Nyc Property Tax Bill Search

Simply begin by searching for a property by address or borough-block-lot BBL number. If a bank or mortgage company pays your property taxes they will receive your property tax bill.

Cuyahoga County Home Has A 211 584 Property Tax Bill See Top Taxed Home In Each Town Cuyahoga County Property Tax County

Cuyahoga County Home Has A 211 584 Property Tax Bill See Top Taxed Home In Each Town Cuyahoga County Property Tax County

Each year Property tax bills are calculated based on the information listed on the Final assessment roll.

Nyc property tax bill search. Apply for tax exemptions and see which exemptions you already receive. Look Up Your Propertys Tax Assessment Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. View Your Property Assessment Roll Data FY2022 Tentative Property Assessment Data.

Or log in to Online Assessment Community. Property Tax Bills. In-depth Queens NY Property Tax Information.

The City Register collects Real Property Transfer Tax RPTT and Mortgage Recording Tax when documents are submitted for recording. NYC is a trademark and service mark of the City of New York. More property tax topics.

Look up information about a property including its tax class and market value. If you pay your property taxes yourself rather than through a mortgage lender you should receive your statement by March 1 2021. Please contact the City Register if you cannot view it online or have questions.

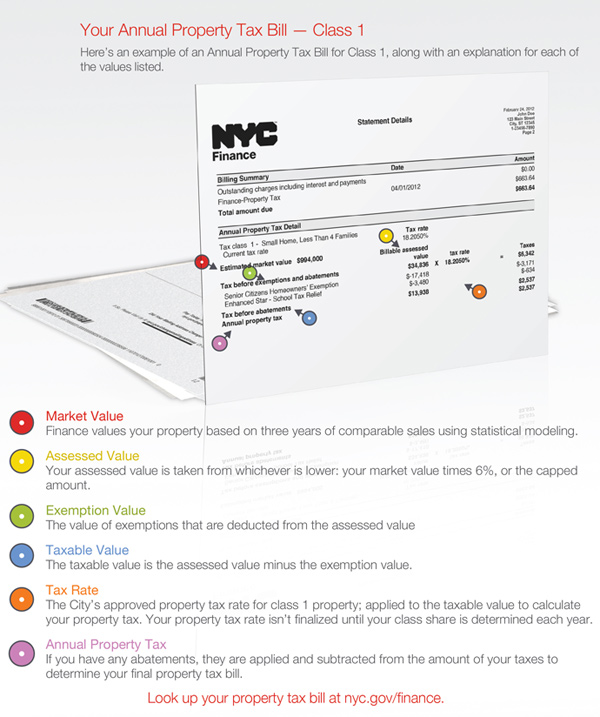

Bills are generally mailed and posted on our website about a month before your taxes are due. DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

The Department of Finance values your property every year as one step in calculating your property tax bill. NYC Department of Finance. If you do nothing it will be automatically applied to your next tax bill.

Real Property Tax Law. Some co-op owners were mailed a semi-annual property tax bill instead of a quarterly property tax bill. Select the SWIS code for the.

School tax bills are generally the first to arrive after assessments are finalized. Data and Lot Information. DOF sent a letter and revised property tax bill to affected property owners with past due charges.

View your property tax bills annual notices of property value NOPV and other important statements. Exemptions. Find Property Borough Block and Lot BBL Payment History Search.

Property Tax and Charges. Directory of City Agencies. The Department of Finance DOF administers business income and excise taxes.

Assessed Value History by Email. Fill in the fields to Search. Fill in the fields to Search.

Each owner name on your propertys tax account and deed should match. In-depth Property Tax Information. Some credits are treated differently.

Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance. New York Property Tax Search by Address.

The data presented on this site may not reflect the most recent updates to our records and is not guaranteed to be accurate as of todays date. Find your local assessment roll municipalities outside of New York City Visit the Municipal Profiles application. The New York City Council recently passed legislation that reduces the late payment interest rate for property taxes due on July 1 2020 for eligible property owners who have been impacted by COVID-19 and who apply to DOF by September 30 2020.

See New York tax rates tax exemptions for any property the tax assessment history for the past years and more. Real and personal property tax statements have been mailed. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form.

It is intended for information purposes only. The Department of Finance recalculated some interest charges for property tax bills due July 1 2020. Enter your BBL Borough Block Lot Number.

If you live in the Bronx Brooklyn Manhattan or Queens search our records online to see if your deed has been recorded correctly. Select the county from the drop-down menu. See what the tax bill is for any New York property by simply typing its address into a search bar.

Any overpaid property tax will be credited to your account. The Property Division is responsible for maintaining the official tax maps of New York City. Select search for a city town or village.

In most communities school tax bills arrive in early September and may also include library taxes. Most taxpayers in New York State receive two tax bills each year. Property Taxes Due July 1 2020.

See Property tax and assessment administration for important updates and access to New York State resources for assessors county real property tax directors and their staff.

Https Www1 Nyc Gov Assets Finance Downloads Pdf Commercial Rent Cr A Instructions 2018 19 Pdf

Nyc Landlord Express Access Portal

Nyc Landlord Express Access Portal

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

What Is An Open House By Appointment Only In Nyc Hauseit Open House Appointments Nyc

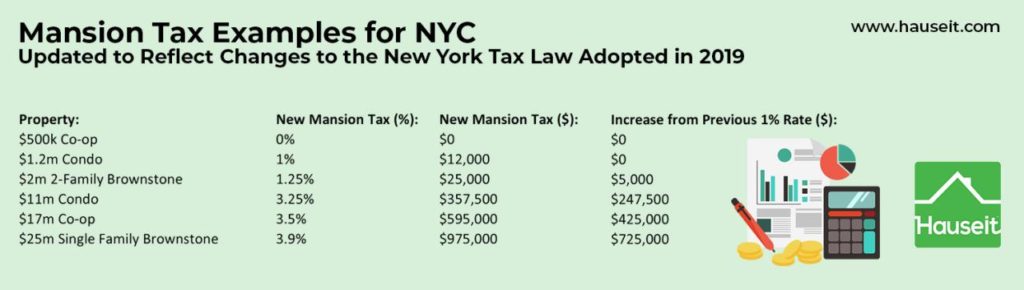

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

Nyc Mansion Tax Of 1 To 3 9 2021 Overview And Faq Hauseit

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

What Is The Fair Market Value Of My Nyc Apartment Hauseit Nyc Nyc Apartment Nyc Market Value

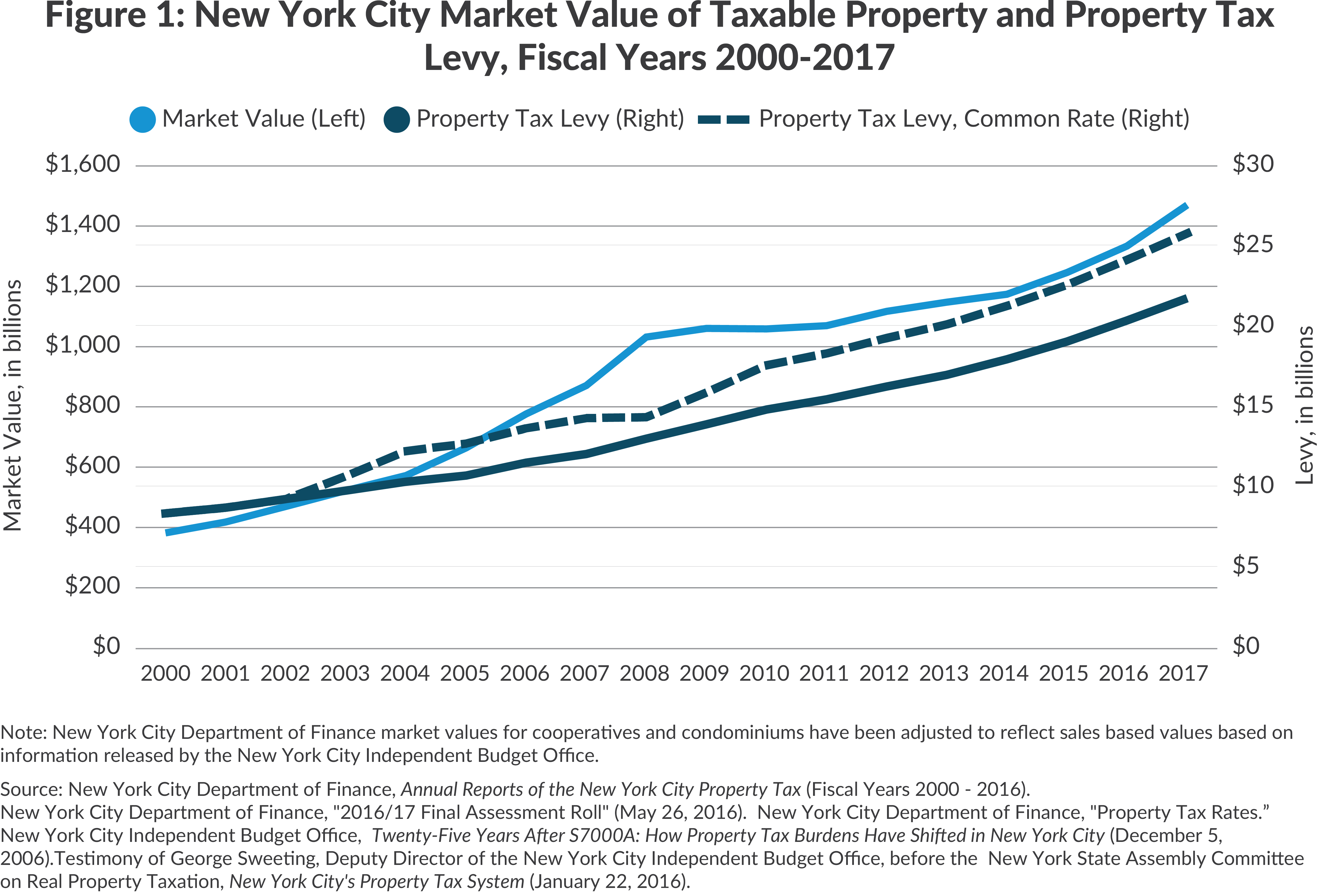

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa Income Tax Return Accounting Services Income Tax

Best Tax Preparation Service Provider Usa Harshwal Company Llp Tax Preparation Services Tax Services Tax Preparation

Best Tax Preparation Service Provider Usa Harshwal Company Llp Tax Preparation Services Tax Services Tax Preparation

Calculating Your Property Taxes

Calculating Your Property Taxes