Land Transfer Tax Calculator York Region

Property tax clawback percentages since 2010. There is no Land Transfer Tax for the Northwest Territories but there is a charge of two fees that make up the process of Land Transfer.

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Timing of Tax Payable Under Subsection 32 of the Act was filed on April 26 2018 to provide quarterly reporting periods for Land Transfer Tax on qualifying unregistered dispositions of a beneficial interest in land.

Land transfer tax calculator york region. Use land transfer tax calculator. This new tax is in addition to Ontarios current Land Transfer Tax. Search the MLS at your convenience FREE market evaluations listing notifications news and more.

NY State Transfer Tax The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more. Land Transfer Tax Calculator. Land transfer tax calculator.

Ontario land transfer tax rebate 3. The proposed MLTT is a bad idea on a number of fronts. Land transfer tax it doesnt sound very pleasing and in many cases its not however Jo-Ann Folino of Royal LePage Your Community Realty Inc Brokerage in Woodbridge Ontario reminds you that.

WE CAN HELP LET US BE YOUR GUIDE. Use the calculator above to find the land transfer tax based on your location or keep reading to find out how land transfer tax is calculated where you live. Closing Checklist for Buyers FREE LTT Calculator Download.

Land Transfer Tax Calculator Region of Durham City of Toronto Current Page. Quarterly Reporting Periods for Land Transfer Tax. Mortgage calculator by.

N Whitby ON L1N 4M9. The Property Power Team consists of specialized individuals who solely focus on their area of expertise to deliver the best results for you. Each province sets its own land transfer tax rates as do some municipalities.

Land Transfer Tax Calculator Nina Saeed Real Estate website. Contact Us Client Testimonials. York Region Council approved the use of limiting property tax decrease by clawing back the decreases within the class as a means to recover the lost revenue from the capped business properties.

The Property Power Team. Land Transfer Tax and CMHC Insurance calculators torihomesroyallepageca 416-443-0300 Register Login. A general tax rate increase across all property classes.

Land transfer taxes are calculated based on the purchase price of your property. The land transfer tax rebate is instantly applied as credit as a rebate to the home buyers at the time of closing or their real estate purchase transaction. Based on Ontarios land transfer tax rates this refund will cover the full tax for homes up to 368000.

For first time home buyers there is a maximum 4000 tax rebate on the Ontario land transfer tax. Effective April 21 2017 a 15 Non-Resident Speculation Tax is imposed on the purchase or acquisition of an interest in residential property located in the Greater Golden Horseshoe by individuals who are not citizens or permanent residents of Canada or by foreign corporations foreign entities or taxable trustees. If politicians get their way it would add over 15000 to an average priced York Region home and double the tax burden on local families.

Further information about the new quarterly reporting period rules is provided on the ministry webpage entitled. The Ontario first time home buyer tax credit also known as the land transfer tax rebate has a value of the full amount of the Ontario land transfer tax up to a maximum 4000. Each member of REMAX All-Stars Benczik Team Realty LIVES AND WORKS within York Region.

Proudly Serving the GTA York Region and Simcoe since 2003. York Region City of Kawartha Lakes City of Peterborough Contact Us Municipal Contacts. Politicians there are asking the province for new tax powers with their sights set on a municipal land transfer tax MLTT similar to the one in Toronto.

Over the last 30 years we have gained a tremendous amount of experience trading real estate throughout York and Durham Region. 150 for every 1000 of property value with a base fee of 100 if the property is under 1000000 and 1 for every 1000 that surpasses it along with a mortgage fee of 1 for every 1000 of the mortgage amount with a base fee of 80. Calculate all your closing costs including Legal Fees Land Transfer Tax Government Registration Fees Title Insurance balance of your purchase price and more.

The higher rate of 065 kicks-in at a lower threshold of 2 million for commercial transactions and residential properties with 4 or more units. Contact Dion Beg - Award Winning Mortgage Broker servicing Pickering Ajax Whitby Toronto and the GTA.

Land Transfer Tax Ontario What Buyers Should Know Loans Canada

Land Transfer Tax Ontario What Buyers Should Know Loans Canada

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Land Transfer Tax Calculator Oakville Burlington Milton Mississauga Mortgage Broker Best Rates

Land Transfer Tax Calculator Woitzik Polsinelli Llp Lawyers Mediators

Land Transfer Tax Calculator Woitzik Polsinelli Llp Lawyers Mediators

Land Transfer Tax Calculator Adam Miller Kelly

Ontario Property Tax Rates Lowest And Highest Cities

Ontario Property Tax Rates Lowest And Highest Cities

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates Investing In Land Ontario First Time Home Buyers

Ontario Land Transfer Tax Who Pays Calculator Exemptions Rebates Investing In Land Ontario First Time Home Buyers

What You Need To Know About Ontario Land Transfer Tax

What You Need To Know About Ontario Land Transfer Tax

Land Transfer Tax Ontario Land Transfer Tax In Mississauga Toronto

Land Transfer Tax Ontario Land Transfer Tax In Mississauga Toronto

Ontario Land Transfer Tax Who Pays It And How Much

How To Dodge The Land Transfer Tax Zolo

How To Dodge The Land Transfer Tax Zolo

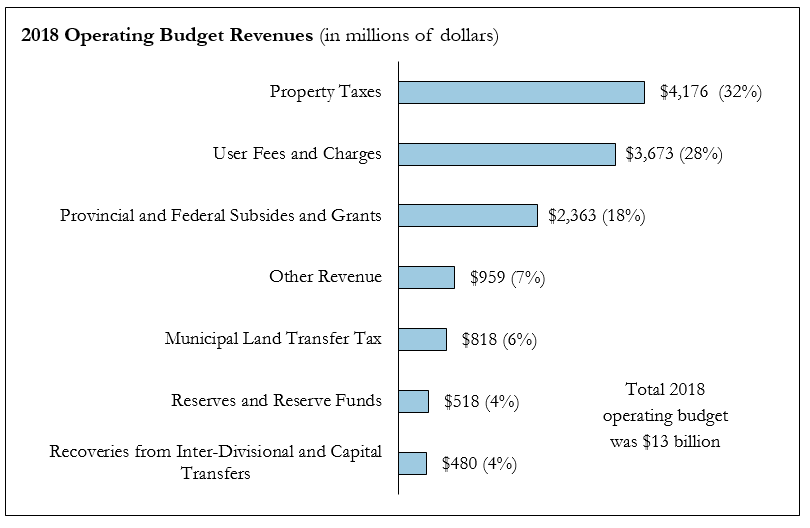

2018 Issue Briefing The City S Operating Revenue Base City Of Toronto

2018 Issue Briefing The City S Operating Revenue Base City Of Toronto

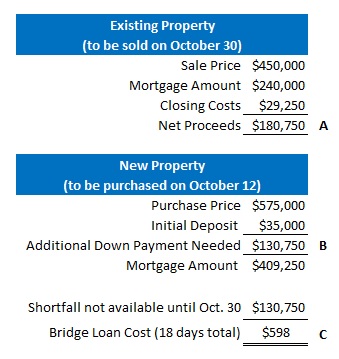

Bridge Financing A Solution When Buy And Sell Dates Don T Overlap Dave The Mortgage Broker

Bridge Financing A Solution When Buy And Sell Dates Don T Overlap Dave The Mortgage Broker

Non Resident Speculation Tax Collected

Non Resident Speculation Tax Collected

Municipal Land Transfer Tax Mltt Rates And Fees City Of Toronto

Municipal Land Transfer Tax Mltt Rates And Fees City Of Toronto

Land Transfer Tax And The Electronic Registration Of Conveyances Of Land In Ontario

Land Transfer Tax And The Electronic Registration Of Conveyances Of Land In Ontario

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

Toronto Land Transfer Tax Rates 2021 Land Transfer Tax Calculator Toronto

Toronto Land Transfer Tax Rates 2021 Land Transfer Tax Calculator Toronto