Tax-exempt Use Property Qualified Allocations

The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors. 7 2019 Deadline to request approval for a.

Innocent Spouse Relief Granted When A Married Couple Files A Joint Tax Return Each Spouse Is Liable For The Entire Tax Tax Return Country Names Single Status

Innocent Spouse Relief Granted When A Married Couple Files A Joint Tax Return Each Spouse Is Liable For The Entire Tax Tax Return Country Names Single Status

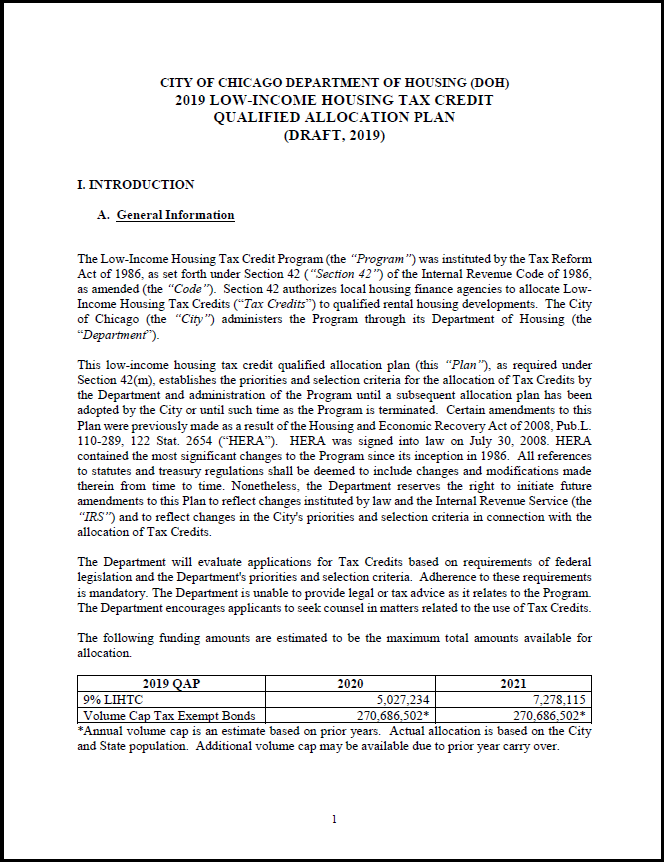

Many terms used in the QAP are defined in Section 42 or in related IRS regulations and readers should refer to these materials for their proper interpretation.

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png)

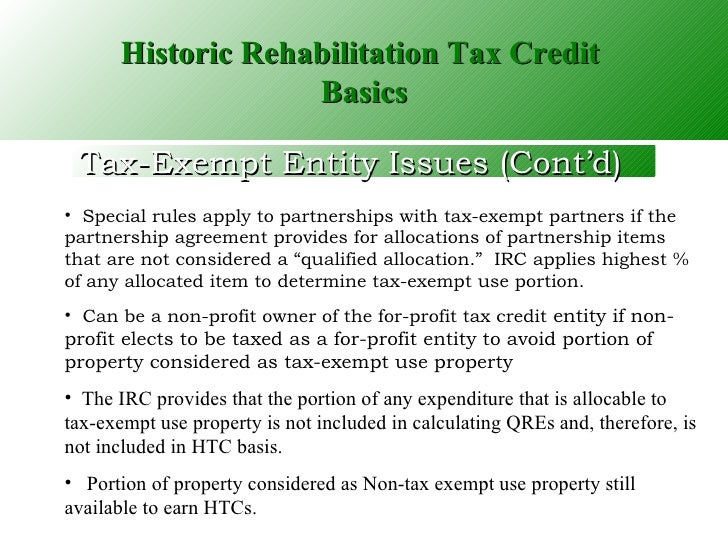

Tax-exempt use property qualified allocations. Unless Ps allocations to E are qualified under section 168j9B 10 percent of each item of partnership property including the building is tax-exempt use property notwithstanding the 35 percent threshold test of section 168j3Biii that is otherwise applicable to 18-year real property. 31 2019 Deadline for submission of CHDO Certification Pre-Application Dec. Otherwise treated as tax-exempt use property is owned by a partnership that has both tax-exempt and taxable partners the proportionate share of the property allocated to the tax-exempt partners will be treated as tax-exempt use property.

Or owned by a partnership that includes such persons and that does not have straight-up qualified allocations-same rules as those that disqualify property for the credit. 2019 HTC training details will be posted on the OHFA website Oct. 2020-2021 Qualified Allocation Plan Page 6.

Tax-exempt use property5 The extensive tax-exempt use property rules in section 168h are not intuitive making the provision a trap for the unwary. If private business use of the Project were for example 44 percent in a year the Qualified Equity would be allocated to 30 percent 30x private business use and proceeds of the Bonds would be allocated to the excess that is 14 percent or 14x resulting in private business use of the Bonds in that year of 20 percent 14x70x. Under 168h6 if any property that is not otherwise tax-exempt use property under 168h is owned by a partnership that has both a tax-exempt entity and a person who is not a tax-exempt entity as partners and any allocation to the tax-exempt entity of partnership items is not a qualified allocation an amount equal to the tax- exempt entitys proportionate share of the property generally is treated as tax-exempt use property.

501a and c3 as amended for the purpose of constructing or rehabilitating. The Qualified Allocation Plan QAP contains OHFAs procedures and policies for the distribution of Ohios allocation of housing tax credits. With out a tax-exempt entity there can be no use by an exempt entity and hence no tax.

It has been an ad valorem tax meaning based on value since 1825. Multiple Points of Use Exemption Certificate. The real property tax is Ohios oldest tax.

2019 Application materials posted to the OHFA website OctNov. Dates Applicant OHFA Oct. Under 168 h 6A property may be tax-exempt use property if it is held by a tax-exempt entity in a partnership that has tax- exempt and non-tax-exempt partners and if the partnership allocations are not qualified allocations as defined by 168 h 6B.

--For purposes of subparagraph A the term qualified allocation means any allocation to a tax-exempt entity which--. Property allocated to the tax-exempt partners will be treated as tax-exempt use property. Any allocation to the tax-exempt entity of partnership items must be a qualified allocation meaning.

This certificate may be used as a multiple points of use form pursuant to section 5739033B of the Ohio Revised Code by a business purchaser of any services or computer software when the services or software is available for concurrent use in multiple locations. Tax-exempt use property generally property leased to a tax-exempt person. Tax-Exempt Entities At the heart of section 168h is the definition of tax-exempt entity.

The term tax-exempt use property shall not include any portion of a property if such portion is predominantly used by the tax-exempt entity directly or through a partnership of which such entity is a partner in an unrelated trade or business the income of which is subject to tax under section 511. Except as otherwise provided in this subsection the term tax-exempt use property means that portion of any tangible property other than nonresidential real property leased to a tax-exempt entity. Expenditures made on buildings that are on tax-exempt use property cannot be considered qualified rehabilitation expenditures.

Property becomes tax-exempt use property only if the allocation to the tax-exempt entity is not a qualified allocation7A qualified allocation is any partnership allocation to a tax-exempt entity that is consistent with the entitys being allocated the same share of partnership tax items during. 1 Real property held by an organization organized and operated exclusively for charitable purposes as described under section 501c3 of the Internal Revenue Code and exempt from federal taxation under section 501a of the Internal Revenue Code 26 USCA. The contemplated limited circumstance in which the Treasury Department and the IRS are considering aggregate treatment for partnerships for private activity bond purposes involves partnership allocations similar to those treated as qualified allocations to tax-exempt entities for purposes of the tax-exempt use property provisions under section 168 h 6.

Bonus Depreciation Available to taxpayer who first places in service. An amount equal to such tax-exempt entitys proportionate share of such property shall except as provided in paragraph 1D be treated as tax-exempt use property. Section 168h defines tax-exempt use property.

Multiple Points of Use. According to an exception provided in Section 47c 2Bvl a property is considered tax-exempt use if 50 percent or more of the property is leased to a tax-exempt entity such as Emerald City in a disqualified lease. 168 h Tax-exempt use property.

Any allocation to the tax-exempt entity of partnership items must be a fiqualified allocationfl meaning equal distribution of income gain loss credit and basis and must have fisubstantial economic effectfl the Treasury Regulations. For purposes of this section A Property other than nonresidential real property.

Https Www Irs Gov Pub Irs Tege Part2h02 Pdf

Https Www Irs Gov Pub Irs Tege Teb2 Lesson4 Pdf

Https Www Chathamborough Org Chatham Government Utilities Sewer 20frequently 20asked 20questions Pdf

Exhibit 2 01 Membership Interest Purchase Agreement

Exhibit 2 01 Membership Interest Purchase Agreement

Https Www Mass Gov Doc Chapter 4 Property Tax Classification Download

Https Www Civicfed Org File 4794 Download Token 3ifci8di

![]() What Proposed Regulations On The Fractions Rule Mean For Tax Exempt Organizations

What Proposed Regulations On The Fractions Rule Mean For Tax Exempt Organizations

Https Www Ubs Com Us En Wealth Management Planning Retire Planning Ira Rollover Jcr Content Mainpar Toplevelgrid Col1 Linklist 180342600 Link 1205328650 File Bgluay9wyxrops9jb250zw50l2rhbs9hc3nldhmvd21hl3vzl3noyxjlzc9kb2n1bwvudhmvzmfxlxvidgkucgrm Faq Ubti Pdf

/ScreenShot2021-02-11at9.35.53AM-18b6615f7bd449e6a035c8e074b14521.png) Form 4562 Depreciation And Amortization Definition

Form 4562 Depreciation And Amortization Definition

Https Www Irs Gov Pub Irs Wd 201510031 Pdf

Https Www Irs Gov Pub Irs Drop N 05 29 Pdf

Https Www Nchfa Com Sites Default Files Page Attachments 13appendixg Pdf

Https Www Irs Gov Pub Irs Tege Eotopicn87 Pdf

City Of Chicago Qualified Allocation Plan

City Of Chicago Qualified Allocation Plan

Https Www Gibsondunn Com Wp Content Uploads 2018 10 Cannon The 100 Percent Tax Exempt Use Property Trap Funds Beware Tax Notes 09 03 18 Pdf

Https Www Irs Gov Pub Irs Wd 201901004 Pdf

Structuring And Financing A Tax Credit Deal 1

Structuring And Financing A Tax Credit Deal 1

Https Www Enterprisecommunity Org Sites Default Files Media Library Financing And Development Asset Management 2016 Tax Return Prep Guide Pdf

Https Www Phfa Org Forms Multifamily News News 2019 2020 Tax Exempt Rfp Pdf