How To Look Up Nyc Property Taxes

Bills are generally mailed and posted on our website about a month before your taxes are due. You can ask for the credits to be applied to other tax periods or you can request a refund by completing a Property Refund Request form.

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

Co Op Vs Condo In Nyc A Detailed Comparison And Faq Hauseit Buying A Condo Real Estate Infographic Real Estate Buying

Property Tax Information Orange Countys Image Mate Online system allows you to search Orange County property by owner name address tax map number or municipality.

How to look up nyc property taxes. Some credits are treated differently. A New York Property Records Search locates real estate documents related to property in NY. Calculating Your Property Taxes NYC property owners receive a property tax bill from the Department of Finance a few times a year.

If you do nothing it will be automatically applied to your next tax bill. Please submit document requests online or through the mail. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property tax assessment records and other documents.

The City Registers office is open in all boroughs except Staten Island. In Public Access you can. Each year Property tax bills are calculated based on the information listed on the Final assessment roll.

Property Tax Credit Lookup tool Use the Property Tax Credit Lookup tool to view and print a list of your STAR and property tax relief credit checks issued in 2020 and prior years. Borough-Block-Lot BBL or parcel numbers identify the location of buildings or properties. This section will help you understand how your property is valued and how those values are used to calculate your property taxes.

Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes. The data presented on this site may not reflect the most recent updates to our records and is not guaranteed to be accurate as of todays date. Look up information about a property including its tax class and market value.

More property tax topics. If you arent sure which county the jurisdiction youre looking for is in click View All Counties and then hit CtrlF to search the page. Any overpaid property tax will be credited to your account.

In most communities school tax bills arrive in early September and may also include library taxes. You may need this number when paying property taxes or completing certain tax or Department of Finance applications. It is part of the Countys commitment to provide 24 hour7 days a week access to real property information via the Internet.

Before you begin youll need. For more information download the Class 1 and Class 2 property tax guides. Find your local assessment roll municipalities outside of New York City Visit the Municipal Profiles application.

If a bank or mortgage company pays your property taxes they will receive your property tax bill. This web page provides information about using the City Register Office. Scroll down to select the content youre looking for regarding local property tax and assessment administration.

You can contact the Tax Map Office online. Weve redesigned the page to provide easy access to content and tools for property owners local officials and real estate professionals. Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics.

You can use this website to review property tax records from the New York counties listed below. Welcome to our new Real Property landing page. Description STAR or Property Tax Relief credit year.

Property Taxes Property Assessments Assessment Lookup How to Challenge Your Assessment Assessment Challenge Forms Instructions Assessment Review Calendar Rules of Procedure PDF Information for Property Owners. Most taxpayers in New York State receive two tax bills each year. You will receive a Property Tax Bill if you pay the taxes yourself and have a balance.

Your prior-year New York State income tax return Form IT-201. To get started please select the county in which the property youre searching for is located. Select search for a city town or village.

Begin Using ACRIS The Office of the City Register records and maintains New York City Real Property and certain Personal Property transfers such as mortgage documents for property in all boroughs except for Staten Island. Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides Reports Private Asset Auctions Get Help. Nassau County Tax Lien Sale Annual Tax Lien Sale Public Notice.

Real Property Tax Law. School tax bills are generally the first to arrive after assessments are finalized. There is no in-person assistance at the Richmond County Clerks Office.

Look up the borough-block-lot number for a specific address. You can view and print the following information regarding your 2017 2018 2019 and 2020 property tax credit checks that have been issued. Our property records tool can return a variety of information about your property that affect your property tax.

Pin On Concepts Trends Interesting Reads

Pin On Concepts Trends Interesting Reads

New York Brownstone Floor Plans Floor Plans New York Brownstone Simple House Plans

New York Brownstone Floor Plans Floor Plans New York Brownstone Simple House Plans

Real Estate Deal Sheet Selling Real Estate Real Estate Estates

Real Estate Deal Sheet Selling Real Estate Real Estate Estates

Rent Roll Overview Nyc Hauseit Nyc Real Estate Rent Rental Income

Rent Roll Overview Nyc Hauseit Nyc Real Estate Rent Rental Income

Manhattan Property Tax Records Manhattan Property Taxes Ny

Manhattan Property Tax Records Manhattan Property Taxes Ny

The Top 10 Biggest Real Estate Projects Coming To Nyc Real Estate Estate Homes Projects

The Top 10 Biggest Real Estate Projects Coming To Nyc Real Estate Estate Homes Projects

Renting An Apartment Nyc Hauseit Rent Nyc Rental Listings

Renting An Apartment Nyc Hauseit Rent Nyc Rental Listings

Condo Vs Co Op Seller Closing Costs In Nyc Closing Costs Condo Nyc

Condo Vs Co Op Seller Closing Costs In Nyc Closing Costs Condo Nyc

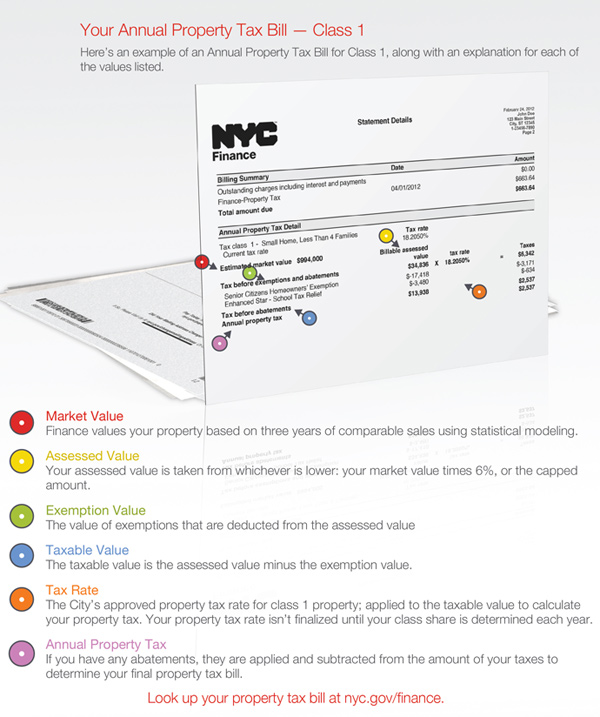

Calculating Your Property Taxes

Calculating Your Property Taxes

Nys And Nyc Real Estate Transfer Tax Overview For Nyc Nyc Real Estate Real Estate Infographic Nyc Infographic

Nys And Nyc Real Estate Transfer Tax Overview For Nyc Nyc Real Estate Real Estate Infographic Nyc Infographic

Neighborhoods Brooklyn Brooklyn Map Map Of New York Brooklyn Neighborhoods

Neighborhoods Brooklyn Brooklyn Map Map Of New York Brooklyn Neighborhoods

Transfer Tax Reform Behind Nyc Luxury Apartment Sales Slump Luxury Sale Nyc Apartment Luxury Mansions

Transfer Tax Reform Behind Nyc Luxury Apartment Sales Slump Luxury Sale Nyc Apartment Luxury Mansions

Perspective Being The Successful Bidder At Auction Is Only The First Step In Obtaining Property With A Tax Lien Being A Landlord First Step Paying Taxes

Perspective Being The Successful Bidder At Auction Is Only The First Step In Obtaining Property With A Tax Lien Being A Landlord First Step Paying Taxes

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

25 Park Row City Hall Empire State Building The Row

25 Park Row City Hall Empire State Building The Row

To Get Legal Help With Estate Tax Planning Issues Call The Experienced Nyc Estate Planning Lawyer At Lawyerland W Estate Planning Education Advocacy Lawyer

To Get Legal Help With Estate Tax Planning Issues Call The Experienced Nyc Estate Planning Lawyer At Lawyerland W Estate Planning Education Advocacy Lawyer

Https Www Hauseit Com Wp Content Uploads 2018 08 How To Prepare A Real Estate Deal Sheet In Nyc Jpg Real Estate Nyc Buying A Condo

Https Www Hauseit Com Wp Content Uploads 2018 08 How To Prepare A Real Estate Deal Sheet In Nyc Jpg Real Estate Nyc Buying A Condo

Pin On Real Estate Investing Tips

Pin On Real Estate Investing Tips