Capital Gains Tax Allowance On Inherited Property

Most of the time it is up to 40 of the entire value of the property at the time of inheritance. If he made some improvements and sold it for 330000 he would have capital gains of 30000.

Service Tax Not Covered U S 145a A Ii Yet Taxable Under Sec 43b Http Taxworry Com Service Tax Not Covered Us 145aaii Yet Tax Tax Capital Gains Tax Cover

Service Tax Not Covered U S 145a A Ii Yet Taxable Under Sec 43b Http Taxworry Com Service Tax Not Covered Us 145aaii Yet Tax Tax Capital Gains Tax Cover

For example suppose you inherit a house that was purchased years ago for 150000 and it is now worth 350000.

Capital gains tax allowance on inherited property. You may need to pay. Capital gains tax on inherited properties You do not owe capital gains tax CGT on property or shares unless they are sold for more than the amount they were valued at during probate. But if you sell the home for less than the stepped-up basis you can deduct the loss amount up to 3000 per year.

To be clear capital gains tax is payable on any amount that you make above the value of the property when you inherited it after allowable deductions have been taken into account ie. Fortunately when you inherit property the propertys tax basis is stepped up which means the basis would be the current value of the property. But this might also depend on other allowances.

Capital Gains Tax Rules for Inherited Property When inheriting property such as a home or other real estate the capital gains tax kicks in if you sell that asset at a higher price point than the person you inherited it from paid for it. Here are 10 facts that taxpayers should know about capital gains and losses. When its inherited property the tax rules apply in certain specific ways.

Thats because when someone sells an inherited asset long-term capital gains tax will be due on the difference between the sales price and the tax basis. If you sell the property for more than your basis you have a taxable gain. Capital gains on the other hand are the tax paid from the profit you make from selling an inherited property.

If you were to sell the property there could be huge capital gains taxes. You sold the house in an arms length transaction. Likewise its possible to claim a capital loss deduction if you end up selling the property at a loss.

Death is not an occasion of charge for capital gains tax purposes. Your profit which only comes into play when the property is sold on. How Can I Avoid Paying Capital Gains Taxes on Inherited Property.

Consequently there is no capital gains tax on inherited property on deathIf the value of the estate after reliefs and exemptions exceeds the nil rate band for inheritance tax purposes inheritance tax will be payable on the excess. You sold the house to an unrelated person. When the deceased acquired the property.

Thats the taxable amount. For the 2017 tax year tax returns due in 2018 the capital gains rates were also 0 percent 15 percent and 20 percent. Whether the property has been used to produce income such as rent whether the deceased was an Australian resident at the time of death.

If you or your spouse gave the property to the decedent within one year before the decedents death see Publication 551 Basis of Assets. IRS Tax Tip 2017-18 February 22 2017 When a person sells a capital asset the sale normally results in a capital gain or loss. Capital Gains Tax Rules for Inherited Property When inheriting property such as a home or other real estate the capital gains tax kicks in if you sell that asset at a higher price point than the.

A capital asset includes inherited property or property someone owns for personal use or as an investment. The capital gains and loss tax rules apply to anything you sell to make money including stocks cars and real estate. People who inherit property arent eligible for any capital gains tax exclusions.

For example take that house inherited by a son from his mother with a date-of-death value of 200000. Report the sale on Schedule D Form 1040 Capital Gains and Losses and on Form 8949 Sales and Other Dispositions of Capital Assets. Income Tax on profit you later earn from your inheritance eg dividends from shares or rental.

However as the brackets have adjusted the dollar amounts have as well. Answer Regarding capital gains on inherited property and losses you can claim a capital loss on inherited property if you sold it and all of these are true. If youre anticipating capital gains from selling your inherited house there are three ways you can reduce or avoid the capital gains tax.

You dont usually pay tax on anything you inherit at the time you inherit it. Timing the Sale of the Home to Avoid Paying Capital Gains Tax One last item to avoid paying federal income taxes on inheriting the home the person inheriting the home will usually need to sell the home within a year after the death of the loved one. So if you decide to keep a property you have inherited and it rises in value you will have to pay CGT on the difference unless it has become your main residence.

If you want the lowest tax rates youll generally need to keep the property for at least a year. If you inherit a dwelling and later sell or otherwise dispose of it you may be exempt from capital gains tax CGT depending on. The higher the basis the smaller the difference between it and the sales price.

A Tax Loophole Everyone Should Know About Estate Planning Family Trust Fund How To Plan

A Tax Loophole Everyone Should Know About Estate Planning Family Trust Fund How To Plan

Summary Of The Candidates Positions On Individual Dividend Capital Gains Amt And Estate Taxes Estate Tax Capital Gain Dividend

Summary Of The Candidates Positions On Individual Dividend Capital Gains Amt And Estate Taxes Estate Tax Capital Gain Dividend

Tax Planning For Property Owned Through Will Or Inheritance Or Gift Or Succession Http Taxworry Com Tax Planning Prop How To Plan Capital Gains Tax Investing

Tax Planning For Property Owned Through Will Or Inheritance Or Gift Or Succession Http Taxworry Com Tax Planning Prop How To Plan Capital Gains Tax Investing

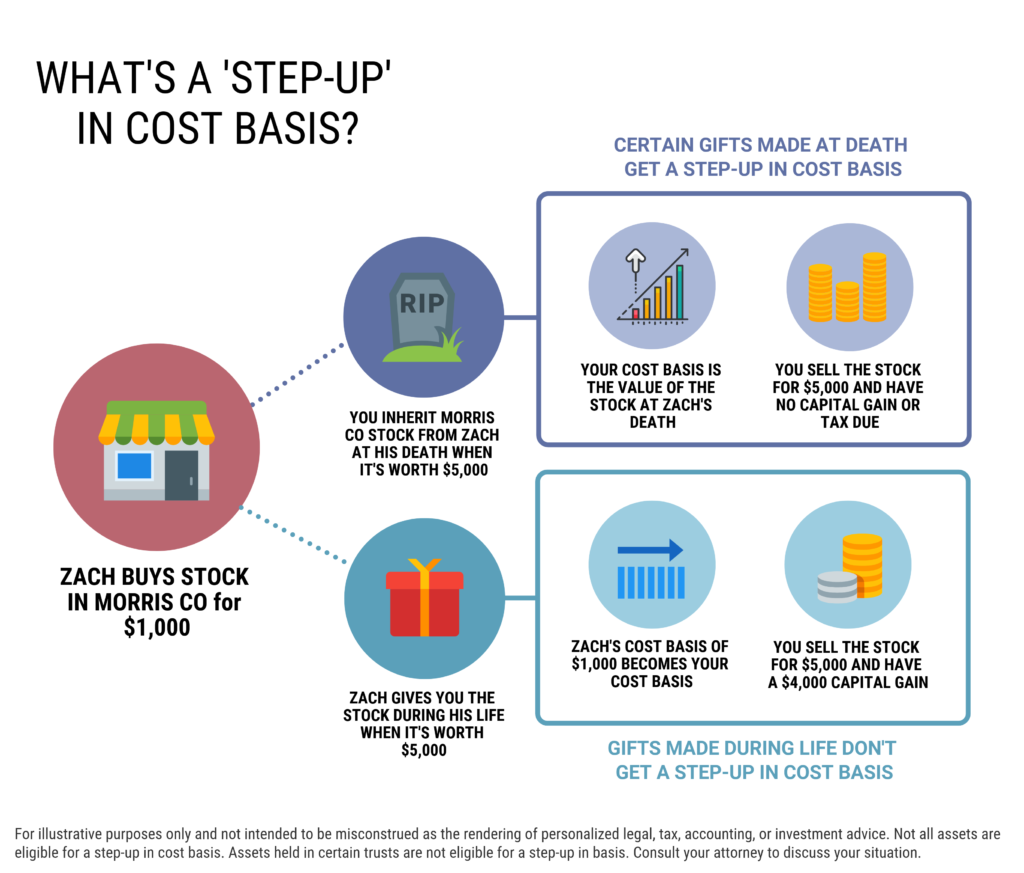

What Is A Step Up In Basis Cost Basis Of Inherited Assets

What Is A Step Up In Basis Cost Basis Of Inherited Assets

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Tax Money Inheritance Tax

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Tax Money Inheritance Tax

4 Misconceptions About Capital Gains And Your Brooklyn Home Sale Capital Gains Tax Inheritance Tax Capital Gain

4 Misconceptions About Capital Gains And Your Brooklyn Home Sale Capital Gains Tax Inheritance Tax Capital Gain

Does Your State Have An Estate Or Inheritance Tax Tax Foundation Inheritance Tax Estate Tax Estate Planning

Does Your State Have An Estate Or Inheritance Tax Tax Foundation Inheritance Tax Estate Tax Estate Planning

Why Property Taxes Are The Complicated Game Of Uk Residential Market Property Tax Property Inheritance Tax

Why Property Taxes Are The Complicated Game Of Uk Residential Market Property Tax Property Inheritance Tax

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

Taxseason2019 Gearup2 0 Aaotaxdein Filing Taxes Tax Services Economic Analysis

How To Sell Property In India And Bring Money To Usa Steps With Pictures Sell Property Things To Sell Inheritance Money

How To Sell Property In India And Bring Money To Usa Steps With Pictures Sell Property Things To Sell Inheritance Money

Do You Pay Capital Gains Taxes On Property You Inherit

Do You Pay Capital Gains Taxes On Property You Inherit

A 500 000 Gift From Uncle Sam Maybe Capital Gains You And San Francisco Real Estate With Kevin And Jonathan Vanguard Properties

A 500 000 Gift From Uncle Sam Maybe Capital Gains You And San Francisco Real Estate With Kevin And Jonathan Vanguard Properties

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Capital Gains Tax On Inherited Property Bhhs Fox Roach

Different Types Of Taxes We Pay In The Us If You Want To Know What Types Of Taxes Americans Have To Pay Scro Types Of Taxes Capital Gains Tax Payroll Taxes

Different Types Of Taxes We Pay In The Us If You Want To Know What Types Of Taxes Americans Have To Pay Scro Types Of Taxes Capital Gains Tax Payroll Taxes

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Avoiding Basis Step Down At Death By Gifting Capital Losses

Avoiding Basis Step Down At Death By Gifting Capital Losses

Taxation On Sale Of Inherited Property Housing News

Taxation On Sale Of Inherited Property Housing News

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block