Property Plant And Equipment Transfer To Investment Property

The entity can never transfer property into another classification once it is classified as investment property 15. Citation needed This can be compared with current assets such as cash or bank accounts described as liquid assetsIn most cases only tangible assets are referred to as fixed.

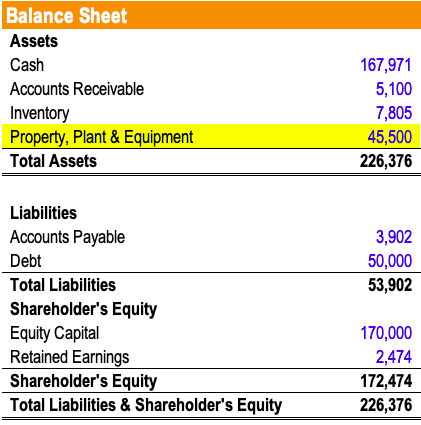

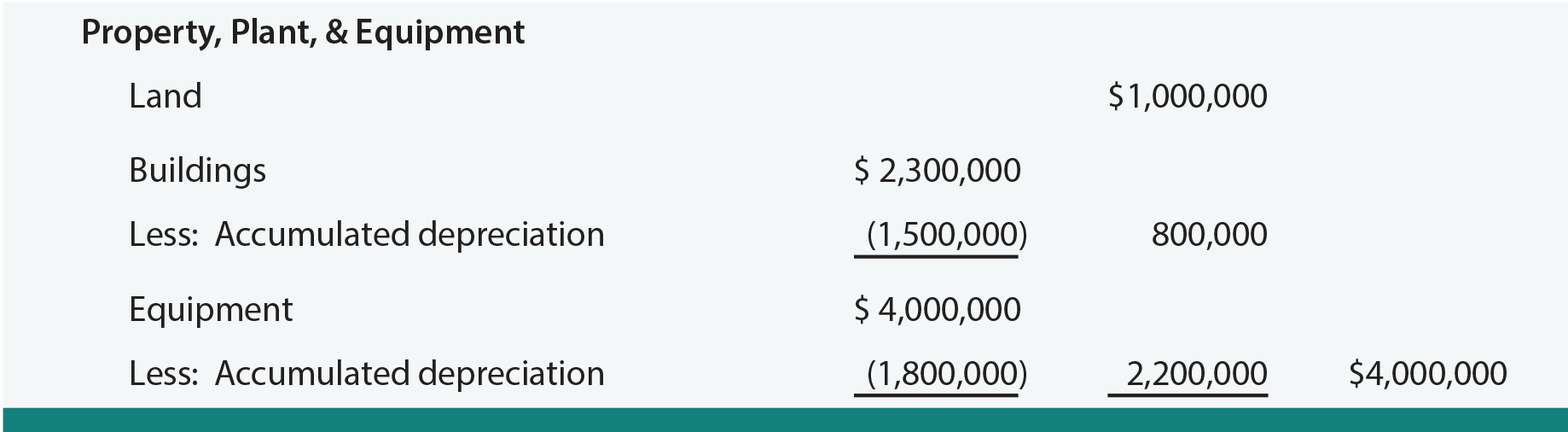

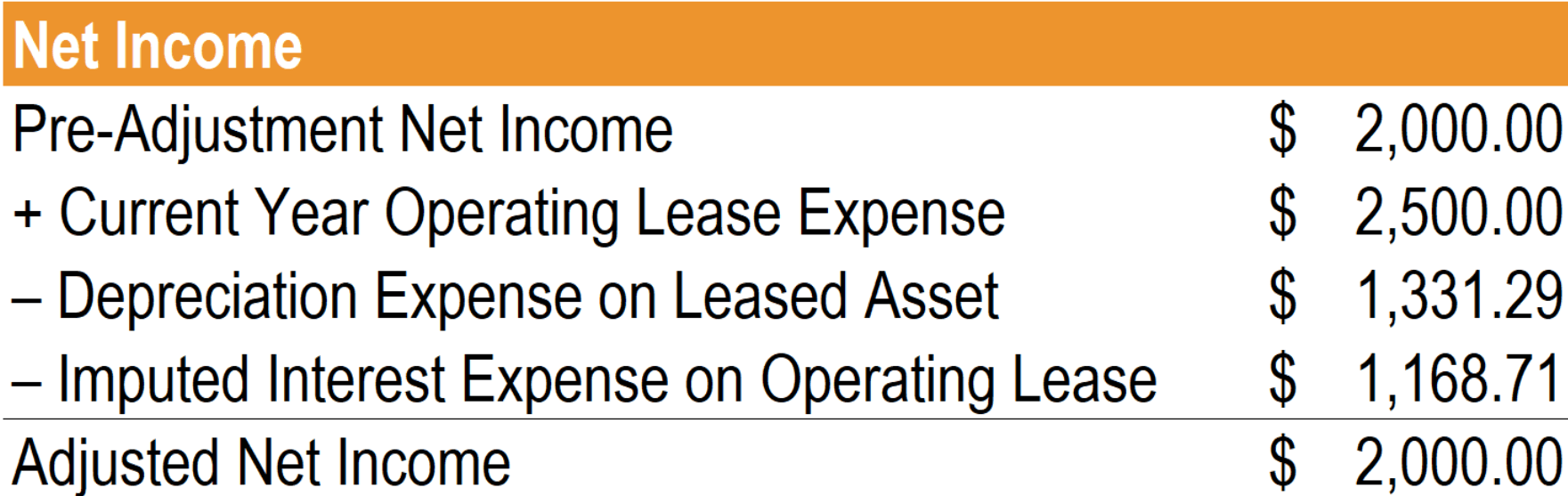

Impact Of Operating Leases Moving To Balance Sheet

Impact Of Operating Leases Moving To Balance Sheet

Investment properties are held for the purpose of earning rentals or capital appreciation or both.

Property plant and equipment transfer to investment property. Transfers from investment property to property plant and equipment are appropriate a. For example maintenance or security services are seen as insignificant. This is the key difference between IAS 16 and IAS 40.

The total value of PPE can range from very low to extremely high compared to total assets. Overview of steps involved in transferring assets. IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment.

Reading 26 LOS 26n. A When there is change of use. Property plant and equipment are tangible assets that are held for use in production or supply of goods or services for rental to others or for administrative purposes and are expected to be used during more than one period.

SFAS 144 and Accounting Standards Codification ASC 360 Property Plant and Equipment. D The entity can never transfer property into another classification on the balance sheet once it is classified as investment property. Fixed assets also known as long-lived assets tangible assets or property plant and equipment PPE is a term used in accounting for assets and property that cannot easily be converted into cash.

Property Plant and Equipment. Property plant and equipment Investment property whose fair value cannot be measured on an ongoing basis It is important to note that this type of investment property will only be measured in terms of s17 however the disclosure will made be made in accordance with s16 investment property. Property plant and equipment are tangible assets meaning they are physical in nature or can be touched.

When a property ceases to meet the definition of an investment property the deemed cost for subsequent accounting as property plant and equipment shall be its fair value at the date of change. C Only when the entity adopts the fair value model under IAS 38. An asset transfer is a movement of an item of plant and equipment from one funddepartment to another using the Asset Cost AdjustTransfers function of the ESP Assets Management System ESP.

Compare the financial reporting of investment property with that of property plant and equipment. The correct answer is A. The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The disposition of ORE is addressed in ASC 360-20 Property Plant and Equipment Real Estate Sales formerly FAS 66 Accounting for Sales of Real Estate. However IAS 16 is dedicated to treating non-current assets used for business operations whereas IAS 40 is predominantly concerned with non-current assets held for rental capital appreciation or for both. Here I assume that you want to use the fair value modelfor accounting for your investment property not the cost model.

Distinguish between Property Plant and Equipment and Investment Property and clearly state how each is treated under the relevant International Accounting Standards. The IFRS Interpretations Committee received a request for clarification of the application of paragraph 57 of IAS 40 Investment Property which provides guidance on transfers to or from investment propertiesMore specifically the question was whether a property under construction or development that was previously classified as inventory could be transferred to investment. PROPERTY PLANT AND EQUIPMENT 1.

Property plant and equipment are used in the production of goods and services. Transfer from investment property to property plant and equipment Key FRS 102 An entity may have investment property that subsequently become owner-occupied. The business unit that is receiving the asset is responsible for processing the transfer in ESP.

Restructurings and ASC 360 Property Plant and Equipment formerly FAS 144 Accounting for the Impairment or Disposal of Long-Lived Assets. If they are insignificant to the contract as a whole then the property is an investment property under IAS 40. Tangible assets with physical substance used in normal operations long-term in nature.

When there is change of use. Only when the entity adopts the fair value model. B Based on the entitys discretion.

Ordinarily investment property would meet the definition of property plant and equipment PPE and be accounted for in accordance with IAS 16 Property Plant and Equipment with revaluations recognised in other comprehensive income OCI. The standard IAS 40 Investment Propertysays that when you transfer an asset from owner-occupied property to the investment property you need to apply IAS 16until the date of transfer. IAS 16 Property Plant and Equipment and IAS 40 Investment Property are very similar in nature and share certain common guidelines as well.

If you provide significant ancillary services then the property is not an investment property under IAS 40 but the property plant and equipment under IAS 16. Recoverable amount is the higher of an assets fair value less costs to sell and its value in use. Transfers from investment property to property plant and equipment are appropriate.

The definition of fair value as defined in ASC 820. Based on the discretion of management. IN8 An entity is required to measure an item of property plant and equipment acquired in exchange for a non-monetary asset or assets or a combination of monetary and non-monetary assets at fair value unless the exchange transaction lacks commercial substance.

An item of property plant or equipment shall not be carried at more than recoverable amount.

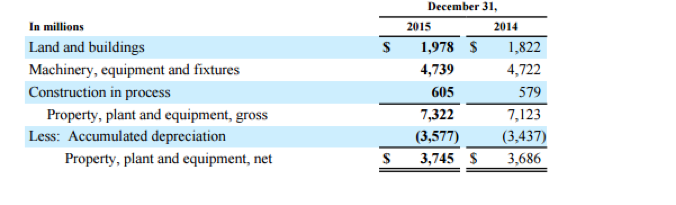

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

How Are Cash Flow And Free Cash Flow Different

Financial Accounting Flashcards Quizlet

Financial Accounting Flashcards Quizlet

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

Https Www Bdo Global Getmedia A18418c9 6237 4bce Ac19 De6404d6c434 Ias 40 2 Aspx

Https Cdn Ifrs Org Media Feature Supporting Implementation Ias 8 Ias 8 Iasc Extract Pdf

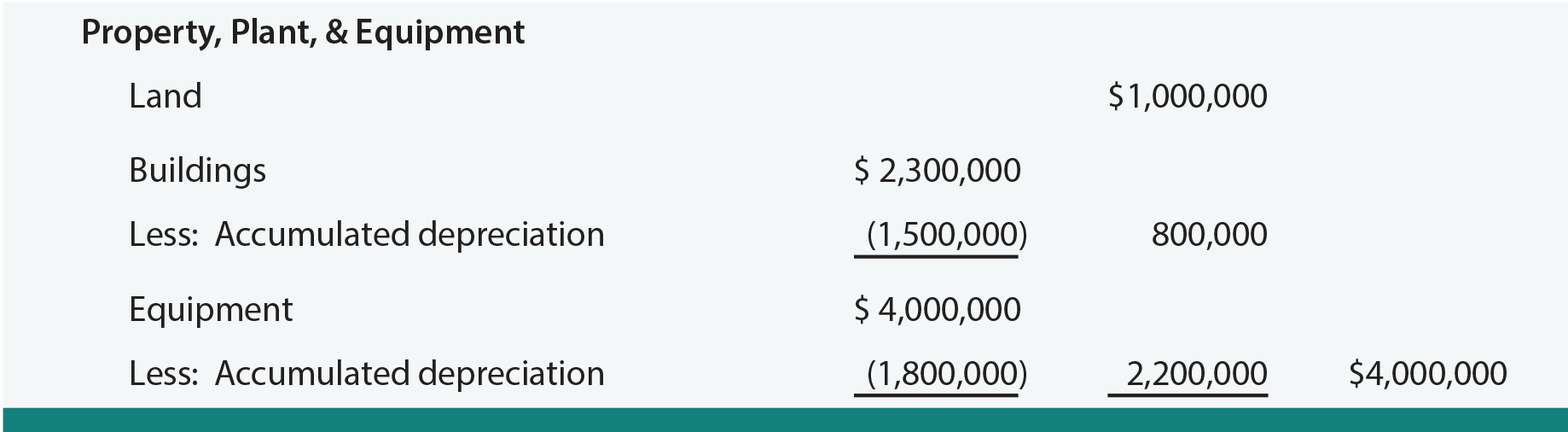

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Operating Lease Learn How To Account For Operating Leases

Operating Lease Learn How To Account For Operating Leases

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg) Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Https Www Pwc Com Gx En Asset Management Assets Practical Guide To Amended Ias 40 Pdf

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

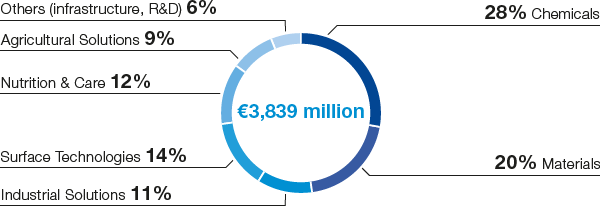

Material Investments And Portfolio Measures Basf Online Report 2019

Material Investments And Portfolio Measures Basf Online Report 2019

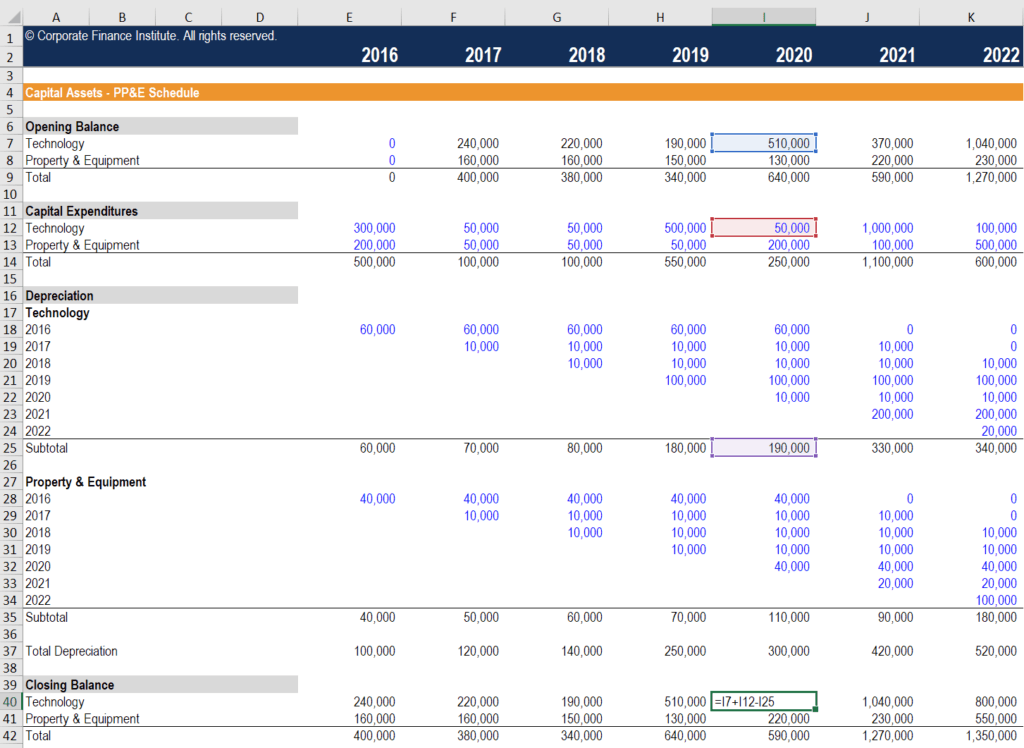

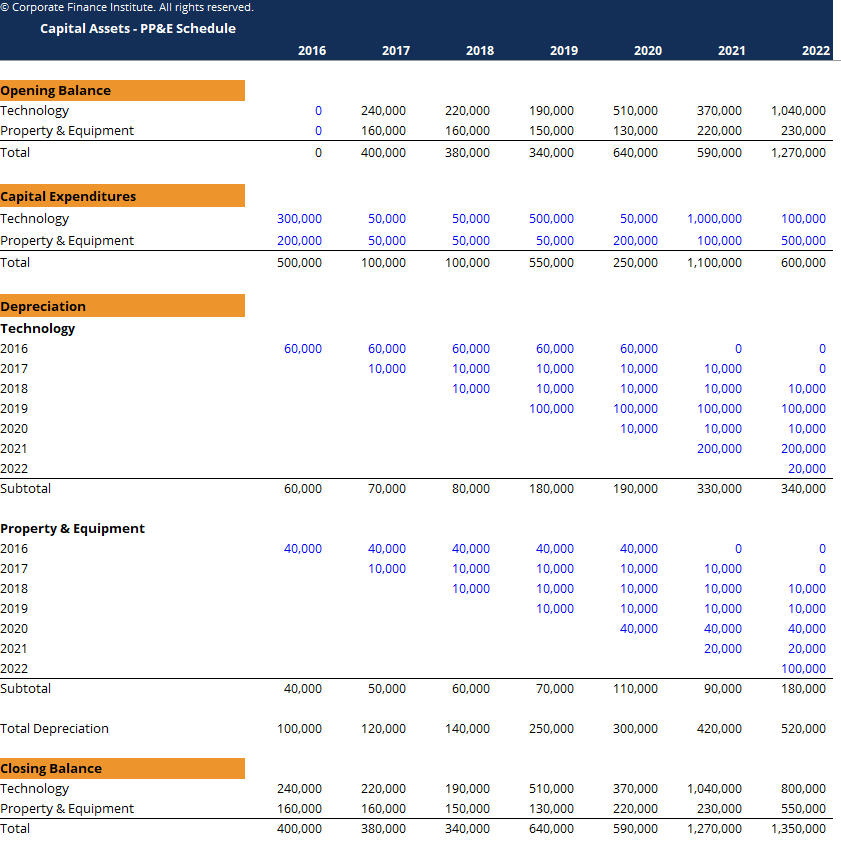

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg) Free Cash Flow To The Firm Fcff Definition

Free Cash Flow To The Firm Fcff Definition

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)