Property Tax Calculator Mill Rate

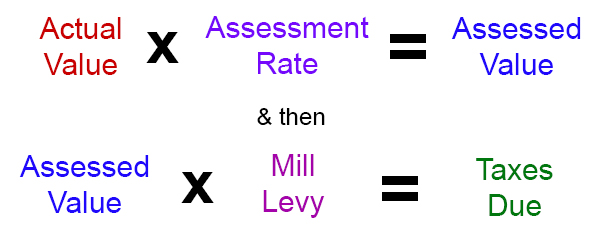

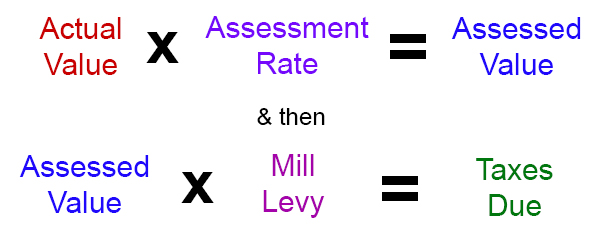

In a county where the millage rate is 25 mills the property tax on that house would be 1000. 4 property 1Property Tax Value x 2Assessment Ratio Assessed Value x 3Millage.

Real Estate Tax Calculation How To Calculate Property Taxes For Commercial Real Estate Youtube

Real Estate Tax Calculation How To Calculate Property Taxes For Commercial Real Estate Youtube

Millage rates are expressed in tenths of a penny meaning one mill is 0001.

Property tax calculator mill rate. Property tax levied on property mill rate x taxable property value 1000. To figure the tax simply multiply the assessed value 25000 by the tax rate of 4221 or 3788 per hundred dollars assessed. Your property tax bill might include additional charges called special assessments.

100000 390000. How to Figure Tax. Five Steps to Estimating Property Taxes.

Divide the mill rate by 1000 to convert it to a decimal. Lets say the homes total millage rate is 70 mills 701000 which means for every 1000 assessed value 70 in property taxes is due. 2019 Millage Rates - A Complete List.

He amount of municipal tax payable by a property owner is calculated by multiplying the mil rate by the assessed value of a property and dividing by 1000. Tax year Millage is found in the table below. The point is this it is critically important that the property tax estimate be as accurate as possible.

For example if the mill rate is 7 and a taxpayers personal residence has a taxable value of 150000 then using. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900.

Rates vary by school district city and county. For example if the mill rate is 20 divide 20 by 1000 to get 002. 2017 Millage Rates - A Complete List.

Millage rates are typically expressed in mills with each mil acting as 11000 of 1000 of property value or 1 total. 100000 60000. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

This rate also includes 10 mills of unvoted taxes guaranteed by the Ohio Constitution. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. 6 property 1Property Tax Value x 2Assessment Ratio Assessed Value x 3Millage.

2020 Millage Rates - A Complete List. 100000 30000. TAX RATE MILLS ASSESSMENT PROPERTY TAX.

For example a property with an assessed value of 50000 located in a municipality with a mill rate of 20 mills would have a property tax bill of 1000 per year. Mill Rates A mill is equal to 100 of tax for each 1000 of assessment. A big miss could impact the value of the property and the price an investor is willing to pay for it.

100000 300000. 2018 Millage Rates - A Complete List. One mill is equal to 1 of tax for every 1000 in assessed value.

To calculate the property tax multiply the assessment of the property by the mill rate and divide by 1000. The millage rate is the amount per 1000 of assessed value thats levied in taxes. Therefore the homeowner owes 2800 in property taxes.

Using the same 7 cap rate the estimated value falls to 37M a 400000 difference. Ohio Property Tax Rates. The assessed value 40 percent of the fair market value of a house that is worth 100000 is 40000.

If the assessment ratio for. Convert the assessment ratio to a decimal. The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by the Metro Council at 4221 Urban Services District or 3788 General Services District per hundred of assessed value.

A 12 mill property tax levy would be 050 per 1000. Voted Tax Rate the total rate approved by the voters in your taxing district for support of your school district library municipality vocational school metro park system police and fire departments and county-wide services. Mil Rate x Assessed Value 1000 Property Tax Bill.

Property tax rates in Ohio are expressed as millage rates. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. To calculate tax estimate.

Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another. So if the millage rate for a property is 7 mills this implies that. Florida is ranked number twenty three out of the fifty states in order of the average amount of property taxes collected.

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Property Tax And Millage Calculator

Property Tax Calculator Tax Rates Org

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Ohio Property Tax Calculator Smartasset

Ohio Property Tax Calculator Smartasset

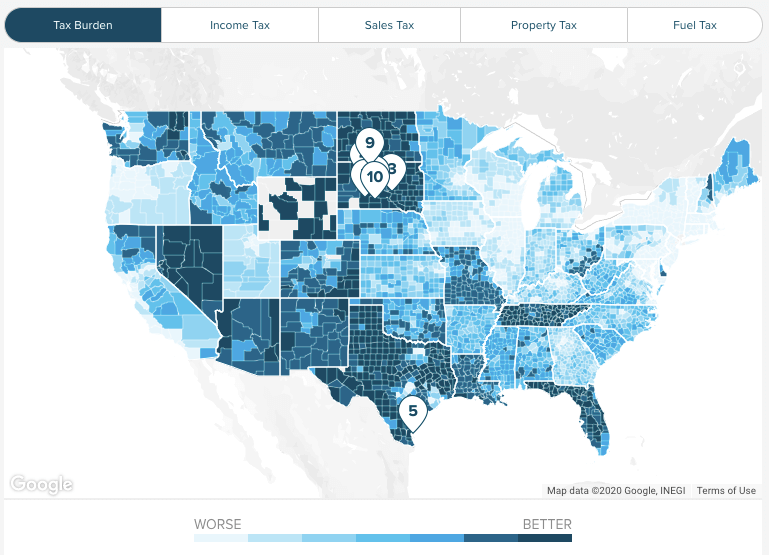

Kansas Income Tax Calculator Smartasset

Kansas Income Tax Calculator Smartasset

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

Nutley New Jersey Property Tax Calculator

Nutley New Jersey Property Tax Calculator

What Is A Millage Rate Millionacres

What Is A Millage Rate Millionacres

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg) How Property Taxes Are Calculated

How Property Taxes Are Calculated

Understand How Your Property Taxes Are Calculated Quick Lesson

Understand How Your Property Taxes Are Calculated Quick Lesson

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset