Property Tax Calculator Tennessee

Estimated Tax Commercial Property. Property is classified based on how the property is used.

The median amount of property tax paid statewide is 1220 per year.

Property tax calculator tennessee. The 2019 tax rate in Shelby County is 405 per 100 of assessed value for ALL Shelby County property owners. To calculate your property tax divide the assessed value by 100 and multiply by whichever tax rate applies to you. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county.

No cities in Tennessee levy local income taxes. County Appraisal Calculate. Our Tennessee Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Tennessee and across the entire United States.

Overview of Tennessee Taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Greene County. Calculating Property Tax To calculate your property tax multiply the appraised value by the assessment ratio for the propertys classification.

To calculate the amount of your taxes multiply the assessed value of your property times the tax rate divided by 100. Assessment Tax Rate. Property Tax Calculator - Estimate Any Homes Property Tax.

City of Cookeville 45 E Broad Street Cookeville TN 38501 Phone. To calculate the tax on your property multiply the Assessed Value by the Tax Rate. As of 2020 the state had a 1 tax on income earned from interest and dividends though it has fully repealed it beginning on Jan.

Counties in Tennessee collect an average of 068 of a propertys assesed fair market value as property tax per year. The assessed value of property is a percentage of the appraised value. Public Access includes a tax calculator tax search online payments using credit cards and electronic checks links to individual County Trustee websites and FAQs.

The Property Tax Calculator The calculator displays the current tax rates for the USD GSD CBID GBID and other satellite city tax rates for Belle Meade Ridgetop Goodlettsville. If youve already paid more than what you will owe in taxes youll likely receive a refund from the IRS. The median property tax on a 10420000 house is 70856 in Tennessee The median property tax on a 10420000 house is 109410 in the United States Remember.

Property taxes in Tennessee are calculated utilizing the following four components. Tax Due Trustee Main Office City County Building 400 Main Street Knoxville TN 37902. Tennessee Property Tax Homeowners in Tennessee pay some of the lowest property taxes in the country.

The median property tax in Tennessee is 93300 per year for a home worth the median value of 13730000. Overview of Tennessee Taxes Tennessee has some of the lowest property taxes in the US. Either way our tax calculator helps you plan for the 2021 tax season.

931-526-4897 Hours Monday - Friday 8 am. If you paid less you may owe a balance. Heres the countys example assuming the value of the home is 100000.

Our Sullivan County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Tennessee and across the entire United States. The ASSESSED VALUE is 25000 25 of 100000 and the TAX RATE has been set by the Metro Council at 4221 Urban Services District or 3788 General Services District per hundred of assessed value. Once we have an idea of what you owe and what youve paid well calculate the difference.

The average effective property tax rate in Tennessee is 064. The median annual property tax paid by homeowners in Tennessee is 1220 about half the national average. To calculate the tax on your property assume you have a house with an APPRAISED VALUE of 100000.

In Tennessee there is no income tax on wages. County Appraisal Calculate. That adds up to an effective property tax rate of 064 meaning the average Tennessee homeowner pays just 064 of their homes market value in taxes annually.

Then multiply the product by the tax rate. As a way to measure the quality of schools we analyzed the math and readinglanguage arts proficiencies for every school district in the country. The CBID GBID Belle Meade Ridgetop or Goodlettsville have not reported whether or not they will increase their tax rate.

Assessment Tax Rate. The Tennessee Trustees Association provides this website for the benefit of its members and the general public. Assume you have a house with an APPRAISED VALUE of 100000.

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Moving To Florida

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Moving To Florida

Pin On Local Homes Spring Hill Southern Middle Tennessee

Pin On Local Homes Spring Hill Southern Middle Tennessee

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Property Tax Retirement Strategies

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Property Tax Retirement Strategies

7 States Without An Income Tax And An 8th State Is Repealing Its Tax Income Tax Income Sales Tax

7 States Without An Income Tax And An 8th State Is Repealing Its Tax Income Tax Income Sales Tax

3 Bedrooms And 2 Bathrooms Tn Real Estate Tennessee Homes For Sale Zillow Tennessee Homes For Sale New Property Zillow

3 Bedrooms And 2 Bathrooms Tn Real Estate Tennessee Homes For Sale Zillow Tennessee Homes For Sale New Property Zillow

7211 Bahne Rd Greenbelt Property Tax Spring Hill

7211 Bahne Rd Greenbelt Property Tax Spring Hill

This Land Is Like An Empty Canvas You Could Do Anything You Desire With It Realestate In 2020 Empty Canvas Build Your Dream Home Real Estate

This Land Is Like An Empty Canvas You Could Do Anything You Desire With It Realestate In 2020 Empty Canvas Build Your Dream Home Real Estate

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How To Calculate Your Tax Bill

How To Calculate Your Tax Bill

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

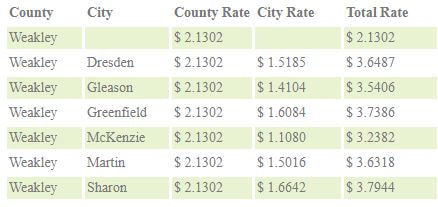

Weakley County Assessor Of Property Tax Rates

Weakley County Assessor Of Property Tax Rates

The Best States For An Early Retirement Health Insurance Early Retirement Life Insurance Facts

The Best States For An Early Retirement Health Insurance Early Retirement Life Insurance Facts

Georgia Retirement Tax Friendliness Retirement Calculator Property Tax Financial

Georgia Retirement Tax Friendliness Retirement Calculator Property Tax Financial

Tennessee Property Tax Calculator Smartasset

Tennessee Property Tax Calculator Smartasset

What Is Mello Roos Tax Property Tax Tax Deductions Refinance Mortgage

What Is Mello Roos Tax Property Tax Tax Deductions Refinance Mortgage

How Much You Really Take Home From A 100k Salary In Every State Income Tax Salary Tax

How Much You Really Take Home From A 100k Salary In Every State Income Tax Salary Tax

0 Rutherford Ln Getaway Places Land For Sale Things To Sell

0 Rutherford Ln Getaway Places Land For Sale Things To Sell