Us Gaap Property Plant And Equipment Recognition

We would like to show you a description here but the site wont allow us. Recognition of Property Plant and Equipment PPE The cost of PPE shall be recognized as an asset only if it is probable that future economic benefits will flow to the entity and the cost of it can be reliably measured.

Property Plant Equipment Accounting Play

Property Plant Equipment Accounting Play

Evaluating these assets and ensuring that the appropriate basis is reflected in a companys financial statements requires a well coordinated effort with cross-functional expertise.

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Us gaap property plant and equipment recognition. ASC 360-10 provides guidance on accounting for property plant and equipment and the related accumulated depreciation on those assets. Right of use assets. In a post by Kim Ginste she focuses on the differences between the two methods.

We support the Boards actions to find a cost effective manner for the Department of Defense DoD to comply with Generally Accepted Accounting Principles GAAP for general property plant and equipment assets acquired in the past. Assume that DigitalFX LLC acquired a new 3D printer at a list price of 12000. In the current period Entity X transfers the asset in a.

IAS 16 Property Plant and Equipment is one of oldest standard and its history goes back to 1980. Property plant and equipment are tangible items that. Property Plant and Equipment are tangible assets and are expected to be used during more than one period generally more than one year.

Our response to the question for respondents follow. Opening Balances for General Property Plant and Equipment. 76 Recognition and derecognition 440 77 Measurement449 78 Impairment462 79 Hedge accounting IFRS 9 475.

Mike can sell the warehouse for 150000 in 20X3. The delivery fee amounted to 2400 import duty 2000 and installation cost 1600. Definite and indefinite-lived intangibles.

The accounting standards incl. I would recommend you to open new ac under property plant and. It 100 will be recognized in CIP then in PPE when it arrives.

Property plant and equipment. However except for the areas of software oil and gas and mining assets IFRS and US GAAP use nearly identical criteria for capitalization. GAAP is included in the Financial Accounting Standards Boards Accounting Standards Codification ASC Topic 360 Property Plant and Equipment.

Failing an ASC 360 Step 1 test each long-lived asset groups discounted cash flows are then compared with their fair value and any impairment. Popular Course in this category All in One Financial Analyst Bundle 250 Courses 40 Projects. On the balance sheet 100000 will be subtracted from PPE to write off the asset while a gain of 50000 will be reported on the income statement after taxes.

The warehouse is listed under the long-term assets account Property Plant and Equipment PPE at the historical cost of 100000. UCF then recognition of impairment may be required. Domestic entity X has a 10 million cost basis in an intellectual property asset for which the tax basis is zero.

US GAAP guidance for PPE was formed from several standards issued over many years until they were combined in the Codification. Recognition of assets under the cost model Both US GAAP and IFRS require an item of property plant and equipment to be measured at its cost. Exception in GAAP that prohibits the recognition of income tax consequences.

Property Plant and Equipment. US GAAP Accounting Discussion 12 General Accounting Discussion 21 There is a problem on recognition of equipment in transit. This Subtopic also includes guidance on the impairment or disposal of long-lived assets.

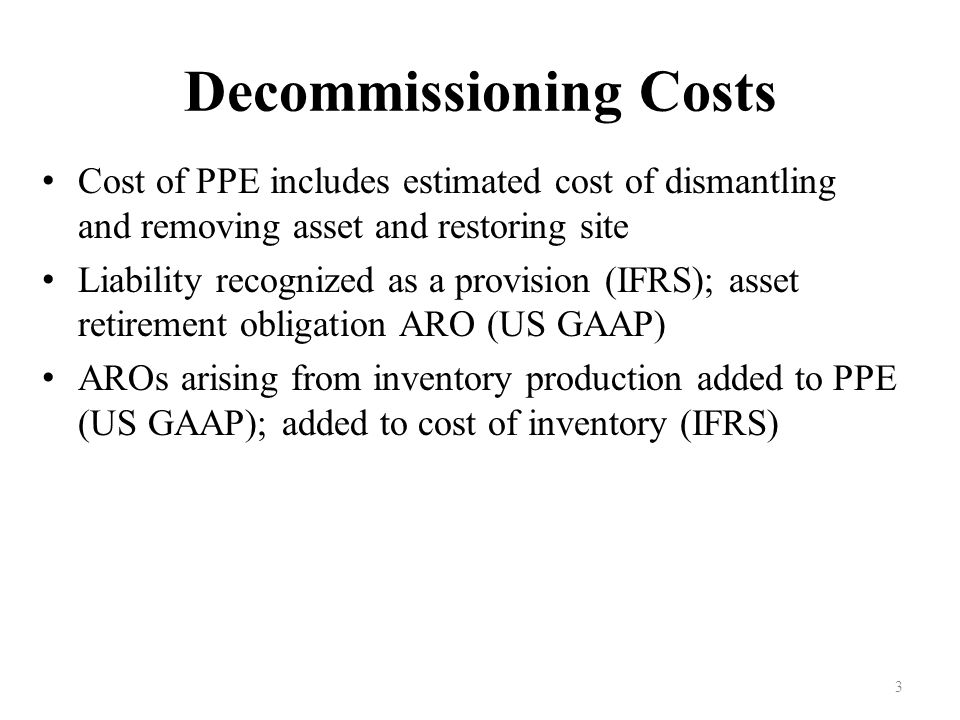

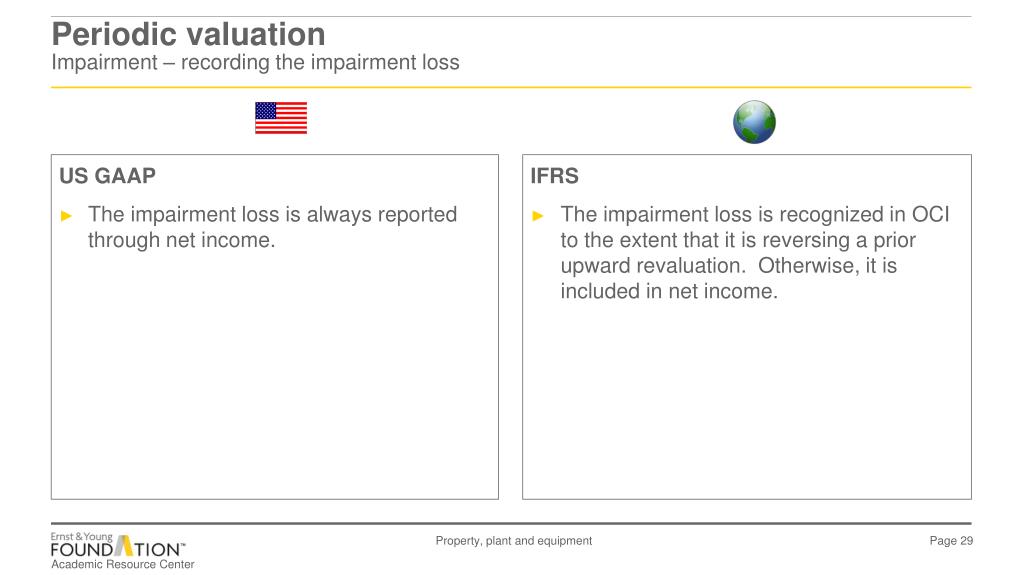

Under US GAAP fixed assets such as property plant and equipment are valued using the cost model ie the historical value of the asset less any accumulated depreciation. For US GAAP references in square brackets identify any relevant paragraphs of the Codification eg. It includes purchasing price discounts custom duties transportation costs installation and assembly costs professional fees and any other directly attributable costs.

The accounting standards that are relevant for PPE accounting are IAS 16 Property Plant and Equipment for IFRS ASC 360 Property Plant and Equipment for US GAAP. Are held for use in the production or supply of goods or services for rental to others. 32 Property plant and equipment 116 33 Intangible assets and goodwill 126.

IFRS allows another model - the revaluation model - which is based on fair value on the date of evaluation less any subsequent accumulated depreciation and impairment losses. Before we discuss detail about the Recognition Measurement depreciation and Disclosure of Fixed Assets we would like to mention the definition of Property Plant and Equipment as per IAS 16. The difference in valuation of property plant and equipment is an important difference between US GAAP and IFRS that will have to be settled for a merger to ever be complete.

Property plant and equipment real estate and financial assets are subject to the. The fixed assets that we will cover here refer to Property Plant and Equipment which is cover in IAS 16 Property Plant and Equipment. US GAAP and IFRS require that property plant and equipment be initially recognized by the cost.

The predominant standard that defines the accounting and reporting for Property Plant and Equipment PPE is IAS 16. Impairment of PPE is covered later in the book. An item may be an asset but if it fails the recognition criteria it will not be recorded as entitys asset in its statement of financial position.

Debt and equity investments. 1 Recognition of property plant and equipment For an item of PPE to be recognized recorded in financial statements it has to first meet the definition of asset and then the recognition criteria. The incoterms CIP so we recognized asset when the first expediter receives equipment.

Any company with GAAP-based financial statements is expected to comply with SFAS 144 now known as ASC 360. In IFRS the guidance related to accounting for property plant and equipment is included in International Accounting Standard IAS 16 Property Plant and Equipment and the guidance related to accounting for investment property is included in IAS 40. The guidance related to accounting for property plant and equipment in US.

Pin On Financial Accounting Standards

Pin On Financial Accounting Standards

Ias 16 Property Plant Equipment Ppe

Ias 16 Property Plant Equipment Ppe

Ppt Property Plant Equipment Powerpoint Presentation Free Download Id 5833440

Ppt Property Plant Equipment Powerpoint Presentation Free Download Id 5833440

Ppt Property Plant And Equipment Ias 16 Powerpoint Presentation Free Download Id 7015853

Ppt Property Plant And Equipment Ias 16 Powerpoint Presentation Free Download Id 7015853

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

Financial Accounting Standards Ias 28 Investments In Associates And Joint Investing Financial Instrument Insurance Fund

Us Gaap Ifrs Reporting Considerations 2 Main Remaining Differences Between Us Gaap And Ifrs Consolidated Financial Statements Business Combinations Ppt Download

Us Gaap Ifrs Reporting Considerations 2 Main Remaining Differences Between Us Gaap And Ifrs Consolidated Financial Statements Business Combinations Ppt Download

Property Plant And Equipment Ppt Video Online Download

Property Plant And Equipment Ppt Video Online Download

Https Policy Ucop Edu Doc 3410279

Impairment Of Tangible And Intangible Assets Cfa Level 1 Analystprep

Impairment Of Tangible And Intangible Assets Cfa Level 1 Analystprep

Module 9 Property Plant And Equipment Ppe And Pd Net

Module 9 Property Plant And Equipment Ppe And Pd Net

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Ifrs 5 Non Current Assets Held For Sale And Discontinued Operations Bookkeeping And Accounting Deferred Tax Hold On

Ppt Property Plant And Equipment Powerpoint Presentation Free Download Id 3603506

Ppt Property Plant And Equipment Powerpoint Presentation Free Download Id 3603506

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Cost Model In Accounting Definition Ias 16 Ifrs Us Gaap Journal Entries Depreciation Example

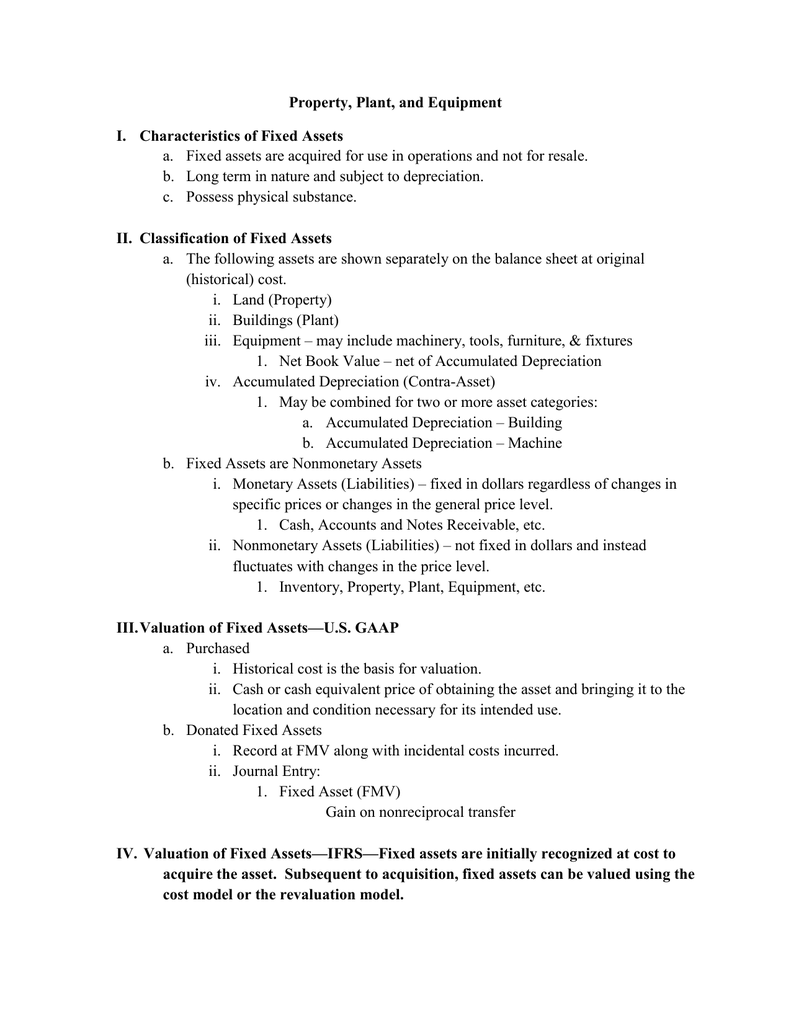

Property Plant And Equipment I Characteristics Of Fixed Assets

Property Plant And Equipment I Characteristics Of Fixed Assets

Ias 16 Property Plant Equipment Ifrs Vs Gaap Audit The Information Contained Herein Is Of A General Nature And Is Not Intended To Address The Circumstances Ppt Download

Ias 16 Property Plant Equipment Ifrs Vs Gaap Audit The Information Contained Herein Is Of A General Nature And Is Not Intended To Address The Circumstances Ppt Download

As 10 Accounting Standard On Property Plant Equipment Quickbooks

As 10 Accounting Standard On Property Plant Equipment Quickbooks

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)