Property Taxes Jefferson Ohio

Located in central Ohio Stark county has property taxes far lower than most of Ohios other urban counties. As of February 19 Jefferson County OH shows 43 tax liens.

43162 Real Estate 43162 Homes For Sale Zillow

43162 Real Estate 43162 Homes For Sale Zillow

The Jefferson County GIS tax map system is considered the leader in the state of Alabama.

Property taxes jefferson ohio. Come cannot exceed the amount set by law. We create and update GIS maps with multi layers of data. County Auditor Property Record Card SearchCounty Recorder Land Records Search.

440-576-3221 Open Office Hours. The current year tax bills are transferred to the Jefferson County Clerk for collection and you would need to contact the Jefferson County Attorneys Office. After locating the account you can also register to receive certified statements by e-mail.

You can call the Jefferson County Tax Assessors Office for assistance at 740-283-8511Remember to have your propertys Tax ID Number or Parcel Number available when you call. To view your balance due please select NEXT and enter your parcel number or name in the search box. When a Jefferson County OH tax lien is issued for unpaid past due balances Jefferson County OH creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

This website doesnt work properly without JavaScript enabled. 2016 Jefferson Parish Assessors Office. The Service Fee is not a part of your tax and Jefferson County will not receive any portion of the fee associated with this service.

If you need to pay your property tax bill ask about a property tax assessment look up the Jefferson County property tax due date or find property tax records visit the Jefferson County Tax Assessors page. After locating the account you can pay online by credit card or eCheck. That is lower than the state average 148 and the rate in neighboring Summit County 181.

In Ohio Jefferson County is ranked 9th of 88 counties in Treasurer Tax Collector Offices per capita and 5th of 88 counties in. The Jefferson County Tax Assessor is charged with responsibility to discover list assess apply exemptions abatements current use and process real and personal property tax returns. In fact the countys average effective property tax rate is just 142.

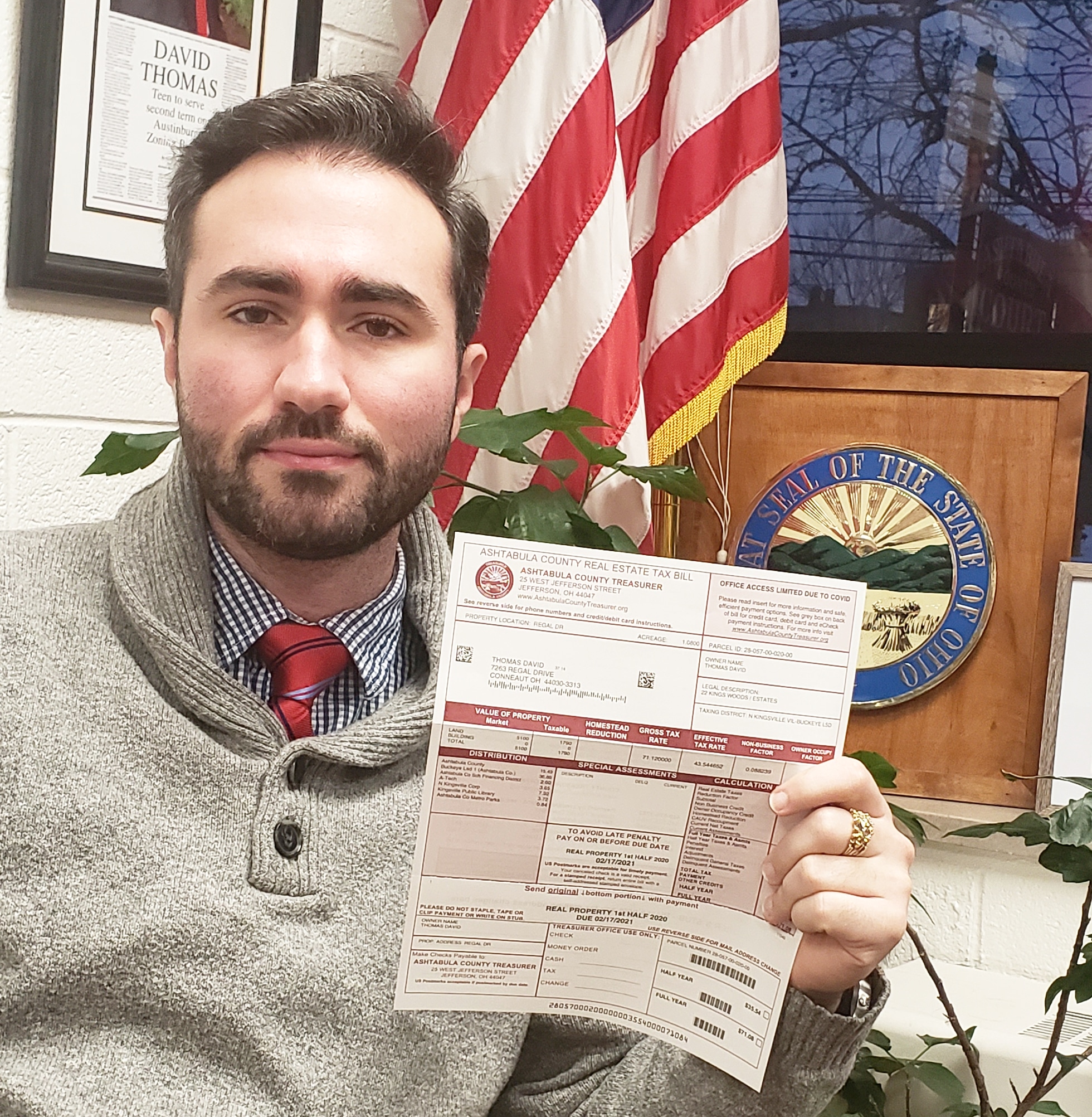

Ashtabula County Treasurer Email Ashtabula County Courthouse 25 W. Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is definedas modifiedadjusted gross income which is comprised of Ohio adjusted gross income plus any busi-ness income deducted on Schedule A line 11 of your Ohio IT 1040. Millages Wards.

How does a tax lien sale work. The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. The Sheriffs Office collection of the 2020 Taxes starts on November 2 2020.

There are 4 Treasurer Tax Collector Offices in Jefferson County Ohio serving a population of 67349 people in an area of 409 square milesThere is 1 Treasurer Tax Collector Office per 16837 people and 1 Treasurer Tax Collector Office per 102 square miles. The Jefferson County Treasurer located in Steubenville Ohio is responsible for financial transactions including issuing Jefferson County tax bills collecting personal and real property tax payments. Search All Tax Years.

Please enable it to continue. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. Please follow the instructions below.

Property tax assessments in Jefferson County are the responsibility of the Jefferson County Tax Assessor whose office is located in Steubenville Ohio. Real Estate Search Personal Property Search. You can search your Real Estate Taxes by Property ID Owner Name or Property Address and Personal Property Taxes by Business Tax Number or Business Name.

Jefferson OH 44047 Ph. Jefferson County Property Inquiry. Interested in a tax lien in Jefferson County OH.

You can search for any account whose property taxes are collected by the Jefferson County Tax Office. The parcel number is located in the top right corner of your tax bill. When contacting Jefferson County about your property taxes make sure that you are contacting the correct office.

Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. Search All Tax Years. The Jefferson County Sheriffs Office will accept installment payments on current year property tax bills during the period that they are collecting the tax bills.

132 W Jefferson St Jefferson Oh 44047 Realtor Com

132 W Jefferson St Jefferson Oh 44047 Realtor Com

3401 Bulah Rd Jefferson Oh 44047 Realtor Com

3401 Bulah Rd Jefferson Oh 44047 Realtor Com

2395 Dodgeville Rd Jefferson Oh 44047 Realtor Com

2395 Dodgeville Rd Jefferson Oh 44047 Realtor Com

2920 State Route 193 N Jefferson Oh 44047 Realtor Com

2920 State Route 193 N Jefferson Oh 44047 Realtor Com

Jefferson Ohio Oh 44047 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Jefferson Real Estate Jefferson Oh Homes For Sale Zillow

Jefferson Real Estate Jefferson Oh Homes For Sale Zillow

1851 Byerly Mill Rd West Jefferson Oh 43162 Mls 221000546 Zillow

1851 Byerly Mill Rd West Jefferson Oh 43162 Mls 221000546 Zillow

571 Oak St Jefferson Oh 44047 Realtor Com

571 Oak St Jefferson Oh 44047 Realtor Com

Questions On Your Tax Charge Or Property Value

Questions On Your Tax Charge Or Property Value

7582 Clifton Ave Jefferson Township Oh 45168 Realtor Com

7582 Clifton Ave Jefferson Township Oh 45168 Realtor Com

4464 State Route 46 S Jefferson Oh 44047 Zillow

4464 State Route 46 S Jefferson Oh 44047 Zillow

1851 Byerly Mill Rd West Jefferson Oh 43162 Realtor Com

1851 Byerly Mill Rd West Jefferson Oh 43162 Realtor Com

305 W Cedar St Jefferson Oh 44047 Realtor Com

305 W Cedar St Jefferson Oh 44047 Realtor Com

145 Maplewood Dr Jefferson Oh 44047 Realtor Com

145 Maplewood Dr Jefferson Oh 44047 Realtor Com

Ashtabula County Oh For Sale By Owner Fsbo 23 Homes Zillow

Ashtabula County Oh For Sale By Owner Fsbo 23 Homes Zillow