Property Value Yearly Increase

Percent increase is a useful thing to calculate when comparing time periods estimating growth percent yearly monthly daily etc or comparing a new state to an old state of things eg. While assessed values remain the same until the next year market values continue to fluctuate throughout the year.

East Palo Alto Real Estate Market Trends Home Prices

East Palo Alto Real Estate Market Trends Home Prices

In 1980 it was 47200 and by 2000 it had risen to 119600.

Property value yearly increase. Not all of the increase is due to appreciation. Some formerly white-hot markets. Topeka was down 13 percent and Youngstown Ohio inched down 10 percent.

This value is based on the requirement that assessed values be established at 100 of market value on January 1st. A detailed notice contains the description of the property. Updates May 2018 Update.

In fact thanks to the magic of home appreciation which is when property value increases on its own recent sellers sold their homes for a median of 55000 29 more than they purchased it. See also our mortgage and loan discounted present value retirement future value and return on investment calculators and currency converter. In 1980 it was 47200 and by 2000 it had risen to 119600.

So when we see the median price of homes go up each year whats hidden in those numbers is that part of the increase is because the homes being sold themselves are getting larger. Annual Home Value Appreciation rate R 100 salePrice purchasePrice 1years 1 About this page. Following slumps home values can increase in some areas of the country because of strong demand and.

21Property taxes increased on more than half of Montgomery Countys residential parcels this year a repercussion of a countywide reappraisal that saw property values climb by double digit percentages for a majority of owners. Preceding years taxable value. According to data analysis by Black Knight Inc the 25-year average appreciation rate of homes in the US.

Only in six areas did homes lose value led by Elmira New York where they fell 54 percent. Home values tend to rise over time but recessions and other disasters can lead to lower prices. Preceding years appraised value.

The value of your neighborhood could rise a sign of the real estate market starting to recover. Ownerly explains that the average home appreciation per year is based on local housing. The countys general fund budget for fiscal 2018 which begins Oct.

Some figures show average prices not median prices. See more about these data. Real estate has historically appreciated at a rate of between 3 and 5 per year depending on the price index youre looking at.

These data are based on experimental estimates of the Housing Price Index HPI by 5-digit ZIP code based in part on home sales price data from Fannie Mae- and Freddie Mac-acquired mortgages. The formula for calculating percent increase used in our percentage increase calculator is. When a lack of confidence is felt in a single region the result could lead to a lower-than-average appreciation value.

Taxing units allowed to tax the property. Limitations on Increasing Property Values on Your Home Prices of new and used homes in Harris County have increased substantially in recent years. The dollar value of more than 543 billion includes an 808 percent gain in real property tax values plus increases in new construction and tangible personal property values.

At the same time 8672 ZIP code areas experienced an increase in housing value. In 1940 the median home value in the US. The more your home appreciates from the purchase price the more profit youll bag at resale.

Draconian is how Mark Tarjan described the 43 increase in value on the home he owns with his wife in Miami Twp. Homes are getting bigger. In fact only 12 of adults said they planned to buy a home within the next year according to an August 2019 survey by the National Association of Home Builders.

Your local state or federal government laws may change causing property taxes to spike. 1 will benefit from a 797 percent boost in total taxable values. While there is no true universal normal rate of appreciation for the housing market we are able to compare home values to historical rates of home price appreciation to see differences in the home value appreciation over time.

Ways to keep home appraisal value high. In order to prevent sharp increases in home property taxes from year to year Texas voters in 1997 approved a constitutional amendment which became effective January 1 1998 to limit increases in. There are no limits on increases or decreases in assessed property values.

While home prices have appreciated nationally at an average annual rate between 3 and 5 percent depending on the index used for the calculation home value appreciation in different metro areas can appreciate at markedly different rates than the national average. 1 Unfortunately its hard to predict a homes exact rate of appreciation since thats based on things that are always changing like. Average Home Value Increase Per Year National appreciation values average around 35 to 38 percent per year.

New 2018 Quarterly. The celebrated phenomenon of your homes value increasing over time. How many buyers are looking for homes how many homes are available and inflation.

First youll need to determine your projected growth rate. Home value appreciation calculator. A new salary or hourly rate versus your previous one.

A Notice of Appraised Value informs the property owner if the appraisal district intends to increase the value of a propertyChief appraisers send two kinds of notices of appraised value.

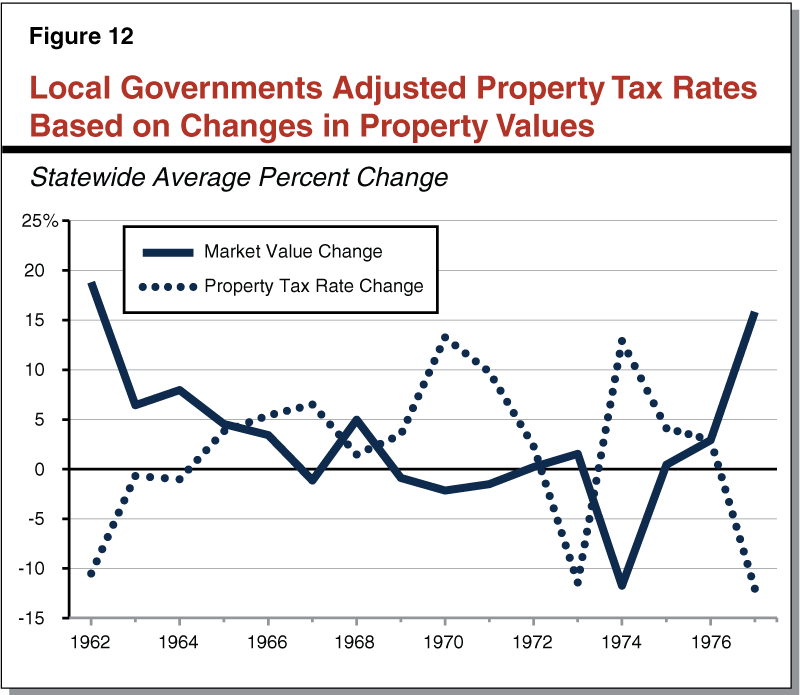

Property Tax Oklahoma Policy Institute

Property Tax Oklahoma Policy Institute

14 Home Renovations That Will Increase The Value Of Your Home Home Improvement Home Improvement Projects Renovations

14 Home Renovations That Will Increase The Value Of Your Home Home Improvement Home Improvement Projects Renovations

South Dakota Property Tax Calculator Smartasset

South Dakota Property Tax Calculator Smartasset

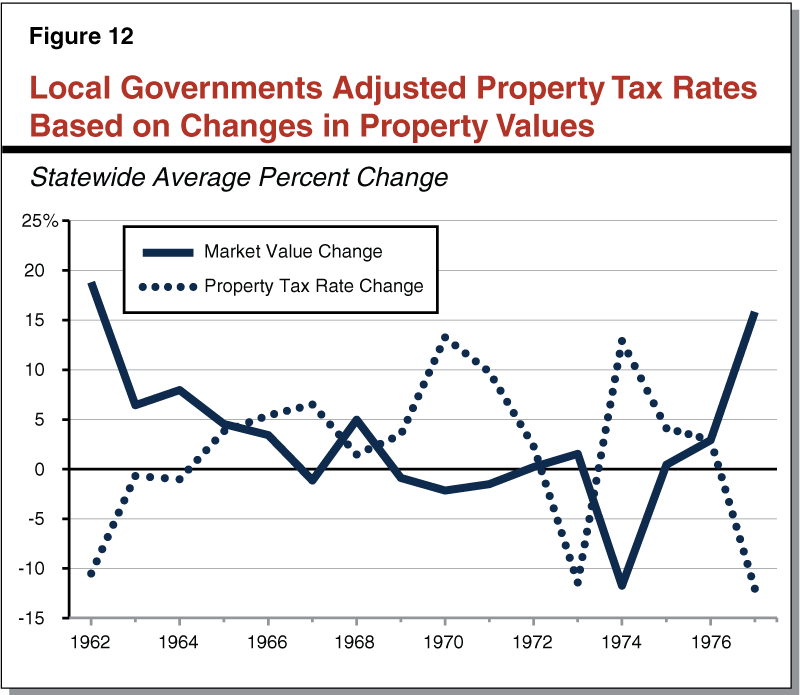

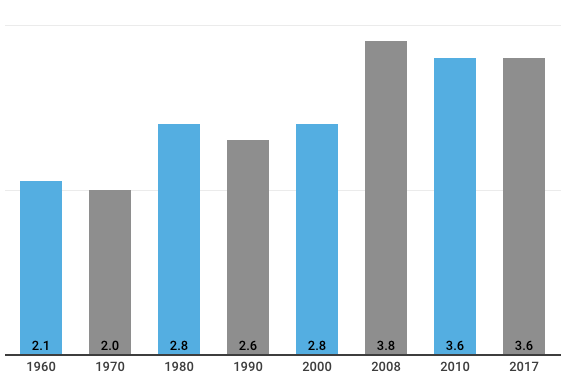

Understanding California S Property Taxes

Understanding California S Property Taxes

28 Housing Market Predictions 2021 2025 Crash Coming

28 Housing Market Predictions 2021 2025 Crash Coming

Millbrae Real Estate Market Trends Home Prices

Millbrae Real Estate Market Trends Home Prices

:max_bytes(150000):strip_icc()/HOWMONEYISMADEREALESTATEFINALJPEG-8db8883c13df4233ba2aad6ae392647f.jpg) How To Make Money In Real Estate

How To Make Money In Real Estate

Investment Analysis Of South Korean Real Estate Market

Investment Analysis Of South Korean Real Estate Market

Long Run Trends In Housing Price Growth Bulletin September Quarter 2015 Rba

Long Run Trends In Housing Price Growth Bulletin September Quarter 2015 Rba

Wages Aren T Keeping Pace With Home Price Growth And It S Putting A Dent In The Housing Market Housingwire

Wages Aren T Keeping Pace With Home Price Growth And It S Putting A Dent In The Housing Market Housingwire

Investment Analysis Of Swedish Real Estate Market

Investment Analysis Of Swedish Real Estate Market

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

18 Best Places To Buy Rental Property In 2021 Cash Flow Appreciation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

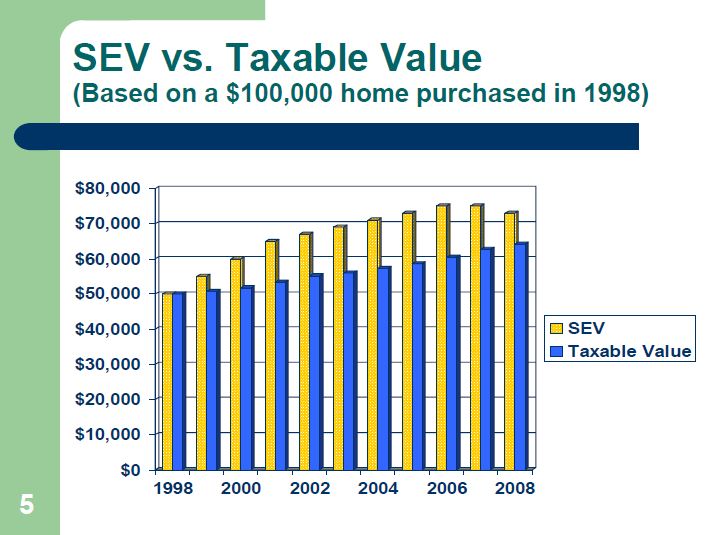

Why Property Taxes Go Up After Buying A Home In Michigan

Why Property Taxes Go Up After Buying A Home In Michigan

Common Claims About Proposition 13

Common Claims About Proposition 13

Want To Invest In Real Estate But Not Sure Where To Start Here Are The 5 Big Real Estate Investing Rental Property Rental Property Management Rental Property

Want To Invest In Real Estate But Not Sure Where To Start Here Are The 5 Big Real Estate Investing Rental Property Rental Property Management Rental Property

Jacksonville Real Estate Market 2021 Housing Forecast Predictions

Jacksonville Real Estate Market 2021 Housing Forecast Predictions