Property Investment Return Rate

Good Rates of Return on Rental Property. Cap rates vary by location and type of property but typically a good cap rate ranges from 4 percent to 10 percent or higher.

Vacation Rentals Huge Rents Any Profits Vacation Rental Management Rental Property Real Estate Rentals

Vacation Rentals Huge Rents Any Profits Vacation Rental Management Rental Property Real Estate Rentals

The income return and the capital return.

Property investment return rate. The cap rate is a rate that helps investors evaluate a real estate investment. The spreadsheet assumes the loan is a fixed rate loan. It seems counter-intuitive that the difference between a 10 return and a 20 return is 6010x as much money but its the nature of geometric growth.

Whether 6 makes a good return on your investment is up to you to decide. Divide the annual return 9600 by the amount of the total investment or 110000. According to the NCREIF definition the total return on a real estate investment is the sum of two components.

According to the Index the average return on investment in the US is 86. Thats a total of 180000 in profit over 10 years. Also explore hundreds of other calculators addressing real estate personal finance math fitness health and many more.

Affordability and returns on rentals in metropolitan coastal cities tend to be poor yet thats where many aspiring rental investors live. In general however to make real estate investing worthwhile many investors aim for returns that match or exceed the average returns on the SP 500. If youre in the 28 tax bracket youll pay a 28 tax on short-term capital gains.

Its most often used for commercial property investments such as office buildings hotels or. The historical average SP 500 return is 10. Capitalization rate or cap rate is a metric used to determine the rate of return on real estate.

Divide the annual return R96 000 R30 900 R126 900 by the amount of the total investment R1 03 million ROI R126 900 R103 million 0123 or 123 ROI is 123. Indeed if every property investor achieved these returns Australia would have a lot more investors with more than 2 properties than the current 10. If you can find higher-quality tenants in a nicer neighborhood then 6 could be a great return.

In 2017 the average cap rate in San Francisco hovered near 51. ROI 9600 110000 0087 or 87. It turns it into 8282 billion.

Residential cap rates generally fall within 4 percent to 10 percent. The IRS taxes you on any net profits you get out of a property when you sell it. Return yield and cap rate are some of the most commonly used terms in the real estate investment industry.

Les Corts and Sarrià - Sant Gervasi were the less profitable districts in Barcelona to purchase a house to rent it out in both districts the rate of return of investment in rental housing stood. 105 per annum is a great rate of return and most investors would take that every day of the week. Youve almost tripled your money.

I want to buy a rental property but the numbers dont work in the city where I live. If youre flipping the property and youve owned it for less than a year you pay short-term capital gains tax which is the same rate as your marginal income tax rate. If the property is bonded the profitability is worked out as follows.

Your propertys net operating income is 1000 per month or 12000 per year. Not only have you made an 8 annual return on your property investment but youve also made a 100000 profit. Your ROI was 87.

With that number in mind many real estate investors feel a ten percent return on an investment property is good while other investors wont look at a property with less than double that amount. Your cap rate is 12000 200000 006 or 6. Commercial real estate on the other hand has an average return on investment of 95.

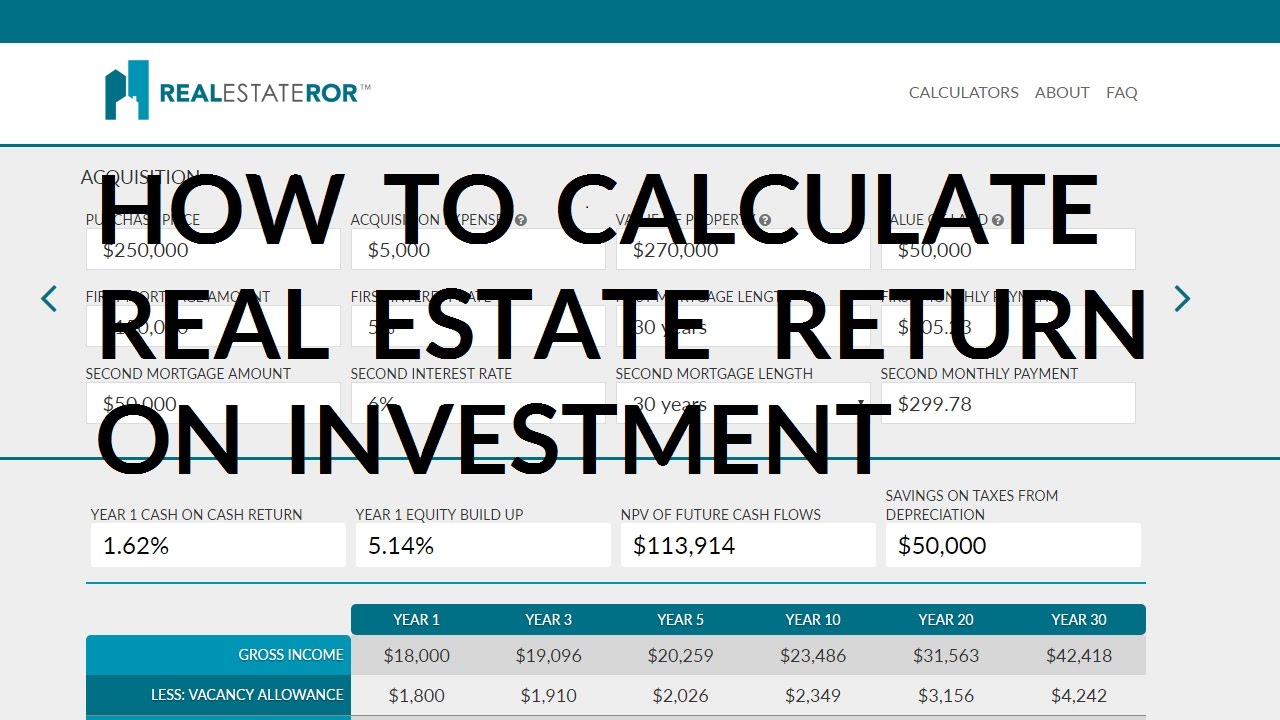

Another example is illustrated in the chart below. The cap rate percentage is the same regardless of whether you have a loan or own the property outright. Free rental property calculator estimates IRR capitalization rate cash flow and other financial indicators of a rental or investment property considering tax insurance fees vacancy and appreciation among other factors.

Unfortunately results vary dramatically depending on where you choose to invest. To calculate the propertys ROI. The term return in real estate investment terminology refers to total return and is the same as the internal rate of return IRR.

To calculate the propertys ROI. Its a common conundrum for would-be rental investors. The average rate of return heavily depends on the type of rental property.

The higher the cap rate the better the return on investment. The cap rate formula is the net operating income divided by the property value. The same 10000 invested at twice the rate of return 20 does not merely double the outcome.

Residential rental properties for instance have an average return of 106. On average anything above 15 of ROI is a good return on real estate investment. Enter your down payment fees and interest rate to calculate the initial investment and total debt.

The cash-on-cash return is where you see the effect of leveraging the banks money.

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Re Real Estate Postcards Real Estate Infographic Property Buying Guide

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Re Real Estate Postcards Real Estate Infographic Property Buying Guide

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

Rental Property Cash Flow Real Estate Investing Rental Property Rental Property Investment Rental Property Management

Investing Rental Property Calculator Determines Cash Flow Statement De Real Estate Investing Rental Property Rental Property Investment Real Estate Rentals

Investing Rental Property Calculator Determines Cash Flow Statement De Real Estate Investing Rental Property Rental Property Investment Real Estate Rentals

Here Are The Top 12 Real Estate Investing Calculations You Need To Know To Invest In Rental Properties Real Estate 101 These

Here Are The Top 12 Real Estate Investing Calculations You Need To Know To Invest In Rental Properties Real Estate 101 These

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Investment Property For Sale

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Investment Property For Sale

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Wealth Calculator

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Wealth Calculator

Buy To Let Property Investment Taking You The Next Step Investing Investment Property Rental Income

Buy To Let Property Investment Taking You The Next Step Investing Investment Property Rental Income

What Is A Good Cap Rate Real Estate Investing Rental Property Real Estate Investing Real Estate Exam

What Is A Good Cap Rate Real Estate Investing Rental Property Real Estate Investing Real Estate Exam

Example Of How You Can Claim Tax From An Investment Property Rental Property Investment Real Estate Investing Rental Property Rental Property Management

Example Of How You Can Claim Tax From An Investment Property Rental Property Investment Real Estate Investing Rental Property Rental Property Management

What Is A Good Rate Of Return On A Real Estate Investment Property Real Estate Investing Investing Investment Property

What Is A Good Rate Of Return On A Real Estate Investment Property Real Estate Investing Investing Investment Property

Profit On Rental Properties Real Estate Investing Rental Property Rental Property Management Rental Property

Profit On Rental Properties Real Estate Investing Rental Property Rental Property Management Rental Property

Investment Property Budget Rental Income Calculator Property Etsy Budget Calculator Investing Budgeting

Investment Property Budget Rental Income Calculator Property Etsy Budget Calculator Investing Budgeting

How To Figure Cap Rate Real Estate Investor Rental Property Investment Rental Property Management

How To Figure Cap Rate Real Estate Investor Rental Property Investment Rental Property Management

How To Figure Cap Rate Rental Property Investment Rental Property Management What Is Cap

How To Figure Cap Rate Rental Property Investment Rental Property Management What Is Cap

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy In 2021 Rental Property Management Rental Property Real Estate Investing

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Investing Rental Property

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Investing Rental Property

Investing In Rental Property Rental Property Investment Investing Investment Property

Investing In Rental Property Rental Property Investment Investing Investment Property

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Income Property Management

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Income Property Management

Investing Rental Property Calculator Roi Calculators Ideas Of Calcula Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment

Investing Rental Property Calculator Roi Calculators Ideas Of Calcula Real Estate Investing Rental Property Real Estate Rentals Rental Property Investment