What Assets Are Exempt From Creditors In Texas

That is personal property is exempt unless it goes over a monetary value listed in the statute. For example clothing basic household furnishings your house and your car are commonly exempt as long as theyre not worth too much.

What Is An Automatic Stay In A Texas Bankruptcy Boerne Bankruptcy Attorney

Some items of property are exempt from liens or seizure under the Texas Constitution Texas Property Code 41001 Texas Property Code 42002 Texas Property Code 420021 the Texas Homestead Law and other laws.

What assets are exempt from creditors in texas. The primary residence of a debtor the homestead. And the debtors IRA or 401 k. Assets exempt from general creditor claims in Texas include.

However taxable distributions are not exempt as soon as they leave the plan administrator. Court-Ordered Child Support and Spousal Support. Texas exempt property includes.

To see this statute click here. 1 100000 for a family. Texas has a similar statute that is just as strong as Floridas.

2 Cash value proceeds of an annuity or insurance policy are deemed exempt from creditors and lawsuits. In keeping with Texas frontier spirit you can even keep two horses if you wish. This act exempts IRA funds from the bankruptcy estate and thus exempts most unsecured business and consumer debts.

Farming or ranching vehicles and implements. 1 home furnishings including family heirlooms. 3 farming or ranching vehicles and implements.

In addition there are tenancy by the entirety states that offer some judgement protection. Social Security or Social Security Disability Income. Property Code Sections 42001 et seq.

Specifically list the amount and types of exempt personal property including a vehicle for each licensed driver in the household. As the judgment creditors exclusive remedy the debtor-partners or other. A few states notably including Florida and Texas offer an unlimited homestead exemption allowing a homeowner to protect 100 of the value of a primary residence.

Your homestead the house and land you occupy as your main home. ERISA qualified including IRAs Roth IRAs and Keoghs are exempt. In general money held in a retirement plan is exempt.

Jewelry up to a certain point. Texas Property Code sections 42001 and 42002 list out types of property and assets that receive an exemption from creditors. Retirement and Vocational Rehab.

It can also seize your exempt assets such as your home even though most creditors are prohibited from taking that step to collect a debt you may owe to them. Some exempt income includes. Retirement plans and life insurance is exempt from creditor seizure.

This means that the retirement money held in the plan is exempt but most monthly payments to the retiree are not exempt. It protects those funds intended for retirement. 4 tools equipment books and apparatus including boats and motor vehicles used in a trade or profession.

Protection From Creditors in Texas. There are many other types of exemptions to protect you from lawsuits besides the IRA creditor protection in each state. Section 41001 of the Texas Property Code exempts a persons homestead from seizure by creditors.

For example one of these include the homestead exemption that shields some or rarely all of the equity in your home. 2 provisions for consumption. Residents living in sunny Florida have been known to joke that if Florida ever changes their asset protection laws theyre hopping on the next plane to Texas.

In most states though the exemption is capped at a prescribed dollar amount sometimes doubled for married couples. All states have designated certain types of property as exempt or free from seizure by judgment creditors. However any property you have that is not exempt can be taken to pay your debts.

Benefits for Veterans. Or 2 50000 for a single adult. A The following personal property is exempt under Section 42001a.

Nontaxable rollover distributions are also exempt. What Is Exempt Property in Texas. How Asset Protection Works Asset protection planning helps protect your assets by.

May exempt certain kinds of personal property from the claims of creditors as long as the combined fair market value of the property does not exceed. A well-crafted and correctly. The list above and even more items are exempt from debt collection under Texas laws from judgment and the owner can make a claim of exemption of enforcement of judgment in the event a creditor tries to seize these assets.

A list of exempt personal property can be found in the Texas Property Code Section 42. Tools equipment books or apparatus including boats and motor vehicles used in a trade or profession. In Texas up to 10 acres of an urban family home plus improvements.

For a single person 30000 and for a married person 60000 of personal property is exempt from seizure. Cash in bank accounts or under your mattress is not exempt. There are two types of property exempted those subject to aggregate limitations.

Both traditional and Roth IRAs are subject to a full exemption limit of 1 million for all such IRAs.

Https Www Tarrantcounty Com Content Dam Main Probate Courts Probate Court 2 Dependent Administrators Guide Pdf

Https Texaslawhelp Org File 1095 Download Token Jbqcxxow

Spendthrift Clause Video Education Level Clause Investment Banking

Spendthrift Clause Video Education Level Clause Investment Banking

Texas Law Puts Protective Umbrella Over Debtors

Sued For Debt These 5 Assets Are Protected In Texas Charles Kennedy P C

Sued For Debt These 5 Assets Are Protected In Texas Charles Kennedy P C

What Interest Do I Pay In A Chapter 13 Bankruptcy In 2020 Home Equity Loan Home Equity Interest Only Loan

What Interest Do I Pay In A Chapter 13 Bankruptcy In 2020 Home Equity Loan Home Equity Interest Only Loan

What Does It Mean To Be Judgment Proof In Texas Seth Kretzer

What Does It Mean To Be Judgment Proof In Texas Seth Kretzer

Probate Creditors Rights Under Texas Law Deeds Com

Probate Creditors Rights Under Texas Law Deeds Com

Protection From Creditors In Texas Green Law Blog

Can Executor Sell The Property Without All Beneficiaries Approving In Texas Things To Sell Sell Property Canning

Can Executor Sell The Property Without All Beneficiaries Approving In Texas Things To Sell Sell Property Canning

Http Www Txnb Uscourts Gov Sites Txnb Files Basic Exemptions Pdf

What Does A No Asset Chapter 7 Bankruptcy Mean Simer Tetens

What Does A No Asset Chapter 7 Bankruptcy Mean Simer Tetens

Texas Bankruptcy Exemptions Dallas Bankruptcy Attorney Allmand Law Firm Pllc

Texas Bankruptcy Exemptions Dallas Bankruptcy Attorney Allmand Law Firm Pllc

Http Daviswillms Com Yahoo Site Admin Assets Docs Asset Preservation 2016 80154255 Pdf

What Are The Bankruptcy Exemptions In Texas Super Lawyers Texas

What Are The Bankruptcy Exemptions In Texas Super Lawyers Texas

Covid 19 Debt Collection And Garnishment Faqs Lone Star Legal Aid

Covid 19 Debt Collection And Garnishment Faqs Lone Star Legal Aid

Asset Protection In Texas Lonestarlandlaw Com

Asset Protection In Texas Lonestarlandlaw Com

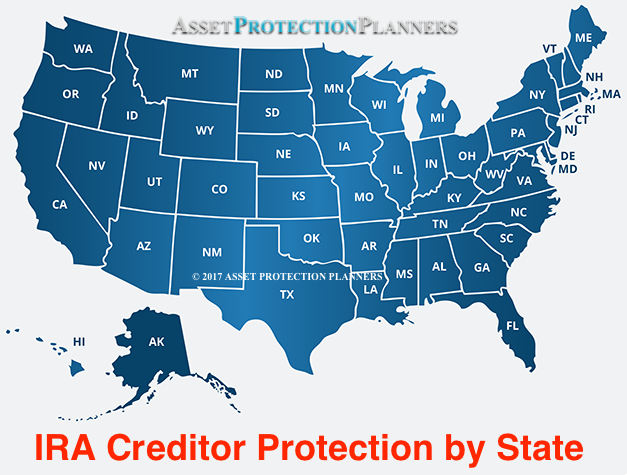

Ira Creditor Protection By State Lawsuit Exemptions For Rollover

Ira Creditor Protection By State Lawsuit Exemptions For Rollover