Nyc Property Tax Transitional Value

You must prove that your property is worth less than this number to have the value adjusted by the NYC Tax Commission or Courts. For class 2 properties with more than 10 units and all class 4 properties changes to the assessed value are phased in over five years.

536 W 29th St New York Ny 10001 Mls 753888 Zillow Zillow New York Taxes History

536 W 29th St New York Ny 10001 Mls 753888 Zillow Zillow New York Taxes History

Assessed Value History by Email.

Nyc property tax transitional value. Find Property Borough Block and Lot BBL Payment History Search. For Class 2a b and c properties it is calculated by dividing your Assessed Value by 45. Your prior year savings.

88650 Current transitional assessed total value. Exemptions. All New York City real estate is subject to annual valuation.

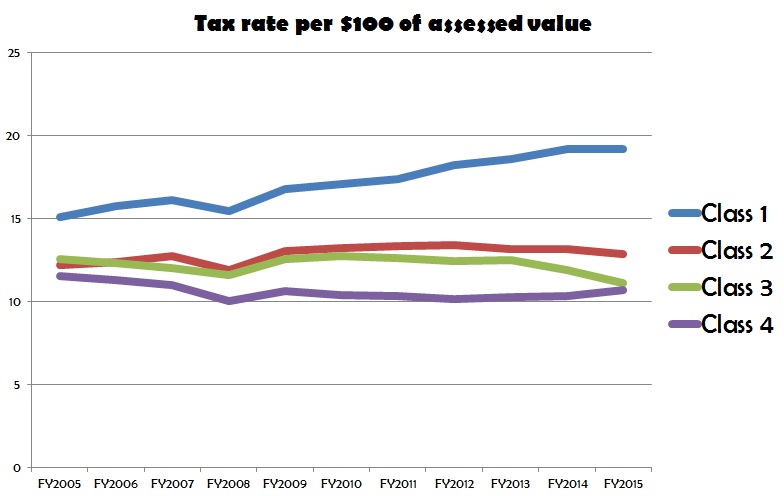

650 651 656 703 707 708 711 718. The assessment rate in turn is dependent upon the propertys tax class. Properties in tax class 1 can count on a 6 assessment rate while those in tax class 2 3 and 4 have a 45 rate applied to assessed value calculations.

6 per year or. As outlined in our post on Assessment Basics a propertys assessed value is determined by applying the assessment ratio to the propertys market value finances estimate of your propertys worth. The transitional value would only increase by 200 percent of the 27000 increase or 5400.

In NYC a propertys assessed value is determined by the market values assessment rate. In 2007 the market value would become 1060000 and the actual assessed value would increase to 477000. Actual assessed value is 45 percent of market value.

A propertys assessment is based on its market value. Taxable assessed value is lower of the two. Property Tax Bills.

Your propertys assessed value or transitional assessed value. For more information download the Class 1 and Class 2 property tax guides. NYC property owners receive a property tax bill from the Department of Finance a few times a year.

Assessments are determined by the assessor a local official who estimates the value of all. The taxes collected by your school district. New York State NYS sets the rates for the STAR Enhanced STAR Senior Citizen Homeowners Disabled Homeowners and Veterans Exemptions.

The taxes collected by your school district. Assessments and market value. New York State NYS sets the rates for the STAR Enhanced STAR Senior Citizen Homeowners Disabled Homeowners and Veterans Exemptions.

New York State NYS sets the rates for the STAR Enhanced STAR Senior Citizen Homeowners Disabled Homeowners and Veteran Exemptions. Your prior year savings. In the 201516 tax year the actual assessed value of Parcel A is 1125000 45 of 25mln.

In any given year there are multiple transitions being applied which results in an actual assessed value and a transitional assessed value for your property each year. Transitional assessed value reflects growth from market value changes phased in over 5 years. If this were a new tax lot the assessed and transitional value in the first year would be 450000 or 450 percent of the market value.

Assume that the transitional assessed value in 201516 is 800000 and the aggregate phase-ins in transitional value equal 150000. The amount of your exemption credit is based upon. 8 per year or.

12042009 Current transitional assessed land value. 30 over five years. For Class 1 properties it is calculated by dividing your Assessed Value based on caps by 6.

Market value is how much a property would sell for under normal conditions. Your prior year savings. This transitional assessed value reflecting the phase-in is compared to the actual assessed.

Data and Lot Information. Your tax class determines what limits apply to your property. The assessed value of a class 2 property with 10 units or less cannot increase by more than.

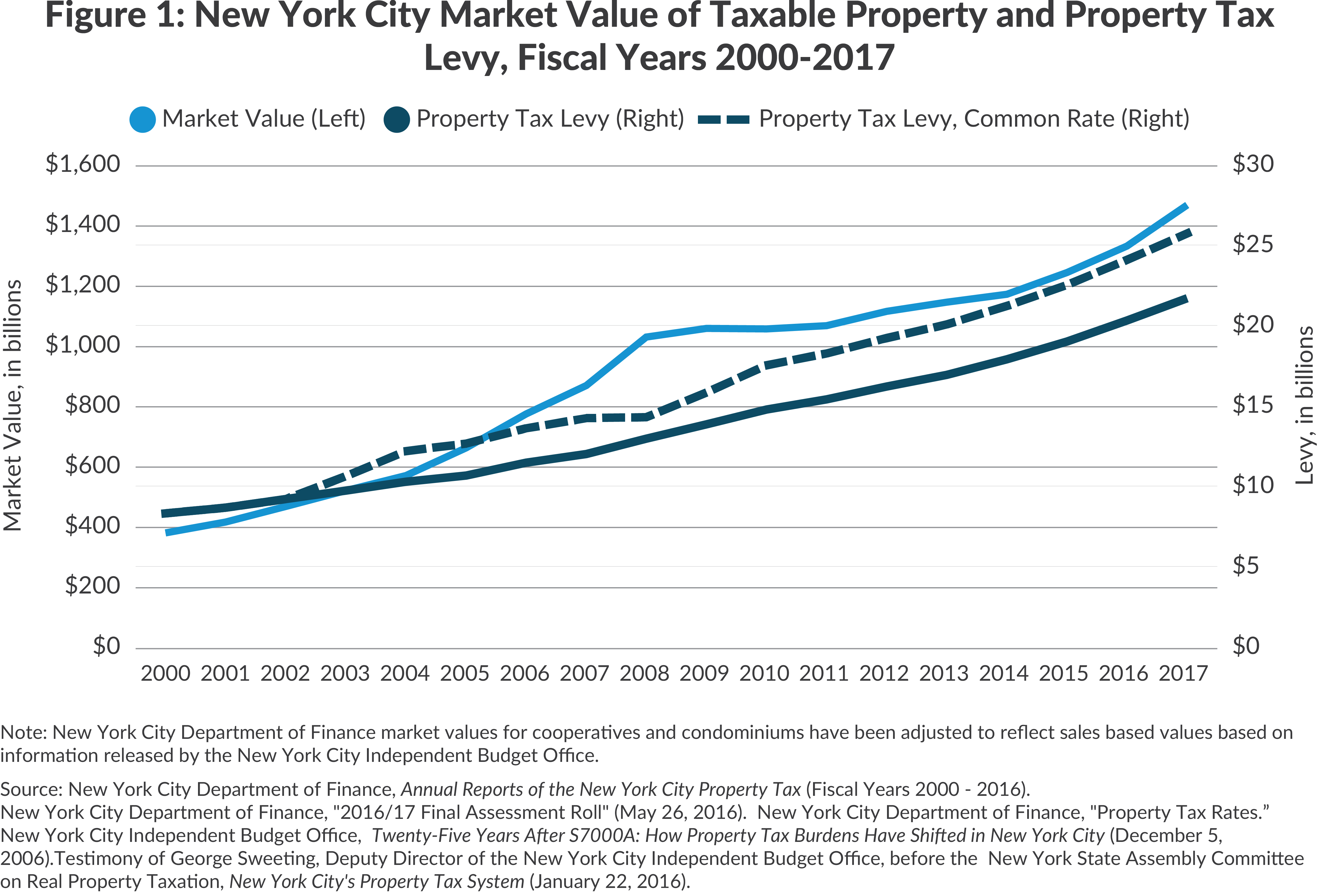

This section will help you understand how your property is valued and how those values are used to calculate your property taxes. Personal property cars jewelry etc is not subject to property taxes in New York State. The Department of Finance assigns market values to all properties in New York City.

The property tax is New York Citys largest source of revenue. Tax class 1 - 6 per year no more than 20 over 5 years. The taxes collected by your school district.

Actual assessed value is 45 percent of market value. It is projected to generate 24 billion in fiscal year 2017 or 44 percent of all City tax revenues and about twice as much as the second largest source the local personal income tax. The amount of your exemption credit is based upon.

New York properties real estate housecondo data New York City New York All US cities. Your propertys assessed value or transitional assessed value. This means that we apply 20 of the change each year for five years.

The assessment ratio for Tax Class One 1 properties is 6 while the assessment ratio for tax class two 2 three 3 and four 4 buildings is 45. The taxes collected by your school district. Your propertys assessed value or transitional assessed value.

Determining Your Transitional Assessed Value. 20 over five years. New York State NYS sets the rates for the STAR Enhanced STAR Senior Citizen Homeowners Disabled Homeowners and Veterans Exemptions.

Market Value is the worth of your property determined by the Department of Finance based on your propertys tax class and the New York State Law requirements for determining market value. We phase in changes to the assessed value of Class 2 properties with more than 10 units and Class 4 properties over a five-year period. Property valuation tax assessments of West 171st Street Manhattan New York City NYC.

Tax classes 2 and 4 - Read about Transitional Assessed Values for information on how your Assessed Values are phased in. Large Rentals 11 Units Net Income Capitalization 45. Your prior year savings.

Your propertys assessed value or transitional assessed value. The amount of your exemption credit is based upon. The amount of your exemption credit is based upon.

Tax class 2a 2b 2c - 8 per year no more than 30 over 5 years for building with 10 or less units.

Https Www1 Nyc Gov Assets Finance Downloads Pdf 17pdf Business Tax Forms Nyc 3a Instr 2017 Pdf

The Numbers On Nyc S Property Tax Non Problem

The Numbers On Nyc S Property Tax Non Problem

Http Helenrosenthal Com Wp Content Uploads 2011 04 Tax Assessments Fact Sheet Pdf

Https Comptroller Nyc Gov Wp Content Uploads Documents Fp09 138a Pdf

Assessment Basics Part Ii Mgny Consulting

Http Www Cynthiaramirez Nyc Uploads 1 1 8 7 118704813 Class 1 Guide 1 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf 18pdf Business Tax Forms Nyc 3a Instr 2018 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf 99pdf Rptsum00 Pdf

Determining Your Transitional Assessed Value

Determining Your Transitional Assessed Value

Calculating Your Property Taxes

Calculating Your Property Taxes

Https Www1 Nyc Gov Assets Finance Downloads Pdf Reports Reports Property Tax Nyc Property Fy20 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf 06pdf Taxpol Proptax 06 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf 14pdf Business Tax Forms Nyc 3a Instr 2014 Pdf

Https Www1 Nyc Gov Assets Finance Downloads Pdf 13pdf Business Tax Forms Gct Nyc 3a Instr 2013 Pdf

Http Www Nyc Gov Html Law Downloads Pdf Procurement Book Pdf

Https Comptroller Nyc Gov Wp Content Uploads Documents Housing Authority Financial Statements 2015 Year Ended Dec 31 2014 Pdf

New York City Property Taxes Cbcny

New York City Property Taxes Cbcny

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Understanding The Difference Between Market Value And Assessed Value Propertyshark Real Estate Blog

Http Arc Riverdale Com Wp Content Uploads 2015 05 Coop Condo Property Tax Guide Pdf