Property Tax Rates By Zip Code Texas

Texas Property Tax Rates. Current property tax data available for Houston area real properties can be found on these central appraisal districts websites depending on which counties the properties are located Austin Brazoria Chambers Fort Bend Galveston Harris Liberty.

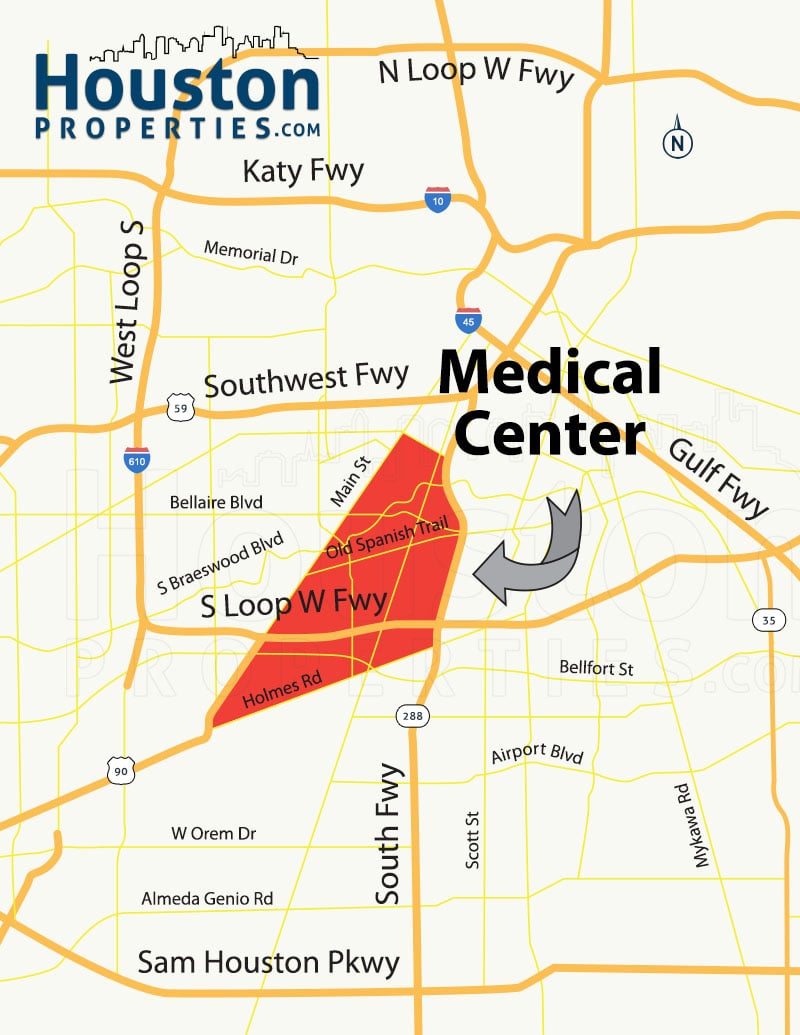

2021 Update Texas Medical Center Houston Homes Neighborhood Guide

2021 Update Texas Medical Center Houston Homes Neighborhood Guide

Maintenance Operations MO and Debt Service.

Property tax rates by zip code texas. They are calculated based on the total property value and total revenue need. Here is some information about what the current property tax rates are for homes in Plano Texas and how property taxes are calculated for homes for sale in Plano Texas. In that same year property taxes accounted for 46 percent of localities revenue from their own sources and 27 percent of overall local.

One important factor in home affordability in Plano Texas is your Plano property taxes. Tarrant Regional Water District. Property Tax Calculator - Estimate Any Homes Property Tax.

The states average effective rate is 242 of a homes value compared to the national average of 107. Here is some information about what the current property tax rates are for homes in Allen Texas and how property taxes are calculated for homes for sale in Allen Texas. To understand how different taxing authorities either cities or counties in Texas calculate your property tax you have to understand.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. The tax rate is determined by the amount of the tax levy to be raised from all or part of an assessing unit and the units total taxable assessed value. Property taxes are an important tool to help finance state and local governments.

The property tax rate for the City of San Antonio consists of two components. The sources may be obtained from the CIP by contacting the County Information Program Texas Association of Counties at 512 478-8753. Junior College Tax Rate.

The propertys taxable assessment and the tax rates of the taxing jurisdictions in which the property is located. To understand how different taxing authorities either cities or counties in Texas calculate your property tax you have to understand. But in California the tax rate is much lower at 081 the 34th lowest in the US.

The most common combined total property tax rates for 958 of the largest citiestowns in Texas are shown on this Texas property tax page. Complimentary to the property tax map I created in 2015 you can see that the average property tax rate still trends upward the farther you get from the city. 1 of the following year as required.

The FY 2021 Debt Service tax rate is 21150 cents per 100 of taxable value. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the median home value. But the median home there valued at 385500 raises 3104 in property taxes.

Or quickly highlight a ZIP code on the map by simply typing it into the search bar. Please enter a valid ZIP code Please enter a ZIP code. One important factor in home affordability in Allen Texas is your Allen property taxes.

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. The tax rates included are for the year in which the list is prepared and must be listed alphabetically according to the county or counties in which each taxing unit is located and by the name of each taxing unit. In a given area however they typically do not change drastically year to year.

Map This Dataset - Generates a map of all 254 counties using the data in this table. The amount of a particular propertys tax bill is determined by two things. Hover over areas to see the assigned ZIP code and the average 2018 property tax rate to that ZIP code.

So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. Hospital District Tax Rate. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

The most common combined total property tax rates for 958 of the largest citiestowns in Texas are shown on this Texas property tax page. Overall homeowners pay the most property taxes in New Jersey which has some of the highest effective tax rates in the country. Name Local Code Local Rate Total Rate.

Current property tax data available for San Antonio area real properties can be found on these central appraisal districts websites depending on which counties the properties are located Atascosa Bandera Bexar Comal Guadalupe Kendall Medina or. In fiscal year 2016 property taxes comprised 315 percent of total state and local tax collections in the United States more than any other source of tax revenue. The Comptrollers Property Tax Assistance Division PTAD publishes this list not later than Jan.

The Fiscal Year FY 2021 MO tax rate is 34677 cents per 100 of taxable value. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

10 States With The Lowest Median Property Tax Rates Hawaii Travel Guide Hawaii Travel Travel

10 States With The Lowest Median Property Tax Rates Hawaii Travel Guide Hawaii Travel Travel

Eligible Service Area For The Dap Located Outside The City Limits Of Houston Pasadena Or Baytown And Within The Unin Galena Park Harris County South Houston

Eligible Service Area For The Dap Located Outside The City Limits Of Houston Pasadena Or Baytown And Within The Unin Galena Park Harris County South Houston

Guide To Katy Neighborhood Real Estate Homes For Sale Katy Katy Texas Katy Tx

Guide To Katy Neighborhood Real Estate Homes For Sale Katy Katy Texas Katy Tx

Cross Creek Ranch Fort Bend County New Homes Tax Rates Fulshear Texas Fulshear Fort Bend County

Cross Creek Ranch Fort Bend County New Homes Tax Rates Fulshear Texas Fulshear Fort Bend County

Amarillo Tx Garden Home For Sale With 2 Bedrooms House Styles Property Sites House

Amarillo Tx Garden Home For Sale With 2 Bedrooms House Styles Property Sites House

Zip Code 77532 Profile Map And Demographics Updated February 2021

Zip Code 77532 Profile Map And Demographics Updated February 2021

The Most Undervalued Cities In America Mortgage Real Estate Values Buying Your First Home

The Most Undervalued Cities In America Mortgage Real Estate Values Buying Your First Home

Tac School Property Taxes By County

Tac School Property Taxes By County

The Zip Codes Where You Can Find The Cheapest Rent In The Us For Rent By Owner Rent Coding

The Zip Codes Where You Can Find The Cheapest Rent In The Us For Rent By Owner Rent Coding

San Antonio Zip Code Map San Antonio Tx San Antonio Real Estate San Antonio

San Antonio Zip Code Map San Antonio Tx San Antonio Real Estate San Antonio

Best Universities In Usa Usa University Education College Best University

Best Universities In Usa Usa University Education College Best University

Meet The Texas Teachers 100 000 Club 7 300 Six Figure Salaries Cost Taxpayers 903 Million

Meet The Texas Teachers 100 000 Club 7 300 Six Figure Salaries Cost Taxpayers 903 Million

Image Detail For 135 Million Grand Lake Austin Texas Estate Jpg Big Mansions Luxury Real Estate Mansions

Image Detail For 135 Million Grand Lake Austin Texas Estate Jpg Big Mansions Luxury Real Estate Mansions

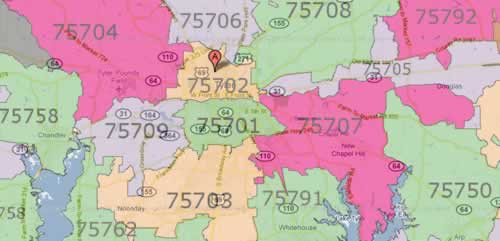

Tyler Texas Vital Statistics Population Census Data Demographics Elevation Zip Codes Area Code Climate

Tyler Texas Vital Statistics Population Census Data Demographics Elevation Zip Codes Area Code Climate

Austin Zip Codes Map Chime Team Zip Code Map Coding Map

Austin Zip Codes Map Chime Team Zip Code Map Coding Map

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

Here Are The Best And Worst States For Taxes What Is Credit Score Healthcare Costs Income Tax

Cost Of Living In Texas Daveramsey Com

Cost Of Living In Texas Daveramsey Com