tax Calculator Smartasset

Vehicles Johnson County Kansas

Vehicles Johnson County Kansas

Property Tax Calculator Tax Rates Org

Illinois Property Tax Calculator Smartasset

Illinois Property Tax Calculator Smartasset

Tax Calculation Crawford County Ks

Tax Calculation Crawford County Ks

New Mexico Property Taxes By County 2021

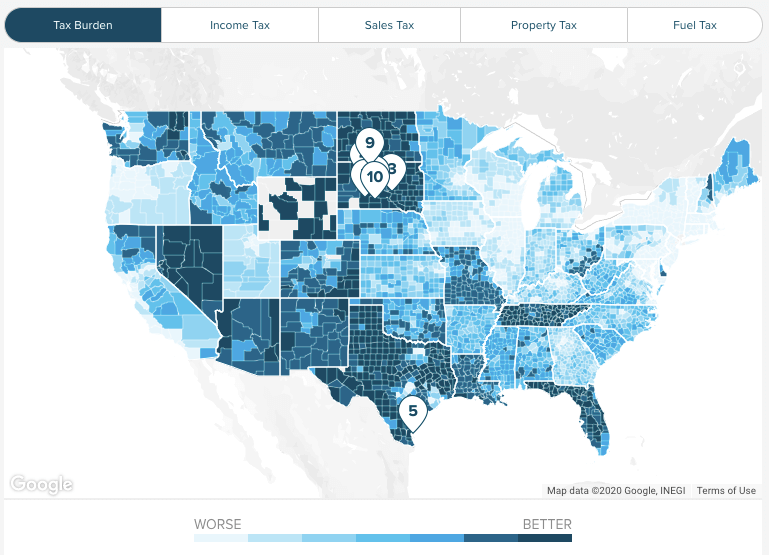

Kansas Property Tax Calculator Smartasset

Kansas Property Tax Calculator Smartasset

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

Real Estate And Personal Property Tax Johnson County Kansas

Real Estate And Personal Property Tax Johnson County Kansas