Property Tax Jurisdiction Code

B Intangible property governed by Article 401 Insurance Code or by Section 89003 Finance Code is taxable as provided by law unless exempt by law if this state has jurisdiction to tax those intangibles. The department is dedicated to helping you with your building project and ensuring that it is built to the current Virginia and Gloucester County.

Confluence Mobile Community Wiki

Property TaxRent Rebate Status.

Property tax jurisdiction code. Search databases view neighborhood information and find details on real estate taxes. 1 owned by a resident of this state. We make no warranties or guarantees about the accuracy completeness or adequacy of the information contained on this site or the information linked to on the state site.

The total property tax as a percentage of state-local revenue is 1693 while the property tax percentage of personal income stands at 312. Division 5 - Property Tax Extension Limitation Law. Article 29 - Special Assessments Benefiting State Property Law.

Follow this link for information regarding the collection of SET. At a minimum each state requires a street address and ZIP code. Tulsa County collects the highest property tax in Oklahoma levying an average of 134400 106 of median home value yearly in property taxes while Cimarron County has the lowest property tax in the state collecting an average tax of 24400 043.

The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Finally the per-capita property tax in the US is 1618. The state code and the city code municipal.

City and County Tax Rates Municipalities With PJ Rates Other Than 12 Corporate Limit Rate. These codes may not be the most recent versionIllinois may have more current or accurate information. The Property Tax Division sets the standards and procedures for equalization of property values in the counties and ensures property is taxed uniformly throughout the state.

Property Tax Code Property Taxes are governed by 35 ILCS 2001-1 through 32-20. Our purpose is to supervise and control the valuation equalization assessment of property and collection of all ad valorem taxes. Our property tax brochure provides a we alth of critical information regarding real estate and personal property tax bills.

Property tax defined Property tax is a tax that is based on a propertys value. 500 Recreation and entertainment. Property Tax Division Property Tax Cycle.

Input your location information on the form. Assess all properties other than state-assessed property Required by law to reassess all property in the jurisdiction at least once every four years every three years in Cook. However some municipalities may levy a PJ rate other than one-half the regular tax rate.

How to Locate the proper property type classification code. Gather property information for areas in Gloucester County. The state property tax contributes 3008 towards the overall income.

Pennsylvania Department of Revenue Tax Information Tax Types and Information Inheritance Tax County Codes. The Illinois Property Tax Code 35 ILCS 2001-1 et seq at wwwilgagov. The street address or the plus-four at the end of your five-digit ZIP code is used to provide the most accurate information for your sales tax rate because it pinpoints your location within a sales tax district or jurisdiction.

Scroll down to find all about these vital property taxes by state segments. Article 30 - Fiscal Responsibility Law. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax.

For example the owner of a 200000 house will have an annual County tax bill of 123380. If so inquire with the local assessor to verify their code definitions. Division 6 - Preparation and Delivery Of Books.

Title 7 - Tax Collection. Revenue and Taxation Code. C This state has jurisdiction to tax intangible personal property if the property is.

Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. The exact property tax levied depends on the county in Oklahoma the property is located in. 600 Community services.

To calculate your 2020 County taxes take the value of your property divide by 100 and multiply by 06169. 6 Define Tax Jurisdiction Codes The tax jurisdiction code in Brazil consists of two parts. It is a code used for determining tax rates in Brazil.

Proudly founded in 1681 as a place of tolerance and freedom. 300 Vacant land. Begin Main Content Area Pennsylvania County Codes.

State Equalization Online Filing. It is sometimes called an ad valorem tax which means according to value Property tax is a local tax imposed by local government taxing districts eg school districts. Typically the police jurisdiction PJ rate will be one-half the regular corporate limits tax rate.

It controls which tax authorities must be paid for a given transaction. The property assessment system is the basis for the collection of property taxes in Michigan. Division 51 - One-Year Property Tax Extension Limitation Law.

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg) How Property Taxes Are Calculated

How Property Taxes Are Calculated

Employer Frequently Asked Questions

Employer Frequently Asked Questions

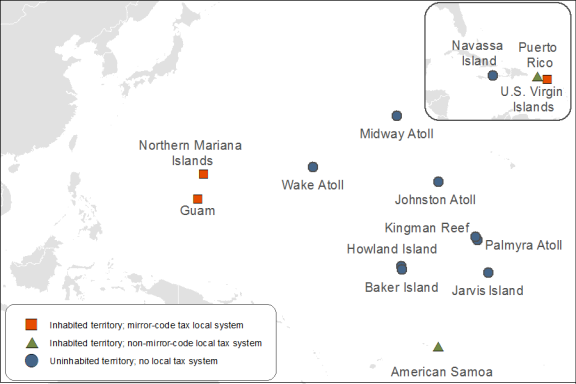

Tax Policy And U S Territories Overview And Issues For Congress Everycrsreport Com

Tax Policy And U S Territories Overview And Issues For Congress Everycrsreport Com

![]() Property Tax Jefferson County Tax Office

Property Tax Jefferson County Tax Office

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

San Antonio Property Tax Rates H David Ballinger

San Antonio Property Tax Rates H David Ballinger

Https Tax Iowa Gov Sites Default Files Idr Documents Dov 20secrets 20to 20success 20webinar Pdf

Http Www House Leg State Mn Us Hrd Pubs Ss Ssptadm Pdf

Goose Creek Isd Tax Website Property Tax Services

Goose Creek Isd Tax Website Property Tax Services

Understanding California S Property Taxes

Understanding California S Property Taxes

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Https Www Hctax Net About Announcements Tax 20sale 20bidders 20auction 20guide Pdf

Https Www Lincolninst Edu Sites Default Files Pubfiles 1069 Franzen Complete Web Pdf