Property Holding Company Ireland

There are no minimum equity requirements for an Irish private company. The Irish Holding Company Investors into European Union EU countries and countries with which Ireland has signed a double tax treaty should make themselves aware of the potential tax efficiencies that can be achieved by using an Irish holding company for their investments.

Top 10 Commercial Property Megadeals In 2019

Companies pay tax at a rate of 25 on rental profits.

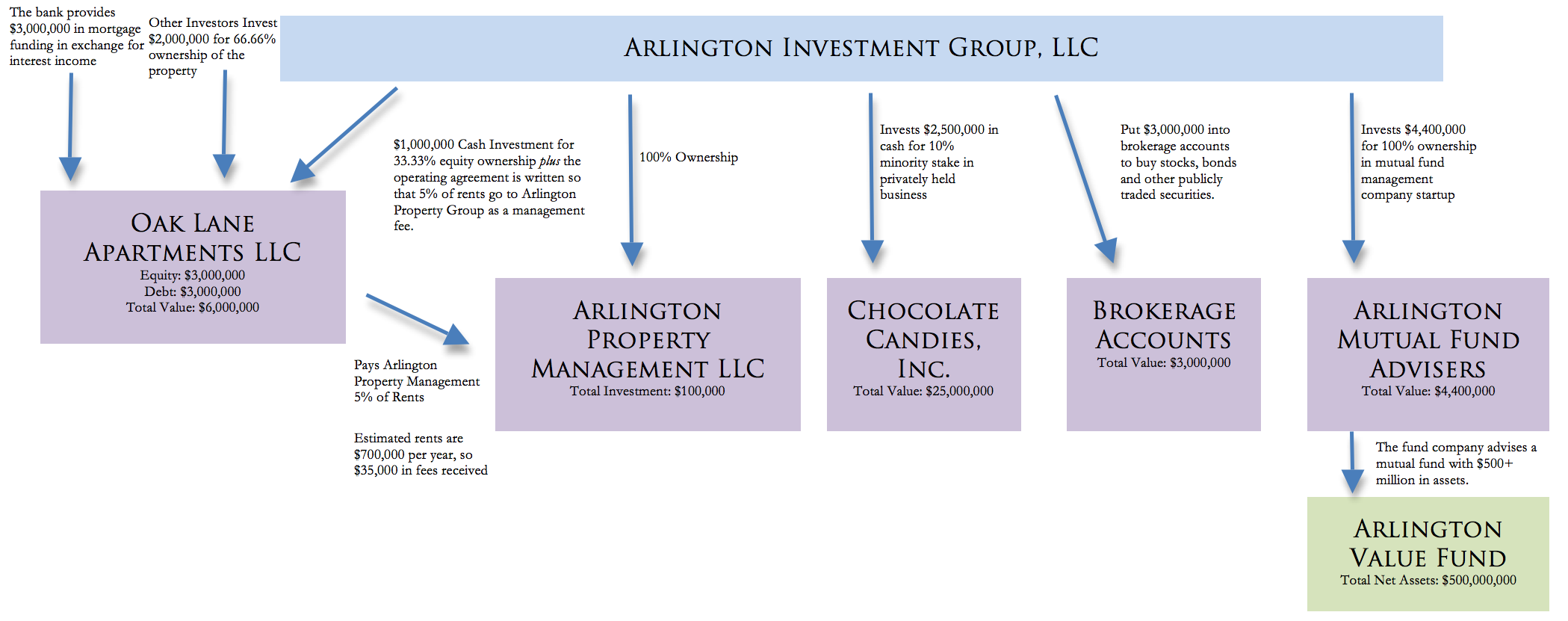

Property holding company ireland. Hence an overall saving of 125 on such income in achieved. Businesses that are completely owned by a holding company are referred to as wholly. In this case study I now want to move that property into my newly formed LLC.

The following conditions must be satisfied before the exemption can apply. The disposal by an Irish holding company of shares in a subsidiary will be exempt from Capital Gains Tax CGT where certain criteria are satisfied. Property and land holding records in Ireland are more important than they might otherwise be because of the absence of 19th century census records.

The biggest trend thats taken place during my time in property is the huge and sudden shift to people buying properties within companies. The property will be owned under Business Holding Company LLC with a property manager in charge of operations. Examples include the transfers of shares and certain documents provided in the articles company law contract law and property law.

Country properties range from multi million euro estates and thoroughbred facilities to smaller sites for building. Use of Companies Companies can also be used to purchase property. Companies in Ireland are separate legal entities which means they can take out loans enter contracts and be sued.

Income tax is applied to rent received by individuals and non resident companies. The holding company must own a minimum of 5 of the shares in the subsidiary. Hegarty Sons is a building and civil engineering company established in Ireland in 1925.

8162660 was incorporated on 23 Feb 2021 in New Zealand. As an Irish private limited company or as a public limited company. If such profits were taken out of the company by the individual owners almost half of it would go in the payment of taxes.

Irish Land and Farms specialise in marketing rural properties with land in the Republic of Ireland and Northern Ireland. The Company undertakes projects throughout Ireland from offices in Dublin Cork and Limerick and has been associated with many of the countrys major developments in the com. They are often the only way of filling in the gaps and fortunately are very extensive.

340 Employees 350 million turnover. The management company would be a trading entity and hence any income earned is taxable at 125 whilst being tax deductible in the property holding company at 25. An Irish resident company or a foreign company that holds the real property as part of or on account of a trade carried on in Ireland will be subject to Irish corporation tax at 25 on the rental profits.

A holding company in Ireland is registered for the sole purpose of owning and managing other legal entities. To do so I would obtain a deed file the necessary paperwork. Trying to find a rural small holding for sale in Ireland and the UK.

Browse our latest agricultural property listings from top rated estate agents. Ireland has become an attractive business destination for the registration of holding companies due to numerous tax advantages and tax exemptions for example this type of company can benefit from a capital gains participation exemption. There are two ways to incorporate a holding company in Ireland.

The main reason for opening a holding company in Ireland is the taxation system. A holding company incorporated in Ireland must take one of the forms provided for by Irish corporate law. Anyone holding 25 or more of company shares on the RBO website.

It also assists in relieving the impact of the close company surcharge. Up until 2015 it was very much a minority choice. There was no compelling need for many people and mortgages for companies were much less competitive.

The downside is that many emigrants were not from land owning families. IRELAND PROPERTY HOLDINGS LIMITED. Acquiring properties can make a good form of investment for after tax profits retained in a company.

Their business is recorded as NZ Limited CompanyThe Companys current operating status is Registered. The low corporate tax and the extended network of double tax treaties Ireland has with many countries provide an excellent environment for holding companies. The main advantage when registering an Irish holding company as private limited company is that there are no minimum share capital requirements.

IRELAND PROPERTY HOLDINGS LIMITED Company No. Holding companies may also own property such as real estate patents trademarks stocks and other assets. We offer for sale and rental farms and country houses equestrian properties forestry and smallholdings.

The most commonly used structure for a holding company is a private limited liability company or a private unlimited liability company. Lets say I purchased an apartment complex before starting Business Holding Company LLC.

Establishing A Holding Company Holding Company Company Infographic

Establishing A Holding Company Holding Company Company Infographic

Why A Property Company May Be A Bad Idea Property Secrets

Why A Property Company May Be A Bad Idea Property Secrets

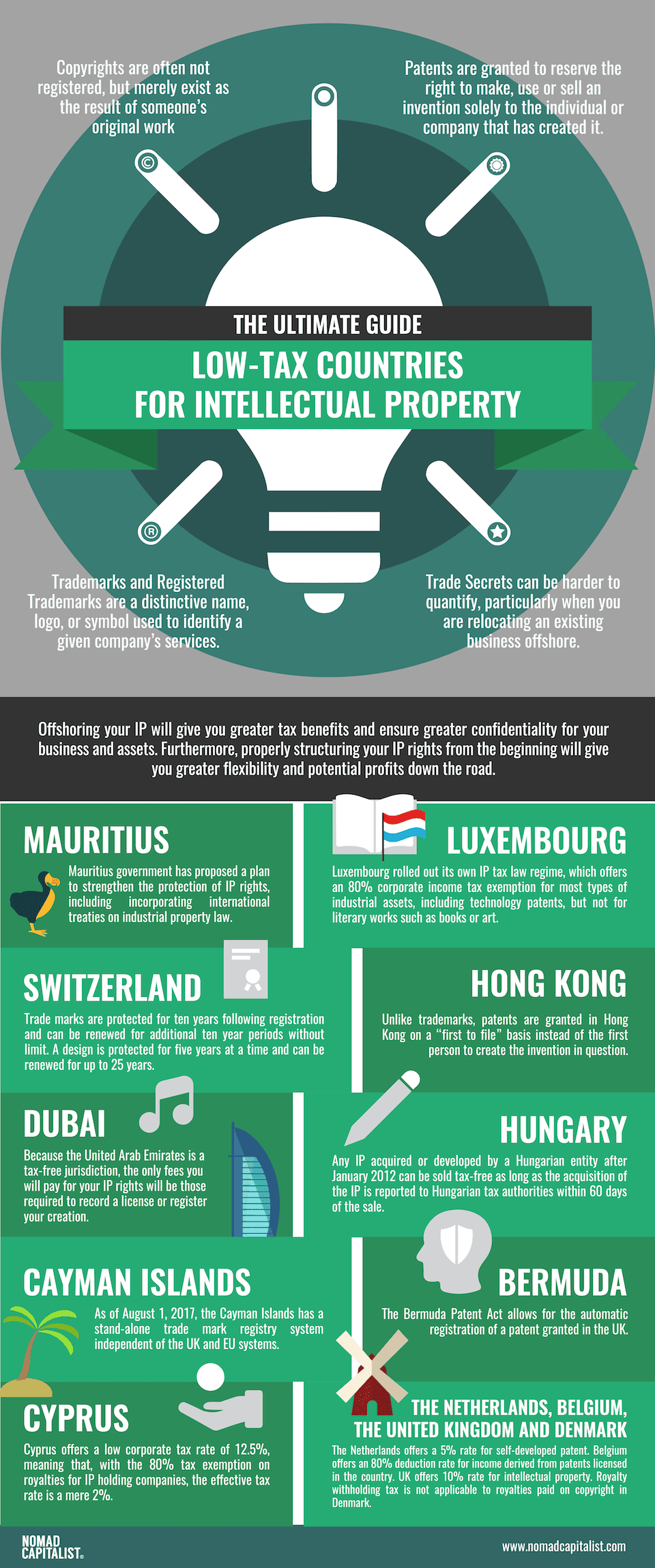

Low Tax Countries For Intellectual Property The Ultimate Guide Nomad Capitalist

Low Tax Countries For Intellectual Property The Ultimate Guide Nomad Capitalist

Roles Responsibilities Of A Company Shareholder

Roles Responsibilities Of A Company Shareholder

All You Need To Know About Holding Companies In Singapore

All You Need To Know About Holding Companies In Singapore

How To Form A Holding Company 9 Steps With Pictures Wikihow

How To Form A Holding Company 9 Steps With Pictures Wikihow

Using Holding Companies As A Property Investor Optimise

Using Holding Companies As A Property Investor Optimise

Irish Limited Company Designated Activity Company The Key Difference

Irish Limited Company Designated Activity Company The Key Difference

Why Choose Ireland To Develop And Manage Intellectual Property

Why Choose Ireland To Develop And Manage Intellectual Property

Https Www Cpaireland Ie Cpaireland Media Education Training Study 20support 20resources P2 20adv 20taxation Relevant 20articles Ireland S Holding Company Regime Relief For The Disposal Of Shares In A Subsidiary Pdf

Dublin Property Firm Bought Stardust Site On Behalf Of Foreign Investors Group

Dublin Property Firm Bought Stardust Site On Behalf Of Foreign Investors Group

The Advantages Of The Uk As A Location For A Holding Company Alliotts

The Advantages Of The Uk As A Location For A Holding Company Alliotts

About Us Liberty Insurance Ireland

About Us Liberty Insurance Ireland

Balmoral International Land Holdings Plc

Thinking Of Buying Property In Ireland Amorys Solicitors

Thinking Of Buying Property In Ireland Amorys Solicitors

Why Indian Startups Incorporate In Singapore A 2020 Guide Corporateservices Com

Why Indian Startups Incorporate In Singapore A 2020 Guide Corporateservices Com