Real Estate Property Tax Calculator Philippines

Taxumo is the best option for digital tax filing in the Philippines. It is imposed by the Local Government Unit as specified under the Local Government Code.

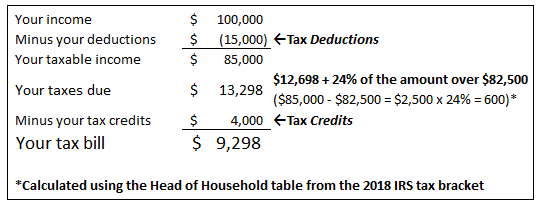

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

RPT is a way to increase funding for the LGU for it provide basic public services.

Real estate property tax calculator philippines. Real estate marketplaces usually state that the average time of selling a property can take anywhere between 65-70 days before it gets sold although again these may vary depending on location. To illustrate maximum RPT rate of properties located in cities and municipalities within the Metro Manila is 2 while only 1 in provinces. Real estate tax in the Philippines or simply Real Property Tax RPT is a tax that you pay annually if you own a property.

Net Estate Gross Estate Deductions. Search and Pay your Real Estate Taxes. 7160 property owners are required by law to pay RPT annually which applies to all types of real properties including lands buildings.

Guide to Real Estate Property Tax in the Philippines By Rob John Valencia - May 21 2015 Purchasing a new property often results in an overwhelming sense of delight. Now that we have the total assessed value of the property we multiply it by the applicable Real Property Tax rate to get the tax amount to be paid by Jesus Gulapa. 7160The implementing rules and regulations of R.

The legal basis is Title II of the Local Government Code LGC Republic Act RA no. D Real Property Tax. Estate tax is imposed on the transfer of the net estate which is the difference between the gross estate as defined under Section 85 of the Tax Code and allowable deductions under Section 86 of the decedent.

12-2018 which contains the implementing guidelines related to the revised Estate Tax and Donors Taxes to be used starting 2018 as mandated in the TRAIN bill signed into law by Pres. Heres everything you need to know about the new Estate Taxes under the approved Philippine TRAIN tax reform law. The total basic real property tax to be paid by Jesus Gulapa is Php56000.

It is not a property tax. In fact the earliest known record of property taxes dates back to the 6th century BC. Property taxes are one of the oldest forms of taxation.

On the other hand as described by the Bureau of Internal Revenue BIR Estate Tax is a tax on the right of the deceased person to transmit hisher estate to hisher lawful heirs and beneficiaries at the time of death and on certain transfers which are made by law as equivalent to testamentary disposition. There are now different online tax calculators in the Philippines. What is Estate Tax.

Rate depends on local government unit where property is located. Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. 7160 can be found here.

With its free online tax calculator it has been the choice of many filipino freelancers small business owners and self-employed professionals. According to the Local Government Code of 1991 or Republic Act no. Then there is also the matter of taxes periodically imposed on the property the most common of which is real property tax RPT.

Estate tax rates are graduated and depend on the net estate amount. Paying property taxes online Some taxes in the Philippines might need to be paid over the counter at an office but it may be possible to pay others online. Specifically it provides real-time tax calculation which can help you avoid tax bill shock.

Agent Brokers commission. Regardless of the gross value of the estate where the said estate consists of registered or registrable property such as real property motor vehicle shares of stock or other similar property for which a clearance from the BIR is required as a condition precedent for the transfer of ownership thereof in the name of the transferee. C x Metro Manila RPT rate 2 Php56000.

Real property may not be transferred from the. Real property tax is a local tax and usually has to be paid at the local office so this is one tax you might need to make a trip for. Plus you can be alert in tax payments by knowing exactly how much you have to pay.

The RPT for any year shall accrue on the first day of January and from that date it shall constitute a lien on. The BUYER pays for the cost of Registration. It is a tax imposed on the privilege of transmitting.

Transfer Tax - 05 of the selling price or zonal value or fair market value which ever is higher. What is Real Property Tax. Current market conditions also play a big role when it comes to determining whether your house will spend a lot of time sitting on the real estate.

You must always be sure to go with the best efficient updated and legitimate online tax calculator program. Documentary Stamp Tax - 15 of the selling price or zonal value or fair market value which ever is higher. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

Real Property Tax is the tax on real property imposed by the Local Government Unit LGU. It is the 1 online tax calculator in the Philippines. Real Estate Taxes and Fees in the Philippines.

Paid only if applicable. The RPT rate is contingent upon the coverage of the property. Unpaid real estate taxes due if any.

For the account of the Seller to be paid by the Seller. 6 of the Selling Price or Zonal Value or Fair Market Value whichever is higher. However the results may not necessarily coincide with tax payable up to the last peso and should not be used in filing for income taxes.

Computation of real property tax in the Philippines is based on the real property tax RPT rate multiplied by the assessed value. The Bureau of Internal Revenue BIR has released Revenue Regulations No.

What Is Taxable Income With Examples Thestreet

What Is Taxable Income With Examples Thestreet

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Real Property Tax In The Philippines Important Faqs Lamudi

Real Property Tax In The Philippines Important Faqs Lamudi

How Much Mortgage Can Your Budget Handle This Simple Calculator Shows What Your Dream House W Simple Mortgage Calculator Mortgage Calculator Calculator Design

How Much Mortgage Can Your Budget Handle This Simple Calculator Shows What Your Dream House W Simple Mortgage Calculator Mortgage Calculator Calculator Design

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How Your Property Tax Is Calculated Youtube

How Your Property Tax Is Calculated Youtube

Real Estate Tax Calculation How To Calculate Property Taxes For Commercial Real Estate Youtube

Real Estate Tax Calculation How To Calculate Property Taxes For Commercial Real Estate Youtube

Paying Property Tax In The Philippines Here S Your 2017 2018 Guide Transferwise

Paying Property Tax In The Philippines Here S Your 2017 2018 Guide Transferwise

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Capital Gains Tax Calculator Real Estate 1031 Exchange

Capital Gains Tax Calculator Real Estate 1031 Exchange

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What Is A 1031 Exchange Asset Preservation Inc

What Is A 1031 Exchange Asset Preservation Inc

Us Expat Taxes Explained Rental Property In The Us

Us Expat Taxes Explained Rental Property In The Us

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg) How Property Taxes Are Calculated

How Property Taxes Are Calculated

Tax Calculator To Estimate Your Tax Refund And Tax Return

Tax Calculator To Estimate Your Tax Refund And Tax Return

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block